Opinion

IMF folly – Imputed Rental Income Tax

By Dr Sirimewan Dharmaratne,

Former Senior Analyst, HM Revenue

and Customs, UK.

While one can only imagine the atmosphere at the discussions with the IMF, what transpires from these meetings, one can presume that there was no resistance or contention to whatever the IMF proposes. The IMF appears to be pretty much dictating the fiscal policies for Sri Lanka to follow. The proposed Imputed Rental Income Tax (IRIT) is a good example how helpless or defenceless Sri Lanka has become to get a bit of money that some oligarchs spend on their yachts. The gravity of this tax is only just gradually sinking in Sri Lanka. Even those in the government, or those wannabes, are clueless as to what this policy is. It is utter stupidity to make statements such as “90% of the property owners won’t be affected” when the policy is not yet even formulated. Without the Sale Price and Rent Register (SPRR), which will be the basis for valuation, it has not been even started, but is required to be completed within a few months. Tax rate has not been determined either. Therefore, it is disingenuous and misleading to say that only 10% of the households will be affected. Further because of the word ‘rental’, some politicians still believe this is a tax on rented properties or on those with ‘commercial value,” whatever that is. But potentially it could be far more sinister!

What is Imputed Rental Income Tax?

This is a highly controversial and nonsensical tax that is imposed in only five countries, namely Iceland, Luxembourg, the Netherlands, Slovenia and Switzerland. None of these are developing countries and even in Switzerland, there is an ongoing debate on its abolition. The tax is imposed on the ‘imputed’ rental income of your own home after deducting mortgage or loan payments. The imputation is based on the rent that you would have to pay to rent a similar property in that location. Once this is determined, there may be some provision for the homeowner to negotiate the imputed value, based on several other factors. In countries where this is imposed, imputed value is negotiated down to be less than half of the potential rental value.

Proposed SPRR

The IMF has suggested implementing this tax by March 2025, once the SPRR is completed within a few months of this year. This will be a monumental task in the informal and disparate property market that exists in Lanka. Except for some properties in high-rise apartment complexes and a few other high-end properties, mainly in Colombo, most rentals and property transactions occur through personal advertisements on newspapers and online. Their rental rates and selling prices are personal information and are unlikely to be recorded anywhere. Further, each property is unique and no two properties, in the same neighbourhood, are the same. This adds to the complexity of determining overarching rental rates, or sale prices, even for a small confined neighbourhood. Also, rents are negotiated, based on personal acquaintances, actual or perceived ability to pay rent and several other factors that cannot be quantified. Often one finds palatial homes in not so desirable neighbourhoods surrounded by very basic abodes. This will make it extremely challenging for authorities to come up with any credible imputed rent register for a myriad of heterogeneous properties strewn all over the island.

This is very much different to developed countries, where there are whole neighbourhoods with pretty much identical properties. Variation is sale prices and rents are very minor within a neighbourhood. Transaction information on only a few properties is enough to impute the sale or rental value of similar properties. In the UK, for example, there are several online property sites that individuals use as guides to advertise properties for sale and rent. Also, since most homes are mortgaged owned, banks have a record of sale prices and mortgages extended to each property. The government and tax authorities have access to all this information almost in real time.

Is this tax realistic in Sri Lanka?

Despite the ill-conceived optimism of the IMF, this tax is highly impractical in Sri Lanka due to aforementioned reasons and certainly not within the suggested time frame. This is an excellent manifestation of what happens when international organisations run out of ideas and are devoid of any sense of reality of the environment that they are working on. In a highly fractured and heterogenous property market, each property will have to be considered individually to calculate the imputed rent as each property is a unique entity. Further, the rental demand for high-end properties in Colombo and its purlieu are by embassies, international organisations and other foreign establishments that can pay high rents, which are out of reach of many ordinary Sri Lankans. While those who are lucky enough to get such clients may demand high rents, to use them to impute rental value of the adjoining property is not possible. For properties of this nature there is an esoteric and limited client base. For the rest of the country, there is a ‘rent ceiling’ that any property could demand, regardless of how grand it is.

Therefore, any kind of rent register has to be either very individualised or fairly prosaic, mostly based on highly conservative estimates in a very parsimonious information environment. Either way, putting together a useful and credible SPRR would be highly contentious and those with means and connections could influence how much their imputed rent would be. This opens up another avenue for widespread corruption, where valuation offices could easily be the new elite surpassing custom offices.

