Business

Norfund to Support the Development of Hela Apparel Holdings’ East African Manufacturing Operations with an Investment of USD 14 Million

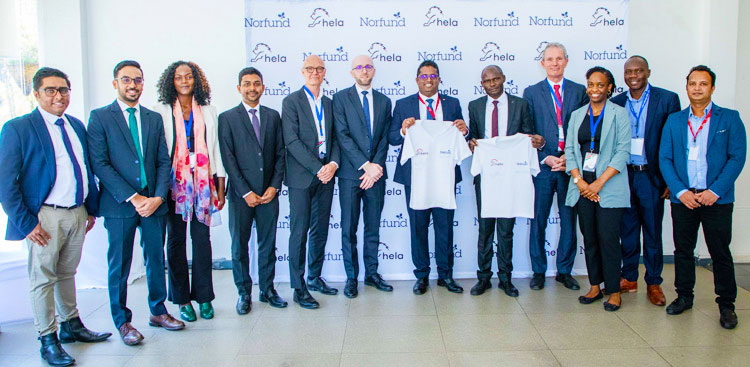

Norfund, the Norwegian government’s investment fund, with a mission to support sustainably driven business operations in developing countries, recently signed a USD 14 million financing agreement with Hela Apparel Holdings PLC to bolster the development of its manufacturing operations in East Africa. NDB Investment Bank Limited acted as the Financial Advisor for the transaction.

The official announcement was made in the presence of Gunnar Andreas Holm – Norwegian Ambassador to Kenya, Tellef Thorleifsson – CEO of Norfund, William Nyaoke – Norfund’s Regional Director for East Africa, Nishantha Mohottige – Country Director for Hela Kenya and Rukshan Aponso – Vice President of Corporate Advisory for NDB Investment Bank Limited, at an event held at Hela’s manufacturing facility in Kenya on the 24th of February 2023.

Hela Kenya, established in 2016, is the largest manufacturing facility within the Hela Group and employs over 4,000 people. The facility is also one of the largest of its kind in Kenya, and currently produces approximately 20% of the country’s total apparel exports. Hela was the first major Sri Lankan apparel manufacturer to establish operations in Kenya and has played a leading role in the rapid growth of the industry across the continent over recent years, with the subsequent establishment of manufacturing locations in Ethiopia and Egypt.

“Our expansion to Africa has been a rewarding venture, and we continue to see many opportunities within the region for further development,” said A.R Rasiah, Chairman of Hela Apparel Holdings. “Given the increasingly unpredictable global environment, establishing long-term financing relationships with strategic partners who share our vision for Africa as a global apparel sourcing hub plays a critical role in ensuring the envisioned plans for growth are realized. Hela’s African operations provide livelihoods to thousands of people, and our continued growth as a manufacturer will help us continue to strengthen and empower many communities across the globe. The intended investment in our Kenyan manufacturing facility, which will be supported by this lending from Norfund, is a key part of the Group’s strategy to remain globally competitive. On behalf of the Board of Directors, I would like to take this opportunity to thank Norfund for their partnership and support towards the organisation’s vision.” He further added.

The proceeds from Norfund’s investment will also be utilized to strengthen Hela’s strategic supply chain partnerships in East Africa. This will enable Hela to leverage regional sourcing from Kenya and Tanzania to a larger extent, providing significant cost and lead time advantages for manufacturing in the region. A potential supply chain investment is also being considered by Hela for the proceeds. Proposed Capex investments within the Kenyan manufacturing facility on process automation will enhance productivity and place the facility in a more competitive position within the region.

“We see great opportunities in contributing to large-scale job creation in East Africa by investing in the apparel and textile industry, in line with our goal of building sustainable businesses to combat poverty. We have been impressed with what Hela has already delivered through its investments in East Africa and are confident that this partnership will go a long way in helping Hela create more employment opportunities primarily for low-skilled women and those vulnerable in society who struggle to find such opportunities.

We look forward to a fruitful partnership in the years to come”, says William Nyaoke, Norfund’s Regional Director for East Africa.

