Business

Political VIPs notably absent at Japanese FDI project launch

by Sanath Nanayakkare

There was notable absence of political heavyweights at the launch of a major foreign direct investment (FDI) hotel project in Colombo last week, arguably reflecting declining appeal of politicians.

Without the participation of any Sri Lankan political VIPs to cut the ribbon or make the keynote speech, the Granbell Hotel Colombo – a USD 60 million worth Japanese hotel in the heart of Colombo, opened its doors warmly welcoming all to experience a fusion of Japanese and Sri Lankan hospitality.

Granbell is the sister property of Le Grand Galle, inaugurated in August 2018 by Asia Leisure and with Belluna Co. Ltd, Japan.

The grandeur of the occasion was celebrated by none other than Mizukoshi Hideaki – the Japanese Ambassador to Sri Lanka who was the chief guest for the occasion.

Having announced that the launch of the hotel was in line with the long-standing friendship between Sri Lanka and Japan which dates back over 70 years, the Japanese Ambassador together with several Japanese invitees including, Kiyoshi Yasuno – the President of Belluna Co. Ltd and Ryo Takarada, Chief Architect of Granbell Colombo inaugurated the hotel.

The Granbell Hotel Colombo is owned and managed by the leading Japanese company Belluna Co. Ltd, a listed company in the Tokyo Stock exchange. It adds to a growing portfolio of properties around the world owned and managed by Belluna.Co.Ltd. The hotel chain includes 17 properties in Japan, one in Hawaii, one in the Maldives and two in Sri Lanka.

The project commenced in 2016 with a foreign direct investment of USD 60 million. The construction was carried out by the Hazama Ando Corporation of Japan and was completed in line with the highest construction standards, combining Japanese architecture and Sri Lankan craftsmanship.

Today, the hotel provides a large number of employment opportunities for the local community further strengthening the economic revival of the nation.

The Granbell is located in proximity to the Colpetty Railway Station in the heart of Colombo and provides a host of exciting facilities and services.

While the Heads of Departments and staff being Sri Lankan, the hotel also brings forth Japanese expertise with its general manager and the head chef to offer an authentic combination of the two cultures.

Opposition MP Patali Champika Ranawaka speaking in parliament two days after the opening of the Granbell Hotel said,” Some people ask why Sri Lanka isn’t convening an international aid forum to obtain the support of friendly countries to come out of the current economic crisis. Such an international aid forum can’t be convened because the international community has no confidence in the government of Sri Lanka. Friendly nations are not helping us any more. Japan, which helped Sri Lanka from time immemorial without any strings attached, had their mega projects in Sri Lanka cancelled by one single stroke of the pen overnight. If we had the $1.5 billion Japanese-funded light rail project, JICA funded project for laying 220 kilovolt underground cable from Kerawalapitiya to the Colombo Port and ADB’s railway project from Maradana to Homagama, we would have had FDIs worth USD 2 billion flowing into the country annually over a few years. Japan, our ‘biggest’ post-independence friend who had no political interest in helping us, was dropped by the government without any courtesy. In such a context, today no country is stepping forward to host an international aid forum to help Sri Lanka.”

Former prime minister Ranil Wickramasinghe said recently that he raised the matter of the Japanese light rail project with President Gotabaya Rajapaksa and that the government has begun to review it in a more favourable manner.

Business

CBSL keeps overnight policy rates unchanged; latest review of IMF program awaited

The Central Bank kept its overnight policy rate unchanged yesterday as it awaited the latest review of a US $2.9-billion International Monetary Fund programme.

‘The Central Bank will maintain the overnight policy rate at 7.75 percent and stable inflation, healthy credit growth and steady economic expansion are the reasons for the decision, Central Bank Governor Dr Nandalal Weerasinghe said. The Central Bank Governor stated this yesterday at the monthly policy review meeting held at Central Bank head office in Colombo.

‘The Board arrived at this decision after carefully considering evolving developments and the outlook on the domestic front and global uncertainties, the Governor said.

