Features

Is the Auditor General the panacea for all our ills?

by Avantha Munasinghe

One of the contentious issues surrounding the 20th Amendment seems to be the issue of the removal of Auditor General’s capacity to audit companies where the Government, Public Corporation or a Local Authority has a majority shareholding. Many critics seem to have picked on this issue, and most of them are resisting the proposed change. Their fear seems to be that if the Auditor General is not permitted to audit a certain government company, it is prone to be riddled with corruption and malpractices.

The audit by definition is a systematic and an independent review and investigation on certain subject matter, which in this case is the financial statements, management accounts, management reports, accounting records etc. of a company. In the case of a company, there is a statutory requirement for such review and investigation to be reported to shareholders annually. The review, is produced as an “opinion” of the “Auditor”.

Other than the shareholders, it is also customarily used by the tax authorities, banks, creditors, analysts or public for their respective decision-making and also to form their own opinion about the status of the company and its future. In all the government companies, the law required them to be audited by independent auditors, qualified to do so as specified by the Companies Act, until 2015. The 19th Amendment changed their auditor to be the Auditor General.

Auditing, just like Accounting, depends on certain commonly adopted set of principles. The audit of financial statements is normally done in accordance with International Standards on Auditing sometimes modified by local auditing standards. In Sri Lanka’s case, the Sri Lanka Auditing Standards are based on the International Standards on Auditing (ISAs) published by the International Auditing and Assurance Standards Board (IAASB) of the International Federation of Accountants (IFAC), with slight modifications to meet local conditions and needs. Thus, to begin with, whether it is the Auditor General or a private auditor, the standards applicable to the task are the same. It is the approach that is different.

There are a large number of companies in Sri Lanka whose shareholding in some way is linked to Government or quasi government entities for whom Auditor General has now become the Statutory Auditor. Some of these companies are merely an extension of government entities serving a function of the government. For example, Rakna Arakshaka Lanka Limited is a government-owned company, providing security services to government installations. Another is Ceylon Petroleum Storage Terminal Ltd., whose only customers are its parent entities i.e. Ceylon Petroleum Corporation and Lanka IOC PLC, only to whom it provides services. Such entities do not have to face competition to secure business.

However, there are also a large number of government-owned companies which do business in the marketplace competing with other local and international companies, which are publicly and privately owned. Lanka General Trading Company Ltd., Lanka Hospitals Ltd., Sri Lanka Insurance Corporation Limited and Milco (Pvt.) Ltd., are a few examples. Each of them has to compete for business with large segment of local and foreign companies which are purely driven by profit motive and enhancement of shareholders’ value.

These companies have very flexible systems and procedures. Their boards of directors can take appropriate decisions in a timely manner to make an urgent procurement or select suppliers to be more competitive and manage all their affairs just in time. They can buy their raw materials without calling for quotations if they think it is a profitable opportunity. Even a junior level executive of such a company may be able to decide a price discount to secure a sale.

The situation of a state-owned company in the marketplace in such scenarios is quite the opposite. They cannot do procurement as the situation demands. They have to dutifully follow the procurement rules, which even the board of directors cannot overrule. The officials have very little flexibility to seize a business opportunity. It is so easy for a private company to grab business from state-owned enterprises as the latter cannot be proactive. There is little surprise most such companies are loss-making and is a burden to the government and taxpayers.

