Opinion

IMF Help for Sri Lanka and accountability

This has reference to Mr Jayanta Kurukulasuriya’s (JK) letter in The Island of 4 February.

He says the name “International Monetary Fund” “misleads” as it is “anything but international.”

He goes on: “Historically, the IMF’s managing director has always been a European citizen and the president of the World Bank is always an American citizen. So much so that in 2011, the world’s largest developing countries (the BRICS states) issued a statement declaring that the tradition of appointing a European as managing director undermined the legitimacy of the IMF.”

Please note: This statement of BRICS states does not say that the BRICS countries also, are now qualified to hold these positions and not only Europeans or Americans. They do not claim a stake for appointment. Instead they appear to open the door wide and are speaking for ALL the countries of the world, well managed, mismanaged, democratic, despotic, corrupt or not.

Brazil is one of the BRICS states. Its former president Lula da Silva (2003 to 2010) was jailed for corruption. However, after serving 580 days jail time he was released; and after a ding-dong legal battle, all charges against him were annulled in 2021.

What is significant for Sri Lanka about his trial is, the Brazilian judiciary enjoys some degree of independence from political interference. Some degree only. No judge’s house was stoned; no judge was impeached; and no judge was shot.

So, what does JK want? Internationalise these appointments? And open the door to thoroughly mismanaged and corruption riddled countries also to stake a claim for appointment as president and managing director of these institutions?

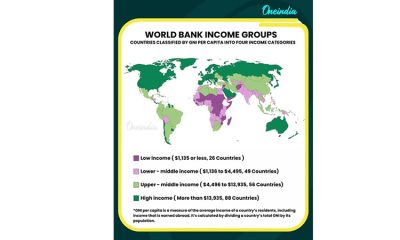

What are those thoroughly mismanaged countries? To name a few, they are Myanmar, Ethiopia, Sudan, Lebanon, Somalia, Zimbabwe; the list is not complete. But why go so far? Look at our own country.

What will happen to the funds in these two institutions then, if these countries also appoint? Have a look at our Treasury, to get an idea. Empty. Even the bottom has vanished.

It is the political masters of these corrupt countries who will nominate them. I leave it to my dear readers to imagine who they will be – if not regarding other countries, at least our own.

JK, Please watch CNN. This channel announces regularly the number of jobs the American economy creates – by hundreds of thousands. Pandemic notwithstanding. Just today 4 February, 2022, The New York Times announced US employers added 467,000 jobs in January, 2022, and “hiring showed the economy’s resilience in the face of record virus cases topping eight hundred thousand (800,000) a day and millions of workers being kept at home.

The reason our leaders give for their inability to create jobs is the pandemic. (They are silent on why they failed before that!) The best that our leaders can do is to plead with South Korea to give more jobs to our youth. In other words, they can only plead with other countries to create jobs for our citizens also in those countries. Simply pathetic, isn’t it? Surely, we can do better than this? We have people who can. It’s just that our electoral system is malfunctioning and is eluding the sovereign people from electing them.

Crafty politicians manipulated the electoral system through the years to exclude them.

Constitutional reformers – please note when drafting the new constitution.

Seventy-four years ago, today, the Britishers handed over to our own rulers for self-rule, a country whose economy they had developed to be among the foremost in the region. To illustrate: The Gal-Oya reservoir was built with the money they left behind when settling accounts at handing over. No money was borrowed. We bought the Trincomalee Tank farm from Britain. We did not borrow for the purchase. These show what a strong debt free economy the Britishers handed over to us, or rather our rulers.

Despite such unimpeachable evidence, some want us to believe British rule was bad.

By contrast, there was starvation and famine in India. Indians were entering Sri Lanka illegally through the Mannar coast just for a plate of rice. My platoon and I apprehended over 700 of them all along the Mannar beach. The wheel of fortune has turned. Today our government is borrowing money from India to buy food.

In 1948, there was no country called Bangladesh. This country was born only in 1971 – 23 years after we received the freedom to rule ourselves. Today we are borrowing money from Bangladesh, a country just 51 years old only. How shameful. By the way what happened to that claim we used to hear when clamouring for freedom, that our civilisation is over 2000 years old and we are quite capable of ruling ourselves?

The economy of Zimbabwe collapsed not because of IMF; but because of Robert Mugabe. Zimbabwe was known as the “bread basket of Africa” when Mugabe took over Rhodesia as it was known previously. He changed the country’s name to Zimbabwe. He plundered the country’s wealth and built palaces for himself and left the country impoverished. Another dubious leader of this kind was Mobutu of Zaire, now Congo. By the time he died, he was among the world’s wealthiest in the world. But in his country even his soldiers were starving.

The big mistake IMF made in Brazil, Argentina, Chile, Greece and so on was to hand over aid to the very rulers who are accountable for their economic failure. They failed to impose or impose effectively the principal of accountability in governance.

If the IMF and the World Bank are treading cautiously on the demand to “legitimize” the two institutions the way BRICS or JK wants, I can well understand why: Very soon they will have no money to help anyone. Appointees nominated by corrupt rulers of populist governments, playing to the gallery, will pocket them all to be shared among themselves. The whole world won’t be a better place then. I see the flip side of populism.

The IMF or the World Bank will not come to Sri Lanka unless asked by Sri Lanka. If invited and they do come, they should insist on one condition: All the rulers who are politically accountable to the sovereign people of Sri Lanka for the massive mismanagement through the years, should be retired; they cannot have any say in handling their assistance and the country’s economy. This condition should be made non-negotiable.

This condition is feasible and reasonable.

Brigadier (Rtd) Ranjan de Silva

Email : rpcdesilva@gmail.com

Opinion

Conference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

January 21 | Olympus Auditorium, Bandaranaike Centre for International Studies (BCIS)

The National Collective of Community Savings and Credit Services Providers organised the conference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There” on January 21 at the Olympus Auditorium, Bandaranaike Centre for International Studies (BCIS), BMICH, to foreground the community savings and credit services as an alternative credit practice to moneylending and microfinance. While underscoring the uniqueness of community credit practices, grounded in collective rights, solidarity, mutual aid, the non-hierarchical nature of organising and long years of practice, community credit providers opposed the Asian Development Bank (ADB)-Treasury-CBSL attempt to subsume the community credit model under moneylending and microfinance in the proposed Microfinance and Credit Regulatory Authority Bill. Over 200 community credit practitioners from more than 50 community organisations from Mannar, Kilinochchi, Jaffna, Mullaitivu, Batticaloa, Anuradhapura, Polonnaruwa, Badulla, Rathnapura, and Hambanthota had gathered at the conference.

M. K. Jayathissa, a farmer leader from Hingurakgoda, Polonnaruwa, explained the microfinance crisis as resulting from the microfinancialisation of rural credit and the targeting of low-income women. He recalled his role in the farmers’ struggle against debt during the 1990s. Jayathissa linked the microfinance crisis among women and the farmers’ debt crisis to a wider crisis in food production.

Renuka Bhadrakanthi, chairperson of the Ekabaddha Praja Sanwardhana Kantha Maha Sangamaya, Weligepola, shared her three decades of experience as a community practitioner. She showed how the community credit framework helped women build assets and wealth through small savings. Unlike market-based initiatives such as microfinance and moneylending, community-controlled credit systems empowered women both with agency and material capabilities. Renuka also noted the regional diversity in organisational frameworks and credit purposes. She stressed the need for vigilance and action now, as globalisation and neoliberalism drive economic reforms aimed at capturing community wealth and making people dependent on the market.

Rajeswary Sritharan from Yuhashakthi, Mullaitivu, brought in experiences from war-torn societies. Yuhashakthi and Mahashakthi networks, operating in the Northern and Eastern provinces and comprising more than 10,000 women members, were created during the civil war to support women’s ability to control the household economy. These two networks have proven resilience against war-related dispossession and loss while also strengthening women. Rajeswary contended that self-help community credit groups are informal and unregulated, revealing that societies are governed by a collective ethos, community audits, and democratic decision-making, ensuring transparency and accountability. She pointed out that community groups do not have a history of bringing their members before the police or courts when they fail to service their debts, unlike microfinance companies. She also raised the significance of community groups such as Yuhashakthi and Mahashakthi as first responders in times of crisis, even as recently as with Ditwah, intervening and assisting affected communities much before the government could.

- Suneth Aruna Kumara

- Pubudu Manohara

- M K Jayathissa

Suneth Aruna Kumara, representing Vimukthi Gami Gowi Kantha Samithiya, Hingurakgoda, Polonnaruwa and also speaking on behalf of the microfinance-affected women, highlighted the creative space that collective forms of association have opened up for microfinance victims. “People who were hiding, afraid of debt collectors, are trying to rebuild their lives autonomously,” he said. In this journey, women are rethinking the meaning of credit, whether it is possible to create credit mechanisms that do not rely on interest income, and imaginative ways of decommodifying community relations. Suneth emphasised that women’s initiatives are emerging from their lived experiences as debtors, exploited by predatory interest rates and violent recovery practices. As a victim himself, Suneth criticised the proposed regulatory Bill for failing to adequately safeguard microfinance and credit consumers by providing legally binding safeguards. According to Suneth, the proposed Bill does not guarantee that the microfinance crisis will not recur.

Another highlight of the conference was the sharing of experiences by Malaihaya women, presented by Letchumanan Kamaleswary from the Centre for Equality and Justice. Kamaleswary described debt as ever-present in the Malaiyaha community. It forced migration from South India and kept people captive as plantation labour for over 200 years. Although the plantation management restricts all community associations within the plantations, microfinance companies can enter and operate freely. Debt is so severe that most Malaiyaha women work past their retirement age.

- Renuka Bhadrakanthi

- Rajeswary Sritharan

Pubudu Manohara, from the Rural Development Foundation in Hambanthota, traced the history of community credit projects to various state poverty alleviation programmes since 1977. These projects, affiliated with governments and supported by international groups such as the World Bank and UNDP, have survived many national and local crises. Over time, however, both the government and international organisations like the ADB have become wary of people’s ability to save. “They are afraid of our ability to create community funds,” he said.

The discussion emphasised that mobilising community groups and local political leaders is essential to oppose the Bill in its current form. Concerns arose about the negative impact of heavy regulations on community organisations and women’s resilience. “Domestic violence is rooted in economic violence. The destruction of community organisations will have a direct effect on local development and local economic activities. That will also burden the government,” said a Yuhashakthi representative from Mullathivu.

Community organisers urged the government to consult directly with them when developing regulations, emphasising that new rules should protect and strengthen community-based initiatives rather than respond to external pressures. They argued that the ADB, having promoted commercialisation of microfinance and contributed to the resulting crisis, lacks the legal and ethical standing to advocate for regulatory frameworks. Instead of receiving directives from the International Financial Institutions (IFIs), the government should converse with the grassroots communities, devising homegrown developmental solutions to regenerate local economies, empower the most vulnerable and build community wealth, the community organisers stressed.

Opinion

A puppet show?

After jog for the camera, wearing shorts in Jaffna, thanks to the freedom gained by the country being liberated from the clutches of the Tigers by the valiant efforts led by Mahinda Rajapaksa, President Anura Kumara Dissanayaka, said: “Some come past Sri Maha Bodhi and other Buddhist temples all the way to Jaffna to observe Sil, not to spread compassion but hatred.” When the need of the hour is reconciliation what an outrageous statement that was, to be made by the head of state! Will he say that the people of the North and the East bypass many Kovils straddling the area and come to Kataragama to spread hate? Probably not! His claim has become a hot topic of conversation.

Having lost a majority of the votes garnered from the North at the presidential and parliamentary elections, to the Tamil nationalist parties at the local government elections, President Dissanayake’s claim may well have been a pitiful attempt to recover lost ground in the North. But at what cost?

It all started with AKD’s refusal to refer to those brave service personnel who saved the unity and the integrity of the country as Rana Viruwo. Interestingly, the most devastating rebuke for this came from a Tamil MP, who is an avowed admirer of Prabhakaran, stating in Parliament that a Sinhala Rana Viruwa saved his life when he was about to be washed off in the flood waters resulting from Cyclone Ditwah. He teased the government by asking in ‘raw’ Sinhala Ei umbalata lejjada unta Rana Viruwo kiyanna? (Are you shy to call them war heroes?)

In addition to slinging mud at MR and harassing service personnel, there is no doubt whatsoever that AKD’s government is trying to harass any Tamil politicians who helped eradicate the Tigers. This fact is borne out by the treatment meted out to Douglas Devananda. Shamindra Ferdinando has explained this in his article, “EPDP’s Devananda and missing weapons supplied by Army” (The Island, 7 January).

NPP ministers publicly insult Buddhist monks, but whenever they are in trouble, they rush to Kandy to meet the Maha Nayakas, the latest being Harini’s visit. Instead of admitting the mistake and trying to make amends, the government went on, until it realised the futility in trying to justify the ‘Buddy’ episode. Excuses given by Harini to the Maha Nayakas, to say the least, were laughable. She had the audacity to say that though the questionable web link was printed in the textbook there were no instructions to click on it! She may continue as Prime Minister but can anyone who does not know what to do with a link or who is trying to encourage ten-year-olds to have e-buddies when the rest of the world is heading towards banning 16-year-olds from social media, continue to be the Minister of Education?

Number of MOUs/pacts signed with India, including defence, have not yet been disclosed even to Parliament. The Cabinet Spokesman once stated that the contents of those MOUs/pacts could not be divulged without the consent of India. Interestingly, we have had very frequent visits from VVIP politicians and top government officials from India, some at very short notice. One of them referred to these as ‘usual’ ones! However, what is unusual is that a party that shed a lot of blood of Sri Lankans for even selling ‘Bombay’ onions, is now in government and seems under Indian command. Perhaps, its transformation occurred when India sponsored a visit by AKD in early 2024, which helped him secure the presidency. Among the NPP’s election pledges, the most touted one was to reveal the mastermind behind the Easter Sunday attacks. It has been alleged in some quarters that India was behind the attacks. The NPP government’s silence about this speaks volumes!

It has transpired recently that it was Indian High Commissioner Gopal Baglay who pressured Speaker Mahinda Yapa Abeywardena in July 2022 to take over the presidency after the elected President was toppled by protesters, but many believe that it was a joint effort by the Indian HC and the ‘Viceroy’ who just left, after an overstay! It is an illegal act as pointed out in the editorial “Conspiracy to subvert constitutional order” (The Island, 22 January) and may be investigated by a future government, if elections are not postponed forever!

We seem to be watching a puppet show where many puppeteers outside are pulling the strings! Are we paying the price for electing a bunch of inexperienced politicians?

By Dr Upul Wijayawardhana ✍️

Opinion

Remembering Cedric, who helped neutralise LTTE terrorism

Salute to a brave father-son

Cedric Martenstyn was a very affluent man. He owned a house in Colombo 7, valuable properties throughout the country, vehicles / speed boats and ran the lucrative business of importing Johnson and Evinrude Outboard Motors (OBM) and sold them to local fishermen and businessmen.

Cedric was the local agent for the OBMs, which were known for reliability and after-sales service, and among his customers were humble fishermen. He was fondly known as Sudu Mahattaya “(white Gentleman) by humble fishermen and he would often travel in his double cab across the country to meet his customers and solve their problems.

He had a loving wife and children. He was an excellent scuba diver, member of Sri Lanka Navy Practical Pistol Firing team and his knowledge of wildlife and reptiles was amazing.

A member of the Dutch Burgher community of Sri Lanka, he was a true patriot, who volunteered to protect country and people from terrorists. An old boy of S. Thomas’ College, Mount Lavinia, he was an excellent sportsman.

The founding father of Sri Lanka Army Commando Unit, Colonel Sunil Peris, was his classmate at S.Thomas’.

I first met Cedric when I was a very junior officer at Pistol Firing Range at Naval Base, Welisara. I helped him catch a poisonous snake in the Range. I think he carried that snake home in a bottle! That was the type of person Cedric was!

We became very close friends as we both loved “guns and fishing rods”. His experience and tactics in angling helped me catch much bigger Paraw (Trevallies) in the Elephant Rock area at the Trincomalee harbour. He was a dangerous man to live with at Trincomalee Naval Base wardroom (officers’ mess), because he had various live snakes kept in bottles and fed them with little frogs!

Even though he was a keen angler, he was keen to conserve endangered species both on land and in water. He spent days in Horton Plains and the Knuckles Mountain Range streams to identify freshwater species in Sri Lanka. Did you know there is an endangered freshwater fish species he found in Horton Plains and Knuckles Mountain Range has been named after him?

Feeding of snakes was an amusement to all our stewards at the wardroom at that time! They all gathered and watched carefully what Cedric was doing, keeping a safe distance to run away if the snake escaped. Our Navy stewards dare to enter Cedric’s cabin (room) at Trincomalee wardroom (officers’ mess), even keeping his tea on a stool outside his cabin door. One day pandemonium broke in the officers’ mess when Cedric announced that one snake escaped! We never found that snake, and that was the end of his hobby as the Commander Eastern Naval Area, at that time, ordered him to ” get rid of all snakes! Sadly, Cedric released all snakes to Sober Island that afternoon.

Cedric was a volunteer Navy officer, but still joined me (he was 47 years old then) to help SBS trainees (first and second batch) on boat handling and OBM maintenance in 1993, when I raised SBS. It was exactly 31 years ago!

The Arrow Boat

Being an excellent speed boat race driver and boat designer, he prepared the blueprint of the first “18-foot Arrow Boat” and supervised building it at a private Boat Yard in 1993. This 18- foot Arrow Boat was especially designed to be used in the shallow waters of the Jaffna lagoon, fitted 115 HP OBMs, and with two weapons he recommended; 40mm Automatic Grenade Launcher (AGL) and 7.62×51 mm General Purpose Machine Guns (GPMGs). In no time, we had highly trained and highly motivated four SBS men on board each Arrow Boat at Jaffna lagoon, and they were very effective.

Same hull (deep V hull) developed during the tenure of Admiral of the Fleet Wasantha Karannagoda, as Commander of the Navy, by Naval architects, with knowledge-gained through captured LTTE Sea Tiger boats, designed 23- foot Arrow Boats and implemented the “Lanchester Theory” (theory of battle of attrition at sea in littoral sea battles) to completely nullify LTTE’s superiority which it had gained with small craft and deadly suicide boats.

Thank you, the Admiral of the Fleet for understanding the importance of Arrow Boat design and mass production at our own boatyard at Welisara. Karannagoda, under whom I was fortunate to serve as Director Naval Operations, Director Maritime Surveillance and Director Naval Special Forces during the last stages (2006/7) of the Humanitarian Operations, always used to tell us “You cannot buy a Navy- you have to build one”! Thank you, Sir!

Cedric craft display at Naval Museum, Trincomalee

The Hero he was

When I was selected for my Naval War Course (Staff Course) conducted by the Pakistan Navy Staff College at Karachi, Pakistan, (now known as Pakistan Navy War College relocated at Lahore), Cedric took over the command (even though he was a VNF officer) as Commanding Officer of SBS.

