News

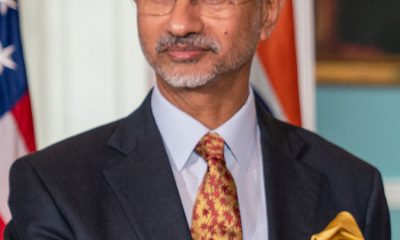

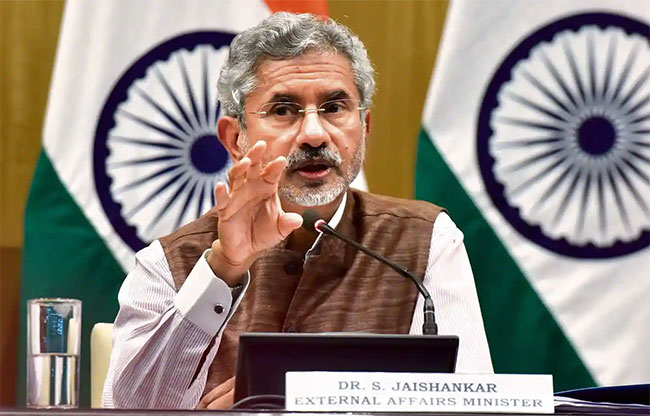

India expected to send ‘positive’ message on debt during Jaishankar’s visit to Lanka

Indian External Affairs Minister S. Jaishankar’s visit to Colombo on Thursday will focus on “supporting Sri Lanka” in its current economic crisis, government sources said, adding that talks are ongoing in the field of energy security, food security, currency swap arrangements as well as talks about restructuring Sri Lanka’s debt. The two-day visit is expected to see some announcements, said a report by The Hindu yesterday.

It said: “India is expected to give a positive response to Sri Lanka’s requirements, in keeping with India’s support last year as well,” said a source, citing India’s combined package of about $4 billion including loans, credit lines for the purchase of essentials and a loan deferment through the Asian Clearing Union.

In addition, talks are expected on two possible MoUs— on the Trincomalee development project and the long-pending plan for a cross-strait transmission line that would allow Sri Lanka access to India’s plans for an energy grid along with other countries like Nepal, Bhutan and Bangladesh.

The sources stressed that while assisting Sri Lanka with its current economic difficulties is a priority, Jaishankar’s visit, his first with the six-month-old government in Colombo, would see a comprehensive review of bilateral ties. </p><p>Meanwhile, diplomatic sources said that the support, in the form of “written financial assurances” from India would be critical for Sri Lanka as it works with its other creditors to resolve the economic crisis.

Announcing the visit by EAM Jaishankar, Lankan President Ranil Wickremesinghe said that he had discussed the need for the debt restructuring programme with all Sri Lanka’s creditors, including the 22-nation ‘Paris Club’ of 22 developed nations that hold much of the global debt and discuss solutions to debt crisis together.

“Japan and the Paris Club, two of our major creditors, have expressed their willingness to assist. We have already begun talks with India and China. According to the discussions with China Exim Bank recently, we’re currently debating on how to restructure our debt. The Chinese side has agreed to move quickly,” Wickremesinghe told a group of businessmen last week.

He said that Sri Lanka’s “only” option was to seek the support of the International Monetary Fund (IMF) for nearly three billion dollar bailout, and was also hopeful of a package from the Asian Development Bank (ADB).

“We discussed with China’s EXIM Bank this week and by now we have commenced exchanging views on it. India’s Foreign Minister is scheduled to visit Sri Lanka on the 19th to discuss the debt restructuring process. We are proceeding with these activities gradually,” the Sri Lankan President said to a separate group of trade union representatives, indicating the visit by Japanese State Minister of the Cabinet Office Satoshi Fujimaru and the ongoing visit of Chen Zhou, Vice Minister of the International Department, the Communist Party of China Central Committee.

After Chen’s meeting with President Wickremesinghe, the Chinese Embassy in Sri Lanka said the talks were “friendly and fruitful”, and quoted Wickremesinghe as saying that he “looked forward to China’s support in restructuring Sri Lanka’s debt at the moment and our economy in the near future”.

Sri Lanka had hoped to finalise its IMF bailout package, but missed a December deadline due to the delay in concluding debt restructure talks. It now hopes to complete the talks in the first quarter of 2023.

News

INS TARANGINI makes port call in Trincomalee

The Sail Training Ship of the Indian Navy, INS TARANGINI arrived at the Port of Trincomalee on a formal training visit on 27 Feb 26. The visiting ship was welcomed by the Sri Lanka Navy (SLN) in compliance with time-honoured naval traditions.

INS TARANGINI is a 54m long platform which is manned by a crew of 36 and is commanded by Commander Nitin Gajjar.

Meanwhile, Officer Under-trainees and Sea Cadets are expected to participate in sail training familiarization programmes aboard the ship and observe its operational functions during its stay in the island.

Furthermore, the ship’s crew is scheduled to take part in programmes organized by the Sri Lanka Navy to enhance camaraderie between the two navies, as well as visit several tourist attractions in the country.

News

Renewed Lanka’s Easter Bombing probe puts NTJ’s South India radicalisation network back under lens

New Delhi (IANS):The arrest of Sri Lanka’s former Intelligence chief, Retired Major-General Suresh Sallay is a turning point in the investigations into the 2019 Easter Sunday bombings that killed 279 people.

The move was a bold one taken by President Anura Kumara Dissanayake who won the presidency in 2024.

He had promised that all persons involved in the attack would be brought to justice.

