Business

‘Securing GSP+ extension beyond 2023 absolutely critical for apparel industry growth’

Deputy Chairman of MAS Sharad Amalean appointed JAAF chairman

The Joint Apparel Association Forum of Sri Lanka (JAAF) called for intensive dialogue and greater stakeholder collaboration in order to arrive to resolve the current forex crisis, as well as legislative reform towards a more sustainable medium-long-term trajectory for Sri Lankan apparel.

These views were expressed at the recent Annual General Meeting (AGM) of the Association, the apex body representing five associations encompassing supply chain partners, the export-oriented apparel manufacturers, buying offices and representatives of international brands in Sri Lanka.

Addressing the gathering, newly appointed Chairman of JAAF and Deputy Chairman of MAS, Sharad Amalean commended the resilience demonstrated by the sector in the face of an unprecedented pandemic and outlined measures necessary for the sector to achieve its target of US$ 8 Bn in exports by 2025, while maintaining GSP+ and enhancing bilateral trade.

Addressing the gathering, newly appointed Chairman of JAAF and Deputy Chairman of MAS, Sharad Amalean commended the resilience demonstrated by the sector in the face of an unprecedented pandemic and outlined measures necessary for the sector to achieve its target of US$ 8 Bn in exports by 2025, while maintaining GSP+ and enhancing bilateral trade.

“Once again, Sri Lankan apparel has delivered an outstanding performance, achieving over US$ 5 Bn in exports last year amidst various challenges. While highly commendable, there are still many obstacles ahead of us. In order to successfully navigate these uncertain times, it is essential that all stakeholders act with unity, and continue to engage in dialogue with authorities on issues pertaining to foreign exchange and the adoption of regulations that can ensure sustainable growth for our vital industry,” Amalean stressed.

“We must also continue to enhance our bilateral trade by engaging with regional partners and associations to enhance trade relations. The securing of a GSP+ extension beyond 2023 will be absolutely critical for the growth of our industry,” he added.

Meanwhile, outgoing JAAF Chairman, A. Sukumaran noted that the industry would likely face continuing disruptions to their supply chain over the coming year, making the need for continuous engagement across industry stakeholders an essential pre-requisite to developing long-term solutions to the industry’s current and future challenges.

“The pandemic exposed underlying vulnerabilities in our extended global supply chains. However, we do not believe that right answer is to simply turn our backs to internationalization and build overlapping national supply chains – as had been advocated by certain quarters. Even with the current issues we face, the theory of comparative advantage within globalization is still a more financially viable approach. However, we also need to identify select areas in which development of domestic capacity can support Sri Lankan firms to effectively compete on a global stage, and ensure that such capacity development is expedited as much as possible.”

“The pandemic exposed underlying vulnerabilities in our extended global supply chains. However, we do not believe that right answer is to simply turn our backs to internationalization and build overlapping national supply chains – as had been advocated by certain quarters. Even with the current issues we face, the theory of comparative advantage within globalization is still a more financially viable approach. However, we also need to identify select areas in which development of domestic capacity can support Sri Lankan firms to effectively compete on a global stage, and ensure that such capacity development is expedited as much as possible.”

“Investing in less transactional and more collaborative supply chain relations will provide major solutions. This forges more resilient supply chains that are also more capable of dealing with our industry’s numerous challenges. We have thrived with our buyers on long-lasting relationships. We must do the same thing with supply chains as well. Balance strategies are a must for us to sustain ourselves on the sourcing map,” Sukumaran added.

The AGM saw the appointment of JAAF’s new executive committee for 2022/2023, which includes Chairman Sharad Amalean, Deputy Chairmen Saiffudeen Jafferjee and Felix Fernando, Past Chairmen Noel Priyathilake, Azeem Ismail and Ashroff Omar. Duly Authorized Representatives of the constituent bodies: Fabric & Apparel Accessory Manufacturers Association Pubudu de Silva, Free Trade Zone Manufacturers Association – Jatinder Biala, Sri Lanka Apparel Exporters Association – Aroon Hirdaramani, Sri Lanka Chamber of Garment Exporters – Hemantha Perera and Sri Lanka Apparel Sourcing Association – Wilhelm Elias.

Other key appointments include individual members of the executive committee; Mahesh Hirdaramani, Manik Santiapillai, Ajith Wijesekera, Jafar Sattar, Anis Sattar, Rehan Lakhany and Mahika Weerakoon.

Meanwhile, Founding Secretary-General of JAAF Tuli Cooray stepped down from his position and will serve as a consultant moving forward. He will be replaced by Industry veteran Yohan Lawrence, Past Chairman of the Sri Lanka Apparel Exporters Association.

Business

‘Notable drop in SL’s 2025 tourism sector earnings compared to those of 2018’

The revenue that was earned from the tourism sector in 2025 was US $ 3.2 billion, which is a significant drop compared to the 2018 figure , which is US$ 4.3 billion, a top tourism sector specialist said.

‘Comparatively there is a revenue deficit of US $ 1.2 billion, which we cannot be satisfied with at any cost, ‘Island Leisure Lanka’ founder chairman Chandana Amaradasa said.

Amaradasa made these observations at a Rotary Club joint meeting organised by Rotary Club Colombo South, featuring also the Rotary Clubs of Kolonnawa and Sri Jayawardenapura, at the Kingsbury Hotel on Tuesday.

Amaradasa added: ‘To develop the tourism sector the government has to do many things which previous governments comprehensively failed to take up.

‘The revenue that comes from the local tourism sector is four to five percent of the GDP, while in Dubai it is more than 45 percent of the GDP.

‘At present the country has 51000 rooms, out of which not more than 10000 rooms are at the four to five star level. Of that number 6000 rooms are located in Colombo, which is a major issue for tourism promotion in tourism potential areas.