Being one of the co-founders of this elite unit, he was the most suitable person to take over as CO SBS. He was loved by SBS officers and sailors. They were extremely happy to see him at Kilali or Elephant Pass, where SBS was deployed during a very difficult time of our recent history – fighting against terrorists during the 1996-97 period.

Motivated by father’s patriotism, his younger son, Jayson, who was a pilot working in the UK at that time, came back to Sri Lanka and joined the SLAF as an volunteer pilot to fly transport aircraft to keep an uninterrupted air link between Palaly (Jaffna) and Ratmalana (Colombo). Sometimes Jayson flew his beloved father on board from Palaly to Ratmalana. Cedric was extremely happy and proud of his son.

Tragically, young Jayson was killed in action in a suspected LTTE Surface-to-Air missile attack on his aircraft. Cedric was sad, but more determined to continue the fight against LTTE terrorists. He would also lead the rescue and salvage operation to identify the aircraft wreckage his son flew in. The then Navy Commander advised him to demobilise from VNF and look after his grieving family or join Naval Operations Directorate and work from Colombo which he vehemently refused. When I called him from Pakistan to convey my deepest condolences, he said, he would look after the “SBS boys”, he had no intention of leaving them alone at that difficult hour of our nation. That was Cedric. He was such a hero—a hero very few knew about!

The young officers, and sailors in SBS were of his sons’ age, and Cedric would not leave them even when he was facing a personal tragedy. He was a dedicated and courageous person.

Scientific name: Systomus Martenstyni

English name : Martenstyn’s Barb

Local name: Dumbara Pethiya

Sadly, like many who served our nation and stood against terrorists, Cedric would go on to be considered Missing In Action (MIA) following a helicopter crash off the seas of Vettalikani with Lt. Palihena (another brave SBS officer- KDU intake). He was returning to Point Pedro after visiting the SBS boys at Elephant Pass, Jaffna.

Cedric and his son, Jayson, will go down in history as a brave father-son duo who paid the supreme sacrifice for the motherland. MAY THEY REST IN PEACE ! Salute!

Commander Martenstyn was considered missing in action (MIA) on 22 January 1996 in the sea off Vettalaikerni, while returning to Palaly Air Force Base in an SLAF helicopter when it was lost to enemy fire. He was returning from visiting an SBS detachment in Elephant Pass near the Jaffna Lagoon. Considering his contribution to the war effort, his gallentry and valour in fighting the enemy, and his steadfast service to the Sri Lanka Navy in manufacturing Arrow Boats, and training the SBS, all SLN Arrow Boats were renamed ‘Cedric’ on his 70th Birthday.

(The writer is former Chief of Defence Staff and Commander of The Navy, and former Chairman of the Trincomalee Petroleum Terminals Ltd.)

By Admiral Ravindra

C Wijegunaratne

(Retired from Sri Lanka Navy)

Former Chief of Defence Staff and Commander of the Sri Lanka Navy,

Former Sri Lanka High Commissioner to Pakistan

-

Features6 days ago

Features6 days agoExtended mind thesis:A Buddhist perspective

-

Opinion5 days ago

Opinion5 days agoAmerican rulers’ hatred for Venezuela and its leaders

-

Business3 days ago

Business3 days agoCORALL Conservation Trust Fund – a historic first for SL

-

Opinion3 days ago

Opinion3 days agoRemembering Cedric, who helped neutralise LTTE terrorism

-

Opinion2 days ago

Opinion2 days agoA puppet show?

-

Opinion5 days ago

Opinion5 days agoHistory of St. Sebastian’s National Shrine Kandana

-

Business11 hours ago

Business11 hours agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Features4 days ago

Features4 days agoThe middle-class money trap: Why looking rich keeps Sri Lankans poor