Business

IPS Policy Insights: COVID-19, the global economy and Sri Lanka’s external sector outlook

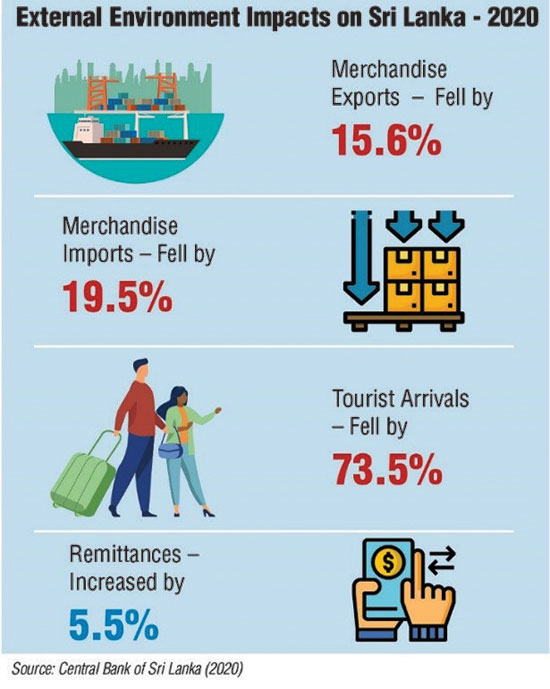

Global economic developments have impacted Sri Lanka’s external sector performance, and the economy overall. While Sri Lanka managed the first wave of the COVID-19 outbreak imposing lockdown measures for two months (March to May 2020), it has since been hit by a second outbreak since October 2020 and a third wave in April 2021. The latter is leading to a substantial increase in active cases of COVID-19, along with higher numbers of deaths, disrupting the gradual economic recovery witnessed from the second quarter of 2020. Merchandise exports, tourism earnings, and foreign direct investment (FDI) inflows are all bearing the brunt of the resultant fallout, except for remittance inflows into the country.

Merchandise Trade

Along with the considerable disruptions to world trade, Sri Lanka’s merchandise trade flows also proved to be fairly volatile, with the overall result being weakened exports and imports during the pandemic. Even prior to the pandemic, Sri Lanka’s long-term export growth rate was on a declining trend, albeit with some improvements in the immediate pre-COVID-19 years. In 2020, the pandemic amplified this long-term decline. Merchandise exports contracted by -15.6% in 2020 compared to the previous year, reflecting both demand and supply shocks.

Overall, as Sri Lanka’s export sector strategies and policies are not firmly integrated into regional and global value chains (GVCs), the impact of supply chain disruptions to the country’s export sector has not been very prominent. However, the country has been facing several adverse issues related to declining demand in its major export markets. Sri Lankan exports traditionally target product markets in a few destinations such as the US, UK and some EU countries. Its export basket too remains rather limited, with overwhelming dependence still on T&G and a few agricultural products. The need to revive export performance with sound strategies will take on even more urgency in the wake of the pandemic to build greater resilience.

As countries adjust to the economic fallout of the pandemic, existing global supply chains will change. Sri Lanka too must be prepared to change direction in favour of strengthening regional linkages. The Asian region is expected to recover swiftly, led by China’s resurgent economy. Whilst India is struggling to bring its latest COVID-19 spread under control, the Indian economy too can be expected to record a strong bounce back eventually. Against these developments, Sri Lanka must exploit potential integration opportunities with the Asian region, to better connect to trade, technology and FDI flows.

Compared to exports, Sri Lanka’s import expenditures fell even more sharply in 2020, contracting by as much as -19.5%. A part of the decline was no doubt a reflection of weakened private investment, declining oil prices and subdued consumer demand. However, a large quantum of the drop in import expenditures is due to restrictions imposed on ‘non-essential’ merchandise imports such as motor vehicles, as well as restrictions on import substitute sectors such as agriculture and processed agricultural food products.

Sri Lanka’s fuel import bill accounts for the country’s largest import category. The expenditure on fuel contracted by -34.7% in 2020 compared to 2019.1 Weakened oil prices in the global market and the sharp decline in domestic demand supported this contraction. While the oil price war between Organization of the Petroleum Exporting Countries (OPEC) and Russia, and declining global oil demand created this decline in prices, a continuation of these advantages cannot be expected as global demand picks up and oil producing countries agree to curb oil supplies.

Tourism and Remittances

In the aftermath of the Easter Sunday attacks in April 2019, Sri Lanka’s post-war tourism sector recovery came to an abrupt halt. In response, several strategies were implemented, including financial assistance to the sector as well as promotional campaigns to secure visitors. The mobility and physical containment measures imposed with the onset of COVID-19 dealt a further blow to the Sri Lankan tourism industry. With the suspension of tourist arrivals from all countries with effect from mid-March 2020, tourist arrivals came to a complete halt more or less for nine months (April to December 2020). International arrivals to the Sri Lankan border saw a sharp decline of -73.5% in 2020.

By contrast, Sri Lanka’s worker remittance inflows have performed much better than what had been forecast. Remittances had been experiencing a consistent decline over the past few years, reflecting external and internal developments related to foreign employment. In 2020, after an initial brief drop, remittances grew by 5.5% to USD 7.1 billion. The increase is perhaps explained by Sri Lankan migrants who may be remitting larger amounts as coping mechanisms for their households, as well as those remitting funds in preparation for returning to Sri Lanka owing to loss of employment in host economies. Additionally, the pandemic conditions, including limited mobility and greater uncertainty may have encouraged the diversion of remittances from informal to formal channels.

Capital Flows: FDI and Capital Market Trends

Even though Sri Lanka is argued to have a strategic geographical advantage straddling major shipping routes in the Indian Ocean, the country has not yet been able to convert this to substantive progress in attracting FDI inflows. FDI inflows saw some improvement in the post-war period and reached a peak in 2018 but has been on a declining trend thereafter. The pandemic has amplified this shrinkage. Retaining investor confidence through sound policy decisions, ensuring domestic security measures, and providing a transparent and accountable regulatory environment are vital to attract more FDI to the country.

The government is attempting to facilitate foreign investments into favourable locations in the country such as the Hambantota industrial zone, the Colombo Port City, as well as easing regulatory constraints to address time taken to set up a business in Sri Lanka, etc. The priority in these efforts appears to hinge on the Colombo Port City which will be granted special tax dispensations and other inducements to kick-start FDI inflows into mixed development projects and other infrastructure dominant sectors. The urgency to attract more FDI is partly related to the governments stated policy intention to move away from debt creating capital inflows to non-debt creating sources such as FDI. In the context in which Sri Lanka is struggling to access international capital markets in a COVID-19 environment, an enhanced inflow of FDI will provide relief on the external front.

Looking Ahead

For a country with a small domestic consumer base, Sri Lanka must remain competitive in international markets as a source of goods and services. Calibrating trade policies to integrate into re-fashioned GVCs, especially in a regional context, should remain an important part of the country’s medium-term recovery efforts towards a stable external sector environment that will support the country’s long-term growth and development aspirations.

* This Policy Insight is based on the comprehensive chapter on “COVID-19, Global Economic Developments and Impact on Sri Lanka” in the ‘Sri Lanka: State of the Economy 2020’ report – the annual flagship publication of the Institute of Policy Studies of Sri Lanka (IPS). The complete report can be purchased from the Publications Unit of IPS located at 100/20, Independence Avenue, Colombo 07 and leading bookshops island wide. For more information, contact 011-2143107 / 077-3737717 or email: publications@ips.lk.

Business

‘Bad Bank,’ Big Stakes: Sri Lanka’s Rs. 300bn gamble on growth

Sri Lanka’s small and medium enterprise (SME) sector—responsible for 52 percent of GDP and employing nearly half the national workforce—has become the next decisive test of the country’s fragile economic recovery.

A proposal to establish a Rs. 300 billion “Bad Bank” to absorb distressed SME loans now places policymakers at a crossroads: act boldly to revive credit and growth, or risk entrenching stagnation in the real economy.

The Sri Lanka Chamber of Small and Medium Industries (SLCSMI) on Tuesday told journalists that they had unveiled a detailed blueprint aimed at restructuring an estimated Rs. 460 billion in non-performing loans (NPLs), much of it concentrated among SMEs battered by successive shocks—from the Easter Sunday attacks and the pandemic to sovereign default and climate-related disruptions such as Cyclone Ditwah.

While headline indicators suggest macroeconomic stabilisation, including lower inflation, improved reserves and a profitable banking sector, credit transmission to smaller enterprises remains severely constrained, Chambers think tank pointed out.

“This is not about rewarding defaulters,” said SLCSMI President Prof. Rohan De Silva. “It is about protecting the productive backbone of the economy. If SMEs collapse, the consequences will extend far beyond individual balance sheets.”

