News

Permanent residence for persons of Sri Lanka descent, foreign spouses

ECONOMYNEXT –Persons of Sri Lanka descent, including those who have renounced their citizenship, and foreign spouses would be able to get permanent residence status, under regulations gazetted by the ministry of public security.

A person of Sri Lankan descent or “whose citizenship of sri Lanka has ceased under sections 19, 20 or 21 of the Citizenship Act” as well as a foreign spouse would be eligible to apply after six months of marriage under the new regulations.

However, if the marriage is dissolved before 5 years, the PR status would automatically cease.A person of Sri Lanka descent is someone whose parents, grand parents or great grand parents were born in or are still citizens of the island.

A fee of 1,000 dollars would be charged. Children would also be allowed PR status at 400 dollars.In Sr Lanka regulations issued by gazette (subsidiary legislation) by most laws, usually have to be presented to parliament before they are implemented by the agency concerned.

Ex-Sri Lankans earlier had to apply for dual citizenship, which was not allowed by some countries.However permanent resident status is provided by many countries.

Sri Lanka’s PR status allows persons to work, run businesses, buy or inherit property.There are large numbers of Sri Lankans who have obtained citizenship in foreign countries who have not applied for dual citizenship.

Sri Lanka also does not have a naturalization path unlike Western nations which leads to them exiting whatever assets they have in this country and investing it in the new countries.A controversy has also arisen at the moment with legislators losing their parliamentary seats due to being foreign citizens.

Features

The final voyage of the Iranian warship sunk by the US

On 17 February, the Indian Navy posted a cheerful message on X.

“Welcome!” it wrote, greeting the Iranian warship Iris Dena as it steamed into the port of Visakhapatnam to join an international naval gathering.

Photographs showed sailors in crisp whites and a grey frigate gliding in the sea harbour on a clear day. The hashtags spoke of “Bridges of Friendship” and “United Through Oceans”.

Two weeks later the ship, carrying 130 sailors, lay at the bottom of the Indian Ocean. It had been torpedoed by a US submarine off Sri Lanka’s southern coast on 4 March.

Commissioned in 2021, the Dena was a relatively new vessel – a Moudge-class frigate of Iran’s Southern Fleet, which patrols the Strait of Hormuz and the Gulf of Oman.

According to US Defence Secretary Pete Hegseth, the vessel “thought it was safe in international waters” but instead “died a quiet death”. Rescue teams from Sri Lanka have recovered at least 87 bodies. Only 32 sailors survived.

The sinking marks a dramatic widening of the war between America, Israel and Iran. And, though it occurred in international waters of the Indian Ocean and outside India’s jurisdiction, it is an awkward moment for Delhi.

“The war has come to our doorsteps. That is not a good thing,” says retired Vice Admiral Arun Kumar Singh.

For some strategists, the episode carries broader implications for India’s regional standing.

Indian strategic affairs expert Brahma Chellaney wrote on X that the US torpedoing of the Iranian warship in India’s “maritime neighbourhood” was “more than a battlefield episode” – calling it a “strategic embarrassment” for Delhi.

“By sinking a vessel returning from an Indian-hosted multilateral exercise, Washington effectively turned India’s maritime neighbourhood into a war zone, raising uncomfortable questions about India’s authority in its own backyard,” Chellaney wrote.

Just days before its destruction, the Dena had been a diplomatic guest of the Indian Navy.

The ship had travelled to Visakhapatnam, a sun-washed port city on India’s east coast, to participate in the International Fleet Review 2026 and Exercise Milan, a large multilateral naval exercise meant to showcase India’s growing maritime leadership.

Seventy-four countries and 18 warships took part in the events, which Delhi described as a demonstration of its ambition to become the Indian Ocean’s “preferedsecurity partner”.

Visiting ships at such multilateral exercises usually do not carry a full combat load of live munitions, unless scheduled for a live-fire drill, according to Chellaney. Even during the sea phase, when drills and live firing take place, ships carry only tightly controlled ammunition limited to the specific exercises.