The government officials and Ministers however want these quasi state organizations to be profitable or run at least without being a burden to the Treasury. The basic business model of these organizations is at a severe disadvantage to begin with. What 19th Amendment brought to such companies by way of auditing by the Auditor General was to push them from pillar to post. This is quite evident by the powers granted to the Auditor General in the National Audit Act, which even a crime investigator would envy. Some of the powers are:

(1) The Auditor-General shall…

… access or call for any written or electronic records or other information relating to the activities of an auditee entity;

… call any person whom the Auditor-General has reasonable grounds to believe to be in possession of information and documents, as he may consider necessary to carry on the functions under this Act, to obtain written or oral statements and require the production of any document, from any person, who may be either in-service or otherwise;

… examine and make copies of or take extracts from any written or electronic records and search for information whether or not in the custody of the auditee entity;

… after obtaining permission from the relevant Magistrate’s Court, examine and audit any account, transaction or activity of a financial institution, of any person, where the Auditor-General has reason to believe that money belonging to an auditee entity has been fraudulently, irregularly or wrongfully paid into such person’s account;

…require any officer of financial institutions to produce any document or provide any information relating to an account, transaction, dealing or activity of person referred to in paragraph (d) and to take copies of any document so produced, if necessary… There is a fundamental difference in the audit approach of a professional auditor and a Supreme Audit Institution such the Auditor General. In a private sector audit, the primary objective is to ensure the report’s recipient gets a true and fair view of the financial status of the company. While the professional auditor is supposed to report on adequacy of the controls in place and report any lapses to shareholders, the focus is primarily on the status of the shareholder’s investment.

The approach of Auditor General is more on ensuring the Compliance to rules, regulations and procedures. This is natural since the Auditor General is supposed to audit the manner in which a government organization has handled its allocation from the consolidated fund to provide a service to the public. The approach is, therefore, not focused on whether the organization is making adequate return on the government’s funds.

What the 19th Amendment did was to replace the professional auditor, who focused on performance of government companies by the Auditor General who is focused on compliance. The officers running such government-owned companies got a signal quite contrary to what the government officials and ministers were pushing them before. Compliance became the key. There is no better way to achieve compliance than to do nothing. The truth is in the last few years; these organization put profit motive in the back burner and wanted to escape from various audit queries raised by the Auditor General. The best way to do that is not to go that extra mile their competitors would go to make the organization profitable. Doing nothing became the modus operandi.

Some of the supporters of Auditor General’s auditing argue that his mere presence stops corruption. Stamping out corruption was the all-pervasive theme of the 19th Amendment. So many new entities were instituted under it to check corruption. Where are we today? Do we see any positive results? In the Corruption Perception Index published by the Transparency International in the year 2015, when the 19th Amendment was enacted, Sri Lanka’s scored 37 out of hundred. In 2019, our score was only 38. We rank 93 out of 198 countries, four places down. It is no secret that the public perceives state sector organizations as corrupt as ever and certainly more corrupt than any private sector organization in this country. The Auditor General has been auditing these state sector organizations for more than 200 years. If the cure against corruption is audit being done by the Auditor General, why are we in this situation today?

The truth is the Auditor General’s presence is a necessary evil in any government ministry or department, which does not have a commercial objective. His presence does ensure at least some level of corruption is made more difficult to accomplish. However, we must not come into the false conclusion that the presence of the Auditor General is the way to root out corruption. In a State-Owned Enterprise (SoE) with commercial objectives, his presence certainly does more harm than benefit.

There is a wrong perception that most public companies are loss making and, therefore, they should be subjected to an Audit by the Auditor General so that the “control” of public funds will put things right. As explained above, it is the business model and restrictions placed that is the very cause for loss-making SoEs to proliferate. If this argument is correct, we should see, out of more than 120 or so government companies, at last one which became profitable due to the Auditor General’s presence during last five years. There is none to show. In fact, this remedy will only make the patient even more sick.

Another untruth floated on the matter is that the financial statements of the government companies are not required to be submitted to Parliament unless they are audited by the Auditor General and that would undermine parliamentary financial oversight. The truth is that the entity, which is the shareholder in these companies, have to consolidate the company’s financial statements with that of the parent entity and the latter is certainly subjected to parliamentary oversight with financial statements of the company audited by a private auditor.

Another misconception is that supervision by COPE will put everything right in the public institutions. COPE’s examination carried out by set of parliamentarians, who on most occasions have no knowledge of the particular business, is not what is required to put these organizations right. In most cases it is the bad business model rather than lack of COPE’s oversight that fail these businesses.

