Business

Lolc Finance concludes a remarkable year with its highest profits ever recorded

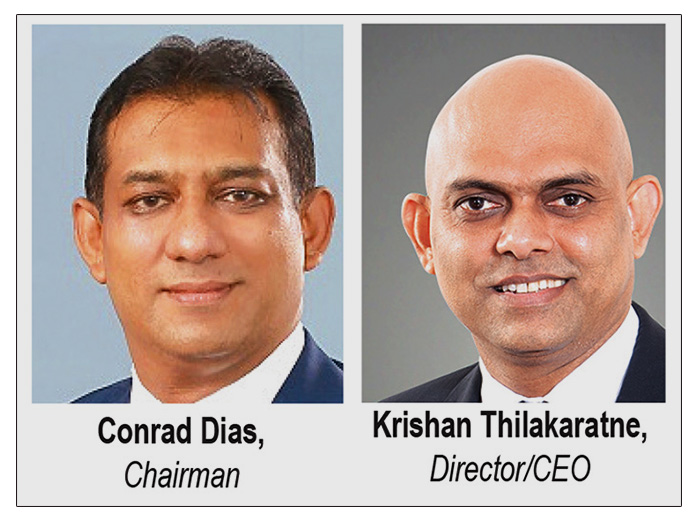

LOLC Finance PLC, the largest non-banking financial institution in Sri Lanka has reported exceptional performance recording Rs.21.5 billion profits for the fiscal year 2023/24 with 39% YoY growth, representing an ROE of 20%. This outstanding performance underscores the company’s strategic excellence and robust market position, achieved through a series of strategic consolidations and a steadfast commitment to cost efficiency, digital transformation, and customer-centricity.

As at the end of the fiscal year, the Company reported a portfolio of Rs. 250 billion and a deposit base of Rs. 206 billion along with a capital base of Rs. 122 billion, the largest in the NBFI sector. Through these results, the company not only demonstrates its dominance in the non-banking financial industry but also its successful navigation through an evolving macroeconomic landscape and the company’s ability to adapt and thrive amidst challenges.

Over the past three years, LOLC Finance has successfully executed three significant mergers, solidifying its market leadership and expanding its operational footprint. These strategic consolidations have enhanced the company’s capabilities, diversified its product offerings, and increased its customer base. Each merger was meticulously planned and executed, ensuring seamless integration and the realization of substantial operational synergies in the forthcoming years.

A cornerstone of LOLC Finance’s strategy has been a relentless focus on cost efficiency. By optimizing operational processes and leveraging economies of scale, the company has been focusing on lowering its cost base.

This is reflected by the cost to income ratio of 40% and is expected to reduce further with the benefits of the merger being extracted. This focus on efficiency improvement has been complemented by a comprehensive digital transformation strategy. The company has invested heavily in cutting-edge technologies and digital solutions, streamlining operations, enhancing customer service, and improving overall business agility. The digital initiatives have not only driven cost savings but also positioned the company at the forefront of technological innovation in the financial services sector.

At the heart of LOLC Finance PLC’s success is its unwavering commitment to customer-centricity. The company has consistently prioritized understanding and meeting the evolving needs of its customers. By offering tailored financial solutions and exceptional customer service, LOLC Finance has built strong, enduring relationships with its clients. This customer-first approach has been instrumental in driving customer loyalty and retention, further reinforcing the company’s market leadership.

Assuming its role as an Economic Enabler for most parts of the segments in the economy, LOLC Finance PLC offers comprehensive lending portfolio, with an array of financial solutions, including auto finance, speed drafts, housing loans, mortgage loans, personal loans, corporate loans, working capital solutions, gold loans, educational loans, and flexi interest loans, among others. This diverse portfolio caters to the specific needs of individuals and enterprises across the economic spectrum.

Boasting over 230 branches across the island and a culturally diverse workforce, LOLC Finance stands prioritise personalized services to its wide-ranging customer base. Setting itself apart from other non-banking financial institutions (NBFIs), LOLC Finance offers doorstep services for clients, encompassing both service provision and post-credit disbursement support. The well-trained employee base of LOLC Finance contributes significantly to the organization’s exceptional service delivery.