Features

OPERATING SEVEN HOTELS – Part 44

CONFESSIONS OF A GLOBAL GYPSY

By Dr. Chandana (Chandi) Jayawardena DPhil

President – Chandi J. Associates Inc. Consulting, Canada

Founder & Administrator – Global Hospitality Forum

chandij@sympatico.ca

At the beginning of 1981, I was transferred to the John Keells corporate office in Colombo. I was proud to get this opportunity to work within the largest group of companies in Sri Lanka. I had been promoted from my previous post of Manager, Hotel Swanee to number two of Keells’ hotel company, Hotel Management & Marketing Services Limited (HMMS). My wife and I quickly settled in well into the Colombo social life style with regular trips to Keells hotels on the weekends. I also re-commenced judo at the Central YMCA. Having stopped judo for six years to focus on building my career as a resort hotelier on the south coast, I was happy to get an opportunity to practice judo, and study for judo grade promotion tests once again, whenever my busy work schedule allowed me to do so.

It was a big adjustment to get used to the corporate culture of John Keells which was very different to the living in and working at resort hotels. Since the nationalization of tea plantations by the socialist government in the early 1970s, John Keells commenced diversifying to multiple industries, including tourism and hospitality. In 1981, some 33 years after Ceylon/Sri Lanka gained independence from British colonizers, John Keells was still headed by two Brits (Chairman Mark Bostock and Deputy Chairman David Blackler). Nevertheless, I liked the atmosphere at the head office as John Keells had a unique and dynamic culture. It faced the historic Beira Lake built by the Portuguese colonizers in the 16th century to prevent Colombo from being re-captured by Sinhala kings and their armies.

John Keells Corporate Office in 1981

Having associated with the group’s chairman since 1972, initially through rugby football and then as a hotel manager, I was an admirer of Mark Bostock. I was extremely grateful to him for fully sponsoring my first, overseas trip and training in London in 1979. My personal friendship with him continued in 1984 when my family was invited to visit his family in their home in Royal Tunbridge Wells, Kent for an overnight stay during my graduate student years in the United Kingdom. Later in 1985, he supported the re-hiring of me to John Keells to manage their two largest hotels (The Lodge and The Village) as the General Manager.

Mark Bostock, was a great visionary leader but a little eccentric. All the executives came to work in our company cars dressed in shirt and tie, but our chairman took pride in coming to work on a scooter from his home in Colombo seven. His usual attire was a white shirt, no tie, white shorts and long white stockings, exactly the way he dressed for work during his early career as a tea planter. He enjoyed a good drink. One day at an office party, his wife was annoyed that he had a couple of extra drinks. She stopped addressing him as ‘Mark’ and said to him, “Bostock, time to go home. I will drive!” They left immediately. She was a very proper English lady and they made a good couple. I also knew their daughter Clair who was studying hotel management in the United Kingdom.

In addition to the directors, senior executives, executives and secretaries, there were office aides who served us excellent tea regularly. They also brought us our mail and office memos. During this pre internet and email era, we depended on them to have speedy inter office communications. One of the earliest memories at the corporate office that I fondly remember is how Mark Bostock often distributed memos from the Chairman’s office personally. “How are you settling in the head office, Chandana?” he asked me in my first week during one of his visits to my office. “Here are some memos for you”. He handed over a few papers to me and left very quickly. It was his clever way of getting some exercise while checking different offices and engaging in a causal conversation with all levels of his vast growing team.

At that time, most of the directors in the top of the group hierarchy were tea specialists or chartered accountants. They usually hired male management trainees with a middle-class English-speaking upbringing and from good schools. Most of those trainees had excelled in sports. These trainees were in their late teens and had no post-secondary education. John Keells tended to hire the attitude and train the skills. Those who learnt the ropes quickly and were dynamic, rose rapidly in the corporate ladder to board positions with impressive stock options. Once they got in, hardly anyone thought of leaving John Keells. They played a “long stay ball game” which provided job security, fun and great career prospects. They also had to play corporate politics and watch carefully where the wind is blowing.

