Business

Seylan Tikiri showcases “Cooking Kiddos” on social media

Seylan Tikiri, the number one minor savings brand in the market by Seylan Bank, wowed its little customers online with “Cooking Kiddos” a social media campaign that showcased their cooking skills to the world. The Bank with a Heart partnered with Emerging Media to give enterprising children the opportunity to try out new recipes, taking a break from their strict schedules.

Always on the lookout for innovative ways to keep their youngest customer base engaged, Seylan Bank hit on the idea of a cooking show to add variety to the life of children mostly spending time studying online. Leveraging on their interest to try out new things and being in the spotlight, Seylan Tikiri wanted to have the children make simple meals and showcase their talent to a wide audience in social media. Seylan Tikiri customers, who participated in the competition and emerged in the top ten, received valuable gift bundles from the Bank.

“Keeping Children active and engaged is one of the toughest things for parents, especially in the current pandemic situation where social distancing is required, which keeps them away from group activities with peers. Seylan Tikiri was the most digitally engaging minor savings account during the lockdown period, and we will continue to deliver innovative activities for them this year too, the first of which is “Cooking Kiddos” which we partnered with Emerging Media to deliver. The enthusiastic response we witnessed with the number of children who participated was amazing and we will continue to focus on our little customers.” said, Gamika de Silva, Assistant General Manager – Marketing and Sales, Seylan Bank commenting on the initiative.

Seylan Tikiri played an important part in keeping children’s spirits high during the extended lockdown period last year, with a range of online activities such as Tikiri lock down diary, Tikiri Digital Avurudu, Vesak Pathuma, Tikiri Champ, Story Telling and many more. These activities grabbed their attention and kept them occupied while they were stuck indoors. Seylan Bank went the extra mile to involve parents in digital activities, and partnered with Dr. Kumudu De Silva to present ‘Tikiri Story Teller’, a series of videos on social media for parents on how to look after kids during the quarantine period and suggesting activities that parents can do with them at home.

With the intention of carrying out a continuous digital presence on social media this year too, Seylan Bank has planned more digital activations to our kids to experience new things with Seylan Tikiri. Winners are chosen from each and every digital initiative, in order to reward and motivate the children. Seylan Tikiri offers a world of benefits to its young customers and parents who are yet to experience the value of the number one minor savings brand can visit the Seylan Bank FB page at facebook.com/SeylanBank , the Bank’s website – www.seylan.lk, or Call 200 88 88 for more details on Seylan Tikiri Minor Savings Accounts.

Seylan Bank, the Bank with a Heart, operates with a vision to offer the ultimate banking experience to its valued customers through cutting-edge technology, innovative products, and best-in-class service. The Bank has a growing clientele of SMEs, Retail and Corporate Customers and has expanded its footprint with 172 branches across the country, 216 ATM units, 70 Cash Deposit Machines (CDM) and 83 Cheque Deposit Kiosks (CDK). Seylan Bank has been endorsed as a financially stable organisation with performance excellence across the board by Fitch Ratings, with the bank’s national long-term rating revised upward, from ‘A-(lka)’ to ‘A (lka)’. The bank was ranked second among public listed companies for transparency in corporate reporting by Transparency Global. Seylan Bank has also been named the Most Popular Banking Service Provider in Sri Lanka in Customer Experience by LMD consecutively in 2019 and 2020. These achievements are a testament to Seylan Bank’s financial stability and unwavering dedication to ensuring excellence across all endeavours.

Business

Embedding human rights, equity and integrity into business leadership

At its 2026 Social Sustainability Programme Kick-Off, the UN Global Compact Network Sri Lanka convened business leaders to advance the translation of global ambition into practical corporate action on inclusion, integrity and human rights.

On 24 February 2026, the UN Global Compact Network Sri Lanka (Network Sri Lanka) convened business leaders at Barefoot Garden Café for its 2026 Social Sustainability Programme Kick-Off, delivered in collaboration with Good Life X.

The gathering did more than introduce a calendar of events. It positioned Sri Lanka’s corporate community within the broader direction of the UN Global Compact’s 2026–2030 global strategy — a strategy anchored in three imperatives: equipping companies to act, catalyzing collective action, and advancing the business case for responsible leadership.

At its core, the 2026 Social Sustainability agenda is designed to move companies from commitment to capability.