SriLankan Airlines is a case of point. Many people say the bad procurement deals, continued losses and increased dependence on the Treasury by the airline would continue to happen if the Auditor General is not auditing the airline. It was making losses ever since it was set up with or without Auditor General as the auditor. The Airline business is one of the most competitive businesses globally. Even the largest airlines sometimes find it difficult to be in the black. The industry needs split second decisions to be made by professional management. As said before, this is not possible at SriLankan Airlines. We have seen Chairmen and Directors coming and going with every change of the subject minister. Nobody is having a long-term commitment to make it a success. Its competitors have boards, which are removed only if the airline makes losses, not if their political masters change. Without changing the business model, even if we have hundred auditors to audit SriLankan Airlines, nothing will change.

We all know that our country is suffering from a severe debt crisis. We invested on massive infrastructure projects, which were all debt financed. To balance that off, we desperately need to bring foreign equity into our economy. Further debt, while giving us temporary solace, will only aggravate the problem. The government is devising Public Private Partnership (PPP) programs to bring Foreign Investment from large global corporations. The government also needs to be in control of them. The 19th Amendment requires such PPP companies to have the Auditor General as its Auditor. Which global business entity would drop their global audit arrangements by the likes of KPMG, Ernst & Young or PwC and accept this arrangement? We can talk till the cows come home on how professional our Auditor General is and how independent he is, but the reality is that we live in a dream if we seriously want to promote PPP structures with this kind of legislation on.

The effective functioning of Superior Audit Institutions such as the Auditor General is definitely an essential requirement of a functioning democracy. However, let’s not fool ourselves – it is not a panacea for all ills.

Even in India where the previous Companies Act required the appointment of Auditors to Government Companies by the Controller and Auditor General of India, the arrangement has been questioned in the Report of the Expert Committee On Company Law, which said “The Committee discussed the application of the corporate law framework to Government companies on many occasions and took the view that in general, there should not be any special dispensation for such companies. …Therefore, the extension of special exemptions and protections to various commercial ventures taken up by Government companies in the course of their commercial operations along with strategic partners or general public should be done away with so that such entities can operate in the market place on the same terms and conditions as other entities. In particular, reflection of financial information of such ventures by Government companies and their audit should be subject to the common legal regime applicable. The existing delays are enabling a large number of corporate entities to evade their responsibilities and liability for correct disclosure of true and fair financial information in a timely manner. In this context, the relevance of the present section 619B of the Act was considered appropriate for a review.”

If the government needs its companies to compete with private sector, the way forward is to make their management more flexible. Throwing those decision-makers to the Auditor General is the last thing required to be done if we want them to compete effectively with the private sector. While the world is moving to embrace the scarce private capital by making things easier for such investors, some of our so-called professionals seem to be, while paying lip service for bringing more and more FDI, doing exactly the opposite by criticizing the removal of this disastrous piece of legislature brought in by the 19th Amendment.

(The writer is an Accountant based in New South Wales, Australia)

Features

Following the Money: Tourism’s revenue crisis behind the arrival numbers – PART II

(Article 2 of the 4-part series on Sri Lanka’s tourism stagnation)

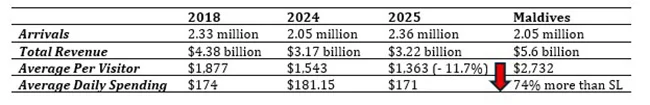

If Sri Lanka’s tourism story were a corporate income statement, the top line would satisfy any minister. Arrivals went up 15.1%, targets met, records broke. But walk down the statement and the story darkens. Revenue barely budges. Per-visitor yield collapses. The money that should accompany all those arrivals has quietly vanished, or, more accurately, never materialised.