Sallay was made State Intelligence Service (SIS) chief in 2019 after Gotabaya Rajapaksa became President.

The allegation against Sallay was that he had permitted the attack to take place with the intention of influencing that year’s presidential election, which was eventually won by Rajapaksa.

Sallay had become a prominent figure in Sri Lanka and was widely credited with dismantling the LTTE. His arrest has led to a political storm and many state that it could revive tensions relating to the LTTE.

Ali Sabry, former Sri Lankan Minister for Foreign Affairs said that the developments are deeply troubling.

An Indian official said that the developments in Sri Lanka are being monitored closely.

On the question whether the LTTE issue would come back into the picture following the arrest of Sallay, the officer said that attempts are being made, but it would be very tough.

There have been several cases that the National Investigation Agency (NIA) has been probing concerning the revival of the LTTE.

The ISI, too, has tried its hand in ensuring the revival of the LTTE, but has not been successful so far.

To prevent the revival of the LTTE, both India and Sri Lanka have been working very closely.

Another official explained that the current ties with Sri Lanka have gone from ideological to an investment-led partnership.

Prime Minister Narendra Modi and President Dissanayake share a pragmatic relationship and this has gone a long way in ensuring cooperation on all fields including security, the official explained.

While some in Sri Lanka do not subscribe to Dissanayake’s decision on Sallay, the fact is that the Easter Bombing case has to be probed from every possible angle.

An Intelligence Bureau official says that a major concern today are the activities of the National Thowheeth Jama’ath (NTJ) and Jamathei Millathu Ibrahim (JMI), the two outfits responsible for this attack.

The NTJ in particular has a vast presence in South India and has managed to radicalise a large number of youth in Tamil Nadu and Kerala.

The mastermind of the attack, Mohammad Zahran Hashim was a frequent visitor to Tamil Nadu. He was also responsible for the radicalisation of Jamesha Mubeen who carried out an unsuccessful attempt to bomb a temple in Coimbatore in 2022.

The Indian agencies have been actively pursuing the role played by Hashim. A probe by the NIA in the South India radicalisation case revealed that the entire plot was being run by Hashim from Sri Lanka.

At least 50 of the 100 radicalisation videos seized by the agency were discourses by Hashim, who had close links with the Islamic State.

Officials say that Sallay could provide details to investigators about the module that Hashim ran.

This would come in handy for the Indian agencies who are probing cases directly linked to the NTJ in South India.

Hashim, who was the ring leader for the suicide bombers during the Easter Bombing had spent a considerable amount of time in India.

The Indian agencies would want to learn if any of the locals that Hashim interacted with had any idea about the Easter Bombings.

While in India, Hashim had focussed his radicalisation programmes mainly at Mallapuram, Coimbatore, Nagapattinam, Kanyakumari, Ramnathpuram, Vellore, Trichy and Thirunelveli, the NIA probe found.

Pallay has for now denied any links to the Easter Bombings.

Indian officials say that they do not want to comment on Pallay and his alleged links.However, it is important that the bombings are probed thoroughly since the activities of the NTJ have a direct bearing on India, particularly the southern states, the official also added.

News

Sajith warns: Don’t let trade union action stall cyclone relief

Opposition and SJB Leader Sajith Premadasa on Friday stressed that relief efforts for communities affected by Cyclone Ditwah must not be derailed by internal disputes, as several trade unions announced plans to withdraw from disaster relief duties.

Taking to ‘X’, Premadasa called on the Government to prioritise coordination and ensure uninterrupted assistance to families still awaiting aid.

“The Government must work closely with officers on the ground to ensure coordination and uninterrupted support. When families are still waiting, how can we allow for this confusion?” he questioned, emphasising that relief measures should not be delayed under any circumstances.

His remarks follow the decision by several trade unions representing Government officers engaged in disaster relief operations to launch trade union action beginning from Friday (27 February).

The unions announced their withdrawal from relief-related duties, citing unresolved issues affecting officers involved in post-disaster operations.

According to the unions, more than 93 days have elapsed since the widespread destruction caused by Cyclone Ditwah. During this period, disaster relief officers and Grama Niladharis have worked continuously, day and night, acting as key coordinators between the Government and affected communities. However, they claim that authorities have failed to adequately address longstanding concerns relating to officers engaged in relief work.

Meanwhile, Secretary to the President Nandika Sanath Kumanayake yesterday underscored the need to expedite relief and recovery initiatives.

Chairing a progress review meeting of the National Council for Disaster Management, he called for strengthened coordination among State institutions responsible for disaster response, noting that effective inter-agency collaboration is critical to delivering timely assistance to affected communities.

Efforts to accelerate recovery and maintain continuity in relief operations are ongoing.

-

Features7 days ago

Features7 days agoLOVEABLE BUT LETHAL: When four-legged stars remind us of a silent killer

-

Business7 days ago

Business7 days agoBathiya & Santhush make a strategic bet on Colombo

-

Business7 days ago

Business7 days agoSeeing is believing – the silent scale behind SriLankan’s ground operation

-

Features7 days ago

Features7 days agoProtection of Occupants Bill: Good, Bad and Ugly

-

News6 days ago

News6 days agoPrime Minister Attends the 40th Anniversary of the Sri Lanka Nippon Educational and Cultural Centre

-

News7 days ago

News7 days agoCoal ash surge at N’cholai power plant raises fresh environmental concerns

-

Business7 days ago

Business7 days agoHuawei unveils Top 10 Smart PV & ESS Trends for 2026

-

Opinion3 days ago

Opinion3 days agoJamming and re-setting the world: What is the role of Donald Trump?