In 1981, we knew that ‘charismatic’ Ken Balendra was destined to become the first Sri Lankan chairman of the group within a few years. Since he had such a good relationship with the two Brits at the helm, some of us in a light-hearted manner, referred to him as ‘Blackstock’, of course behind his back. We also fondly referred to him as ‘Ken Bala.’ One day when I addressed him as ‘Sir’, he tapped on my shoulder and said, “Chandana, call me Ken.”

Having managed the Maintenance and Projects Department at John Keells for a few years, my father-in-law, Captain D. A. Wickramasinghe (Captain Wicks) had been promoted by the board to re-organize and manage the outbound travel company of the group, Silverstock. That company focused on Buddhist pilgrimages to India and Nepal.

As all at the corporate office worked a half day every Saturday morning, I was ready in a shirt and tie for my first Saturday at John Keells. “Chandi, change into something more casual on Saturdays which is the Beer Day @ Keells”, Captain Wicks suggested to me. When I asked for clarification, he said that, “On Saturdays we work for a couple of hours catching up on outstanding work and plan for the next week. Then everybody is served beer and we socialize a little before going home for lunch.”

Building a Corporate Hotel Team

Hotel Management and Marketing Services (HMMS) was a small office at that time as it was started in 1979 with just two people, Director – Operations, Bobby Adams and his secretary. I became the first Manager – Operations in 1981. Our team quickly expanded to have an Engineer, Credit Controller, Hotel Reservations Coordinator and a Management Trainee. There was a vacancy for a Food and Beverage Manager on my team, so I initiated the recruitment of a well-qualified and experienced hotelier who had been educated in Beirut, Lebanon and at the oldest and the best-known hotel school in the world, The École hôtelière de Lausanne, Switzerland (Chris Weeratunga) to that position. Later, when I left John Keells, Chris was promoted to my position.

Accounting and financial services were provided by a team led by Senior Finance Director, Vivendra Lintotawela (who later in the year 2000, became the Group Chairman). He was very focused on raising our average daily room rates. Sales and marketing support was provided by Walkers Tours. The central purchasing unit of John Keells coordinated most of the purchases for our hotels.

HMMS team managed seven properties in 1981. There were four resort hotels on the South West coast – Bayroo, Swanee, Ceysands and Ambalangoda. I often went to Habarana to be engaged in operational projects at the Village and for pre-opening projects for the Lodge. The Kandy Walkin project (later opened as Hotel Citadel) was still in the planning stage, but I used to occasionally go to the Keells holiday bungalow on that site with my family and friends visiting from Austria. It was a beautiful spot close to the Mahaweli River.

Managing Temple Trees, the residence of the Prime Minister and his family, was a demanding management contract. I visited Temple Trees occasionally to support Fazal Izzadeen, our manager there and his team. Given the personal friendship Bobby Adams had with Prime Minister R. Premadasa, the Director – Operation had to be personally involved in managing this prestigious property. Being a perfectionist, Mr. Premadasa did not tolerate any sub-standard quality in maintenance, upkeep and cleanliness. Fazal did a great job in keeping the second family of Sri Lanka content with the services we provided, and more importantly, off our backs.

In Colombo, we had negotiated to take over the management of Ceylinco Hotel. “Finally, the Ceylinco deal was signed and sealed today Chandi. I would like you to take over the management of this hotel and re-organize it from now on. I know your style, and as you prefer, you have a totally free hand”, Bobby informed me. He knew that I had a personal friendship with the Ceylinco Group Chairman, Lalith Kotalawala, which was useful in taking over Ceylinco Hotel housed in, at one time the tallest building in Sri Lanka. Lalith and his wife Sicille, loved Hotel Swanee, where they used to visit occasionally when I was the manager there.

Taking over the Management of Ceylinco Hotel

One of the first things I did at Ceylinco Hotel was to have one on one discussions with each member of the management team of Ceylinco Hotel. The hotel manager decided to leave after the change. My choice for the new manager was to internally promote the Food & Beverage Manager of Ceylinco Hotel, Kesara Jayatilake as the Hotel Manager. Bobby thought that we should appoint a manager experienced with HMMS, but when he realized that I was very keen about Kesara, Bobby agreed with my suggestion.