Dr Weerasinghe said that the Board is of the view that the current monetary policy stance will support steering inflation towards the target of 5 percent

The CBSL Governor added: ‘Inflation measured by the Colombo Consumer Price Index (CCPI) remained unchanged at 2.1 percent in December 2025. However, food prices edged higher in December compared to November.

‘ This was due to supply chain disruptions caused by Cyclone Ditwah and higher demand for food during the festive season.

‘Inflation is projected to accelerate gradually and move towards the target of 5 percent by the second half of 2026. Core inflation, which excludes price changes in volatile food, energy and transport from the CCPI basket, has also shown some acceleration in recent months.

‘Core inflation is expected to accelerate further as demand in the economy strengthens. Meanwhile, inflation expectations appear to be well anchored around the inflation target.

‘The economy grew by 5.0 percent during the first nine months of 2025. Despite the slowdown in economic activity following Cyclone Ditwah in late 2025, early indicators reflect greater resilience.

‘Credit disbursed to the private sector by commercial banks and other financial institutions continued its notable expansion in late 2025.

‘This reflects increased demand for credit amid improving economic

activity and increased vehicle imports. Post-cyclone rebuilding is expected to sustain this momentum.

‘The external current account is estimated to have recorded a sizeable surplus in 2025, despite the widening of the trade deficit. Foreign remittances remained healthy during 2025.

‘Despite large debt service payments during the year, Gross Official Reserves were built up to USD 6.8 bn by the end of 2025.

‘This was mainly supported by the net foreign exchange purchases by the Central Bank and inflows from multilateral agencies. The Sri Lanka rupee depreciated by 5.6 percent against the US dollar in 2025 and has remained broadly stable thus far during this year. This includes the swap facility from the People’s Bank of China.

‘The Board remains prepared to implement appropriate policy measures to ensure that inflation stabilises around the target, while supporting the economy to reach its potential.’

By Hiran H Senewiratne

Business

Janashakthi Finance records 35% growth in Net Operating Income and LKR 389 Mn. PBT in Q3 FY26

Janashakthi Finance PLC, formerly known as Orient Finance PLC and a subsidiary of JXG (Janashakthi Group) announced a strong financial performance for the nine-month period ended 31 December 2025, driven by sustained growth in its core businesses, disciplined execution and continued focus on scale and efficiency.

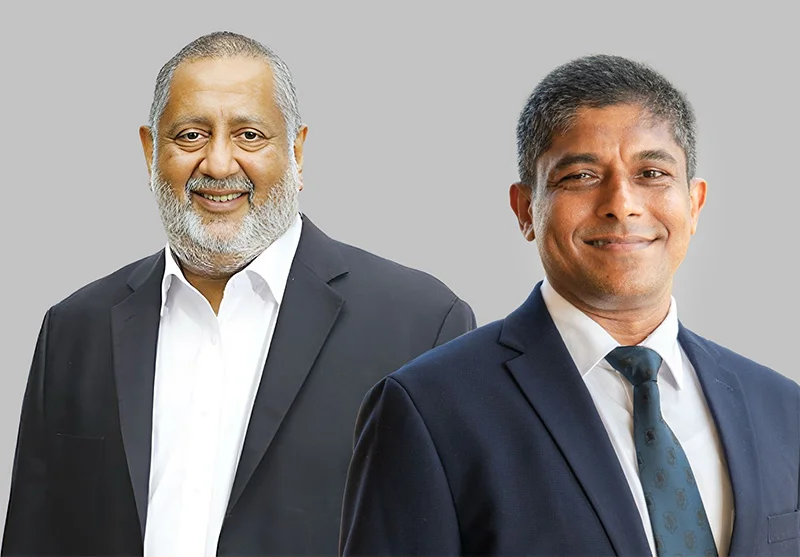

Commenting on the results, Rajendra Theagarajah, Chairman of Janashakthi Finance PLC, said, “The performance for the period reflects the clarity of our strategic priorities and the strength of our governance framework. With strong leadership in place that is confidently driving the business, we continue to grow steadily while maintaining balance sheet strength and stakeholder confidence.”

For the period under review, Profit Before Tax (PBT) rose by 39% year-on-year to LKR 389 million, supported by higher operating income and portfolio expansion. Net Operating Income increased by 35% year-on-year to LKR 2.2 billion, reflecting sustained lending activity and improved business scale.Net Profit After Tax (NPAT) amounted to LKR 240 million.