Singh, an invitee to the event, recalls seeing the warship and its Iranian sailors in Visakhapatnam just days before its fate changed.

“I saw the boys marching in front of me,” he says of the Iranian naval contingent during the parade along the seafront, just 10m away. “All young people. I feel very sad.”

He says on 21 February, the assembled ships – including the Iranian vessel – sailed out for the sea phase of Exercise Milan, scheduled to run until 25 February.

“What happened next is less clear: the ship may have returned to port or peeled away after exercises. Either way, the waters where it was later sunk – off Galle in Sri Lanka – lie only two to three days’ sailing from India’s east coast,” Singh says. What the ship was doing in the 10-12 days in between is not clear.

Singh, who has commanded submarines, believes the sequence leading up to the attack was probably straightforward.

The US, he notes, tracks vessels across the world’s oceans. “They would have known exactly when the ship left and where it was heading,” he says. A fourth of America’s submarine fleet of 65-70 is at sea at any given time, according to analysts.

According to the Indian Navy, the Iranian warship had been operating about 20 nautical miles west of Galle – roughly 23 miles (37km) – in waters that fall under Sri Lanka’s designated search-and-rescue zone.

The attack, Singh says, appears to have involved a single Mark-48 torpedo, a heavyweight weapon carrying about 650 pounds of high explosive, capable of snapping a ship in two. Video footage suggests the submarine may have fired from 3-4km away, around 05:30 local time.

The aftermath was grim and swift.

The warship reportedly sank within two to three minutes, leaving little time for rescue. “It’s a miracle they managed to send an SOS,” Singh says, which was picked up by the Sri Lanka Maritime Rescue Coordination Centre in Colombo.

According to the Indian Navy, a distress call from the Iranian warship was picked up by Colombo in the early hours of 4 March, triggering a regional search-and-rescue effort.

The navy said in a statement that Sri Lanka’s navy began rescue operations first, while India moved to assist later.

The Indian Navy deployed a long-range maritime patrol aircraft to support the search and kept another aircraft with air-droppable life rafts on standby.

A naval vessel already operating nearby reached the area by late afternoon. Another ship, which sailed from the southern Indian port city of Kochi to join the effort, continues to comb the waters for survivors and debris.

Under the Second Geneva Convention, countries at war are required to take “all possible measures” to rescue wounded or shipwrecked sailors after a naval attack. In practice, however, this duty applies only if a rescue can be attempted without putting the attacking vessel in serious danger.

Singh says submarines are rarely able to help.

“Submarines don’t surface,” he says. “If you surface and give up your position, someone else can sink you.”

Singh suspects the speed of the sinking – and possibly sparse shipping in the area at the time – meant few nearby vessels could respond. “A ship breaking up that fast leaves almost no chance,” he says.

In a shooting war, Singh says, the legal position is blunt.

Fighting between the United States and Iran had been under way since 28 February, with claims that 17 Iranian naval vessels had already been destroyed.

“When a shooting war is on, any ship of a belligerent country becomes fair game,” he says.

Many questions remain. Why was the Iranian warship still in waters near Sri Lanka nearly two weeks after leaving India’s naval exercise? Was it heading home, or on another mission? And how long had the US submarine been tracking it before firing?

For Delhi, the episode is diplomatically awkward.

India has drawn closer to Washington on defence while maintaining long-standing political and economic ties with Tehran – a balancing act the war has made harder.

Indian Prime Minister Narendra Modi has called broadly for “dialogue and diplomacy” to resolve conflicts, but has neither addressed the sinking of the Iranian vessel directly nor criticised the American strike.

Iran’s Foreign Minister Abbas Araghchi described the attack as “an atrocity at sea” and stressed that the frigate had been “a guest of India’s Navy”. Meanwhile Sri Lanka has taken control of another Iranian naval vessel off its coast after an engine failure forced it to seek port, a day after the US attack.