‘Sri Lanka should focus on high quality standards in tourism and also develop the East Coast with the necessary infrastructure; especially having an international airport is absolutely necessary.

‘Colombo could be developed as a MICE tourism hub in the region. But not having an international level conference/convention hall is a another bottle neck in promoting that market as well.’

By Hiran H Senewiratne ✍️

Business

A Record Year for Marketing That Works: SLIM Effie Awards Sri Lanka 2025 crosses 300+ entries

The Sri Lanka Institute of Marketing (SLIM) announces a defining milestone for the country’s marketing, advertising, and creative sectors, as Effie Awards Sri Lanka 2025 records the highest number of entries in its history, crossing 300+ submissions. The unprecedented response reflects a stronger, more confident industry, one that is increasingly committed not only to bold creativity, but to creativity that can prove its value through measurable business and brand outcomes.

Now in its 17th year in Sri Lanka, the Effie Awards remain the most recognised benchmark for marketing effectiveness, honouring campaigns that bring together creative excellence, strategic discipline, and results. As the industry evolves, the Effies have become a space where the agency community, brand teams, media and creative partners are collectively challenged to raise the bar, moving beyond attention and awards, toward work that drives growth, shapes behaviour, and delivers real impact.

The record volume of entries this year also signals a healthy shift in the market: more brands and agencies are willing to be evaluated against rigorous effectiveness criteria, and to put forward work that demonstrates clear thinking, strong execution, and proof of performance. SLIM notes that this momentum highlights the expanding role of marketing and advertising in Sri Lanka, not simply as communication, but as a strategic driver of competitiveness and value creation.

SLIM confirms that the judging process will commence soon, guided by the established Effie evaluation framework that assesses entries on insight, strategy, execution, and measurable outcomes. The Grand Finale is scheduled for end-February 2026, where Sri Lanka’s most effective marketing work will be recognised on a national platform.

For inquiries, entries, and sponsorship opportunities, please contact the SLIM Events Division: +94 70 326 6988 | +94 70 192 2623.

Business

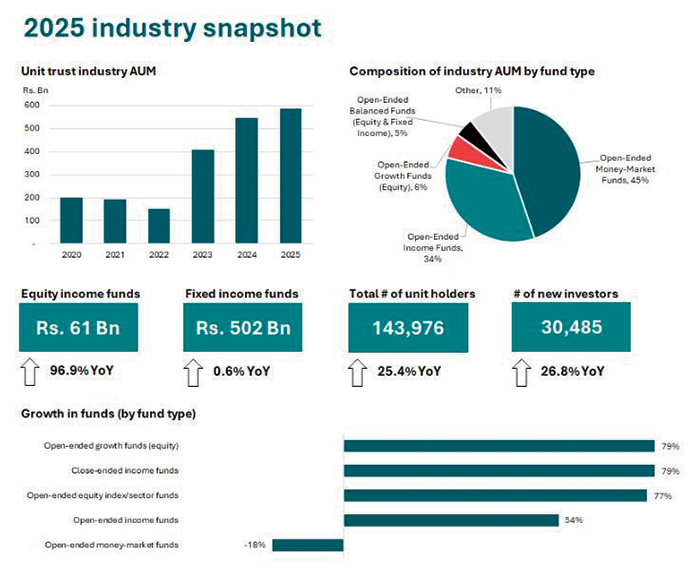

The Unit Trust industry closes 2025 with Rs. 587 Bn assets under management

The Unit Trust industry of Sri Lanka reported a 7.8% year-over-year growth of its assets under management (AUM) to Rs. 587 Bn by the end of 2025. During the year, the AUM reached a high of Rs. 613 Bn, indicating continued interest in the asset category. These assets are currently managed across 86 funds by 16 management companies.

While fixed-income funds accounted for the largest share of AUM, equity-related funds saw strong inflows, increasing by Rs. 30 Bn in 2025 compared to just Rs. 2 Bn for fixed-income funds. This reflects improved investor sentiment, with a clear shift from a capital preservation mindset toward long-term capital growth.

The year also saw a move from ultra-safe short-term instruments to medium-term growth, with strong inflows into open-ended income funds, open-ended equity index/sector funds, and balanced funds, accompanied by a decline in inflows to money-market funds. Additionally, open-ended growth funds (equity) recorded a 79% year-over-year increase, signalling a rising risk appetite among investors.

Commenting on the full-year industry performance, Secretary of the Unit Trust Association of Sri Lanka (UTASL) and Director/CEO of Senfin Asset Management Jeevan Sukumaran noted: “Post-economic crisis, the unit trust industry has been on a strong upward trend with the AUM surpassing Rs. 600 Bn last year.

‘’The steady growth of the unit trust industry in 2025 is a strong indication of increasing investor confidence in professionally managed and well-regulated investment products. Beyond the growth in fund flows, we have also seen encouraging progress in expanding the investor base — not only in terms of unit holder numbers, but also in the broadening of investor demographics — reflecting a gradual shift towards long-term, market-linked investing.”

-

Editorial6 days ago

Editorial6 days agoIllusory rule of law

-

Features6 days ago

Features6 days agoDaydreams on a winter’s day

-

Features6 days ago

Features6 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features5 days ago

Features5 days agoExtended mind thesis:A Buddhist perspective

-

Features6 days ago

Features6 days agoThe Story of Furniture in Sri Lanka

-

Opinion4 days ago

Opinion4 days agoAmerican rulers’ hatred for Venezuela and its leaders

-

Features6 days ago

Features6 days agoWriting a Sunday Column for the Island in the Sun

-

Business2 days ago

Business2 days agoCORALL Conservation Trust Fund – a historic first for SL