The Company’s Loans and Receivables portfolio grew by 49% year-on-year to LKR 29 billion, driven by demand across key lending segments and focused growth initiatives. Deposits increased to LKR 17 billion, recording a 14% year-on-year growth, reinforcing funding diversity and customer confidence.

Reflecting on the year’s progress, Sithambaram Sri Ganendran, Chief Executive Officer of Janashakthi Finance PLC, stated, “During the period, we focused on expanding our loan book responsibly, strengthening our funding base and enhancing operational capability. The growth achieved across our key indicators positions the Company strongly as we continue to execute our medium-term strategy and respond to market opportunities.”

Business

JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

The Group continued to deliver a strong performance, with all businesses reporting improved profitability.

The operationalisation of two of the Group’s largest projects, the City of Dreams Sri Lanka integrated resort and the West Container Terminal (WCT-1) at the Port of Colombo, continued to progress well. The encouraging quarter-on-quarter momentum demonstrates the strong ramp up potential of both projects.

The country faced an unexpected challenge in November with Cyclone Ditwah, which impacted parts of Southeast and South Asia. The cyclone caused loss of lives, affected a significant portion of the population, and resulted in considerable infrastructure damage in certain areas of Sri Lanka. While the operations of the Group were disrupted during the few days of the cyclone, there were no significant operational or financial impact as a direct result of the cyclone and related flooding.

The Group and its staff supported relief efforts through various initiatives, including a substantial contribution of Rs.500 million from John Keells Holdings PLC and its affiliate companies towards the Government’s ‘Rebuilding Sri Lanka’ initiative.

Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs.23.76 billion in the third quarter of the financial year 2025/26 is an increase of 68% against Group EBITDA of Rs.14.15 billion recorded in the third quarter of the previous financial year.

Cumulative Group EBITDA for the first nine months of the financial year 2025/26 at Rs.55.10 billion is an increase of 84% against the EBITDA of Rs.29.94 billion recorded in the same period of the financial year 2024/25.

During the quarter under review, the Group recorded fair value gains on investment property amounting to Rs.2.30 billion [2024/25 Q3: Rs.955 million], and net exchange losses of Rs.759 million [2024/25 Q3: gain of Rs.782 million], mainly due to the impact of the deprecation of the Rupee on the foreign currency denominated loan at City of Dreams Sri Lanka.

Profit attributable to equity holders of the parent is Rs.6.48 billion in the quarter under review, which includes fair value gains on investment property and net exchange losses amounting to Rs.1.45 billion. Profit attributable to equity holders of the parent for the corresponding period of the previous financial year was Rs.2.85 billion, which included fair value gains on investment property and net exchange gains amounting to Rs.1.70 billion.

The second interim dividend for FY2026 of Rs. 0.10 per share is aligned with the first interim dividend paid in November 2025. This reflects the expectation that the current momentum of performance will sustain or further improve going forward. The outlay for the second interim dividend is Rs.1.77 billion, which is an increase compared to Rs.881 million in the previous year.

(JKH)

-

Business4 days ago

Business4 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business5 days ago

Business5 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion5 days ago

Opinion5 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Opinion7 days ago

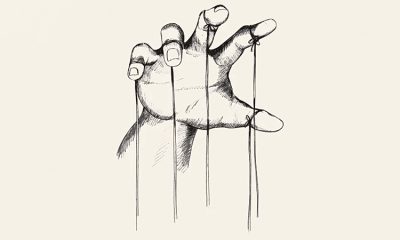

Opinion7 days agoA puppet show?

-

Opinion4 days ago

Opinion4 days agoLuck knocks at your door every day

-

Business6 days ago

Business6 days agoDialog Brings the ICC Men’s T20 Cricket World Cup 2026 Closer to Sri Lankans

-

Features7 days ago

Features7 days ago‘Building Blocks’ of early childhood education: Some reflections

-

News5 days ago

News5 days agoRising climate risks and poverty in focus at CEPA policy panel tomorrow at Open University