Business

Sampath Bank launches innovative Mini-POS Solution, empowering SMEs to boost sales and enhance customer experience

Responding to the increasing demand for digital payment solutions within the small and medium-sized enterprise (SME) sector, Sampath Bank is the first bank in Sri Lanka to launch a MiniPOS device, proudly announcing the innovative bespoke mini-POS solution. These innovative systems, meticulously crafted to address the unique needs of SMEs, empower businesses to streamline transactions and enhance customer experiences.

As SMEs continue to play an increasingly pivotal role in the market, Sampath Bank recognises the importance of providing affordable and user-friendly payment solution. Developed with portability, versatility, and ease of use in mind, the mini-POS solution offer SMEs a convenient avenue to accept payments from customers, thereby driving sales and revenue growth. Customers can seamlessly process transactions over multiple payment schemes such as Visa, Mastercard, China Union Pay, JCB, Lanka QR, and UPI networks is also another important feature of this handy portable device.

Shiran Kossinna, Assistant General Manager of the Card Centre at Sampath Bank, shared his insights on the initiative, stating, “At Sampath Bank, we are committed to supporting the growth and success of SMEs. Our mini-POS solution not only cater to the specific needs of this segment but also align with government efforts to modernise payment channels, ultimately fostering financial inclusion.”

In addition, Sampath Bank’s mini-POS solution offers a range of features to meet the diverse needs of businesses. These include portability, as the compact and lightweight systems are ideal for various business such as pop-up shops by entrepreneurs, grocery stores, boutiques, delivery/courier companies, event vendors, and outdoor markets, ensuring a convenient payment option wherever customers go, supporting multiple payment methods, including contactless payments (NFC), chip cards, and payments via mobile wallet (QR), thereby enhancing the overall shopping experience. Furthermore, the mini-POS systems enable faster transactions, crucial in busy environments during peak shopping times or events with high foot traffic, ensuring quick and efficient payments. Lastly, advanced security features safeguard customer data during transactions, providing peace of mind for both businesses and customers.

By offering a modern and efficient payment solution tailored for SMEs, Sampath Bank focuses on empowering these entrepreneurs. This is achieved by boosting sales through enhanced customer experience, providing a convenient payment solution, reducing checkout times, and streamlining the payment process. Additionally, Sampath Bank supports government initiatives to digitalise domestic payment channels. They aim to expand market reach by offering a portable and versatile mini-POS solution and differentiate themselves from competitors by providing a cost-effective and user-friendly system, with merchants who acquired the POS machine on or before 31st August 2024 receiving six months of free rental.

As Sampath Bank continues to pioneer advancements in digital payments, SMEs can look forward to a future of enhanced efficiency, flexibility, convenience, and growth opportunities.

Business

Selling pressure makes a dent in CSE’s early trading gains

CSE trading kicked off on a positive note yesterday but turned negative on account of selling pressure from investors deriving from tensions in the West Asian region, market analysts said. Amid those developments both indices moved downward. The All Share Price Index went down by 115.36 points, while the S and P SL20 declined by 55.67 points.

Turnover stood at Rs 5 billion with nine crossings. Top seven crossings were as follows: ACL Cables 7.5 million shares crossed for Rs 727 million; its shares traded at Rs 97, Ceylinco Holdings 185,000 shares crossed to the tune of Rs 616 million; its shares sold at Rs 3300, Renuka Agri 8.3 million shares crossed for Rs 111.6 million; its shares traded at Rs 12.56, HNB 164000 shares crossed for Rs 70.2 million; its shares traded at Rs 428, Hemas Holdings 2.2 million shares crossed for Rs 70 million; its shares traded at Rs 31.60, Commercial Bank 200,000 shares crossed for Rs 42.8 million; its shares traded at Rs 240 and JKH two million shares crossed for Rs 42.6 million; its shares sold at Rs 21.