Within the Diversity & Inclusion Working Group, this means building practical pathways toward equal pay for equal work and strengthening male allyship as a governance issue rather than a cultural afterthought. It means examining sexual and reproductive health, disability inclusion, and mental health not as employee benefits, but as structural determinants of productivity and retention. It means sharpening strategic communications so inclusion is embedded in brand integrity. It also means applying science-based behavioural change approaches to shift organizational culture in measurable ways.

Across the Business & Human Rights Working Group, equipping companies takes the form of deepened engagement on decent work and living wage implementation, strengthening human rights due diligence processes, and addressing emerging risk areas such as AI and digital rights. It extends to reinforcing business integrity and anti-corruption frameworks, understanding the social dimensions of a just transition, and recognizing the link between child rights, nutrition, and workforce productivity.

Business

Union Bank to raise LKR 3 Bn via Basel III Compliant Debenture Issue

Union Bank of Colombo PLC announced its proposed Debenture Issue 2026, a strategic move aimed at raising up to LKR 3 billion. This issue is designed to bolster the Bank’s Tier II capital base and provide a robust financial foundation for its upcoming growth initiatives.

The offering consists of Basel III compliant, listed, rated, unsecured, subordinated, redeemable high-yield debentures with Non-Viability Conversion. The instrument has been assigned a rating of BB (lka) by Fitch Ratings (Lanka) Ltd, reflecting the bank’s creditworthiness and the structured nature of the subordinated debt.

Investors can choose from three distinct interest structures starting from a high-yield 13% fixed rate per annum (Type A). This option is paid annually, while Type B offers a 12.5% fixed rate paid semi-annually (12.89% AER). For those seeking market-linked returns, Type C provides a floating rate of the 182-days Treasury Bill rate plus a 400-basis point margin, also paid semi-annually.

The debentures are priced at LKR 100 per unit with a 5-year tenure (2026–2031). The initial issue size is set at 20,000,000 debentures with an option to raise 10,000,000 at the discretion of the Bank and is scheduled to open on 10 March 2026.

Shanka Abeywardene, Chief Financial Officer of Union Bank stated “This debenture issue marks a significant step in the Bank’s journey towards enhanced financial stability. By strengthening its capital adequacy, Union Bank is well-positioned to navigate evolving market conditions while fuelling its long-term strategic objectives for sustainable growth”

Business

Sanjay Kulatunga appointed to WindForce Board

WindForce PLC announced the appointment of Sanjay Kulatunga as an Independent, Non-Executive Director to its Board with effect from 03rd March 2026, following the resignation of Dilshan Hettiaratchi. The appointment further strengthens the Company’s governance framework, strategic oversight, and long-term decision-making capabilities.

Kulatunga brings an established track record as a founder, entrepreneur, and senior executive across financial services and export-oriented industries. He is the Chief Executive Officer and Co-Founder of LYNEAR Wealth Management, a boutique investment firm established in 2013, which has since grown to become one of Sri Lanka’s largest private wealth management institutions, serving high-net-worth individuals as well as local and international institutional clients.

Prior to founding LYNEAR, Kulatunga played a pivotal role in the establishment of Amba Research, an investment research offshoring firm rooted in Sri Lanka and now operating as part of Acuity Analytics.

Over the years, he has contributed extensively to several key national institutions. His previous appointments include serving on the Financial Sector Stability Consultative Committee of the Central Bank of Sri Lanka, as well as the Board of Investment of Sri Lanka and the Securities and Exchange Commission of Sri Lanka.

-

Features3 days ago

Features3 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features6 days ago

Features6 days agoAn innocent bystander or a passive onlooker?

-

Opinion3 days ago

Opinion3 days agoSri Lanka – world’s worst facilities for cricket fans

-

Business6 days ago

Business6 days agoAn efficacious strategy to boost exports of Sri Lanka in medium term

-

Features4 days ago

Features4 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features4 days ago

Features4 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone

-

Features3 days ago

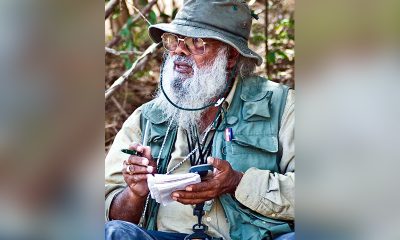

Features3 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul