Business

Participation of the Employees’ Provident Fund in the Domestic Debt Optimisation Programme

The Employees’ Provident Fund (EPF/the Fund) wishes to inform its members that as an eligible participant and with the approval of the Monetary Board of the Central Bank of Sri Lanka, it has submitted an offer to exchange the portfolio of Treasury Bonds of the EPF under the Domestic Debt Optimization (DDO) programme in terms of the invitation made by the Ministry of Finance, Economic Stabilisation and National Policies (MOF) following a Resolution adopted by Parliament.

Accordingly, the following are brought to the notice of the members:

a. On 04 July 2023, MOF announced the Government’s policy on domestic public debt optimization strategy, which was approved by the Parliament by a Resolution on 01 July 2023.

b. As per the announcement, MOF has identified, inter-alia, the conversion/exchange of existing Treasury bonds of superannuation funds into new Treasury bonds to constitute the DDO, to avoid superannuation funds incurring a substantially higher tax of 30% on taxable income from Treasury bond investments. This tax will be applied from 01 October 2023, as per the Inland Revenue (Amendment) Act, No. 14 of 2023. At present, the tax rate applicable to the income of the EPF including the income from Treasury bonds is 14% and the continuation of a concessionary tax rate of 14% beyond 30 September 2023 is contingent upon the effective participation of the EPF in the DDO as defined in the Act.

c. The Exchange Memorandum dated 04 July 2023 and subsequent amendments issued by MOF contained comprehensive details of the debt conversion/exchange. Further, the MOF held an investor presentation on 07 July 2023, outlining the proposed terms of the debt exchange and its implications, and subsequently issued clarifications to questions raised following this presentation. As per the Exchange Memorandum, eligible holders were required to analyse the implications of making or not making an offer by reference to the legal, tax, financial, regulatory, accounting and related aspects of the DDO. All communications in this regard can be accessed through https://treasury.gov.lk/web/ddo.

d. In this regard, a presentation was made to the Cabinet of Ministers on 28 June 2023, titled “Debt Restructuring in Sri Lanka” prepared by the MOF in consultation with CBSL. On 29 and 30 June 2023, the Committee on Public Finance (COPF) has been informed regarding the expected impact of DDO on EPF through a presentation, followed by extensive discussions. Further, the COPF at its meeting held on 07 September 2023 discussed the impact of the proposed amendments to the Inland Revenue Act on the superannuation funds.

e. As per the Exchange Memorandum, the following two options were available for EPF under DDO programme.

i. Exchange Option: EPF can exchange a minimum required amount of existing Treasury bonds with 12 new Treasury bond series that mature from 2027 to 2038. These new bonds are offered with a coupon rate of 12% per annum until 2026 and 9% per annum thereafter.

The EPF would continue to pay income tax at 14% per annum on its taxable income attributable from its Treasury bond portfolio.

ii. Non-Exchange Option: If EPF decides not to exchange the existing Treasury bonds a 30% tax rate would apply to the taxable income of Treasury bond portfolio of the EPF.

f. The Monetary Board has carefully examined how the DDO could affect the Fund under the above two scenarios. Accordingly, to assist the Monetary Board to ascertain the possible impact of the DDO on the Fund, the internal staff of CBSL has conducted relevant analyses.

Such assessments have been carried out on the basis of several prudent and realistic assumptions and further taking into consideration the legal, tax, financial, regulatory, accounting and related aspects of the DDO.

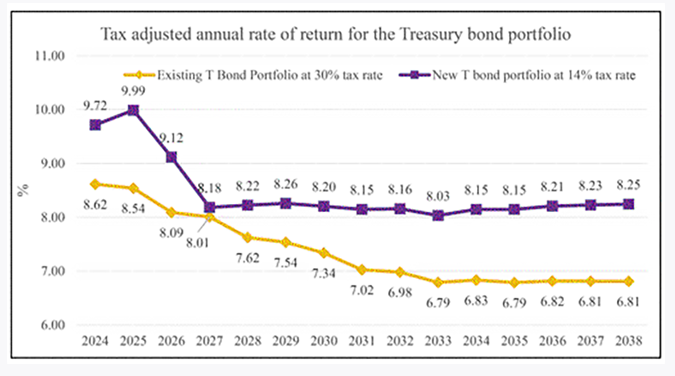

The summary of the expected returns of the EPF

Treasury bond portfolio under the two scenarios is given in the Chart below. At present Treasury bond portfolio consists of 88% of the total Fund and a larger portion of the remainder is in Treasury bills. Treasury bills portfolio and new funds can be invested at prevailing market rates so that total return of the Fund portfolio would be higher than the likely returns of the Treasury bond portfolio under both scenarios shown in the Chart below.

g. The main factors and assumptions taken into due consideration in arriving at the above annual rate of return of the Treasury bond portfolio are given below.

i. The face value of the Treasury bond portfolio of EPF is Rs. 3,220 bn. In order to fulfill the minimum participation requirement, 78% of the face value of the Treasury bond portfolio on face value basis had to be exchanged.

ii. The government will service all obligations relating to Treasury bonds including the new Treasury bonds issued under the Debt Exchange as they fall due in a timely manner.

iii. Cash receipts due from above mentioned maturities and coupons will be reinvested in sixyear Treasury Bonds at rates of 13.50% for 2023, 12.00% for 2024, 10.50% for 2025 and 10% for 2026 and onwards. (Expected returns were also been computed under different reinvestment rate scenarios of which the pattern of the returns remains the same).

iv. If EPF participated in the Exchange Option, the current tax rate of 14% will be applied.

However, if EPF did not participate in the Debt Exchange, the tax rate applicable on the taxable income of Treasury bonds will be increased to 30% which is more than double the applicable post exchange tax rate. It was further assumed that these tax rates will remain unchanged until 2038. (CBSL)

Business

Low-quality coal shipment affects Lakvijaya coal power plant operations

Operations at Sri Lanka’s main coal-fired power facility, the Lakvijaya coal power plant, suffered a significant disruption soon after a new shipment of coal was introduced, raising concerns over generation stability and environmental emissions.

Energy analyst Dr. Vidura Ralapanawa said in a social media post that the plant began using coal from “Ship 11” on Wednesday, following confirmation from officials of the Ceylon Electricity Board (CEB).

However, almost immediately after the new batch of coal was fed into the system, the plant’s generation capacity began to decline due to the poor quality of the fuel.

According to Dr. Ralapanawa, the plant’s output dropped by about 82 megawatts overall. Unit 1 recorded a drop of 45 MW, Unit 2 fell by 15 MW, and Unit 3 declined by 22 MW shortly after the coal was introduced.

The situation worsened later in the night when two coal mills in Unit 3 reportedly became clogged around 11 p.m., causing a rapid fall in generation capacity. Unit 3, which normally operates at a higher output level, was said to be running at around 170 MW following the malfunction.

Coal mills are a crucial component in coal-fired power generation. They grind raw coal into a fine powder before it is fed into the boiler for combustion. Each generating unit at the Norochcholai facility is equipped with five coal mills, and any obstruction in these systems can severely affect plant operations.

When mills become clogged, plant operators often have to rely on diesel-fired burner guns to stabilise the flame inside the boiler. While this helps maintain combustion, it significantly increases operating costs because of the high price of diesel.

The heavy use of diesel has another consequence. According to Dr. Ralapanawa’s post, when diesel firing increases, the plant’s Electro-Static Precipitators (ESPs) must be shut down. ESPs are designed to capture and remove particulate matter such as fly ash before emissions are released through the chimney.

With the ESPs switched off, large amounts of fly ash may be released into the atmosphere, potentially affecting surrounding communities.

Dr. Ralapanawa further noted that the coal shipment appears to have low calorific value, low volatile matter, and high ash content, all of which reduce combustion efficiency. In addition, the coal reportedly has a low grindability index, making it harder to pulverise and increasing the likelihood of mill blockages.

He added that while the immediate clogging of the mills may be cleared within a day, the underlying quality issues with the coal could make the problem persistent.

The development comes amid earlier assurances from officials of the Ceylon Electricity Board that the Norochcholai plant could be operated effectively even with lower-quality coal supplies.

The Norochcholai facility, with an installed capacity of 900 MW, is the largest power station in Sri Lanka and a critical component of the national grid. Any disruption to its operations can have wider implications for the country’s electricity supply, potentially forcing the system to rely on more expensive oil-based power generation.

Engineers are currently working to address the clogged mills and stabilise generation, but energy analysts warn that unless the fuel quality improves, similar operational issues could recur.

By Ifham Nizam

Business

CSE regains some positive terrain but challenges remain

CSE trading yesterday was positive overall on account of local economic growth prospects but concerns deriving from West Asian tensions lingered.

The market is still recovering from previous days’ uncertainties, market analysts said.

The All Share Price Index went up by 256 points, while the S and P SL20 rose by 63.8 points. Turnover stood at Rs 5.68 billion with nine crossings.

Seven crossings were reported in HNB Finance where 130 million shares crossed to the tune of Rs 1.1 billion; its shares traded at Rs 8.50, LMF four million shares crossed for Rs 348 million; its shares traded at Rs 87, Commercial Bank 661,000 shares crossed for Rs 142 million; its shares traded at Rs 215, Seylan Bank (Non-Voting) 750,000 shares crossed for Rs 49 million; its shares sold at Rs 75.50, ACL Cables 500,000 shares crossed for Rs 49 million; its shares traded at Rs 98, HNB 100,000 shares crossed for Rs 43.2 million; its shares sold at Rs 432 and Access Engineering 500,000 shares crossed for Rs 38.5 million and its shares fetched at Rs 77.

