Business

Reform or perish, it’s not too late

Sri Lankan economy in historic crisis

By K.D.D.B Vimanga and Naqiya Shiraz

The Sri Lankan economy faces a historical crisis. The root causes are the twin deficits. First, the persistent fiscal deficit – the gap between government expenditure and income. Second, the external current account deficit – the gap between total exports and imports. The problems have been festering for too long. Without urgent reforms, the crisis could easily morph into a full-blown debt crisis.

Sovereign debt workouts are extremely painful for citizens. A mangled debt restructuring can perpetuate the sense of crisis for years or even decades. A return to normal economic activity may be delayed, credit market access frozen, trade finance unavailable.

With the global pandemic, these are unusual and difficult times. The next five years are going to be crucial for the country. The problems can no longer be avoided and should be faced squarely. The journey ahead is going to be painful but the longer these are delayed the worse the problem becomes and the magnitude of the damage compounds.

With the global pandemic, these are unusual and difficult times. The next five years are going to be crucial for the country. The problems can no longer be avoided and should be faced squarely. The journey ahead is going to be painful but the longer these are delayed the worse the problem becomes and the magnitude of the damage compounds.

State of the Economy

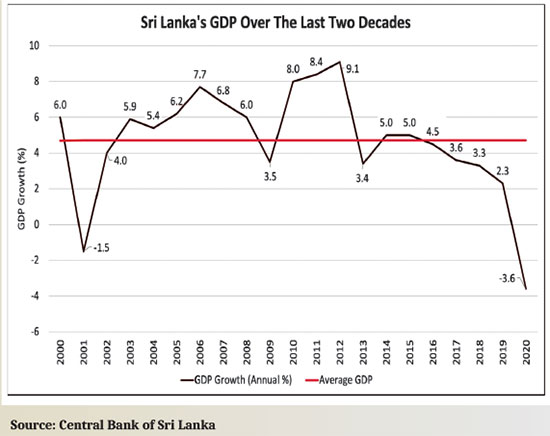

The new government inherited a fragile economy, battered by the Easter attacks of 2019, the constitutional crisis of October 2018 and the worst drought in 40 years in 2017. With the pandemic in 2020 Sri Lanka’s economy shrank by 3.6% with all sectors of the economy contracting.

Yet, the pandemic is not the sole cause – it only accelerated the decline of Sri Lanka’s economy that was weak to begin with. The country has long been plagued by structural weaknesses, with growth rates in the last few years even below the average growth rate during the war. Mismanaged government expenditure coupled with a long term decline in revenue have characterised Sri Lanka’s fiscal policy. As of 2020 total tax as a percentage of GDP fell to just 8%, while recurrent expenditure increased.

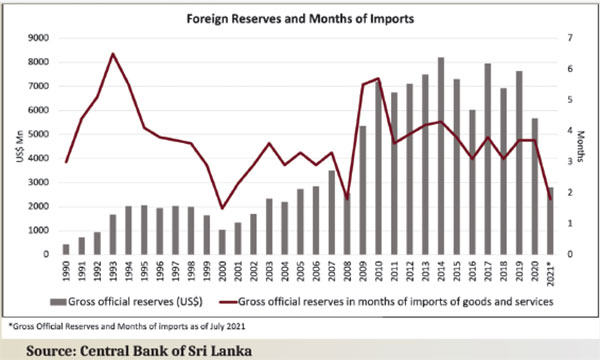

Borrowing to finance the persistent budget deficits is proving to be unsustainable. Total government debt rose to 101% of GDP in 2020 and has grown since. Sovereign downgrades have shut the country from international debt markets. The foreign reserves declined from US$ 7.6 bn in 2019 to US$ 5.7bn at the end of 2020 and to US$ 2.8 bn by July 2021. This level of reserves is equivalent to less than two months of imports. With future debt obligations also in need of financing, the situation is dire.

The import restrictions placed to combat this foreign exchange crisis have failed to achieve their purpose and are doing more harm than good. imports rose 30% in the first half of 2021 compared to 2020 despite stringent restrictions.

The problem lies not in the trade policy but in loose fiscal and monetary policy that has increased demand pressures within the economy, drawing in imports and leading to the balance of payments crisis and consequently the depreciation of the currency.

Measures by the Central Bank to address this by exchange rate controls and moral suasion have caused a shortage of foreign currency leading to a logjam in imports.

Fundamental and long-running macroeconomic problems were intensified by the pandemic.Import restrictions, price and exchange controls do not address the real causes.

Treating symptoms instead of the underlying causes is a recipe for disaster.