With six popular restaurants and bars, this hotel needed a manager who was a specialist in food and beverage operations. In addition, I was impressed with Kesara’s well-established social connections in Colombo. After his promotion as manager of Ceylinco Hotel, Kesara was extremely loyal to me until his untimely death a little over a decade later, after managing a few well-known hotels in Sri Lanka, such as Lihinia Surf and Browns Beach Hotel. He was my good friend and I sorely missed him.

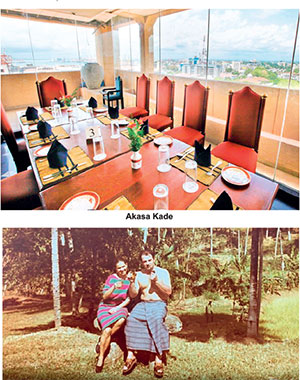

The rooftop restaurant of Ceylinco Hotel, Akasa Kade was a charming place. It was famous for its Sri Lanka specialities including egg hoppers. Music for dancing at Akasa Kade was provided by the popular band named after its legendary band leader and the lead singer, ‘Sam the Man’. It was also very popular for business lunches. I loved going to Akasa Kade in the evenings

I transferred a few food and beverage management and supervisory stars who worked with me at other hotels, to Ceylinco to strengthen Kesara’s team. We introduced theme events and opened a new evening restaurant using the front car park of the building which was never full after office hours. After brainstorming with the new management team of Ceylinco Hotel, we developed a concept unique to Sri Lanka in the early 1980s and gave the new restaurant a Sinhala name – ‘Para Haraha’ (Across the Road). It was the first ever side walk café in Sri Lanka.

An Assignment in Hong Kong

In the midst of my busy schedule with HMMS, Bobby Adams entrusted me, on short notice, with a very special assignment in Hong Kong. He wanted me to quickly plan and organize a large Sri Lankan and Maldivian food festival at the Hotel Furama InterContinental, Hong Kong. It was an important, two-week tourism promotional festival, in partnership with a few organizations. They were represented by well-known leaders of the tourist industry, such as M. Y. M. Thahir of Walkers Tours, Pani Seneviratne of Ceylon Tourist Board and Ahamed Didi of Universal Resorts, The Maldives.

The InterContinental Hotel Group was expected to be represented by a senior Sous Chef from their five-star hotel in Colombo. The festival included 28 large buffets for lunch and dinner over 14 days, promoting Sri Lankan cuisine and a few dishes from the Maldives. The Hotel Furama InterContinental had agreed to provide three of their cooks to assist the Guest Executive Chef representing Sri Lanka.

At the eleventh hour, the Executive Chef of Hotel Ceylon InterContinental, who was a Swiss-German, had refused to release his second in command to travel to Hong Kong. He had been concerned that the support in Hong Kong was inadequate to produce 28 large buffets over 14 days. He wanted three Sri Lankan additional chefs from his brigade to be provided with air tickets to Hong Kong. That request was not accepted by Air Lanka, the airline sponsor of festival.

The reputation of Walkers Tours (a key subsidiary of John Keells Group) as the main organizer of the festival was at stake. Bobby asked me, “Chandi, we need someone like you to rise to the occasion. Can you please help our company by organizing all aspects of food for this festival in Hong Kong?” I planned the menus, calculated quantities of all ingredients and purchased a few key buffet decorations on the same day from Laksala, and took off on an Air Lanka flight to Hong Kong the very next day. Having ceased to be an Executive Chef, two years prior to that, it was a challenging assignment for me, but I always loved a challenge!

During the flight, I was thinking of my father’s advice given to me just before my trip. He said, “Chandana, try your best to do even a short trip to China after the food festival. Future global tourism will be divided into two – China and the rest of the world! Don’t miss this opportunity.” As a former state visitor to China in the 1950s and the author of the first-ever Sinhala book about China in the 1960s, my father had a deep knowledge about China’s past and the present. Therefore, I was not surprised by his prediction for the future, although in 1981, it was difficult to imagine how China would eventually become one of the four top tourist destinations in the world.