In the retail market companies that mainly contributed to the turnover were; HVA Foods Rs 226 million (35.9 million shares traded), ACL Cables Rs 196 million (two million shares traded), Colombo Dockyard Rs 175 million (1.2 million shares traded), HNB Finance Rs 174 million (17.5 million shares traded), Lanka Credit and Business Finance Rs 135 million (16.3 million shares traded), Softlogic Capital Rs 122.8 million shares traded) and Sampath Bank Rs 118.8 million (718,000 shares traded). During the day 196.5 million share volumes changed hands in 33719 transactions.

Royal Ceramics announced an interim dividend of Rs one per share. The share was trading at Rs 47.80, up 0.21 percent.

The banking, find manufacturing sectors performed well. Among banks Commercial Bank and Sampath Bank were impressive. In the manufacturing sector JKH led.

Yesterday the rupee was quoted at Rs 311.30/60 to the US dollar in the spot market,weaker from Rs 310.50/311.10 the previous day, dealers said, while bond yields were broadly steady across the yield curve with the exception of the 01.062033 which saw demand and edged down.

A bond maturing on 01.05.2028 was quoted at 9.10/14 percent.

A bond maturing on 15.10.2029 was quoted at 9.58/62 percent, down from 9.59/62 percent.

A bond maturing on 15.12.2029 was quoted at 9.58/62 percent, down from 9.60/65 percent.

A bond maturing on 01.03.2030 was quoted at 9.60/64 percent, down from 9.65/68 percent.

A bond maturing on 01.07.2030 was quoted at 9.67/72 percent.

A bond maturing on 15.03.2031 was quoted flat at 9.85/90 percent.

A bond maturing on 01.10.2032 was quoted at 10.22/28 percent, from 10.20/30 percent.

A bond maturing on 01.06.2033 was quoted at 10.48/51 percent, down from 10.50/55 percent.

A bond maturing on 15.06.2034 was quoted at 10.67/75, up from 10.65/75 percent.

A bond maturing on 15.06.2035 was quoted flat at 10.75/80 percent.

A bond maturing on 01.07.2037 was quoted at 10.85/95 percent.

By Hiran H Senewiratne

Business

CDS accounts on the increase, crosses one million accounts

Central Depository Systems (Pvt) Ltd (CDS), a subsidiary of the Colombo Stock Exchange (CSE), has reached a milestone as total registered accounts surpassed the 1 million mark. This achievement coincides with the approach of the organization’s 35th anniversary in September 2026, marking three and a half decades of providing depository infrastructure for the Sri Lankan capital market.

Since its inception in 1991, the CDS has held the distinction of being the first depository in the South Asian region. In its core capacity as a depository, the institution is responsible for holding a wide array of securities including shares, debentures, corporate bonds, and units belonging to investors in electronic form.

The crossing of the one million account threshold also reflects the aggressive broad basing of the retail investor market over the past five years. This expansion is largely attributed to the comprehensive digitalization of the CSE, which has created accessibility for individuals across the country. Digital tools such as the CSE Mobile App and the “CDS e-Connect” portal have revolutionized how investors interact with the stock market, providing them with real time access to their holdings and a seamless interface for account management. The “CDS e-Connect”, originally launched in 2016 and revamped in 2021, has become a one stop shop for stakeholders, by offering services such as client profile management, real time balance and transaction viewing, eNomination facility, monthly statements and newly introduced dividend payment history viewing option. From 2016, by offering eStatements and SMS alert facilities CDS ensures transparency and security for the CDS accountholders. By decentralizing account openings and introducing online facilities in 2020, the CDS successfully brought the stock market to the fingertips of the general public, moving away from the traditional, paperwork heavy processes that once characterized the industry.

A critical pillar of this 35-year history was the 2011 launch of the full dematerialization drive. This initiative was designed to significantly reduce the movement of physical certificates, which were prone to loss, damage, and forgery. Today, the success of this drive is evident as the CDS holds 97 percent of listed equity and 100 percent of corporate debt in scripless form. This near total transition to electronic records has provided a secure and accessible service environment. The Central Control Unit plays a vital role, ensuring that all functions performed by the depository and its participants align with strict rules and regulatory guidelines. By identifying operational, financial, and market risks early, the CDS maintains the integrity of the ecosystem and fosters trust among both domestic and international investors.