Despite strong liquidity and a return to profitability in the banking system, thousands of SMEs remain blacklisted at the Credit Information Bureau (CRIB), unable to access fresh working capital.

The Chamber argues that unless distressed assets are separated from viable enterprises, banks will remain structurally risk-averse, prolonging the paralysis in private sector credit growth.

The proposed “Bad Bank” would function as a specialised rehabilitation vehicle, purchasing or warehousing toxic SME loans and granting viable firms a five-to-ten-year restructuring window, shielded from parate execution, to rebuild cash flows. Senior Vice President Colvin Fernando described the initiative as an economic circuit-breaker rather than a bailout. “These are not failed enterprises,” Fernando said.

He added:”They are businesses hit by extraordinary external shocks. Unless we ring-fence these distressed loans, credit transmission will remain paralysed.”

The concept draws on international precedents where asset management companies were deployed after systemic crises. Yet such mechanisms succeed only when governed by strict asset valuation discipline, professional management and insulation from political interference. Without these safeguards, they risk becoming vehicles for concealed subsidies or fiscal leakage.

The most contentious element of the Chamber’s proposal lies in its funding model. It calls for a hybrid structure combining low-cost international financing, a levy on commercial bank profits and the utilisation of unutilised balances from the Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF).

Prof. De Silva argues that the banking sector, having restored profitability partly through elevated interest margins during the crisis years, has both the capacity and systemic responsibility to contribute. “The banking system has returned to strong profitability,” he said. “A structured contribution toward SME rehabilitation is not punitive—it is an investment in systemic stability.”

The suggested mobilisation of pension fund balances, however, is likely to provoke scrutiny over governance and fiduciary safeguards, while a levy on bank profits may raise investor sensitivity in a sector that has only recently regained confidence.

Fernando acknowledged the risks, emphasising that transparency and strict eligibility criteria would be essential. “This must be professionally managed, transparent and focused strictly on viable enterprises. Without discipline and accountability, the entire purpose would be defeated,” he cautioned.

Adding urgency to the debate is the Government’s decision to lower the VAT registration threshold to Rs. 36 million annually from April 1, 2026, drawing more small firms into the tax net. The Chamber warns that tightening tax compliance while credit remains restricted could create a double squeeze. “You cannot increase tax burdens and restrict financing simultaneously without economic consequences,” Prof. De Silva observed, describing the timing as highly sensitive.

Immediate Past President Mohideen Cader underscored the scale of the stakes. With SMEs contributing 52 percent to GDP and already under severe strain, he warned that inaction would result in irreversible economic scarring.

The macroeconomic logic is clear: without restoring SME balance sheets, private investment and employment growth are unlikely to regain momentum. Yet the countervailing risk is equally apparent. A poorly designed vehicle could create moral hazard, transfer private losses onto public shoulders and introduce new contingent liabilities into an economy still emerging from sovereign default.

Sri Lanka’s IMF-backed reform programme has so far focused on fiscal consolidation and debt sustainability. The SME “Bad Bank” proposal introduces a more complex phase in the recovery narrative—one that shifts attention from stabilisation to growth. The question confronting policymakers is whether the economy can sustain recovery without unclogging the credit arteries that feed its most labour-intensive sector.

The Rs. 300 billion proposal is, in essence, a calculated gamble that repairing SME balance sheets will unlock lending, revive investment and restore economic momentum. If executed with rigour, transparency and independence, it could serve as a bridge from crisis management to expansion. If mishandled, it risks deepening vulnerabilities in a system that has only recently regained its footing. For an economy seeking to move beyond stabilisation, the stakes could hardly be higher.

By Ifham Nizam

Business

The all-new Nissan Almera has arrived

Associated Motorways (Private) Limited (AMW), a stalwart of Sri Lanka’s automotive industry, officially unveiled the all-new Nissan Almera on February 7th, 2026. The launch, held at the Nissan Showroom in Union Place, signaled a bold step forward in providing ‘market-relevant mobility solutions’ to a dicerning local audience.

Addressing the gathering, Jawahar Ganesh, Group Managing Director of AMW, highlighted the strategic engineering behind the new model.

“The all-new Nissan Almera has been thoughtfully engineered to deliver what today’s Sri Lankan customer truly values: efficiency, safety, comfort, and intelligent design,” Ganesh stated.

He further emphasised that AMW’s leadership, backed by the global expertise of the Al-Futtaim Group, remains committed to bringing world-class standards to the local market.