The episode has nonetheless sparked debate within India’s strategic community.

Kanwal Sibal, a veteran diplomat, argued that India’s responsibility may not be legal, but it is moral.

“The Iranian ship would not have been where it was had India not invited it to the Milan exercise,” he wrote on X. “A word of condolence at the loss of lives of those who were our invitees would be in order.”

Others like Chellaney have framed the issue in more strategic terms.

He described the strike as a blow to India’s maritime diplomacy. The torpedoing of the frigate in “India’s maritime backyard”, he argued, punctured Delhi’s carefully cultivated image as a “preferred security partner” in the Indian Ocean.

“In one torpedo strike, American hard power has punctured India’s carefully cultivated soft power,” says Chellaney.

As the debate gathered pace in strategic circles, India’s official response remained cautious.

External Affairs Minister S Jaishankar said on X that he had held a telephone conversation with Araghchi, and also posted a photograph of a meeting with Iran’s Deputy Foreign Minister Saeed Khatibzadeh at a foreign policy summit in Delhi.

For military historian Srinath Raghavan, the legal position is clear: once the Iranian vessel left India’s shores, Delhi had no formal responsibility.

The strategic message, however, is harder to ignore.

“First, the spreading geography of this war. Second, India’s limited ability to manage its fallout,” says Raghavan.

“Indeed, the US Navy has fired a shot across the bow aimed at all regional players, including India.”

[BBC]

Latest News

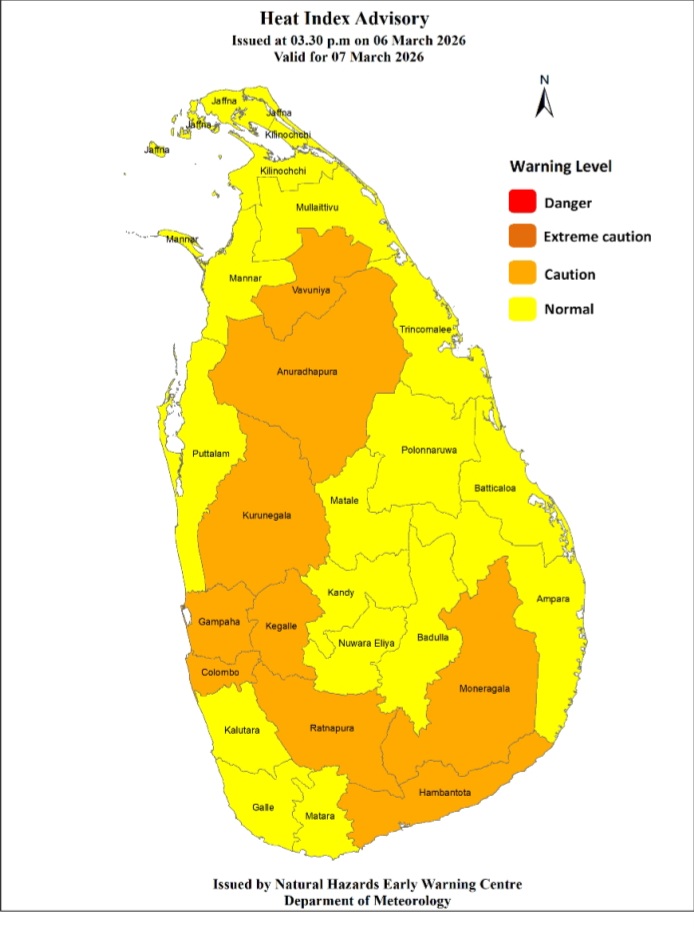

Heat Index at ‘Caution Level’ in the Sabaragamuwa province and, Colombo, Gampaha, Kurunegala, Anuradhapura, Vavuniya, Hambanthota and Monaragala districts

Warm Weather Advisory Issued by the Natural Hazards Early Warning Centre of the Department of Meteorology at 3.30 p.m. on 06 March 2026, valid for 07 March 2026.

The public are warned that the Heat index, the temperature felt on human body is likely to increase up to ‘Caution level’ at some places in the Sabaragamuwa province and in Colombo, Gampaha, Kurunegala, Anuradhapura, Vavuniya, Hambantota and Monaragala districts.

The Heat Index Forecast is calculated by using relative humidity and maximum temperature and is the condition that is felt on your body. This is not the forecast of maximum temperature. It is generated by the Department of Meteorology for the next day period and prepared by using global numerical weather prediction model data.

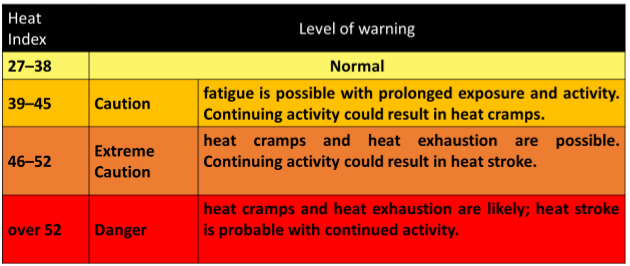

Effect of the heat index on human body is mentioned in the above table and it is prepared on the advice of the Ministry of Health and Indigenous Medical Services.

ACTION REQUIRED

Job sites: Stay hydrated and takes breaks in the shade as often as possible.

Indoors: Check up on the elderly and the sick.

Vehicles: Never leave children unattended.

Outdoors: Limit strenuous outdoor activities, find shade and stay hydrated.

Dress: Wear lightweight and white or light-colored clothing.

Note: In addition, please refer to advisories issued by the Disaster Preparedness & Response Division, Ministry of Health in this regard as well. For further clarifications please contact 011-7446491

Latest News

Prompt solutions will be provided for the salary anomalies prevailing within the teacher and principal services — PM

Prime Minister Dr. Harini Amarasuriya stated that the government has paid close attention to the salary anomalies prevailing within the teacher and principal services and that prompt solutions will be provided following extensive discussions held with trade unions.

The Prime Minister made these remarks while responding to questions raised in Parliament on Friday (06).

Presenting data on existing vacancies in the education sector, the Prime Minister explained the current situation.

There are 903 vacancies existing in the Sri Lanka Education Administrative Service (SLEAS) and 3,790 vacancies in Sri Lanka Principals’ Service (SLPS).

In order to fill the vacancies which still remain due to various reasons, including selected officers not accepting appointments after the examinations and interviews conducted since 2021, interviews are scheduled to be held in the second week of March 2026.

Further, in order to fill the vacancies for the years 2021 and 2025, competitive examinations will be conducted in the future with the approval of the Public Service Commission.

At present, entry into the Principals’ Service is considered as a new recruitment. As a solution to the salary-related issue arising in this regard, a new Cabinet paper is being prepared seeking approval to consider appointments to the Principals’ Service as a promotion, thereby enabling appropriate salary conversion.

The Prime Minister also emphasized that sustainable solutions are required not only for salary issues in the education sector but also for salary-related concerns in several other sectors. Accordingly, the government plans to appoint a new Salary Commission. Through this commission, the government expects to provide lasting solutions to the issues faced by teachers and principals within this year.

In accordance with the service minute of the Principals’ Service, several training programmes have been made mandatory for the professional development of principals.

These include, Induction training at the beginning of service, capacity development training prior to promotion to Grade II and Grade I, and periodic awareness programmes conducted at provincial and zonal levels.

The Prime Minister further stated that discussions are undertaking with the Department of Management Services regarding the proposals submitted by principals’ associations. Based on the responses received, the government is prepared to take the necessary steps through the Cabinet of Ministers.

[Prime Minister’s Media Division]

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

Business3 days ago

Business3 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

Features7 days ago

Features7 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

News2 days ago

News2 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land