If Sri Lanka’s tourism story were a corporate income statement, the top line would satisfy any minister. Arrivals went up 15.1%, targets met, records broke. But walk down the statement and the story darkens. Revenue barely budges. Per-visitor yield collapses. The money that should accompany all those arrivals has quietly vanished, or, more accurately, never materialised.

This is not a recovery. It is a volume trap, more tourists generating less wealth, with policymakers either oblivious to the math or unwilling to confront it.

Problem Diagnosis: The Paradox of Plenty:

The numbers tell a brutal story.

Read that again: arrivals grew 15.1% year-on-year, but revenue grew only 1.6%. The average tourist in 2025 left behind $181 less than in 2024, an 11.7% decline. Compared to 2018, the drop is even sharper. In real terms, adjusting for inflation and currency depreciation, each visitor in 2025 generates approximately 27-30% less revenue than in 2018, despite Sri Lanka being “cheaper” due to the rupee’s collapse. This is not marginal variance. This is structural value destruction. (See Table 1)

The math is simple and damning: Sri Lanka is working harder for less. More tourists, lower yield, thinner margins. Why? Because we have confused accessibility with competitiveness. We have made ourselves “affordable” through currency collapse and discounting, not through value creation.

Root Causes: The Five Mechanisms of Value Destruction

The yield collapse is not random. It is the predictable outcome of specific policy failures and market dynamics.

1. Currency Depreciation as False Competitiveness

The rupee’s collapse post-2022 has made Sri Lanka appear “cheap” to foreigners. A hotel room priced at $100 in 2018 might cost $70-80 in effective purchasing power today due to depreciation. Tour operators have aggressively discounted to fill capacity during the crisis recovery.

This creates the illusion of competitiveness. Arrivals rise because we are a “bargain.” But the bargain is paid for by domestic suppliers, hotels, transport providers, restaurants, staff, whose input costs (energy, food, imported goods) have skyrocketed in rupee terms while room rates lag in dollar terms.

The transfer is explicit: value flows from Sri Lankan workers and businesses to foreign tourists. The tourism “recovery” extracts wealth from the domestic economy rather than injecting it.

2. Market Composition Shift: Trading European Yields for Asian Volumes

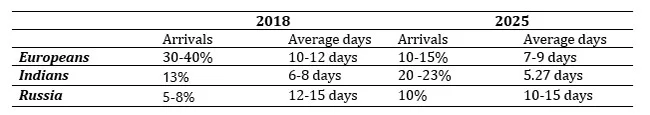

SLTDA data shows a deliberate (or accidental—the policy opacity makes it unclear) shift in source markets. (See Table 2)

The problem is not that we attract Indians or Russians, it is that we attract them without strategies to optimise their yield. As the next article in this series will detail, Indian tourists average approximately 5.27 nights compared to the 8-9 night overall average, with lower per-day spending. We have built recovery on volume from price-sensitive segments rather than value from high-yield segments.

This is a choice, though it appears no one consciously made it. Visa-free entry, aggressive India-focused marketing, and price positioning have tilted the market mix without any apparent analysis of revenue implications.

3. Length of Stay Decline and Activity Compression

Average length of stay has compressed. While overall averages hover around 8-9 nights in recent years, the composition matters. High-yield European and North American tourists who historically spent 10-12 nights are now spending 7-9. Indian tourists spend 5-6 nights.

Shorter stays mean less cumulative spending, fewer experiences consumed, less distribution of value across the tourism chain. A 10-night tourist patronises multiple regions, hotels, guides, restaurants. A 5-night tourist concentrates spending in 2-3 locations, typically Colombo, one beach, one cultural site.

The compression is driven partly by global travel trends (shorter, more frequent trips) but also by Sri Lanka’s failure to develop compelling multi-day itineraries, adequate inter-regional connectivity, and differentiated regional experiences. We have not given tourists reasons to stay longer.

4. Infrastructure Decay and Experience Degradation

Tourists pay for experiences, not arrivals. When experiences degrade, airport congestion, poor road conditions, inadequate facilities at cultural sites, safety concerns, spending falls even if arrivals hold.