“Norfund is one of the largest shareholders of our ultimate parent, NDB Bank, and our relationship with them has been a very successful one indeed, and this transaction was no exception”, stated Darshan Perera, Chief Executive Officer of NDBIB. “The wealth of knowledge gained by our prior dealings with Norfund and other DFIs enabled us to successfully execute this transaction, which is Hela’s first fundraising via a DFI. We are extremely pleased to have advised Hela in our debut transaction in the African Region and look forward to working with them in realizing their plans in Africa.” He further stated.

Business

Why Sri Lanka’s new environmental penalties could redraw the Economics of Growth

For decades, environmental crime in Sri Lanka has been cheap.

Polluters paid fines that barely registered on balance sheets, violations dragged through courts and the real costs — poisoned waterways, degraded land, public health damage — were quietly transferred to the public. That arithmetic, long tolerated, is now being challenged by a proposed overhaul of the country’s environmental penalty regime.

At the centre of this shift is the Central Environmental Authority (CEA), which is seeking to modernise the National Environmental Act, raising penalties, tightening enforcement and reframing environmental compliance as an economic — not merely regulatory — issue.

“Environmental protection can no longer be treated as a peripheral concern. It is directly linked to national productivity, public health expenditure and investor confidence, CEA Director General Kapila Mahesh Rajapaksha told The Island Financial Review. “The revised penalty framework is intended to ensure that the cost of non-compliance is no longer cheaper than compliance itself.”

Under the existing law, many pollution-related offences attract fines so modest that they have functioned less as deterrents than as operating expenses. In economic terms, they created a perverse incentive: pollute first, litigate later, pay little — if at all.

The proposed amendments aim to reverse this logic. Draft provisions increase fines for air, water and noise pollution to levels running into hundreds of thousands — and potentially up to Rs. 1 million — per offence, with additional daily penalties for continuing violations. Some offences are also set to become cognisable, enabling faster enforcement action.

“This is about correcting a market failure, Rajapaksha said. “When environmental damage is not properly priced, the economy absorbs hidden losses — through healthcare costs, disaster mitigation, water treatment and loss of livelihoods.”

Those losses are not theoretical. Pollution-linked illnesses increase public healthcare spending. Industrial contamination damages agricultural output. Environmental degradation weakens tourism and raises disaster-response costs — all while eroding Sri Lanka’s natural capital.

Economists increasingly argue that weak environmental enforcement has acted as an implicit subsidy to polluting industries, distorting competition and discouraging investment in cleaner technologies.

The new penalty regime, by contrast, signals a shift towards cost internalisation — forcing businesses to account for environmental risk as part of their operating model.

The reforms arrive at a time when global capital is becoming more selective. Environmental, Social and Governance (ESG) benchmarks are now embedded in lending, insurance and trade access. Countries perceived as weak on enforcement face higher financing costs and shrinking market access.

“A transparent and credible environmental regulatory system actually reduces investment risk, Rajapaksha noted. “Serious investors want predictability — not regulatory arbitrage that collapses under public pressure or litigation.”

For Sri Lanka, the implications are significant. Stronger enforcement could help align the country with international supply-chain standards, particularly in manufacturing, agribusiness and tourism — sectors where environmental compliance increasingly determines competitiveness.

Business groups are expected to raise concerns about compliance costs, particularly for small and medium-scale enterprises. The CEA insists the objective is not to shut down industry but to shift behaviour.

“This is not an anti-growth agenda, Rajapaksha said. “It is about ensuring growth does not cannibalise the very resources it depends on.”

In the longer term, stricter penalties may stimulate demand for environmental services — monitoring, waste management, clean technology, compliance auditing — creating new economic activity and skilled employment.

Yet legislation alone will not suffice. Sri Lanka’s environmental laws have historically suffered from weak enforcement, delayed prosecutions and institutional bottlenecks. Without consistent application, higher penalties risk remaining symbolic.

