Business

Invest in a peaceful retirement with Life Insurance

Life is a beautiful journey – but often unpredictable, as events outside our control can derail the best-laid plans. While we may have no influence over many of these major life events, we can definitely protect our loved ones and ourselves by using insurance both as protection against emergencies and as an investment. With increased life expectancy, people are leading longer lives, but unfortunately after retirement there is no security of a monthly income. This is where insurance kicks in – as it ensures financial independence to enjoy your preferred lifestyle while protecting you against unforeseen circumstances such as medical emergencies which are usually unavoidable in old age.

Moreover, having Life Insurance can give peace of mind to your family members and help minimize the financial impact in case of serious illnesses or the policyholder’s untimely demise. In addition, insurance retirement plans offer income replacement, as in the event of the policyholder’s death, Life Insurance can provide financial benefits as lump-sum or regular instalments which will ensure your loved ones will get to enjoy the lifestyle you envisioned for their future without hassle.

Also the strong financial security provided by insurance ensures one can enjoy the same lifestyle even after retirement, and without compromising on life goals such as travel and lifestyle expenses. Therefore, the best time to decide on a long-term life insurance plan is when an individual is at the prime of life so that you are rest assured that you have provided wisely for your retirement. It is important to invest at a young age where the premium one has to pay is way less oppose to starting a retirement plan at an older age. Depending on the age and medical conditions the premiums will differ and in most cases it will be higher.

Sound retirement plans can help to plan out your post retirement life as it should be after years of working hard for your loved ones as they can provide policyholders with a monthly income to be financially independent alongside Health and other benefits. Customers have the option of adding covers such as critical illness coverage, extended permanent disability benefits due to accidents, family protection benefits, and many more to their retirement plans

There are numerous retirement plans in the market which are made available by the Life Insurance companies in Sri Lanka. Insurance Association of Sri Lanka (IASL) reiterates the importance of having a Life Insurance plan for every individual from all walks of life and therefore invites all citizens to study the available plans and select the most suitable plan which will provide benefits for a peaceful and enjoyable retirement.

Business

‘Notable drop in SL’s 2025 tourism sector earnings compared to those of 2018’

The revenue that was earned from the tourism sector in 2025 was US $ 3.2 billion, which is a significant drop compared to the 2018 figure , which is US$ 4.3 billion, a top tourism sector specialist said.

‘Comparatively there is a revenue deficit of US $ 1.2 billion, which we cannot be satisfied with at any cost, ‘Island Leisure Lanka’ founder chairman Chandana Amaradasa said.

Amaradasa made these observations at a Rotary Club joint meeting organised by Rotary Club Colombo South, featuring also the Rotary Clubs of Kolonnawa and Sri Jayawardenapura, at the Kingsbury Hotel on Tuesday.

Amaradasa added: ‘To develop the tourism sector the government has to do many things which previous governments comprehensively failed to take up.

‘The revenue that comes from the local tourism sector is four to five percent of the GDP, while in Dubai it is more than 45 percent of the GDP.

‘At present the country has 51000 rooms, out of which not more than 10000 rooms are at the four to five star level. Of that number 6000 rooms are located in Colombo, which is a major issue for tourism promotion in tourism potential areas.

‘Sri Lanka should focus on high quality standards in tourism and also develop the East Coast with the necessary infrastructure; especially having an international airport is absolutely necessary.

‘Colombo could be developed as a MICE tourism hub in the region. But not having an international level conference/convention hall is a another bottle neck in promoting that market as well.’

By Hiran H Senewiratne ✍️

Business

A Record Year for Marketing That Works: SLIM Effie Awards Sri Lanka 2025 crosses 300+ entries

The Sri Lanka Institute of Marketing (SLIM) announces a defining milestone for the country’s marketing, advertising, and creative sectors, as Effie Awards Sri Lanka 2025 records the highest number of entries in its history, crossing 300+ submissions. The unprecedented response reflects a stronger, more confident industry, one that is increasingly committed not only to bold creativity, but to creativity that can prove its value through measurable business and brand outcomes.

Now in its 17th year in Sri Lanka, the Effie Awards remain the most recognised benchmark for marketing effectiveness, honouring campaigns that bring together creative excellence, strategic discipline, and results. As the industry evolves, the Effies have become a space where the agency community, brand teams, media and creative partners are collectively challenged to raise the bar, moving beyond attention and awards, toward work that drives growth, shapes behaviour, and delivers real impact.