The continuation of such policies will lead to the deterioration of the economy, elevate scarcities, disadvantage the poor who are more vulnerable and in the long run lead to even higher prices and lower output due to lack of investment.

Sri Lanka’s GDP growth over the last decade has been alternating between short periods of high growth and prolonged periods of low growth. This is a result of the state-led, inward looking policies of the last decade.

A comprehensive reform agenda must be built around five fundamental pillars:

i) fiscal consolidation – The need to manage government spending within available resources and to reduce debt are paramount. Revenue mobilization must improve but the control of expenditure cannot be ignored. Budgetary institutions must be strengthened and there must be reviews not only of the scale of spending but also the scope of Government.

ii) Much of government expenditure is rigid – the bulk comprises salaries, pensions and interest so reducing these is a long term process. Reforming State Enterprises, especially in the energy sector and Sri Lankan Airlines is less difficult and could yield substantial savings. Continued operation of inefficient and loss-making SOE’s is untenable under such tight fiscal conditions. Financing SOE’s from state bank borrowings and transfers from government reduces the funds available for vital and underfunded sectors such as healthcare and education. Excessive SOE debt also weakens the financial sector and increases the contingent liabilities of the state. Therefore SOE reforms commencing with improving governance, transparency, establishing cost reflective pricing and privatisation are necessary. This can take a significant weight off the public finances and by fostering competition contribute to improvements in overall economic productivity.

iii) Tighten monetary policy and maintain exchange rate flexibility. Immediate structural reforms include, Inflation targeting, ensuring the independence of the central bank by way of legislation and enabling the functioning of a flexible exchange rate regime. Further significant attention has to be placed on the financial sector stability with a cohesive financial sector consolidation plan, with special emphasis on restructuring of SOE debt.

iv) Supporting trade and investment. Sri Lanka cannot achieve economic growth without international trade which means linking to global production sharing networks. Special focus has to be given to reducing Sri Lanka’s high rates of protection which creates a domestic market bias in the economy along with measures to improve trade facilitation and attract new export oriented FDI.

Attempts to build local champions supported by high levels of protection have

(a) diverted resources away from competitive businesses,

(b) created a hostile environment for foreign investment,

(c) been detrimental to consumer welfare,

(d) dragged down growth

v) Structural reforms to increase productivity and attract FDI – Productivity levels in Sri Lanka have not matched pace with the rest of the growing economies. The reforms mentioned above are extensively discussed in Advocata’s latest publication “Framework for Economic Recovery”.

Sri Lanka stumbled into the coronavirus crisis in bad shape,with weak finances; high debt and widening fiscal deficits. It no longer has the luxury to delay painful reforms. Failure to do so will not only jeopardize the economy; it could even spawn social and humanitarian crises.

Naqiya Shiraz is the Research Analyst at the Advocata Institute and can be contacted at naqiya@advocata.org.K.D.D.B. Vimanga is a Policy Analyst at the Advocata Institute. He can be contacted at kdvimanga@advocata.org.

Business

Relief measures to assist affected Small and Medium Enterprises

As agreed with the Sri Lanka Banks’ Association (Guarantee) Ltd. (SLBA), to provide relief measures to affected SMEs by licensed commercial banks and licensed specialised banks, Circular No. 04 of 2024 dated 19.12.2024, and its addendum, Circular No. 01 of 2025 dated 01.01.2025 were issued by the Central Bank of Sri Lanka to ensure the effective implementation of the relief measures specified in the cited Circulars in a consistent manner across all licensed banks.

In case of any rejections or disputes, borrowers are requested to contact the respective banks and to appeal to the Director, Financial Consumer Relations Department of CBSL (FCRD), if required through the following channels:

Based on the repayment capacity and the submission of an acceptable business revival plan by the borrower, the relief measures extended to affected SMEs include rescheduling of credit facilities up to a period of 10 years, extending the time to commence repayments based on the capital outstanding, waiving off unpaid interest subject to conditions, and providing new working capital loans. Despite the availability of the above relief measures, limited number of borrowers had approached licensed banks to avail themselves of these benefits to date.

In addition to the above measures, with the gradual recovery of the economy, in order to facilitate the sustainable revival of businesses that were adversely affected during the recent past, several other measures were taken by CBSL together with the banking industry.

Accordingly, inter alia, strengthening the Post Covid 19 revival units of licensed banks, CBSL issued Circular No. 02 of 2024 dated 28.03.2024 on “Guidelines for the Establishment of Business Revival Units of Licensed Banks” mandating banks to establish Business Revival Units (BRUs) to assist viable businesses that are facing financial and operational difficulties.