Is this tax fair?

One of the main arguments against IRIT is that it goes against the very principle of taxation. A tax is imposed on a transaction or when an income is generated. This tax is imposed on a non-income generating asset. As such, it is biased against those individuals who are asset rich but cash poor. Sri Lankan house ownership is unique. Most people strive throughout their working years to build a house that eventually becomes their family home. When they retire and income is drastically reduced, it not only becomes their permanent refuge, but also serves as a launching pad for grown up children until they become independent. Few lucky ones acquire homes through bequeath or marriage. For these individuals’ this tax may not be as unfair as for those who have spent their hard-earned money building or acquiring a property. However, the morality of the tax is still questionable. This tax is penalising people for their enterprise. It is in effect disincentivizing people from investing in their future and the welfare of their children. While tax implications can be taken into account in making a decision about going for a higher paying job, or purchasing an item, no one would know what the future tax is when they start to build their own home. It is completely at the mercy of an imperfect and capricious valuation process. Therefore, if applied regressively, this tax would be unfair on the owners of the existing stock of property and could peril the livelihood of those who are living at the margins, but fortunate enough to have their own comfortable home in a desirable location. Those who are planning to get on the property ladder would be no better off either as they would have to consider some random tax that will be imposed once the property is built or acquired.

Why in this predicament?

The reason that Sri Lanka is in this quandary and has to propitiate IMF is due to years of neglect to implement sensible tax policies. Ridiculously low historic personal income taxes and their ad hoc implementation has given a false sense of prosperity that accustomed the populace to a lifestyle that otherwise would not have been possible. If the taxes have been allowed to increase marginally over the years to reflect the true cost of providing public services, the pain would have been much less. To cover the gap that could not be covered by taxes, all elected governments have been borrowing heavily, primarily to support consumption. Even when borrowed for income generation, gratuitous corruption and egregious decisions have rendered most investments liabilities. All the while the debt has been piling up unabated, and passed on from one administration to another. Economic mismanagement and the maintenance of a bloated, inefficient and corrupt public service have finally nailed the coffin in. While decreasing government expenditure through restructuring and privatisation is facing fierce opposition, agreeing to raise taxes and find new sources for taxation appears to be the only way to convince creditors to lend more. But is it?

Tax Gap – Finding tax leakages

One of the main accusations against pervasive taxation is the inability or unwillingness to clamp down on widespread tax evasion. Different groups point out sources where substantial haemorrhage of tax occurs. However, quantifying leakages of tax revenue has hampered putting forward a compelling case against imposing more debilitating taxes. To realise how extra tax can be collected without imposing new taxes, the government needs to know how much tax is lost and then formulate a comprehensive plan to collect. The method to estimate lost tax is by calculating the tax gap. Tax gap calculates the overall deficit in the tax that is due under full compliance and what is actually collected. It can be broken down by sector, such as tax lost through income tax, corporate tax, excise tax. The concept is fairly straightforward although computationally data driven. Rather than agreeing to every outlandish suggestion that the IMF makes, the government should be able to suggest alternative methods to raise taxes without further burdening the long-suffering public. The way to achieve this is by having people who could hold a conversation at their level. Obsequiousness is seen as a sign of weakness that organisations like the IMF have come to expect in developing countries. Unless the government gets its act together and shows that they could put forward fact-based strong arguments, it won’t be able to defend the public from the wrath of the IMF. Without the knowledge of how much tax is lost and a comprehensive plan to collect it, it is not surprising that only one party dominates these discussions.

Repercussions of Excessive Taxation

Studies done in the UK and other countries have shown that excessive tax burden promotes evasion and evasion is self-feeding. When people see others evade taxes, they are also compelled to do so, especially if they see no action is taken. Since taxes don’t give any direct benefits, individuals are more likely to comply if everyone else does. People neither feel good when they pay taxes or feel bad when they evade. Because they feel ‘everyone’ is doing it. All this means that there will be a huge cost making individuals comply with various taxes and associated regulations that are popping up like mushrooms. This will in turn increase government expenditure, negating most or some of the revenue from increased taxation. A complicated tax like IRIT will face significant difficulties and costs through its implementation. Identifying the ownership, imputed rent valuation, adjusting it for various mitigating factors, negotiations, endless legal challenges and distortions to the property market will render this tax unworkable in Sri Lanka. The IMF really should stay away from prescribing specific tax policies that are not suitable for Sri Lanka while the government should be much more erudite in holding their ground and fighting their corner.

Opinion

Plantation Workers : Proposed wage hike and related matters

Dr Parakrama Waidyanatha

President Ranil Wickramasinghe’s pronouncement at a recent political meeting with the plantation workers, that their wages would be raised from Rs 1,000 per day to Rs 1,700, naturally more than delighted the workers. It was, however, clearly a vote catching exercise! The workers would have been even quite contended with a smaller increase of about Rs 200! By contrast, the plantation managers are shocked by the sudden decision without consulting them, and many say that with marginal profits they are making, it is impossible to agree to such a huge increase, and the repercussions of implementation of this decision could be catastrophic! Some companies even claim that they will have to cut back on operational costs by reducing labour employment. As also pointed out by Dr Pethiyagoda in his article, on the same matter, that appeared some day ago in The Island newspaper, such a wage increase decision should have been ideally made in consultation with the Wages Board of the Labour Department following a meeting of the worker representatives and plantation managers. However, there is no argument that the estate workers, many yet living in squalor and poverty, need better wages and living conditions. The potential for generating substantial profits from plantations is there, if plantation managers had done what was needed, and as seen from the information below, giving a livable wage should have been no problem!

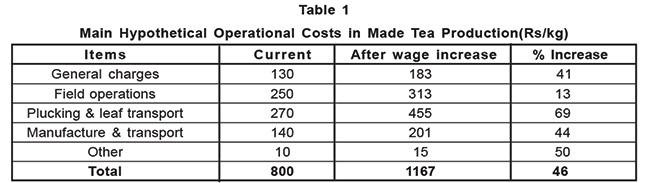

A simple calculation shows that that with EPF, ETF and gratuity components the total daily wage increase should amount to about Rs 1167. An approximate calculation of operational costs for tea made by a colleague of mine, an expert in the tea industry, is given in the Table 1 shown here.

With the enactment of the Land Reforms Act of 1972 all foreign company owned plantations numbering to over 500 estates were nationalised and handed over to the state owned State Plantations Corporation (SPC) and Janata Estates Development Board (JEDB) for management. However, on realising that the management of plantations and returns were unsatisfactory, 450 estates were handed over to 22 plantation companies and the remaining 55 estates essentially in the mid country were retained by the JEDB and SPC, handing over 11 of them to the then newly established state –owned Elkaduwa Plantations Limited.

The mid country tea estates were historically running at a loss for a long period as a result of low prices obtained for their teas compared to the upcountry and low country teas. This had led to poor crop management resulting in heavy soil erosion and fertility losses leading to poor yields. Some plantations such as the Mobray Estate, Hindagala, Kandy District, were abandoned or fragmented and sold. Many holdings in the mid country which were diversified essentially into pepper and other spices are making substantial profits.

(See Table 1: General charges: salaries, vehicles and building upkeep, holiday pay, gratuity, head office costs. Field operations: fertiliser and application, weed management, pruning, etc.)

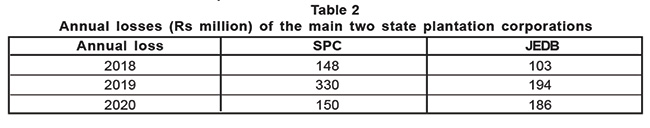

The more recent profit /loss information of the two state enterprises, SPC and JRDB was not available in the public domain. Published data were available online only up 2020 as shown in Table 2.

This means that the government had to dole out large sums to maintain the plantations. Regrettably both companies yet have large extents of old seedling tea as a result of their very low replanting rates which is even below the national average of 0.6%; the recommended rate being 2%. However, a news item in The Island newspaper of 21st Sept. 2022 reported a Rs.100 million profit forecast for the year by the Chairman/JEDB. Similarly, the SPC too is now apparently making marginal profits largely as a result of diversification into forestry and other investments. This should have been done decades ago! On the other hand, the Elkaduwa Plantations Limited which for many years was running at a loss has, in recent years, been making profit as a result of improved crop management, crop diversification and investments in tourism; and recently had a ceremony giving out the newly increased wages to employees.

