Business

Learnings for Sri Lanka on SOE Reforms – Singapore’s Temasek Holdings

Introduction

A super-holding company for managing State-Owned Enterprises (SOEs) has been identified as a globally successful model for SOE management. This model allows the government to adopt a more arms-length approach to SOEs’ operational decision-making, relieving it of the direct responsibility of overseeing all the SOEs dispersed across various industries, and redirect its budget and energy elsewhere. The merits of this model have enabled countries such as Malaysia and Singapore, which have similar holding company structures, to ensure impressive performances of their SOEs.

This article is the first of a three-part series where part one and two provide an in depth analysis of the case of Singapore’s and Malaysia’s SOE holding company models (Singapore’s Temasek Holdings and Malaysia’s Khazanah Nasional), and their role in enabling economic growth and development for the respective countries. Part three will provide learnings for Sri Lanka, which can be adopted for the country’s SOE reform process. This series of articles is a joint effort by the Ceylon Chamber of Commerce (CCC) and the Colombo Stock Exchange (CSE).

Part One: Singapore’s Temasek Holdings

Overview

Temasek was incorporated in 1974 under the Singapore Companies Act to hold and manage assets previously held by the Singapore Government. The objective of transferring assets to a commercial company was to free the Ministry of Finance of the responsibility so that it could focus on its core role of policymaking and regulations, while Temasek would own and manage these SOEs (also known as Government-linked Companies – GLCs) on a commercial basis.

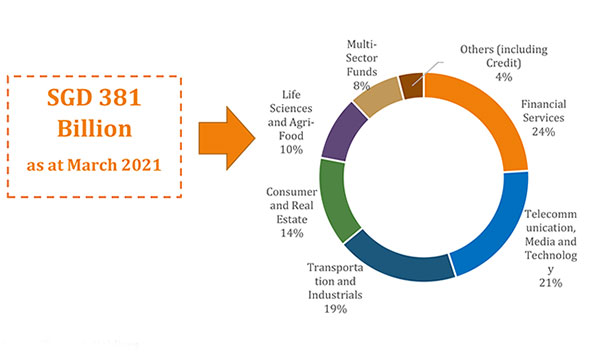

Similar to any commercial company, Temasek has its own Board of Directors and a professional management team. It pays taxes to the government and distributes dividends to its shareholders. Temasek was established to contribute to Singapore’s economic growth by nurturing entities into world-class companies through effective stewardship and strategically driven commercial investments. Today, it operates in 9 countries and its portfolio value amounted to SGD 381 billion as at the end of March 2021. This is equivalent to around USD 283 billion, which is about 6 times Sri Lanka’s external debt accumulated over the years and about 4 times the amount of Sri Lanka’s Gross Domestic Product (GDP).

Temasek invested mainly in Singaporean companies in its early days, but it has turned into a major global investor in recent years. Geographically, the majority of these investments are in China (27%) followed by Singapore (24%), America (20%) and rest of the world (12%). Temasek operates a diversified portfolio spread across many segments such as Financial Services, Telecom, Media, Technology and Transportation and Industry. Please refer figure 01 for a breakdown of sectors.

Source: Temasek Holdings

Why was Temasek Successful?

SOEs are generally regarded as inefficient firms because of political interference, and corruption. Despite this, various studies have shown that Singaporean SOEs exhibit higher valuations than non-SOEs, even after controlling for firm specific factors and also have better corporate governance practices.

The reasons for this lies in the political, social and economic context that Singapore faced during the period of self-governance to the early years of independence from the late 1950s to the early 1970s. The difficult economic conditions coupled with a challenging political environment in Singapore during this period played a significant role in nurturing good political governance in Singapore, which was in turn transposed to Singapore’s SOEs with good corporate governance practices. The Temasek corporate governance framework covers the following broad areas:

1. Board Governance

Temasek aims to help SOEs build effective boards by setting out guidelines on the appropriate composition of board, tenure of the directors, their size, and formation of specialized board committees.

2. Business Charters

Temasek encourages SOEs to stay focused on their core competencies and it will not disapprove of SOEs diversifying if it is done in the best interest of its shareholders.

3. Talent and Remuneration

Temasek encourages SOEs to recruit the best global talent and to reward them competitively.

4. Value Creation

Temasek works closely with their SOEs to adopt appropriate performance benchmarks to maximize returns on shareholder investments. It expects its companies to be profitable and generate a high rate of return on investment like any shareholder.

Therefore, Temasek’s stewardship has enabled SOEs to create value for their shareholders. This has led to the SOEs on average demonstrating higher valuations than non-SOEs, even after controlling for firm specific factors such as profitability, leverage, firm size, industry effect, and foreign ownership.

How has it Contributed to Development Goals?

Temasek is a government holding company that acts as a shareholder on behalf of the Singaporean government (Ministry of Finance). It pursues its developmental mandate by buying direct stakes in global companies, mostly in Singapore and Asian, and then reinvesting its proceeds from asset sales and dividend income into foreign assets, acting similar to a private equity fund.

The arms-length approach from the government has made it possible for Temasek’ to manage its financing and exercise independence. Temasek hasn’t received any regular financing from the government in its close to 50-year history, but receives ad-hoc occasional injections from time to time, which are publicly disclosed.

The compounded annualised total shareholder return since inception in 1974 is at 14% in Singapore dollar terms. The Temasek foundation oversees 23 non-profit philanthropic projects, and has positively impacted 1.5 million lives across Asia and Singapore through their community work.

Contribution to Reserves

In terms of the contributions to the Singaporean economy, the Singapore government can include around 50% of Temasek’s expected long term returns along with the Government of Singapore Investment Corporation (GIC) and Monetary Authority of Singapore (MAS) investment returns. These three institutions contribute to government reserves through the Net Investment Returns Contribution (NIRC). NIRC is comprised of up to 50% of the Net Investment Returns (NIR) on the net assets invested by GIC, MAS and Temasek, and the Net Investment Income (NII) derived from past reserves from the remaining assets.

The full brief can be accessed at: Holding Company for SOEs: Learnings for Sri Lanka.

Business

CBSL keeps overnight policy rates unchanged; latest review of IMF program awaited

The Central Bank kept its overnight policy rate unchanged yesterday as it awaited the latest review of a US $2.9-billion International Monetary Fund programme.

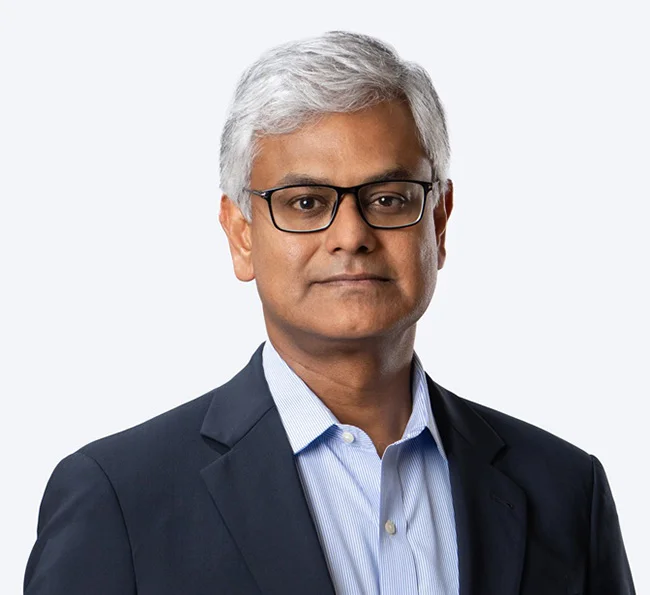

‘The Central Bank will maintain the overnight policy rate at 7.75 percent and stable inflation, healthy credit growth and steady economic expansion are the reasons for the decision, Central Bank Governor Dr Nandalal Weerasinghe said. The Central Bank Governor stated this yesterday at the monthly policy review meeting held at Central Bank head office in Colombo.