The 2024-2025 congestion at Bandaranaike International Airport, with reports of tourists nearly missing flights due to bottlenecks, is the visible tip. Beneath are systemic deficits: poor last-mile connectivity to tourism sites, deteriorating heritage assets, unregistered businesses providing sub-standard services, outbound migration of trained staff.

An ADB report notes that tourism authorities face resource shortages and capital expenditure embargoes, preventing even basic facility improvements at major revenue generators like Sigiriya (which charges $36 per visitor and attracts 25% of all tourists). When a site generates substantial revenue but lacks adequate lighting, safety measures, and visitor facilities, the experience suffers, and so does yield.

5. Leakage: The Silent Revenue Drain

Tourism revenue figures are gross. Net foreign exchange contributions after leakages, is rarely calculated or published.

Leakages include:

· Imported food, beverages, amenities in hotels (often 30-40% of operating costs)

· Foreign ownership and profit repatriation

· International tour operators taking commissions upstream (tourists book through foreign platforms that retain substantial margins)

· Unlicensed operators and unregulated businesses evading taxes and formal banking channels

Industry sources estimate leakages can consume 40-60% of gross tourism revenue in developing economies with weak regulatory enforcement. Sri Lanka has not published comprehensive leakage studies, but all indicators, weak licensing enforcement, widespread informal sector activity, foreign ownership concentration in resorts, suggest leakages are substantial and growing.

The result: even the $3.22 billion headline figure overstates actual net contribution to the economy.

The Way Forward: From Volume to Value

Reversing the yield collapse requires

systematic policy reorientation, from arrivals-chasing to value-building.

First

, publish and track yield metrics as primary KPIs. SLTDA should report:

· Revenue per visitor (by source market, by season, by purpose)

· Average daily expenditure (disaggregated by accommodation, activities, food, retail)

· Net foreign exchange contribution after documented leakages

· Revenue per room night (adjusted for real exchange rates)

Make these as visible as arrival numbers. Hold policy-makers accountable for yield, not just volume.

Second

, segment markets explicitly by yield potential. Stop treating all arrivals as equivalent. Conduct market-specific yield analyses:

· Which markets spend most per day?

· Which stays longest?

· Which distributes spending across regions vs. concentrating in Colombo/beach corridors?

· Which book is through formal channels vs. informal operators?

Target marketing and visa policies accordingly. If Western European tourists spend $250/day for 10 nights while another segment spends $120/day for 5 nights, the revenue difference ($2,500 vs. $600) dictates where promotional resources should flow.

Third

, develop multi-day, multi-region itineraries with compelling value propositions. Tourists extend stays when there are reasons to stay. Create integrated experiences:

· Cultural triangle + beach + hill country circuits with seamless connectivity

· Themed tours (wildlife, wellness, culinary, adventure) requiring 10+ days

· Regional spread of accommodation and experiences to distribute economic benefits

This requires infrastructure investment, precisely what has been neglected.

Fourth

, regulations to minimise leakages. Enforce licensing for tourism businesses. Channel bookings through formal operators registered with commercial banks. Tax holiday schemes should prioritise investments that maximise local value retention, staff training, local sourcing, domestic ownership.

Fifth

, stop using currency depreciation as a competitive strategy. A weak rupee makes Sri Lanka “affordable” but destroys margins and transfers wealth outward. Real competitiveness comes from differentiated experiences, quality standards, and strategic positioning, not from being the “cheapest” option.

The Hard Math: What We’re Losing

Let’s make the cost explicit. If Sri Lanka maintained 2018 per-visitor spending levels ($1,877) on 2025 arrivals (2.36 million), revenue would be approximately $4.43 billion, not $3.22 billion. The difference: $1.21 billion in lost revenue, value that should have been generated but wasn’t.

