Business

LOLC listed among the LMD Hall of Fame

LOLC has been listed amongst the LMD ‘Hall of Fame’ of the Most Respected Entities for 2021. The award was recently presented to LOLC Group Managing Director/CEO, Kapila Jayawardena by Hiran Hewavisenti, Editor-In-Chief of LMD. The globally diversified financial conglomerate took the first place in the LMD 100’s profitability ranking. LOLC secured this position based on another year of stellar financial performance.

The 17th annual edition of the LMD Most Respected, ranks the nation’s most admired corporations. The LMD Most Respected entities in Sri Lanka is commissioned and conceptualised by LMD, and conducted by NielsenIQ. This year’s Most Respected special edition continued with the revised methodology from 2019 for ranking entities whereby NielsenIQ’s exclusive survey for LMD to gauge peer perceptions employed a weighted ranking system.

Laying claim to being Sri Lanka’s most valuable globally diversified financial conglomerate, the LOLC Group posted a record-breaking performance for the 2020/21 financial year, achieving a colossal Rs. 57 billion in profit before taxes. This feat is the first for any corporate in Sri Lanka, achieved amidst a challenging economic environment.

Commenting about the achievement, LOLC Group Managing Director/CEO, Kapila Jayawardena said, “LOLC has strategically diversified into different industries and across borders, targeting and penetrating new and growing markets, and that has provided us a unique competitive edge. The most vital pillar for us is our strong operational backbone. Further, LOLC has always been conscious of its reputation, and strives to maintain an impeccable record. That is why within a span of just 10 years, LOLC has become a global leader in microfinance, and we take pride in it because no other organisation matches our footprint in this sphere”.

Having established a high performance microfinance business model, LOLC rapidly exported its expertise to global markets such as Cambodia, Myanmar, Indonesia, Philippines, Pakistan, Zambia, Nigeria, Malawi, Tajikistan and Tanzania, bringing prosperity to people at the bottom of the pyramid. In addition, the Group has established its footprint in the Maldives, Mauritius and Sierra Leone in the arena of Non-Financial Services. Over the years, the Group has been backed strongly by Development Finance Institutions and multilateral funding lines, which reflects the confidence these global entities place in the Group’s sustainable operations. Sustainability is embedded in the Group’s ethos and embodied in its transparent, fair, equitable and beneficial products and services that are uplifting the lives and livelihoods of people, giving them hope for a brighter tomorrow. The LOLC Group is on an accelerated growth trajectory and is inspired by the quest to nurture and shape the future of individuals and communities across the world. (end)

Business

SIA warns of 1,000 SME collapses, urges fair policies to protect Sri Lanka’s rooftop solar sector

By Sanath Nanayakkare

The Solar Industries Association (SIA), representing over 1,000 companies and employing 40,000 workers in Sri Lanka’s rooftop solar sector, issued a stern warning recently regarding threats to the industry’s survival and the nation’s renewable energy ambitions. The association condemned recent regulatory instability and called for urgent policy reforms to avert economic and social crises.

The SIA categorically rejected the Ceylon Electricity Board’s (CEB) claim that rooftop solar installations caused the recent island-wide power outage, calling the accusation “baseless and misleading.”

“Public trust is eroded when accountability is misdirected,” the SIA stated. “We demand an independent, transparent investigation led by experts appointed by the Ministry or the Public Utilities Commission (PUCSL). The CEB’s unilateral statements disregard the sector’s contributions and jeopardize Sri Lanka’s renewable energy transition,” they said.

“While acknowledging the formation of a tariff determination committee, the SIA criticized its narrow focus on financial parameters, ignoring the sector’s socioeconomic value. Rooftop solar empowers businesses and households with energy independence, reduces grid strain, and supports climate goals. However, proposed volatile tariff structures risk destabilizing over 100,000 installations—primarily owned by middle-class families—and deter future investment,” they noted.

“A rigid, equation-based tariff system is unsustainable,” the association warned. “Sri Lanka needs a stable policy framework to attract long-term investments. For instance, retirees could invest EPF savings into solar projects, securing income while advancing national energy targets. Without urgent action, 1,000 SMEs and 40,000 jobs face collapse, with dire consequences for employment, energy security, and economic stability,” they pointed out.

SIA urged policymakers to establish an independent committee to investigate the power outage fairly, expand the tariff committee’s mandate to include socioeconomic and environmental benefits and implement predictable policies to safeguard SMEs, households, and investor confidence.