‘The Board arrived at this decision after carefully considering evolving developments and the outlook on the domestic front and global uncertainties, the Governor said.

Dr Weerasinghe said that the Board is of the view that the current monetary policy stance will support steering inflation towards the target of 5 percent

The CBSL Governor added: ‘Inflation measured by the Colombo Consumer Price Index (CCPI) remained unchanged at 2.1 percent in December 2025. However, food prices edged higher in December compared to November.

‘ This was due to supply chain disruptions caused by Cyclone Ditwah and higher demand for food during the festive season.

‘Inflation is projected to accelerate gradually and move towards the target of 5 percent by the second half of 2026. Core inflation, which excludes price changes in volatile food, energy and transport from the CCPI basket, has also shown some acceleration in recent months.

‘Core inflation is expected to accelerate further as demand in the economy strengthens. Meanwhile, inflation expectations appear to be well anchored around the inflation target.

‘The economy grew by 5.0 percent during the first nine months of 2025. Despite the slowdown in economic activity following Cyclone Ditwah in late 2025, early indicators reflect greater resilience.

‘Credit disbursed to the private sector by commercial banks and other financial institutions continued its notable expansion in late 2025.

‘This reflects increased demand for credit amid improving economic

activity and increased vehicle imports. Post-cyclone rebuilding is expected to sustain this momentum.

‘The external current account is estimated to have recorded a sizeable surplus in 2025, despite the widening of the trade deficit. Foreign remittances remained healthy during 2025.

‘Despite large debt service payments during the year, Gross Official Reserves were built up to USD 6.8 bn by the end of 2025.

‘This was mainly supported by the net foreign exchange purchases by the Central Bank and inflows from multilateral agencies. The Sri Lanka rupee depreciated by 5.6 percent against the US dollar in 2025 and has remained broadly stable thus far during this year. This includes the swap facility from the People’s Bank of China.

‘The Board remains prepared to implement appropriate policy measures to ensure that inflation stabilises around the target, while supporting the economy to reach its potential.’

By Hiran H Senewiratne

Business

Janashakthi Finance records 35% growth in Net Operating Income and LKR 389 Mn. PBT in Q3 FY26

Janashakthi Finance PLC, formerly known as Orient Finance PLC and a subsidiary of JXG (Janashakthi Group) announced a strong financial performance for the nine-month period ended 31 December 2025, driven by sustained growth in its core businesses, disciplined execution and continued focus on scale and efficiency.

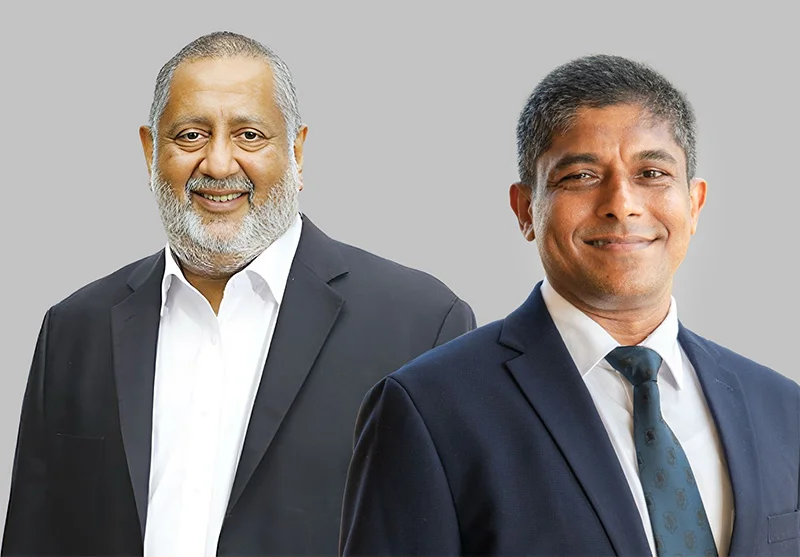

Commenting on the results, Rajendra Theagarajah, Chairman of Janashakthi Finance PLC, said, “The performance for the period reflects the clarity of our strategic priorities and the strength of our governance framework. With strong leadership in place that is confidently driving the business, we continue to grow steadily while maintaining balance sheet strength and stakeholder confidence.”