Features

Tariffs as business deals?

From White House to Wall Street:

I am going to examine the financial market repercussions of President Donald Trump’s 2025 tariff policies, focusing on equities, bonds, derivatives, and interest rates. It explores how asymmetric information and alleged insider trading influenced market dynamics, highlighting the challenges posed to market integrity and investor confidence.

I am going to examine the financial market repercussions of President Donald Trump’s 2025 tariff policies, focusing on equities, bonds, derivatives, and interest rates. It explores how asymmetric information and alleged insider trading influenced market dynamics, highlighting the challenges posed to market integrity and investor confidence.

In 2025, President Donald Trump’s administration implemented a series of tariffs targeting major trading partners, including China, Canada, and Mexico. These policies aimed to protect domestic industries but resulted in significant volatility across global financial markets. The sudden shifts in trade policy introduced uncertainty, affecting various asset classes and raising concerns about the exploitation of insider information.

In response to escalating market turmoil and international pressure, President Trump announced a 90-day deferral on certain tariffs, via social media on April 9, 2025. However, the announcement’s ambiguity led to continued market instability.

Pre-Tariff Market Conditions

(February 2025)

In February 2025, US financial markets were experiencing relative stability. The S&P 500 was trading near record highs, buoyed by strong corporate earnings and positive economic indicators. Interest rates remained steady, with the 10-year Treasury yield hovering around 3.9%, reflecting moderate inflation expectations and a balanced economic outlook. The CBOE Volatility Index (VIX), a measure of market volatility, was subdued, indicating investor confidence.

Impact on Financial Markets

Equities and Traditional Investment Strategies

The announcement of tariffs led to a sharp decline in US stock markets. Major indices, such as the Dow Jones Industrial Average and the Nasdaq Composite, experienced significant losses, with the Nasdaq entering bear market territory after a 5.82% drop. The traditional 60/40 investment strategy, allocating 60% to equities and 40% to bonds, proved ineffective during this period, as both asset classes suffered losses due to rising bond yields and falling stock prices (Figure 1).

Market Indices (S&P 500, Nasdaq, Dow Jones): Major crashes occurred on April 3–4, 2025, following the tariff imposition. Slight recovery or stabilisation followed Trump’s deferral tweet on April 9, but markets dipped sharply again on April 10 (Table 1).

Market Reaction to Tariff Imposition

(April 2–5, 2025)

* April 3, 2025: The S&P 500 plummeted by 4.88%, the Nasdaq Composite fell by 5.97%, and the Dow Jones Industrial Average declined by 3.98%. The Russell 2000 entered bear market territory, dropping over 20% from its recent peak.

* April 4, 2025: Markets continued their downward trajectory. The S&P 500 fell an additional 5.97%, the Nasdaq Composite decreased by 5.82%, and the Dow Jones Industrial Average dropped by 5.50%.

* April 5, 2025: The newly imposed tariffs officially took effect, further exacerbating market volatility and investor uncertainty.

* Over this period, US stock markets lost approximately $6.6 trillion in value, marking the largest two-day loss in history.

Market Response to Tariff Deferral

(April 9–11, 2025)

* April 10, 2025: Despite the deferral, the S&P 500 declined by approximately 15%, and long-term Treasury bonds faced significant selling pressure. The US dollar weakened, and gold prices surged as investors sought safe-haven assets.

* April 11, 2025: Consumer sentiment plummeted, with the University of Michigan Consumer Sentiment Index dropping to 50.8, the second-lowest level since records began in 1952. This decline reflected widespread economic pessimism amid the ongoing trade tensions.

Bond Market and Interest Rates

The bond market reacted to the tariffs with increased yields, reflecting investor concerns about inflation and economic growth. The US 10-year Treasury yield rose to 4.358%, indicating expectations of higher interest rates. This rise in yields contributed to the decline in bond prices, further challenging traditional investment strategies.

10-Year Treasury Yield: Climbed steadily from 3.9% to 4.358% (April 2–21), suggesting increased inflation expectations and risk premium. The bond market experienced significant fluctuations during this period. Therefore, investors demanded higher returns for perceived increased risk. This rise in yields indicated expectations of higher inflation and potential economic slowdown due to the tariffs. (Table 2).

Derivatives and Market Volatility

The derivatives market, including options and futures, experienced heightened volatility in response to tariff announcements. The CBOE Volatility Index (VIX), often referred to as “Wall Street’s fear index,” spiked to its highest level since 2020, closing at 45.31 points. This surge in volatility presented both risks and opportunities for investors, particularly those with access to timely information.

VIX Volatility Index: Rose from 19 on April 2 to a peak of 45.31 on April 4, indicating extreme market fear. The VIX spiked to 45.31, its highest level since 2020, indicating heightened market anxiety (Table 3).

Asymmetric Information and Insider Trading Allegations

Allegations of insider trading emerged during the tariff saga, highlighting concerns about asymmetric information. Congresswoman Marjorie Taylor Greene faced scrutiny for stock transactions made shortly before tariff announcements, including purchases in companies like Amazon and Tesla, and the sale of Treasury bills. While Greene denied insider knowledge, the timing of these trades raised questions about the potential exploitation of non-public information (The Times, 2025).

Additionally, unusual trading patterns in S&P 500 futures preceding major policy shifts suggested possible insider activity. Although direct evidence linking these trades to White House insiders remains inconclusive, the patterns underscore the challenges in detecting and preventing insider trading in policy-driven markets (Los Angeles Times, 2025).

Tariff Decisions as Business Deals

While tariffs are typically seen as instruments of trade policy aimed at protecting domestic industries or rebalancing trade deficits, the Trump administration’s 2025 tariff imposition and abrupt deferral appear less rooted in strategic policy and more akin to short-term market manipulations. These decisions unfolded not through institutional processes or legislative debates, but rather through presidential tweets and sudden reversals, strongly suggesting a deal-making mindset characteristic of business negotiations rather than public governance.

The Role of Asymmetric Information and Market Elites

Insider trading is traditionally associated with illegal access to non-public corporate information. However, in this case, asymmetric political information—known only to a select few close to power—may have created an opportunity to profit.

Market actors with proximity to decision-makers, or even sophisticated algorithms tied to social media monitoring, could have anticipated the tariff deferral.

Billionaire investors and influencers like Elon Musk, who maintain both financial influence and political access, are often speculated to benefit from such opaque decision-making environments. The quick reversal of tariffs led to a surge in tech stocks, many of which form the core holdings of large institutional investors, hedge funds, and elite entrepreneurs.

For example: The Nasdaq rebounded by 1.5% following the deferral tweet. Options trading volumes spiked on tech-heavy indices, indicating pre-positioning by well-informed actors. Reports from Bloomberg and Reuters noted unusual activity in Tesla call options shortly before the deferral (Reuters, 2025; Bloomberg Markets, 2025).

A Business Deal Mindset

Trump’s own language underscores the deal-making philosophy. The President tweeted that the tariffs were a “strong hand in negotiations” and “paused for talks with China”, using terms more common in corporate boardrooms than diplomatic channels. This rhetoric, combined with the lack of institutional transparency, raises serious concerns about the manipulation of public policy for private gains.

In this light, the administration’s behaviour is not reflective of classical economic policy objectives like comparative advantage or strategic protectionism. Instead, it aligns with the wealth-maximising tactics of a private enterprise, where the aim is to control narrative, timing, and volatility to benefit select stakeholders.

Conclusions

More critically, the Trump tariff saga of 2025 blurs the lines between public policy and private profit. The opacity, erratic timing, and informal communication channels—particularly via presidential tweets—suggest that these were less about coherent trade strategies and more akin to orchestrated business maneuvers. The reactive movements of major indices, coupled with unusual options trading patterns and speculative capital flows, indicate that market elites likely capitalised on volatility, benefiting from privileged access or predictive positioning based on asymmetric information.

This raises serious concerns about market integrity and the ethical boundaries between governance and profiteering. When financial markets are left vulnerable to abrupt and opaque political actions, especially ones lacking institutional oversight, the door opens to manipulation, insider trading, and erosion of public trust.