“Sri Lanka stands at a crossroads,” the SIA emphasized. “Protecting rooftop solar isn’t just about energy—it’s about livelihoods, economic resilience, and a sustainable future. We urge stakeholders to collaborate on solutions that prioritize both people and progress,: they emphasized.

Business

SLT-MOBITEL partners with the Rush Lanka Group to power its apartment portfolio

SLT-MOBITEL has entered into a strategic partnership with Rush Lanka Group to provide exclusive SLT-MOBITEL Fibre connectivity solutions to their portfolio of luxury apartment developments in Colombo and the suburbs, enhancing the digital experience of all residents.

The agreement was signed between Imantha Wijekoon, Chief Business Officer of Consumer Business at SLT, and Zaid Ariff, Director of Construction at the Rush Group headquarters. Representatives from both companies also attended the ceremony.

Under the partnership, SLT-MOBITEL will serve as the exclusive digital service provider for five prestigious Rush Lanka developments including Street Rush Residencies and Rush Court 4 in Mt. Lavinia, Rush Tower 2, Rush Metropolis in Dehiwala, and Rush Court 5 in Colombo 14. The collaboration ensures residents will enjoy superior fibre connectivity speeds, enabling seamless digital experiences in modern smart homes. The partnership with the Rush Lanka Group aligns with SLT-MOBITEL’s commitment to offer ultra-fast, reliable connectivity solutions to residential developments. Delivering exclusive fibre connectivity to luxury apartments, SLT-MOBITEL ensures residents have access to world-class digital services that complement the living experience promised by Rush Lanka Group.

Powered by advanced fibre technology, SLT-MOBITEL network will provide the residences with seamless performance across digital activities. The SLT-MOBITEL Fibre backbone ensures lag-free experiences whether tenants are gaming online, attending virtual classes, working remotely, or streaming high-definition entertainment. SLT-MOBITEL Fibre will transform the lifestyles of all apartment users bringing greater convenience and superior quality of life.

Rush Lanka Group, established in 1992, is a property developer specializing in luxury and semi-luxury apartments.

Business

Sri Lanka makes outstanding appearance at OTM and SATTE 2025 in India

Starting its promotional work for 2025, Sri Lanka Tourism Promotion Bureau (SLTPB) added another feather into its cap of endorsements, by being recognized as the most innovative Tourism Board promotion in Outbound Travel Mart (OTM) . In parallel to that, several other sub events were held. The OTM was held in Jio World Convention Centre, Mumbai—India, from 30th January to 01st February 2025.Before OTM, the Global Village – Global Exchange & Trade Exhibition was held at the Surat International Exhibition & Convention Centre , Sarsana, Surat (Gujarat – India , from 25th to 27th January 2025. This travel fair was organized by Southern Gujarat Chamber of Commerce and Industry (SGCCI).

Sri Lanka participated in both OTM and South Asia’s Travel & Tourism Exchange (SATTE), held from 19th – 21st Feb 2025, in New Delhi, India . This was an excellent opportunity for Sri Lanka to promote it’s potential as a unique travel destination, especially for the Indian counterparts, as SLTPB has identified India as the number one source market for Sri Lanka, tourism bringing the largest number of tourist arrivals to the destination.

-

Editorial7 days ago

Editorial7 days agoRanil roasted in London

-

Features7 days ago

Features7 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Opinion6 days ago

Opinion6 days agoInsulting SL armed forces

-

Features7 days ago

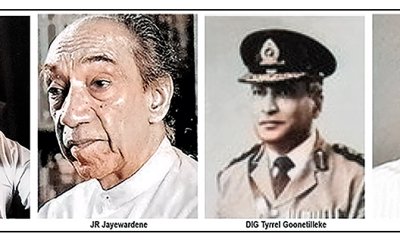

Features7 days agoMr. JR Jayewardene’s passport

-

News4 days ago

News4 days agoAlfred Duraiappa’s relative killed in Canada shooting

-

Features7 days ago

Features7 days agoAs superpower America falls into chaos, being small is beautiful for Sri Lanka

-

Opinion7 days ago

Opinion7 days agoBeyond Victory: sportsmanship thrives at Moratuwa Big Match

-

Features7 days ago

Features7 days agoMemorable moments during my years in Parliament