For the period under review, Profit Before Tax (PBT) rose by 39% year-on-year to LKR 389 million, supported by higher operating income and portfolio expansion. Net Operating Income increased by 35% year-on-year to LKR 2.2 billion, reflecting sustained lending activity and improved business scale.Net Profit After Tax (NPAT) amounted to LKR 240 million.

The Company’s Loans and Receivables portfolio grew by 49% year-on-year to LKR 29 billion, driven by demand across key lending segments and focused growth initiatives. Deposits increased to LKR 17 billion, recording a 14% year-on-year growth, reinforcing funding diversity and customer confidence.

Reflecting on the year’s progress, Sithambaram Sri Ganendran, Chief Executive Officer of Janashakthi Finance PLC, stated, “During the period, we focused on expanding our loan book responsibly, strengthening our funding base and enhancing operational capability. The growth achieved across our key indicators positions the Company strongly as we continue to execute our medium-term strategy and respond to market opportunities.”

Business

JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

The Group continued to deliver a strong performance, with all businesses reporting improved profitability.

The operationalisation of two of the Group’s largest projects, the City of Dreams Sri Lanka integrated resort and the West Container Terminal (WCT-1) at the Port of Colombo, continued to progress well. The encouraging quarter-on-quarter momentum demonstrates the strong ramp up potential of both projects.

The country faced an unexpected challenge in November with Cyclone Ditwah, which impacted parts of Southeast and South Asia. The cyclone caused loss of lives, affected a significant portion of the population, and resulted in considerable infrastructure damage in certain areas of Sri Lanka. While the operations of the Group were disrupted during the few days of the cyclone, there were no significant operational or financial impact as a direct result of the cyclone and related flooding.

The Group and its staff supported relief efforts through various initiatives, including a substantial contribution of Rs.500 million from John Keells Holdings PLC and its affiliate companies towards the Government’s ‘Rebuilding Sri Lanka’ initiative.

Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs.23.76 billion in the third quarter of the financial year 2025/26 is an increase of 68% against Group EBITDA of Rs.14.15 billion recorded in the third quarter of the previous financial year.

Cumulative Group EBITDA for the first nine months of the financial year 2025/26 at Rs.55.10 billion is an increase of 84% against the EBITDA of Rs.29.94 billion recorded in the same period of the financial year 2024/25.

During the quarter under review, the Group recorded fair value gains on investment property amounting to Rs.2.30 billion [2024/25 Q3: Rs.955 million], and net exchange losses of Rs.759 million [2024/25 Q3: gain of Rs.782 million], mainly due to the impact of the deprecation of the Rupee on the foreign currency denominated loan at City of Dreams Sri Lanka.

Profit attributable to equity holders of the parent is Rs.6.48 billion in the quarter under review, which includes fair value gains on investment property and net exchange losses amounting to Rs.1.45 billion. Profit attributable to equity holders of the parent for the corresponding period of the previous financial year was Rs.2.85 billion, which included fair value gains on investment property and net exchange gains amounting to Rs.1.70 billion.

The second interim dividend for FY2026 of Rs. 0.10 per share is aligned with the first interim dividend paid in November 2025. This reflects the expectation that the current momentum of performance will sustain or further improve going forward. The outlay for the second interim dividend is Rs.1.77 billion, which is an increase compared to Rs.881 million in the previous year.

(JKH)

-

Business4 days ago

Business4 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business5 days ago

Business5 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion5 days ago

Opinion5 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Business23 hours ago

Business23 hours agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion7 days ago

Opinion7 days agoA puppet show?

-

Opinion4 days ago

Opinion4 days agoLuck knocks at your door every day

-

Business6 days ago

Business6 days agoDialog Brings the ICC Men’s T20 Cricket World Cup 2026 Closer to Sri Lankans

-

Features7 days ago

Features7 days ago‘Building Blocks’ of early childhood education: Some reflections