In sum, the 2025 Trump tariff episode serves as a cautionary tale—one that highlights the dangers of politicising economic policy, the vulnerabilities of global markets to personalised decision-making, and the importance of upholding the foundational principles of fairness, transparency, and accountability in modern financial systems.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)

Features

The sea-change after Modi’s visit

The cosy relationship between President Anura Kumara Dissanayake and Indian Prime Minister Narendra Modi is causing concerns, perhaps, for good reasons. The inheritor of the leadership of the party, the JVP, which launched the first insurgency in the modern history of Sri Lanka, way back in 1971 citing ‘Indian expansionism’ as one of the reasons, seems to have undergone a miraculous transformation; it is now cosying up to India. The process started well before the last presidential election, with the astute Indian intelligence sensing which way political winds were blowing in Sri Lanka; AKD was invited as an honoured guest to India, though he did not hold any important position in Sri Lanka. This, no doubt, increased his chances of victory but the bigger beneficiary was India as during that trip AKD showed that he was prepared to reverse the attitude of the JVP towards India. The camaraderie between AKD and Modi has increased, culminating in the latter’s Sri Lanka visit, which Indian media have hailed as a foreign policy success.

Some political commentators have expressed concern that Sri Lanka is heading towards being the 29th state of India. Those in government may attempt to dispel this as a baseless fear but, unfortunately, they fail to realise that it is the very actions of their president that has given rise to such concerns, the way Indo-Lanka Defence MoU/agreement was signed during the recent visit of the Prime Minister Modi. One may wonder why there are no protests but there is a very reasonable explanation for this; those who mounted repeated protests against closer ties with India, from as far back as 1971, are now in government and seem to have metamorphosed to be the most pro-Indian!

During the recent ‘flying’ state-visit of the Indian PM Modi, a large number of MOUs have been signed, including the one on defence corporation, the contents of which are unknown, apparently even to the members of the Cabinet! How come this happens with a government that came to power on the promise of eradicating corruption, establishing transparency, and system change? Neville Ladduwahetty, in an excellent analysis, points out that this agreement would result in Sri Lanka becoming, at least, a vassal state of India (Sri Lanka-India MoUs and their implications, The Island 18 April).

Some of the excuses being doled out are nothing short of hilarious. When questions were raised in parliament about the contents of these MOUs and pacts, the response from a government spokesman was that if anyone is interested, they can obtain details by making a request under the Rights to Information act! Isn’t this the actions of a government which has lost all semblance of transparency in such a short period of time? An even more important question is whether India is exploiting the lack of experience of the politicians in power to its advantage.

One may wonder whether it was a coincidence that this extremely important and closely guarded defence pact was signed on 5 April, 54 years to the very day the JVP launched its first insurrection in Sri Lanka with the rallying-cry, “Motherland or death”! Considering the sinister ways of India’s operations, at times, it is more likely to be a deliberate and subtle reminder to the NPP/JVP government than a coincidence. What an irony it was for the Sri Lankan President, the heir to the JVP throne, to award the highest honour possible to the Prime Minister of India, a country they detested so much! After his very successful trip, PM Modi flew by helicopter, no doubt, gazing at the remnants of the Ram Sethu bridge, probably dreaming of rebuilding it to connect the 29th state to the mainland!

It is high time the government reassured the public by informing at least the context of the defence pact signed, even if details are withheld for security reasons. If it is not done the credibility of the government would be further eroded. It has already lost its credibility on the promise of honesty and integrity. The former speaker, who had to give up the third highest ranking position in the country as he had misplaced the certificates of his doctorate from a private university in Japan, promised to produce the certificates to clear his name. Enough time has passed for him to get even duplicates but despite the obvious dishonesty, unashamedly, he remains an MP! Is this the cleansing of Diyawannawa they promised?