Beyond its primary depository functions, the CDS has significantly expanded its influence through the Corporate Solutions Unit (CSU), established in 2017. The CSU was created to standardize and elevate the benchmarks for corporate action services in Sri Lanka and has since grown through the strategic acquisition of PW Corporate Registrar arm. This diversification allows the CDS to expand registrar services and manage corporate actions for both listed and unlisted companies, providing a holistic suite of services that includes the distribution of dividends, rights issues, and e-applications for Initial Public Offerings (IPOs). The digitization of issuer services has been a hallmark of the CSU’s work, introducing innovations such as eDividend payments, eWarrants, and eNotices. These advancements have streamlined the process for issuers while ensuring that shareholders receive their entitlements promptly and securely.

The strategic outlook for the CDS is now centred on the newly formed Research and Development Unit, which is essential to the organization’s vision for the future. This unit functions as a Project Management Office and is responsible for developing innovative services. By cultivating strategic alliances and international collaborations, the R&D unit ensures that the CDS remains a future forward institution capable of adapting to the evolving needs of the global financial sector.

As the CDS looks toward its 35th year of service, it remains focused on digital transformation, strategic partnerships that power progress, new service offerings and enhanced international relations. The integration of new technologies continues to ensure robust infrastructure for the next generation of market participants.

Head of CDS Nadeera Athukorale commenting on the vision of the CDS, remarked “By balancing its core depository duties with non-core registrar and consultancy services, the CDS has positioned itself for long term sustainability and industry leadership.”

The achievement of one million accounts serves as a testament to the resilience and adaptability of the Sri Lankan capital market infrastructure, demonstrating CDS’ ability to facilitate a growing digitized market while continuing to serve as the backbone of the nation’s investment landscape. (CSE)

Business

TONIK set to become next Sri Lankan hospitality brand reaching the global stage

TONIK, a new hospitality venture under Sri Lanka’s Acorn Group, has unveiled its vision to place culture, storytelling and design at the heart of island exploration, positioning itself as the next Sri Lankan hospitality brand to achieve global recognition.

Built on the Acorn Group’s decades of expertise across aviation, travel, logistics and leisure in multiple Asian markets, TONIK aims to elevate Sri Lanka’s tourism by translating the “soul” of destinations into curated experiences. The brand’s philosophy, “Every Stay Is a Story”, treats villas and boutique hotels as “living narratives” shaped by architecture, memory, craft and community.

The venture addresses a key market gap: while Sri Lanka features exceptional independent villas, many struggle with visibility and global reach. TONIK seeks to resolve this by amplifying each property’s unique value proposition – transforming distinctiveness into revenue -generating potential for owners.

“TONIK’s philosophy aligns with the evolution of our industry- where authenticity and meaningful experiences are no longer optional but essential,” said Harith Perera, Partner at Acorn Group. “Sri Lanka’s narrative deserves platforms that elevate its voice globally.”

For property owners, TONIK offers access to Acorn’s intelligence networks across the Maldives, Middle East, Europe and Asia, including insight into High-Net-Worth travel patterns.

CEO Sundararajah Kokularajah said: “By nurturing properties as living narratives, we aim to shape a new chapter for tourism – authentic, future-ready and deeply Sri Lankan.”

By Sanath Nanayakkare

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

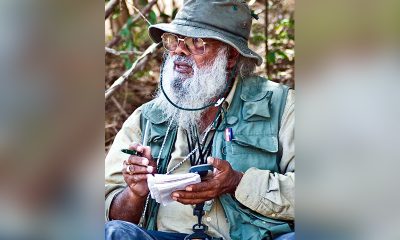

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

Business3 days ago

Business3 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

Features7 days ago

Features7 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features7 days ago

Features7 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone