News

IMF to begin talks with Lanka

ECONOMYNEXT – The International Monetary Fund intends to begin discussions with Sri Lanka on a program to support the country, spokesman Gerry Rice said as the island is facing steep currency depreciation and inflation after an unusual bout of money printing to keep interest rates low.

President Gotabaya Rajapaksa said in a national address Wednesday said that he had given the go ahead for an IMF program after meeting senior staff of the lender in Colombo.

“The authorities have also indicated that they are actively considering an IMF-supported program,” IMF spokesman Gerry Rice said.

“We will discuss with the authorities how best we can assist Sri Lanka going forward, including during the Minister of Finance’s visit in Washington in April.”

The IMF has already called for tighter monetary policy to stop liquidity injections which create forex shortages.

The IMF has analyzed Sri Lanka’s economy in a staff report which has been submitted to the board, following annual Article IV consultations. The full report has not been made public, but key conclusions, including that the debt is unsustainable is now known.

The report also warned that the economy could implode unless actions was taken to halt monetary instability, though analysts say the IMF does not make a habit of modelling disaster scenarios.

Rice said the IMF had highlighted “the urgent need of implementing a credible and coherent strategy to restore macroeconomic stability and debt sustainability, while protecting vulnerable groups through strengthened, well-targeted social safety nets.”

With the debt deemed unsustainable, re-structuring or re-profling will also be required.

Sri Lanka for sometime has not had a working exchange rate regime, with a peg having lost credibility and parallel exchange rates emerging due to money printing.

In a program a float of the currency to end dual anchor conflicts (reserves sales for imports and money printing to maintain the policy rate) is a prior action. Though the exchange rate has been allowed to fall, a clean float has not yet been established.

Analysts have said the central bank should to remove a surrender requirement that effectively imposes a strong side convertibility undertaking in the style of a peg and further weakens the rupee.

Further policy rate hikes are also needed to make the float work.

If a float is not established, economic problems that took place at 200 to the US dollar, will continue to take place at a weaker level. The currency can be appreciated if required after domestic credit slows (consumption and investments slows) and sterilizing inflows.

An IMF program typically involves a tight reserve money program to stop inflation and block the validation of domestic prices as the currency weakens.

Tax hikes and spending cuts will reduce the budget deficit and domestic credit, keeping down the corrective interest rate. Sri Lanka’s private citizens are net savers and are incapable of triggering currency pressure.

A foreign reserve target is also given and reserves for imports are generally discouraged (sometimes a so-called disorderly market conditions intervention is allowed which however can undermine the currency unless they are unsterilized).

Debt re-structuring will also reduce the corrective interest rate and the need to immediately deploy more savings for debt repayment and leave space for reasonable growth path.

India is giving a 500 million US dollar credit and a billion dollar credit for food and medicines which can be used to finance the deficit if they are not used for subsidies.

Medicine credits can be used for the health budget directly or cash collected from private sector importers can be used to finance other expenses such as the salary bill, analysts say.

Unemployed graduates had progressively bloated the public sector and have become a key consumer of the productive efforts of society.

Classical economists and analysts have called for reforms to the central bank to outlaw intermediate monetary regimes (flexible exchange rates/soft-pegs) and go for a single anchor regime made up of a fully reserve-backed hard peg or a clean floating regime with a low inflation-driven monetary base and no foreign reserves.

Such a regime will eliminate the need for IMF programs in the future. A hard peg with a low inflating reserve currency in particular will also serve as a hard budget constraint and help social unrest.

Latest News

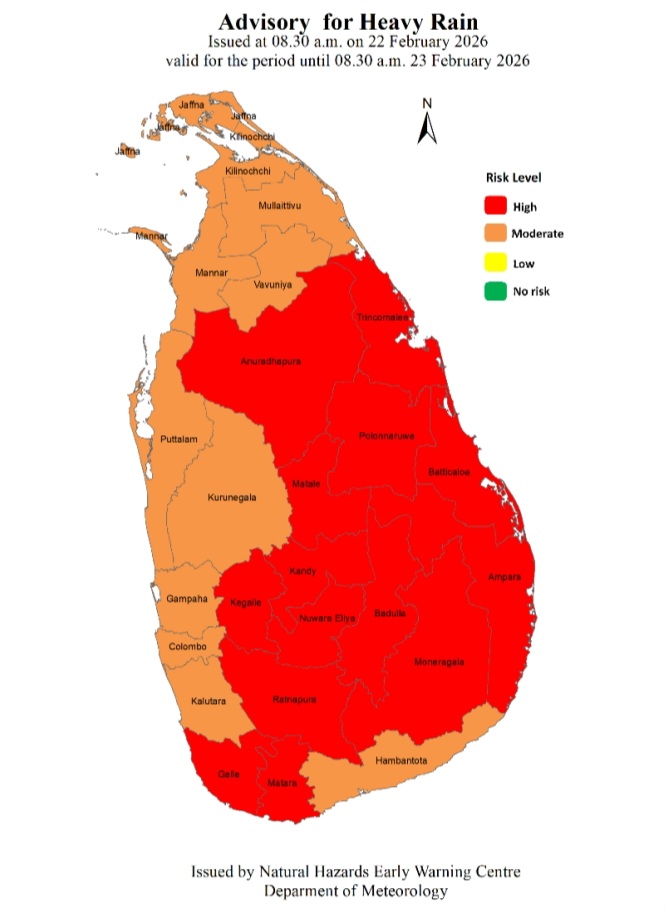

Advisory for Heavy Rain issued for the Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts

Advisory for Heavy Rain Issued by the Natural Hazards Early Warning Centre at 08.30 a.m. on 22 February 2026 valid for the period until 08.30 a.m. 23 February 2026

Due to the influence of the low level atmospheric disturbance in the vicinity of Sri Lanka, Heavy showers above 100 mm are likely at some places in Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts.

Therefore, general public is advised to take adequate precautions to minimize damages caused by heavy rain, strong winds and lightning during thundershowers

News

Matara Festival for the Arts’ inaugurated by the Prime Minister

The inaugural ceremony of the Matara Festival for the Arts, featuring a wide range of creations by local and international artists, was held on February 19 at the Old High Court premises of the Matara Fort, under the patronage of Prime Minister Dr. Harini Amarasuriya.

The festival, centred around the Old High Court premises in Matara and the auditorium of the Matara District Secretariat, will be open to the public from 20 to 23 of February. The festival will be featured by visual art exhibitions, short film screenings, Kala Pola, and a series of workshops conducted by experts.

The inaugural event was attended by the Minister of Women and Child Affairs, Ms. Saroja Paulraj, along with artists, guests, and a large number of schoolchildren.

(Prime Minister’s Media Division)

News

Only single MP refuses salary as Parliament details pays and allowances

Only one Member of Parliament has chosen not to receive the salaries and allowances entitled to MPs, Prime Minister Dr. Harini Amarasuriya revealed in Parliament last Thursday, shedding light on the financial perks enjoyed by members of the Tenth Parliament.

Speaking on Thursday (Feb. 19) in response to a question from SJB Badulla District MP Chaminda Wijesiri, the Prime Minister outlined the full range of pay and allowances provided to parliamentarians.

According to Dr. Amarasuriya, MPs receive a monthly allowance of Rs. 54,285, an entertainment allowance of Rs. 1,000, and a driver’s allowance of Rs. 3,500—though MPs provided with a driver through the Ministry of Public Security and Parliamentary Affairs are not eligible for the driver’s allowance.

Additional benefits include a telephone allowance of Rs. 50,000, a transport allowance of Rs. 15,000, and an office allowance of Rs. 100,000. MPs are also paid a daily sitting allowance of Rs. 2,500 for attending parliamentary sessions, with an additional Rs. 2,500 per day for participation in parliamentary sittings and Rs. 2,500 per day as a committee allowance.

Committee meetings held on non-parliament sitting days also attract Rs. 2,500 per day.

Fuel allowances are provided based on the distance between an MP’s electoral district and Parliament. National List MPs are entitled to a monthly allocation equivalent to 419.76 litres of diesel at the market price on the first day of each month.

Despite the comprehensive benefits, only SJB Badulla District MP Nayana Wasalathilaka has opted not to draw a salary or allowances. Dr. Amarasuriya said that in accordance with a written notification submitted by MP Wasalathilaka on August 20, 2025, payments have been suspended since that date.

The Prime Minister also confirmed that she, along with the Speaker, Deputy Speaker, committee chairs, ministers, deputy ministers, the Opposition Leader, and senior opposition whips, have all informed the Secretary-General of Parliament in writing that they will not claim the fuel allowance.

Challenging the ruling party’s voluntary pledge to forgo salaries, MP Wijesiri pointed out that all MPs except Wasalathilaka continue to receive their salaries and allowances. “On one hand you speak about the people’s mandate, which is good. But the mandate also included people who said they would voluntarily serve in this Parliament without salaries. Today we have been able to prove, Hon. Speaker, that except for one SJB MP, the other 224 Members are drawing parliamentary salaries,” he said.

The Prime Minister responded by defending the political culture and practice of allocating portions of MPs’ salaries to party funds. Referring to previous practices by the JVP and NPP, she said: “It is no secret to the country that the JVP has for a long time not personally taken MPs’ salaries or any allowances. I think the entire country knows that these go to a party fund. That is not new, nor is it something special to mention. The NPP operates in the same way. That too is not new; it is the culture of our political movement.”

When MP Wijesiri posed a supplementary question asking whether diverting salaries to party funds was an indirect method of taking care of MPs, Dr. Amarasuriya said: “There is no issue there. No question was raised; the Member made a statement. What we have seen throughout this week is an inability to understand our political culture and practice, and a clash with decisions taken by political movements that misused public funds. What is coming out is a certain mindset. That is why there is such an effort to find fault with the 159. None of these facts are new to people. He did not ask a question, so I have nothing to answer.”

The disclosures come days after the Government moved to abolish the parliamentary pension, a measure that has sparked renewed debate over MP compensation and the transparency of funds allocation.

-

Features23 hours ago

Features23 hours agoWhy does the state threaten Its people with yet another anti-terror law?

-

Business7 days ago

Business7 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features23 hours ago

Features23 hours agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features23 hours ago

Features23 hours agoReconciliation, Mood of the Nation and the NPP Government

-

Latest News2 days ago

Latest News2 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Features23 hours ago

Features23 hours agoVictor, the Friend of the Foreign Press

-

Latest News2 days ago

Latest News2 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News2 days ago

Latest News2 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction