News

Imposing 30% tax on EPF/ETF makes workers paupers – Eran

SJB MP Eran Wickramaratne strongly criticized the Wickremesinghe-Rajapaksa decision to impose a 30% income tax on EPF/ETF, regardless of opposition from some political parties, trade unions and civil society. This tax will apply on all of EPF/ETF income, without any tax relief. Therefore, even an employee earning a monthly salary of Rs. 30,000 will be liable to bear the tax of 30% on their savings on EPF/ETF. “Is this justified at a time the vast majority of people were struggling to make ends meet”, Wickramaratne asked.

The government declared the economy bankrupt and entered into an agreement with the International Monetary Fund to obtain a loan of US $ 3 billion. Restructure of the country’s debt is a condition involved.

Foreigners invest in bonds of small countries looking for more income, absorbing the risk factor. Having already profited from the high interest/income, restructuring of said loans does not bear significant consequences to the investors. The government has already declared bankruptcy and have stopped repaying foreign debt, including bonds. Although it was initially announced that the foreign bond will be restructured, the government recently postponed the discussion with foreign investors for the second time. However, it is foreign debt that is best restructured.

Instead, the government has prioritised domestic debt restructuring. This is an injustice to the people of the country. The value of their investments has already taken a hit from inflation and devaluation of currency.

If the government does not act wisely, in relation to the restructuring of bonds, Wickramaratne, a former banker says that the government will not be able to successfully resolve the financial crisis.

All MPs of the present government supported this motion for domestic debt restructuring. But, the Opposition is vehemently opposed to local debt restructuring as it is not a good strategic move. The debt restructuring is not equitable in terms of local and foreign bond holders. It is also not equitable between EPF holders as opposed to private individuals, businesses, banks and primary dealer who have been unfairly favoured. It is to be noted that the EPF/ETF has been unfairly targeted in the process of domestic debt restructuring.

At the end of 25 – 30 years of employment, the EPF holder bears an accumulated reserve with low interest. It is estimated that the monthly return will cover between 20% – 35% of an individual’s cost of living in retirement. The proposed 30% tax on EPF will further reduce income.

Wickramaratne declared that the Rajapaksa–Ranil rule makes the poor, poorer and the rich, richer. On the other hand, cronies are given rebate, concessions and tax exemption. SJB disagrees with the proposed government policy of imposing 30% tax on EPF/ETF.

News

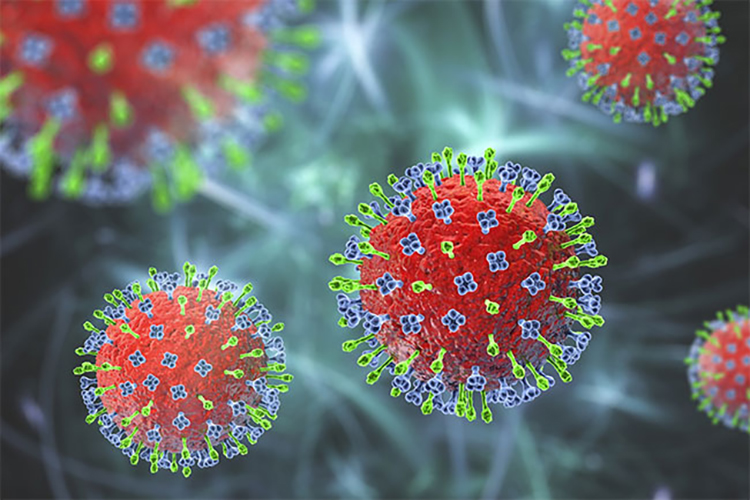

Health authorities on high alert over Nipah Virus threat

Sri Lanka has stepped up efforts to detect and respond to a potential outbreak of the deadly Nipah virus (NiV), with health authorities enhancing surveillance and laboratory readiness amid growing concerns in the region.

The Medical Research Institute (MRI), the country’s premier laboratory, has upgraded its testing capacity with the latest technology to identify the Nipah virus, enabling early detection of suspected cases, an MRI source said.

Nipah virus is a highly infectious zoonotic disease that can spread from animals

to humans and also through human-to-human contact. Fruit bats are the natural hosts of the virus.

First identified in Malaysia in 1988, the virus has since caused deadly outbreaks in countries including India and Bangladesh. Experts warn that Sri Lanka, with its close human-animal interactions and tropical climate, must remain vigilant against such emerging infectious diseases.