Under BRUs, banks may provide support to viable businesses, such as restructuring and rescheduling of credit facilities including the adjustment of interest rates, maturity extensions, providing interim financing, advisory services etc., subject to the condition that such borrowers are required to submit acceptable business plans and feasible repayment plans. As reported by banks, by the end of 2024, around 6,000 facilities had been facilitated through these BRUs.

The above cited Circulars and Guidelines can be accessed via https://www.cbsl.gov.lk

Business

Visa commits to support women entrepreneurs in Sri Lanka

Visa (NYSE: V), the global leader in digital payments reiterated its support to women entrepreneurs across Sri Lanka as a part of its International Women’s Month celebrations across the world, by stating a firm commitment towards financial inclusion and digitization of women-led businesses, and hosted women from different walks of life in a specially curated event at Colombo.

Avanthi Colombage, Country Manager for Visa in Sri Lanka and Maldives stated, “At Visa, we believe in being the best way to pay and be paid by uplifting everyone, everywhere. This year, we celebrated International Women’s Month to support the very capable businesswomen in our country, with an event titled ‘Overcoming Barriers to Growth’ along with Square Hub, an incubator and business accelerator.”

The event by Visa brought together 35 upcoming women entrepreneurs across various sectors, including fashion, e-commerce, fintech, technology, manufacturing, and agriculture. While prominent industry experts shared views, learnings and experiences from their own journeys, the event also facilitated open discussions and networking among entrepreneurs, on how they can build and sustain thriving businesses.

Avanthi elaborates that Visa has built a firm foundation in supporting female entrepreneurship and the empowerment of women in Sri Lanka and understands the challenges women-owned businesses face when seeking capital, access, networks and guidance and continues to actively uplift women in Sri Lanka. Globally and in Sri Lanka, Visa believes that the participation of women is key to the growth of an economy. Avanthi adds, “Two years ago, when we celebrated 35 years of Visa in Sri Lanka, we announced a grant for The Asia Foundation to assist women-led small and medium businesses (SMBs) throughout the country. This initiative offered vital seed funding, skills training, and financial inclusion opportunities for women entrepreneurs, helping remove some major barriers to their success,” she recalled.

Business

Environmentalists renew concerns over Adani Group’s proposed Mannar wind power project

Environmental groups, including the Wildlife and Nature Protection Society (WNPS), the Centre for Environmental Justice (CEJ) and the Environmental Foundation Ltd. (EFL), are raising renewed concerns about the potential ecological impact of large-scale wind energy development on Mannar Island. Conservationists argue that the island, home to a unique and sensitive ecosystem, faces serious risks from industrial projects that may disrupt biodiversity and endanger local wildlife.

At the heart of the controversy is whether the environmental issues raised by Adani Group’s proposed wind energy project in Mannar were being adequately considered. Critics argue that tariff negotiations and economic interests overshadowed ecological assessments, potentially leading to a project that might compromise the island’s rich natural heritage.

“Can wind energy coexist with Mannar Island’s fragile ecosystem? asked environmental scientist Hemantha Withanage of the CEJ.

He told The Island Financial Review: “We must ensure that our transition to renewable energy does not come at the cost of irreplaceable biodiversity.”

Other conservationists have pointed out that environmentalists are often misrepresented as obstructionists in debates over development. “Are we being painted as enemies of progress, or is the public being misled about the real consequences of such projects? questioned Dr. Rohan Pethiyagoda, a leading environmental advocate.

With Adani’s possible withdrawal from the project, there is now an opportunity to reevaluate Sri Lanka’s approach to sustainable energy. Experts emphasize the need for a smarter, science-driven path that prioritizes both renewable energy and environmental conservation.

A joint media conference, scheduled for today at the Dutch Burgher Union, Colombo, aims to address these concerns. Organized by WNPS, CEJ, EFL and Pethiyagoda, the event will explore questions such as whether the project might resurface under a new guise and who the true beneficiaries of such large-scale energy initiatives are.

By Ifham Nizam

-

Sports4 days ago

Sports4 days agoSri Lanka’s eternal search for the elusive all-rounder

-

News3 days ago

News3 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

News5 days ago

News5 days agoGnanasara Thera urged to reveal masterminds behind Easter Sunday terror attacks

-

Business6 days ago

Business6 days agoAIA Higher Education Scholarships Programme celebrating 30-year journey

-

News4 days ago

News4 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features4 days ago

Features4 days agoSanctions by The Unpunished

-

Latest News2 days ago

Latest News2 days agoIPL 2025: Rookies Ashwani and Rickelton lead Mumbai Indians to first win

-

Features4 days ago

Features4 days agoMore parliamentary giants I was privileged to know