In the retail market companies that mainly contributed to the turnover were; HNB Finance Rs 331 million (34.8 million shares traded), Lanka Credit and Business Finance Rs 184 million (21.6 million shares traded), LOLC Holdings Rs 180 million (320,000 shares traded), Commercial Bank Rs 167 million (774,000 shares traded), Softlogic Capital Rs 138 million (twelve million shares traded), Sampath Bank Rs 124 million (789,000 shares traded) and ACL Cables Rs 123 million (1.26 million shares traded). During the day 330 million share volumes changed hands in 36639 transactions.

It is said that the banking and financial sectors performed well. HNB Finance was active in the financial sector, while Commercial Bank and HNB were active in the banking counters.

Further, National Development Bank has received Colombo Stock Exchange approval in principle to list Rs 16 billion of 11.50, 11.04 and 11.85 percent debentures, it said in a CSE filing.

NDB will issue 120 million Tier 2, listed, rated, unsecured, subordinated, redeemable Basel III compliant GSS+ bonds with a non-viability conversion, at Rs 100 each.

Yesterday the rupee was quoted at Rs 310.70/85 to the US dollar in the spot market, weaker from Rs 310.30/60 the previous day, dealers said, while bond yields were broadly steady.

By Hiran H Senewiratne

Business

Indian Ocean under fire: Parliament explodes over the sinking of ‘IRIS Dena’

A new crisis looms with a second Iranian vessel at the doorstep

Sri Lanka’s parliament became a secondary battleground yesterday as the sinking of the Iranian frigate IRIS Dena ignited a fierce debate over national sovereignty, regional maritime priciples, and the government’s perceived ‘strategic paralysis.’

While the Navy’s rescue of 32 sailors was initially painted in shades of heroism, Opposition MPs have now unfurled a narrative of missed warnings and geopolitical betrayal.

In a scathing address, Opposition firebrand Chamara Sampath Dissanayake challenged the circumstances of the vessel’s arrival in Sri Lankan waters. The IRIS Dena had been a guest of the Indian Navy during the MILAN-2026 exercises just days prior. Dissanayake alleged that at the conclusion of the fleet review, the vessel was effectively ‘put out’ of India, leaving the crew with no choice but to steer toward Sri Lanka.

“This was a deliberate attempt by the host to put a guest in harm’s way,” Dissanayake charged, stopping just short of naming India directly while making the implication undeniable. He argued that Sri Lanka had been ‘set up’ to deal with the fallout of a targeted strike that occurred only 11 nautical miles from Galle.

The debate took a darker turn when SJB MP Mujibur Rahman dropped a bombshell regarding the timing of the attack. Rahman alleged that the IRIS Dena had signalled for permission to enter Sri Lankan waters 11 hours before it was struck by U.S. torpedoes.

“Why did the authorities keep silent?” Rahman demanded. He blasted the government for failing to act on humanitarian grounds, suggesting that Colombo’s hesitation provided the necessary window for what U.S. Defense Secretary Pete Hegseth termed a ‘Quiet Death.’ Rahman’s critique painted a picture of a government ensnared in superpower machinations, unable to uphold the principles of the Indian Ocean as a ‘Zone of Peace.’

Responding to the barrage of questions, Cabinet Spokesman Dr. Nalinda Jayatissa confirmed a chilling new development: a second Iranian vessel is currently positioned in the Exclusive Economic Zone (EEZ) off Colombo.

While Jayatissa assured the House that the President and the Security Council are ‘fully aware’ and making ‘necessary interventions’ to protect those on board, the lack of specific details fueled further anxiety. Political analysts suggest that the government’s failure to announce a clear, proactive neutral policy has left it in a state of ‘vacillation,’ unable to decide whether to grant refuge to the second ship or risk another tragedy on its doorstep.

The parliamentary clash was punctuated by the visit of former president Ranil Wickremesinghe to the Iranian Embassy yesterday to offer condolences for the passing of Supreme Leader Ayatollah Ali Khamenei. Wickremesinghe had warned on March 2 – just 48 hours before the sinking – that the current ‘leadership eviction’ methodology in the Middle East could destabilise the Indian Ocean.

As the death toll from the IRIS Dena stands at 87 with 60 still missing, the ‘can of worms’ opened in parliament reveals a nation at a crossroads. The government’s silence during the Dena’s final hours and its current ‘intervention’ with the second vessel will likely define Sri Lanka’s standing in a rapidly fragmenting global order.

As the House adjourned, one question remained hanging in the air: In the face of a superpower conflict, does Sri Lanka have the ‘backbone’ to be truly neutral, or is it merely a spectator to its own maritime destiny?

by Sanath Nanayakkare

-

Features4 days ago

Features4 days agoBrilliant Navy officer no more

-

Opinion4 days ago

Opinion4 days agoSri Lanka – world’s worst facilities for cricket fans

-

Features4 days ago

Features4 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

Business2 days ago

Business2 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

Features5 days ago

Features5 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features5 days ago

Features5 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone

-

News1 day ago

News1 day agoLegal experts decry move to demolish STC dining hall

-

Latest News2 days ago

Latest News2 days agoAround 140 people missing after Iranian navy ship sinks off coast of Sri Lanka