Echoing this sentiment, Atul Aggarwal, Director Aftersales and South Asia Business Unit for Nissan Motor Corporation, noted that the Almera is designed to offer the ‘Nissan Peace of Mind.’ He expressed confidence that the sedan would replicate the massive market success recently seen by the Nissan Magnite.

The Almera is powered by the unique HRA0 1.0-litre Turbo engine, producing 100 hp and 152 Nm of torque. This ‘flat torque’ setup ensures responsive acceleration for city driving and confident overtaking on highways. To bolster fuel economy, it features an Idling Stop system.

Inside, the cabin prioritises the “human element” with:

Quole Modure Seats: Innovative materials that reflect heat, keeping the cabin cool in the tropical sun.

Zero Gravity Seats: Ergonomically designed to reduce fatigue during long commutes.

360-degree Safety Shield: A comprehensive suite including an Around View Monitor, Blind Spot Warning, and Lane Departure Warning.

With immediate stock availability and flexible financing via AMW Capital Leasing, the Almera is positioned as the premier choice for professionals and families seeking a smart, refined, and safe driving experience.

Although AMW did not announce pricing at the event, sources told The Island Financial Review that the new sedan will retail in the LKR 12.5–13 million range. Early birds are in for a win, too, with an encouraging discount reserved for the first 100 buyers.

Notably, the event was a departure from typically lengthy automotive launches, the Almera ceremony was a masterclass in simplicity. The entire event concluded in just twenty minutes – comprising a 15-minute preamble and speeches, followed by a five-minute ceremonial reveal as the Almera glided into the auditorium.

Participants described the event as ‘short and sweet,’ a sentiment that aligned perfectly with the ‘C-word’ emphasised by Jawahar Ganesh, Group Managing Director of AMW about the Nissan brand: Credibility.

By Sanath Nanayakkare

Business

Bourse trading transforms from apathy to energy as interest in some stocks soars

CSE trading started on a dull sentiment yesterday but later turned positive due to buying interest in certain stocks.

The All Share Price Index went up by 4.59 points, while the S and P SL20 rose by 4.46 points. Turnover stood at Rs 3.3 billion with 11 crossings.

Top seven crossings that mainly contributed to the turnover were: Samson International 350, 000 shares crossed to the tune of Rs 136.5 million; its shares traded at Rs 390,Melstacorp 245,000 shares crossed for Rs 44 million; its shares traded at Rs 180.50, Lanka Milk Food 500,000 shares crossed for Rs 36.25 million; its shares sold at Rs 72.50, Lanka IOC 250,000 shares crossed to the tune of Rs 35 million; its shares traded at Rs 141, Sunshine Holdings 1 million shares crossed to the tune of Rs 33.8 million; its shares traded at Rs 33.80, Distilleries 500,000 shares crossed to the tune of Rs 39.5 million; its shares sold at Rs 59 and Bahiraha Farm 315,763 shares crossed for Rs 25.6 million; its shares fetched Rs 81.

In the retail market top seven companies that mainly contributed to the turnover were; UB Finance Rs 172 million (53 million shares traded), Sierra Cables Rs 147 million (4.1 million shares traded), Lanka Credit and Business Finance Rs 119 million (13.1 million shares traded), LMF Rs 112 million (1.5 million shares traded), Colombo Dockyards Rs 111.7 million (758,000 shares traded), HNB Rs 105.4 million (245,000 shares traded) and ACL Cables Rs 96.9 million (975,000 shares traded). During the day 170.3 million share volumes changed hands in 23008 transactions.

It is said that manufacturing sector counters and financial counters performed well. Mixed interest was observed throughout the day.

Yesterday the rupee was quoted at Rs 309.35/38 to the US dollar in the spot market, from Rs 309.43/47 the previous day, dealers said, while bond yields were down significantly as the bullish sentiment continued amid elevated liquidity levels.

A bond maturing on 01.05.2027 was quoted at 8.35/45 percent.

A bond maturing on 15.02.2028 was quoted at 8.92/97 percent.

A bond maturing on 15.10.2028 was quoted at 9.00/05 percent.

A bond maturing on 15.12.2029 was quoted at 9.45/50 percent.

By Hiran H Senewiratne

-

Features4 days ago

Features4 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business5 days ago

Business5 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business4 days ago

Business4 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business4 days ago

Business4 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business4 days ago

Business4 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business1 day ago

Business1 day agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Business5 days ago

Business5 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Business5 days ago

Business5 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check