The case fatality rate of Nipah virus ranges from 40% to 75%, making it one of the most lethal viral infections affecting humans. There are currently no specific drugs or vaccines, with treatment relying mainly on intensive supportive care, health specialists say.

Symptoms of infection initially include fever, headaches, muscle pain, vomiting, and sore throat, followed by dizziness, drowsiness, altered consciousness, and neurological signs indicating acute encephalitis. Severe cases may progress to atypical pneumonia, acute respiratory distress, seizures, and coma within 24 to 48 hours.Authorities continue to urge heightened awareness and precautionary measures, emphasizing that early detection and rapid response are key to preventing outbreaks.

by Chaminda Silva ✍️

News

Free Media Movement demands govt. accountability on free speech issues

The Free Media Movement (FMM) has demanded government accountability on many freedom of expression issues referred to in a statement issued by the Human Rights Commission in a statement issued last week.

The statement under the hands of FMM Convener Lasantha De Silva and Secretary Dileesha Abeysundera says FMM has paid close attention to the statement issued by the Human Rights Commission (HRC) under reference number HRC/S/i/E/03/02/26. It has also informed that global stakeholders, including the International Federation of Journalists—of which it is a member—that are already closely monitoring this matter.

In its statement, HRC has elaborated at length on the issues that have arisen in Sri Lanka concerning freedom of expression and online safety. It specifically points out that the actions of the Sri Lanka Police have been a major contributing factor to these concerns. The Commission notes that recent conduct of the police has indirectly interfered even with the professional activities of journalists.

HRC has also drawn attention to the practice of summoning journalists and other activists before the police without providing clear reasons, in violation of circulars issued by the IGP. In certain instances, the police have stated that journalists were summoned due to alleged defamation arising from media activities.

However, freedom of expression guaranteed by the Constitution is restricted only within constitutionally prescribed limits. Accordingly, defamation that is no longer a criminal offence cannot be acted upon by the police. Such matters constitute civil offences that must be resolved before courts of law. The Commission further observes that attempts by politicians and others to lodge complaints with the Criminal Investigation Department regarding defamation are efforts to portray defamation as a criminal offence.

The HRC statement also addresses the Online Safety Act. While emphasizing the need to be mindful of online safety, the Commission points out that the current law does not address genuine needs. Therefore, as already demanded by many stakeholders, the government has the option to repeal this Act.

In addition, HRC has outlined a three-pronged approach that should be adopted to safeguard freedom of expression, as guaranteed by the Constitution and in line with Sri Lanka’s commitments under the Universal Declaration of Human Rights of the United Nations.

FMM said it is of the view that the Government of Sri Lanka must give serious consideration to this statement and to the recommendations emphasized therein. “This is a moment in which the accountability of the Sri Lankan government is being questioned. Accordingly, the Free Media Movement urges the government to take immediate steps to implement the recommendations set out in this statement,” it said.

News

Opposition alleges Govt deliberately delaying PC polls

ITAK Batticaloa District MP Shanakiyan Rasamanickam accused the government in Parliament on Friday of deliberately delaying Provincial Council elections, pointing to its failure to nominate members to a Parliamentary Select Committee.

The committee, tasked with considering matters related to Provincial Council polls, was announced on 6 January 2026. Opposition parties submitted their nominees promptly.

However, a month later, the government has yet to name its eight members, preventing the committee from being constituted and from commencing its work, Rasamanickam alleged.

Opposition representatives argue that this delay represents intentional inaction aimed at postponing elections. They urged the government to appoint its nominees without further delay to allow the committee to proceed.

-

Business1 day ago

Business1 day agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business5 days ago

Business5 days agoSLIM-Kantar People’s Awards 2026 to recognise Sri Lanka’s most trusted brands and personalities

-

Business6 days ago

Business6 days agoAll set for Global Synergy Awards 2026 at Waters Edge

-

Business1 day ago

Business1 day agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Business5 days ago

Business5 days agoAPI-first card issuing and processing platform for Pan Asia Bank

-

Editorial3 days ago

Editorial3 days agoAll’s not well that ends well?

-

Business1 day ago

Business1 day agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check

-

Features3 days ago

Features3 days agoPhew! The heat …