What is happening regarding the Easter terrorist attack is raising concerns too, as it is being reinvestigated to find a mastermind under the supervision of two retired police officers, who were rewarded with top posts for openly supporting the NPP, despite being found fault for neglect of duty by a committee of Inquiry tasked to investigate the failures leading to that attack. Even if they were wrongly implicated by that committee, they should not be a party to any relevant investigation till their names were cleared. The government has demonstrated the lack of good governance by allowing these two officers to be involved in the investigation and the two officers have demonstrated their total lack of integrity by not removing themselves voluntarily. The current investigation reminds one of the Sinhala saying Horage ammagen pena ahanawa wagei (seek help from a female clairvoyant to catch a thief who happens to be her own son.)

This search for a mastermind, which started with the pronouncements of a previous Attorney-General who has refused, so far, to substantiate his claims took a new turn with the notorious Channel 4 programme based on the testimony of an asylum seeker who has produced fraudulent documents. President Sirisena, long after he left the presidency, claimed to know the mastermind! Anyone with an interest in facts ought to watch the excellent “Hyde Park” interview on Ada Derana with Professor Rohan Gunaratna, an internationally acclaimed authority on counterterrorism. He has interviewed key personnel in ISIS and has studied 337 intelligence reports, both local and international including those from FBI, Scotland Yard, Interpol etc. He is of the strong opinion that it was an attack masterminded by ISIS and there is no basis, whatsoever, to consider it to be politically motivated. However, he did not address the issue of whether a foreign nation was masterminded for other reasons.

Attributing a political motivation may suit the government as it has a vested interest. It should not be forgotten that the father of two of the bombers, one of them the leader, was a prominent financial backer of the JVP whose name was on its national list.

The other theory advanced by some is that India’s RAW may be behind the attack, the reasons given being that RAW gave exactingly detailed intelligence regarding the attacks and that the attack on Taj Samudra was aborted, at the last moment, due to a mysterious telephone call the bomber received.

Adding fuel to the fire of speculation is the latest action of AKD. His much-promised exposure of the mastermind on 21 April turned out to be a pus wedilla! The country waited eagerly, but all he did was to hand over the Presidential Inquiry report to the CID, contrary to the recommendation of the commission that it be handed over to the Attorney General for action!

Hasn’t there been a sea-change after PM Modi’s visit?

By Dr Upul Wijayawardhana

Features

RuGoesWild: Taking science into the wild — and into the hearts of Sri Lankans

At a time when misinformation spreads so easily—especially online—there’s a need for scientists to step in and bring accurate, evidence-based knowledge to the public. This is exactly what Dr. Ruchira Somaweera is doing with RuGoesWild, a YouTube channel that brings the world of field biology to Sri Lankan audiences in Sinhala.

“One of my biggest motivations is to inspire the next generation,” says Dr. Somaweera. “I want young Sri Lankans to not only appreciate the amazing biodiversity we have here, but also to learn about how species are studied, protected, and understood in other parts of the world. By showing what’s happening elsewhere—from research in remote caves to marine conservation projects—I hope to broaden horizons and spark curiosity.”

Unlike many travel and wildlife channels that prioritise entertainment, RuGoesWild focuses on real science. “What sets RuGoesWild apart is its focus on wildlife field research, not tourism or sensationalised adventures,” he explains. “While many travel channels showcase nature in other parts of the world, few dig into the science behind it—and almost none do so in Sinhala. That’s the niche I aim to fill.”

Excerpts of the Interview

Q: Was there a specific moment or discovery in the field that deeply impacted you?

“There have been countless unforgettable moments in my 20-year career—catching my first King cobra, discovering deep-diving sea snakes, and many more,” Dr. Somaweera reflects. “But the most special moment was publishing a scientific paper with my 10-year-old son Rehan, making him one of the youngest authors of an international peer-reviewed paper. We discovered a unique interaction between octopi and some fish called ‘nuclear-forager following’. As both a dad and a scientist, that was an incredibly meaningful achievement.”

Saltwater crocodiles in Sundarbans in Bangladesh, the world’s largest mangrove

Q: Field biology often means long hours in challenging environments. What motivates you to keep going?

“Absolutely—field biology can be physically exhausting, mentally draining, and often dangerous,” he admits. “I’ve spent weeks working in some of the most remote parts of Australia where you can only access through a helicopter, and in the humid jungles of Borneo where insects are insane. But despite all that, what keeps me going is a deep sense of wonder and purpose. Some of the most rewarding moments come when you least expect them—a rare animal sighting, a new behavioural observation, or even just watching the sun rise over a pristine habitat.”