It is very encouraging to note that the seven plantation companies that had ventured out into oil palm cultivation are making substantial profits of which Watawala which has the largest extent of oil palm is making nearly 75 % profit from it! In April 2021, the former President was driven by unprofessional advice against oil palm and moved to ban it. He even ordered uprooting the existing crop and also totally banned palm oil imports! However, palm oil import ban was lifted a few late later, but the policy to ban oil palm cultivation still exists. The decision was to expand coconut cultivation to meet the national oil demand, without realizing the serious limits to it. The Coconut Research Institute has shown that with global warming and increasing temperatures in the dry zone coconut growing areas in the dry months, such as in some parts of the northern districts, there is poor fruit set. These lands are ideal for expansion of cashew cultivation which yields huge profits.

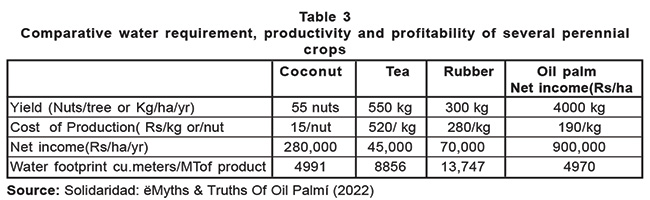

One of the main objections to oil palm cultivation is that it consumes excessive water causing dryness in soil. However, this is a faulty observation , and as shown in Table 3 the soil water consumption of coconut and oil palm are comparable and much less than that of rubber or tea. .

As regards return on investment, oil palm is far ahead of the other plantation crops as shown in Table 3. The commodities prices may be higher now , but the relative picture is yet depicted in Table 3. (Source: Solidaridad: ‘Myths and Truths Of Oil Palm’ (2022)

The national annual vegetable oil demand is about 250,000 MT over 70% of which is met from palm oil imports, the local contribution from palm oil and coconut being only 6% and 10% respectively. In fact the seven or eight plantations that diversified into oil palm are making substantial profits. For example, the Watawala Plantations PLC, the leading palm oil producer, with over 3,000 hectares of this crop is gaining about 85% of the profit from it. Clearly, the SPC and JEDB and even other plantation companies should, diversify some of the lands into this crop, at least to produce the national vegetable oil requirement and save the associated foreign exchange. There is also growing interest especially among rubber smallholders to grow oil palm and it is reported that more than 500 of them have already ventured out to do so because of poor returns from the rubber. So oil palm could be the game – changer!

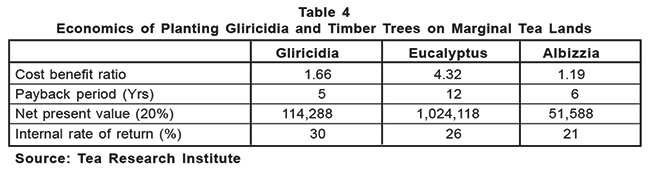

With the little diversification into forestry and other ventures, it is heartening to learn that SPC and JEDB are now making at least marginal profits. The Tea Research Institute’s calculations shown on Table 4 show that even growing Gliricidia which can be done at minimal cost would be more profitable than maintaining old seedling tea! Had these corporations ventured out into diversification earlier the losses could have been avoided. (See Table 4 Source: Tea Research Institute.)

The state- owned coconut based plantation companies, Kurunagela (KPL) and Chilaw are making huge profits not only because of good coconut prices but because of intercropping, crop diversification, cattle farming and other ventures. KPL which like the SPC and JEDB was running at a loss in 2005, with change in management, made huge strides in income generation over the years and has made over Rs 500 million net profit in 2023, a substantial share of it coming from investments in other ventures than coconut.

In conclusion, there is no argument that the workers should be amply paid, and this could be done with visionary resource management and good agricultural practices that could yield profits. Impressive vision and mission statements as also beautiful photos in annual reports are inadequate! The government should take immediate action to privatise state owned plantations as well as privatised poor performing ones and hand them to proven performers.

Opinion

13th Amendment, fair political representation, and social-choice theory

by Chandre Dharmawardana,

chandre.dharma@yahoo.ca

The TNA is the main political party of the North. S. Shritharan was recently elected its leader and M. A. Sumanthiran, who is regarded by some as being “barely Tamil”, as one Eelamist resident in Canada put it, was sidelined. Sritharan’s vision, expressed in post-election speeches, demands the merger of the Northern and Eastern provinces; he rejects the 13A as being grossly inadequate to meet the aspirations of the Tamils. The political parties of Gajendra Ponnamblam, and of C. V. Wigneswaran takes an even harder public stand. All tactically reject 13A, even though they rush to India to support 13A when support for 13A weakens in the South. The positions taken by southern politicians regarding 13A are also merely tactical and opportunistic.

Ironically, 13A is already a part of Sri Lanka’s Constitution, with some parts of it implemented, and others in suspense, mainly due to a huge lack of trust across the Northern and Southern political formations. Even the Eastern Tamil leaders do not trust the Northern leaders.

While the minority leaders still seek the chimera of an Indian supervisory role, the majority-community politicians know that strong Indian interventions, even “parippu dropped from air” are no longer a part of the show. President Ranil Wickremasinghe was seated next to Prime Minister Narendra Modi at the latter’s inauguration, while no TNA leader was visible. Meanwhile, the provincial councils themselves have atrophied, with provincial elections not even considered worth the cost, under the current circumstances.

The Northern political leaders rightly believe that any government in Colombo will be a government of the Majority Community and that minority rights will NOT be protected under such a set-up, judging by past history. So, they aspire to have a separate government of their own as the “only effective approach”. However, this approach triggered the past history of communal politics and violence that led to terror and counter-terror. Finally, the TULF leaders, Sinhalese politicians, even the Indian Leader who fathered the 13A, and thousands of innocent civilians got wiped out.

If there is no trust, there can be NO federalism, nor an effective 13A. Even an independent Eelam, separate from a Sinhalé by a physical border is not viable, as the two neighbours will be continually at war, as is the case between India and Pakistan, or across and even within Indian states (e. g. Manipur), even though the “Indian Model”, like 13A, is claimed to resolve these conflicts. Furthermore, such “independent” states will be forced to join up with big powers and become mere pawns of global proxy wars. That is the end of their “self-determination”.

The TNA says, “We don’t trust the majority, so we want our own government; but the minorities who will be under us, i.e., Muslims of the East or any Sinhalese who live in our “exclusive homeland” must trust us. Just forget attacks on Muslims or Sinhalese minorities when the TNA was an LTTE proxy”! This “aspiration” for hegemony by Tamil leaders over other minorities will be rejected by the respective minorities, just as the Tamil leaders reject being ruled by the Majority that they do not trust.

Social-choice theory

How can we equitably allocate agents (or electoral seats) to represent a group of people within a unitary setup (with a total quota of 225 seats), or with subdivided setups (e. g., with provincial councils or federal states with quotas of seats reflecting minority groups)?

This question falls within a class of much studied mathematical problems in game theory, mathematical economics as well as in the theory of social choice. Intellectual giants like John von Neumann and other mathematicians pioneered these studies. However, the most important results relevant to our discussion here came from Blinski and Young as well as from Kenneth Arrow. The latter won the Nobel Prize for economics in 1972 for his theorems on “social-choice theory”.

Blinski and Young proved a theorem showing that any apportionment rule (or representation and devolution rule) that stays within an assigned quota (say, of seats) suffers from what is known as the population apportionment paradox. This states that unless the populations remain absolutely static, even if the minority has a decisively large rate of population growth, the majority still gains more representation (or more power) inexorably! There is NO fair apportionment scheme!

Blinsky and Young’s result was a surprising “no-go” theorem. However, Arrow’s theorem, formulated in 1951 was even more surprising and counter-intuitive. Arrow laid down five “self-evident” axioms (or rules) about what may be called the “Will of the People” to be represented. For instance, a key rule is that the preferences and aspirations of a group should be chosen only from the group members (and not from outsiders). Another axiom is that the “will of the group” must not be that of one particular person; this is known as the no-dictator rule. The other axioms are similar harmless-looking rules about the group having specific preferences (e.g., favouring a set of religious or cultural traits against another set), or having maverick members who have changed policies in the past on a specific preference, although now in accordance with the “will of the group”.

Arrow’s impossibility theorem

Kenneth Arrow proved that, in spite of the highly democratic and seemingly “fair” formulation of these axioms, no such fair representation is possible. This is known as Arrow’s Impossibility Theorem. This theorem states that mandating the preferences and aspirations of the group cannot be ensured while adhering to usual “democratic” principles of fair voting procedures!

The mathematical conclusion is that a selection of people making decisions for those who elected them can never be a rational or fair process, however wise or benevolent they are! Their decisions will be necessarily autocratic! Naturally, the minorities within any group, be it under the Sinhalese majority in the main government, or under the Tamil majority in the TNA government reigning over the North and the East, will discriminate against the minority in each case.

Every available constitutional representation that satisfies Arrow’s axioms (i.e., common-sense ideas of fairness) is a perverse one. There is no “will of the people” or a democratic way of representing it. This very painful conclusion, reached by mathematicians in the 1950s, has stood all critical attacks on it. For over twenty-two decades, political scientists for whom the concept of the “will of the people” is as sacrosanct as the geocentric universe was to the medieval church attacked it! Instead of disproving Arrow, similar impossibility theorems, no-cloning theorems, etc., have been established in quantum information theory and quantum mechanics.

Devising an electoral scheme is mathematically equivalent to an apportionment scheme. Instead of allocating seats on the basis of population (i.e., “The People”), one may consider allocating “seats” on the basis of votes. This leads to models based on proportional representation (PR) instead of apportionment.

Mathematicians have shown that PR leads to even more serious negative consequences than apportionment. A variety of paradoxes of the Blinsky and Young type have been established. A very serious conclusion is that even the mildest PR system will confer a disproportionate amount of power to the third largest party in parliament! The third largest party becomes the king maker and often comes into a coalition with the second-ranking party to become the government! The validity of these results from game theory in practical politics has been established by studies of the history of governments in Germany, Israel and Denmark where high levels of proportional government have been legislated.

In my opinion, a way around these problems is to abandon electoral methods and return to the method of SORTITION advocated by Aristotle and used in several Hellenic cities during the time of Pericles.

Sortition has been adopted today in various limited ways, especially for local or provincial governments, in Ireland, France, Belgium, Canada and even Mongolia. In the simplest sortition model one arbitrarily selects by lottery a group of people who constitute the parliament. While these legislators last only five or six years, it is the administrative service that persists. The sortition parliament is not claimed to represent the “will of the people”. The lottery may be open to all the people, or only to a selection defined by their public service, education etc., as specified by a parliament chosen initially by simple sortition. That is, the first sortition parliament may enact more elaborate sortition models, but ensuring that the random element implied by sortition is never negated.

The sortition model ensures that the same set of corrupt politicians do not continue to get elected every time by controlling the list of candidates as well as the vote-gathering infrastructure which favours existing parties that have accumulated much wealth, by hook or crook. It also eliminates demagogues as the election is by lottery.

In other words, SORTITION ensures that a “system change” occurs every time. It ensures that political crooks, their henchmen and progeny do not entrench themselves and hold onto power over decades and decades, be it in the North or the South. I had given a discussion of the sortition model in a previous article in the Island (02-01-2023). It may also be accessed via the web (https://thuppahis.com/2023/01/02/crunchtime-resolving-sri-lankas-political-dilemma/ The applicability of the sortition model to the political problems in the USA has been discussed in the Harvard Review of politics (https://harvardpolitics.com/sortition-in-america/).

Opinion

Executive must cease intimidating and undermining independence of judiciary

Lawyers’ Collective Statement:

“The Lawyers’ Collective condemns the above statements made by the President, the Minister of Justice, the Minister of Education, and Dayasiri Jayasekare, MP. We are of the view that any allegation against the judiciary must be made in the form of a formal complaint before the appropriate forum and not by way of a statement in the Parliament under the cover of Parliamentary privilege. The Collective believes such statements, immediately prior to an election, to be politically expedient and aimed to cause uncertainty and loss of confidence in the People in the judiciary and democratic processes. The Collective requests the public to stand up in protection of the independence of the Judiciary at this time and always.”

On 18 June 2024 President Ranil Wickremesinghe, speaking in Parliament, criticising the recent Supreme Court determination on the Gender Equality Bill referred to the court as having engaged in ‘judicial cannibalism’. The President went on to say that Parliament ‘could not agree with the Supreme Court ruling’ and while he doesn’t propose to summon judges before parliament, he proposes the appointment a Parliamentary Select Committee to review the determination. Previously, the President also demanded the appointment of a parliamentary Select Committee to investigate the workings of the Constitutional Council when it did not approve his nominee to the Supreme Court.

On 19 June 2024, the Minister of Justice, Wijedasa Rajapakshe, in Parliament, stated that the Supreme Court Orders in effect suspended parts of the Constitution and drew comparison between the orders of the Supreme Court and Adolf Hitler suspending the civil rights prior to the outbreak of World War II. These statements are aimed at instilling fear and confusion in the minds of citizens.