The record volume of entries this year also signals a healthy shift in the market: more brands and agencies are willing to be evaluated against rigorous effectiveness criteria, and to put forward work that demonstrates clear thinking, strong execution, and proof of performance. SLIM notes that this momentum highlights the expanding role of marketing and advertising in Sri Lanka, not simply as communication, but as a strategic driver of competitiveness and value creation.

SLIM confirms that the judging process will commence soon, guided by the established Effie evaluation framework that assesses entries on insight, strategy, execution, and measurable outcomes. The Grand Finale is scheduled for end-February 2026, where Sri Lanka’s most effective marketing work will be recognised on a national platform.

For inquiries, entries, and sponsorship opportunities, please contact the SLIM Events Division: +94 70 326 6988 | +94 70 192 2623.

Business

The Unit Trust industry closes 2025 with Rs. 587 Bn assets under management

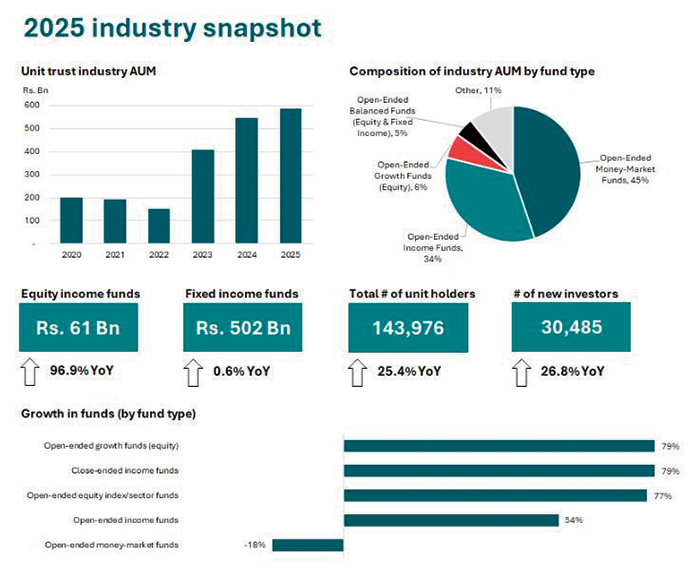

The Unit Trust industry of Sri Lanka reported a 7.8% year-over-year growth of its assets under management (AUM) to Rs. 587 Bn by the end of 2025. During the year, the AUM reached a high of Rs. 613 Bn, indicating continued interest in the asset category. These assets are currently managed across 86 funds by 16 management companies.

While fixed-income funds accounted for the largest share of AUM, equity-related funds saw strong inflows, increasing by Rs. 30 Bn in 2025 compared to just Rs. 2 Bn for fixed-income funds. This reflects improved investor sentiment, with a clear shift from a capital preservation mindset toward long-term capital growth.

The year also saw a move from ultra-safe short-term instruments to medium-term growth, with strong inflows into open-ended income funds, open-ended equity index/sector funds, and balanced funds, accompanied by a decline in inflows to money-market funds. Additionally, open-ended growth funds (equity) recorded a 79% year-over-year increase, signalling a rising risk appetite among investors.

Commenting on the full-year industry performance, Secretary of the Unit Trust Association of Sri Lanka (UTASL) and Director/CEO of Senfin Asset Management Jeevan Sukumaran noted: “Post-economic crisis, the unit trust industry has been on a strong upward trend with the AUM surpassing Rs. 600 Bn last year.

‘’The steady growth of the unit trust industry in 2025 is a strong indication of increasing investor confidence in professionally managed and well-regulated investment products. Beyond the growth in fund flows, we have also seen encouraging progress in expanding the investor base — not only in terms of unit holder numbers, but also in the broadening of investor demographics — reflecting a gradual shift towards long-term, market-linked investing.”

-

Editorial6 days ago

Editorial6 days agoIllusory rule of law

-

Features6 days ago

Features6 days agoDaydreams on a winter’s day

-

Features6 days ago

Features6 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features5 days ago

Features5 days agoExtended mind thesis:A Buddhist perspective

-

Features6 days ago

Features6 days agoThe Story of Furniture in Sri Lanka

-

Opinion4 days ago

Opinion4 days agoAmerican rulers’ hatred for Venezuela and its leaders

-

Features6 days ago

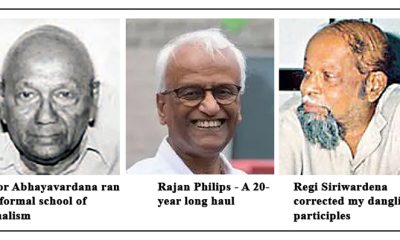

Features6 days agoWriting a Sunday Column for the Island in the Sun

-

Business2 days ago

Business2 days agoCORALL Conservation Trust Fund – a historic first for SL