That $1.21 billion is not a theoretical gap. It represents:

· Wages not paid

· Businesses not sustained

· Taxes not collected

· Infrastructure not funded

· Development not achieved

This is the cost of volume-chasing without yield discipline. Every year we continue this model; we lock in value destruction.

The Policy Failure: Why Arrivals Theater Persists

Why do policymakers fixate on arrivals when revenue tells the real story?

Because arrivals are politically legible. A minister can tout “record tourist numbers” in a press conference. Revenue per visitor requires explanation, context, and uncomfortable questions about policy choices.

Arrivals are easy to manipulate upward, visa-free entry, aggressive discounting, currency depreciation. Yield is hard, it requires product development, market curation, infrastructure investment, regulatory enforcement.

Arrivals theater is cheaper and quicker than strategic transformation. But this is governance failure at its most fundamental. Tourism’s contribution to economic recovery is not determined by how many planes land but by how much wealth each visitor creates and retains domestically. Every dollar spent celebrating arrival records while ignoring yield collapse is a waste of dollars.

The Uncomfortable Truth

Sri Lanka’s tourism “boom” is real in volume, but it is a value bust. We are attracting more tourists and generating less wealth. The industry is working harder for lower returns. Margins are compressed, staff are paid less in real terms, infrastructure decays, and the net contribution to national recovery underperforms potential.

This is not sustainable. Eventually, operators will exit. Quality will degrade further. The “affordable” positioning will shift to “cheap and deteriorating.” The volume will follow yield down.

We have two choices: acknowledge the yield crisis and reorient policy toward value creation or continue arrivals theater until the hollowness becomes undeniable.

The money has spoken. The question is whether anyone in power is listening.

Features

Misinterpreting President Dissanayake on National Reconciliation

President Anura Kumara Dissanayake has been investing his political capital in going to the public to explain some of the most politically sensitive and controversial issues. At a time when easier political choices are available, the president is choosing the harder path of confronting ethnic suspicion and communal fears. There are three issues in particular on which the president’s words have generated strong reactions. These are first with regard to Buddhist pilgrims going to the north of the country with nationalist motivations. Second is the controversy relating to the expansion of the Tissa Raja Maha Viharaya, a recently constructed Buddhist temple in Kankesanturai which has become a flashpoint between local Tamil residents and Sinhala nationalist groups. Third is the decision not to give the war victory a central place in the Independence Day celebrations.

Even in the opposition, when his party held only three seats in parliament, Anura Kumara Dissanayake took his role as a public educator seriously. He used to deliver lengthy, well researched and easily digestible speeches in parliament. He continues this practice as president. It can be seen that his statements are primarily meant to elevate the thinking of the people and not to win votes the easy way. The easy way to win votes whether in Sri Lanka or elsewhere in the world is to rouse nationalist and racist sentiments and ride that wave. Sri Lanka’s post independence political history shows that narrow ethnic mobilisation has often produced short term electoral gains but long term national damage.

Sections of the opposition and segments of the general public have been critical of the president for taking these positions. They have claimed that the president is taking these positions in order to obtain more Tamil votes or to appease minority communities. The same may be said in reverse of those others who take contrary positions that they seek the Sinhala votes. These political actors who thrive on nationalist mobilisation have attempted to portray the president’s statements as an abandonment of the majority community. The president’s actions need to be understood within the larger framework of national reconciliation and long term national stability.

Reconciler’s Duty

When the president referred to Buddhist pilgrims from the south going to the north, he was not speaking about pilgrims visiting long established Buddhist heritage sites such as Nagadeepa or Kandarodai. His remarks were directed at a specific and highly contentious development, the recently built Buddhist temple in Kankesanturai and those built elsewhere in the recent past in the north and east. The temple in Kankesanturai did not emerge from the religious needs of a local Buddhist community as there is none in that area. It has been constructed on land that was formerly owned and used by Tamil civilians and which came under military occupation as a high security zone. What has made the issue of the temple particularly controversial is that it was established with the support of the security forces.

The controversy has deepened because the temple authorities have sought to expand the site from approximately one acre to nearly fourteen acres on the basis that there was a historic Buddhist temple in that area up to the colonial period. However, the Tamil residents of the area fear that expansion would further displace surrounding residents and consolidate a permanent Buddhist religious presence in the present period in an area where the local population is overwhelmingly Hindu. For many Tamils in Kankesanturai, the issue is not Buddhism as a religion but the use of religion as a vehicle for territorial assertion and demographic changes in a region that bore the brunt of the war. Likewise, there are other parts of the north and east where other temples or places of worship have been established by the military personnel in their camps during their war-time occupation and questions arise regarding the future when these camps are finally closed.

There are those who have actively organised large scale pilgrimages from the south to make the Tissa temple another important religious site. These pilgrimages are framed publicly as acts of devotion but are widely perceived locally as demonstrations of dominance. Each such visit heightens tension, provokes protest by Tamil residents, and risks confrontation. For communities that experienced mass displacement, military occupation and land loss, the symbolism of a state backed religious structure on contested land with the backing of the security forces is impossible to separate from memories of war and destruction. A president committed to reconciliation cannot remain silent in the face of such provocations, however uncomfortable it may be to challenge sections of the majority community.

High-minded leadership

The controversy regarding the president’s Independence Day speech has also generated strong debate. In that speech the president did not refer to the military victory over the LTTE and also did not use the term “war heroes” to describe soldiers. For many Sinhala nationalist groups, the absence of these references was seen as an attempt to diminish the sacrifices of the armed forces. The reality is that Independence Day means very different things to different communities. In the north and east the same day is marked by protest events and mourning and as a “Black Day”, symbolising the consolidation of a state they continue to experience as excluding them and not empathizing with the full extent of their losses.

By way of contrast, the president’s objective was to ensure that Independence Day could be observed as a day that belonged to all communities in the country. It is not correct to assume that the president takes these positions in order to appease minorities or secure electoral advantage. The president is only one year into his term and does not need to take politically risky positions for short term electoral gains. Indeed, the positions he has taken involve confronting powerful nationalist political forces that can mobilise significant opposition. He risks losing majority support for his statements. This itself indicates that the motivation is not electoral calculation.

President Dissanayake has recognized that Sri Lanka’s long term political stability and economic recovery depend on building trust among communities that once peacefully coexisted and then lived through decades of war. Political leadership is ultimately tested by the willingness to say what is necessary rather than what is politically expedient. The president’s recent interventions demonstrate rare national leadership and constitute an attempt to shift public discourse away from ethnic triumphalism and toward a more inclusive conception of nationhood. Reconciliation cannot take root if national ceremonies reinforce the perception of victory for one community and defeat for another especially in an internal conflict.

BY Jehan Perera

Features

Recovery of LTTE weapons

I have read a newspaper report that the Special Task Force of Sri Lanka Police, with help of Military Intelligence, recovered three buried yet well-preserved 84mm Carl Gustaf recoilless rocket launchers used by the LTTE, in the Kudumbimalai area, Batticaloa.

These deadly weapons were used by the LTTE SEA TIGER WING to attack the Sri Lanka Navy ships and craft in 1990s. The first incident was in February 1997, off Iranativu island, in the Gulf of Mannar.

Admiral Cecil Tissera took over as Commander of the Navy on 27 January, 1997, from Admiral Mohan Samarasekara.

The fight against the LTTE was intensified from 1996 and the SLN was using her Vanguard of the Navy, Fast Attack Craft Squadron, to destroy the LTTE’s littoral fighting capabilities. Frequent confrontations against the LTTE Sea Tiger boats were reported off Mullaitivu, Point Pedro and Velvetiturai areas, where SLN units became victorious in most of these sea battles, except in a few incidents where the SLN lost Fast Attack Craft.