The CEA says reforms will be accompanied by improved monitoring, digitalised approval systems and closer coordination with enforcement agencies.

By Ifham Nizam

Business

Milinda Moragoda meets with Gautam Adani

Milinda Moragoda, Founder of the Pathfinder Foundation, who was in New Delhi to participate at the 4th India-Japan Forum, met with Gautam Adani, Chairman of Adani Group.

Adani Group recently announced that they will invest US$75 billion in the energy transition over the next 5 years. They will also be investing $5 billion in Google’s AI data center in India.Milinda Moragoda,

Milinda Moragoda, was invited by India’s Ministry of External Affairs and the Ananta Centre to participate in the 4th India–Japan Forum, held recently in New Delhi. In his presentation, he proposed that India consider taking the lead in a post-disaster reconstruction and recovery initiative for Sri Lanka, with Japan serving as a strategic partner in this effort. The forum itself covered a broad range of issues related to India–Japan cooperation, including economic security, semiconductors, trade, nuclear power, digitalization, strategic minerals, and investment.

The India-Japan Forum provides a platform for Indian and Japanese leaders to shape the future of bilateral and strategic partnerships through deliberation and collaboration. The forum is convened by the Ministry of External Affairs, Government of India, and the Anantha Centre.

Business

HNB Assurance welcomes 2026 with strong momentum towards 10 in 5

HNB Assurance enters 2026 with renewed purpose and clear ambition as it moves into a defining phase of its 10 in 5 strategic journey. With the final leg toward achieving a 10% life insurance market share by 2026 now in focus, the company is gearing up for a year of transformation, innovation, and accelerated growth.

Closing 2025 on a strong note, HNB Assurance delivered outstanding results, continuously achieving growth above the industry average while strengthening its people, partnerships and brand. Industry awards, other achievements, and continued customer trust reflect the company’s strong performance and ongoing commitment to providing meaningful protection solutions for all Sri Lankans.

Commenting on the year ahead, Lasitha Wimalarathne, Executive Director / Chief Executive Officer of HNB Assurance, stated, “Guided by our 2026 theme, ‘Reimagine. Reinvent. Redefine.’, we are setting our sights beyond convention. Our aim is to reimagine what is possible for the life insurance industry, for our customers, and for the communities we serve, while laying a strong foundation for the next 25 years as a trusted life insurance partner in Sri Lanka. This year, we also celebrate 25 years of HNB Assurance, a milestone that is special in itself and a testament to the trust and support of our customers, partners and people. For us, success is not defined solely by financial performance. It is measured by the trust we earn, the promises we honor, the lives we protect, and the positive impact we create for all our stakeholders. Our ambition is clear, to be a top-tier life insurance company that sets benchmarks in customer experience, professionalism and people development.”

For HNB Assurance looking back at a year of progress and recognition, the collective efforts of the team have created a strong momentum for the year ahead.

“The progress we have made gives us strong confidence as we enter the final phase of our 10 in 5 journey. Being recognized as the Best Life Insurance Company at the Global Brand Awards 2025, receiving the National-level Silver Award for Local Market Reach and the Insurance Sector Gold Award at the National Business Excellence Awards, and being named Best Life Bancassurance Provider in Sri Lanka for the fifth consecutive year by the Global Banking and Finance Review, UK, reflect the consistency of our performance, the strength of our strategy, along with the passion, and commitment of our people.”

-

News2 days ago

News2 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

News2 days ago

News2 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

News3 days ago

News3 days agoPrivate airline crew member nabbed with contraband gold

-

News1 day ago

News1 day agoPrez seeks Harsha’s help to address CC’s concerns over appointment of AG

-

News1 day ago

News1 day agoGovt. exploring possibility of converting EPF benefits into private sector pensions

-

News5 days ago

News5 days agoHealth Minister sends letter of demand for one billion rupees in damages

-

Features2 days ago

Features2 days agoEducational reforms under the NPP government

-

Features3 days ago

Features3 days agoPharmaceuticals, deaths, and work ethics