Q: How do you balance scientific rigour with making your work engaging and understandable?

“That balance is something I’m constantly navigating,” he says. “As a scientist, I’m trained to be precise and data-driven. But if we want the public to care about science, we have to make it accessible and relatable. I focus on the ‘why’ and ‘wow’—why something matters, and what makes it fascinating. Whether it’s a snake that glides between trees, a turtle that breathes through its backside, or a sea snake that hunts with a grouper, I try to bring out the quirky, mind-blowing parts that spark curiosity.”

Q: What are the biggest misconceptions about reptiles or field biology in Sri Lanka?

“One of the biggest misconceptions is that most reptiles—especially snakes—are dangerous and aggressive,” Dr. Somaweera explains. “In reality, the vast majority of snakes are non-venomous, and even the venomous ones won’t bite unless they feel threatened. Sadly, fear and myth often lead to unnecessary killing. With RuGoesWild, one of my goals is to change these perceptions—to show that reptiles are not monsters, but marvels of evolution.”

Q: What are the most pressing conservation issues in Sri Lanka today?

“Habitat loss is huge,” he emphasizes. “Natural areas are being cleared for housing, farming, and industry, which displaces wildlife. As people and animals get pushed into the same spaces, clashes happen—especially with elephants and monkeys. Pollution, overfishing, and invasive species also contribute to biodiversity loss.”

Manta Rays

Q: What role do local communities play in conservation, and how can scientists better collaborate with them?

“Local communities are absolutely vital,” he stresses. “They’re often the first to notice changes, and they carry traditional knowledge. Conservation only works when people feel involved and benefit from it. We need to move beyond lectures and surveys to real partnerships—sharing findings, involving locals in fieldwork, and even ensuring conservation makes economic sense to them through things like eco-tourism.”

Q: What’s missing in the way biology is taught in Sri Lanka?

“It’s still very exam-focused,” Dr. Somaweera says. “Students are taught to memorize facts rather than explore how the natural world works. We need to shift to real-world engagement. Imagine a student in Anuradhapura learning about ecosystems by observing a tank or a garden lizard, not just reading a diagram.”

Q: How important is it to communicate science in local languages?

“Hugely important,” he says. “Science in Sri Lanka often happens in English, which leaves many people out. But when I speak in Sinhala—whether in schools, villages, or online—the response is amazing. People connect, ask questions, and share their own observations. That’s why RuGoesWild is in Sinhala—it’s about making science belong to everyone.”

‘Crocodile work’ in northern Australia.

Q: What advice would you give to young Sri Lankans interested in field biology?

“Start now!” he urges. “You don’t need a degree to start observing nature. Volunteer, write, connect with mentors. And once you do pursue science professionally, remember that communication matters—get your work out there, build networks, and stay curious. Passion is what will carry you through the challenges.”

Q: Do you think YouTube and social media can shape public perception—or even influence policy?

“Absolutely,” he says. “These platforms give scientists a direct line to the public. When enough people care—about elephants, snakes, forests—that awareness builds momentum. Policymakers listen when the public demands change. Social media isn’t just outreach—it’s advocacy.”

by Ifham Nizam

-

Business4 days ago

Business4 days agoDIMO pioneers major fleet expansion with Tata SIGNA Prime Movers for ILM

-

News3 days ago

News3 days agoFamily discovers rare species thought to be extinct for over a century in home garden

-

Features6 days ago

Features6 days agoNipping the two leaves and the bud

-

Features5 days ago

Features5 days agoProf. Lal Tennekoon: An illustrious but utterly unpretentious and much -loved academic

-

Features6 days ago

Features6 days agoAvurudu celebrations … galore

-

Foreign News4 days ago

Foreign News4 days agoChina races robots against humans in Beijing half marathon

-

News6 days ago

News6 days agoCounsel for Pilleyan alleges govt. bid to force confession

-

Editorial4 days ago

Editorial4 days agoSelective use of PTA