Carl Gustaf recoilless rocket launchers

The intelligence reports confirmed that the LTTE Sea Tigers was using new recoilless rocket launchers against aluminium-hull FACs, and they were deadly at close quarter sea battles, but the exact type of this weapon was not disclosed.

The following incident, which occurred in February 1997, helped confirm the weapon was Carl Gustaf 84 mm Recoilless gun!

DATE: 09TH FEBRUARY, 1997, morning 0600 hrs.

LOCATION: OFF IRANATHIVE.

FACs: P 460 ISRAEL BUILT, COMMANDED BY CDR MANOJ JAYESOORIYA

P 452 CDL BUILT, COMMANDED BY LCDR PM WICKRAMASINGHE (ON TEMPORARY COMMAND. PROPER OIC LCDR N HEENATIGALA)

OPERATED FROM KKS.

CONFRONTED WITH LTTE ATTACK CRAFT POWERED WITH FOUR 250 HP OUT BOARD MOTORS.

TARGET WAS DESTROYED AND ONE LTTE MEMBER WAS CAPTURED.

LEADING MARINE ENGINEERING MECHANIC OF THE FAC CAME UP TO THE BRIDGE CARRYING A PROJECTILE WHICH WAS FIRED BY THE LTTE BOAT, DURING CONFRONTATION, WHICH PENETRATED THROUGH THE FAC’s HULL, AND ENTERED THE OICs CABIN (BETWEEN THE TWO BUNKS) AND HIT THE AUXILIARY ENGINE ROOM DOOR AND HAD FALLEN DOWN WITHOUT EXPLODING. THE ENGINE ROOM DOOR WAS HEAVILY DAMAGED LOOSING THE WATER TIGHT INTEGRITY OF THE FAC.

THE PROJECTILE WAS LATER HANDED OVER TO THE NAVAL WEAPONS EXPERTS WHEN THE FACs RETURNED TO KKS. INVESTIGATIONS REVEALED THE WEAPON USED BY THE ENEMY WAS 84 mm CARL GUSTAF SHOULDER-FIRED RECOILLESS GUN AND THIS PROJECTILE WAS AN ILLUMINATER BOMB OF ONE MILLION CANDLE POWER. BUT THE ATTACKERS HAS FAILED TO REMOVE THE SAFETY PIN, THEREFORE THE BOMB WAS NOT ACTIVATED.

Sea Tigers

Carl Gustaf 84 mm recoilless gun was named after Carl Gustaf Stads Gevärsfaktori, which, initially, produced it. Sweden later developed the 84mm shoulder-fired recoilless gun by the Royal Swedish Army Materiel Administration during the second half of 1940s as a crew served man- portable infantry support gun for close range multi-role anti-armour, anti-personnel, battle field illumination, smoke screening and marking fire.

It is confirmed in Wikipedia that Carl Gustaf Recoilless shoulder-fired guns were used by the only non-state actor in the world – the LTTE – during the final Eelam War.

It is extremely important to check the batch numbers of the recently recovered three launchers to find out where they were produced and other details like how they ended up in Batticaloa, Sri Lanka?

By Admiral Ravindra C. Wijegunaratne

By Admiral Ravindra C. Wijegunaratne

WV, RWP and Bar, RSP, VSV, USP, NI (M) (Pakistan), ndc, psn, Bsc (Hons) (War Studies) (Karachi) MPhil (Madras)

Former Navy Commander and Former Chief of Defence Staff

Former Chairman, Trincomalee Petroleum Terminals Ltd

Former Managing Director Ceylon Petroleum Corporation

Former High Commissioner to Pakistan

-

Features4 days ago

Features4 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business5 days ago

Business5 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business4 days ago

Business4 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business4 days ago

Business4 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business4 days ago

Business4 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business5 days ago

Business5 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Editorial7 days ago

Editorial7 days agoAll’s not well that ends well?

-

Business5 days ago

Business5 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check