The Minister levelled serious allegations naming specific judges and lawyers. Any such allegation of corruption involving judicial officers must be taken extremely seriously but these public statements are a misuse of Parliamentary privilege. Allegations should be confined to formal complaints before the proper fora. Every allegation must be dealt with due process and with a view to strengthening institutions. It is disappointing and extremely concerning that the Minister, a senior member of the legal profession, a President’s Counsel, levels allegations against the District Court judge who issued a stay order against the Minister regarding an issue on the office bearers of the SLFP. Further the Minister of Education, Susil Premjayantha and Dayasiri Jayasekare, Member of Parliament also made comments on the cases in which they have certain interests.

The above remarks are an assault upon the independence of the judiciary, a cornerstone of our Constitution. The President, Minister of Justice, Minister of Education are representatives of the entire Executive. The President also exercises a critically important Constitutional power and responsibility in appointing judges to our highest judicial forum- the Supreme Court and the Minister of Justice controls resources to the judiciary. Such high executive office making insidious sweeping remarks about the judiciary using parliamentary privilege is a clear abuse of their power. It sends strong signals to judicial officials that certain judicial decisions will not be tolerated by this executive.

It implies complicity with the executive may receive career advancement and support. By using the nationally televised platform afforded to speeches in Parliament, the President and Minister of Justice to make disparaging remarks on the judiciary demeans this important public institution central to a functioning democracy. It undermines the public confidence in the authority and impartiality of the judiciary. Foundational concepts of the rule of law, the separation of powers and the balance of power are founded on maintaining public confidence. Public confidence among the sovereign People legitimises the entire State. The People support and legitimise State powers of governance when they have confidence in the judiciary. As such, these statements directly threaten the political stability of the country.

Constructive critique, fair comment and difference of opinions are all valid forms of the right to freedom of expression. However, given the Executive’s equal role in ensuring the balance of power among the organs of government, and protecting the sovereignty of the People as guaranteed by the Constitution. It is incumbent on the Executive in a democracy to refrain from eroding the powers and responsibilities of the other key institutions and express disagreement due care.

Disagreement cannot cross into threat or intimidation. Restraint must also be exercised in any comments or actions made about the judiciary even in Parliament in direct recognition of the fact that judges do not have a right of reply and cannot defend themselves.

The Lawyers’ Collective views this attack on the judiciary, which in the context of mounting litigation before courts, is the last recourse and refuge against abuse of State powers. The Collective has observed increased participation in democracy, whereby citizens have challenged decisions on appointments to high posts, corrupt decisions, undemocratic and repressive legislation initiated by the executive and Executive measures mounting hardships on the lives of the People.

We have also seen repressive measures by the Executive against public protests and dissent. In this context, and the mounting evidence of executive interference with the judiciary, these statements are not isolated excesses, but now form a clear pattern of intimidation by politicians holding executive power. It is a pattern of authoritarian conduct by a President who serves without a direct mandate from the people and a Minister in the Cabinet of such a President.

The Lawyers’ Collective condemns the above statements made by the President, the Minister of Justice, the Minister of Education, and Dayasiri Jayasekare, MP. We are of the view that any allegation against the judiciary must be made in the form of a formal complaint before the appropriate forum and not by way of a statement in the Parliament under the cover of Parliamentary privilege. The Collective believes such statements, immediately prior to an election, to be politically expedient and aimed to cause uncertainty and loss of confidence in the People in the judiciary and democratic processes. The Collective requests the public to stand up in protection of the independence of the Judiciary at this time and always.

On behalf of the Lawyers’ Collective

Upul Jayasuriya, President’s Counsel

M.M. Zuhair, President’s Counsel

Dr. Jayampathy Wickramaratne, President’s Counsel

Professor Savitri Goonesekere, Attorney-at-Law

Anura B. Meddegoda, President’s Counsel

Saliya Pieris, President’s Counsel

Professor Deepika Udagama

Professor Camena Gunaratne

S.T. Jayanaga, President’s Counsel

Upul Kumarapperuma, President’s Counsel

Rev. Fr. Noel Dias, Attorney-at-Law

Jagath Kularatne, Attorney-at-Law

Lakshan Dias, Attorney-at-Law

Srinath Perera, Attorney-at-Law

K. W. Janaranjana, Attorney-at-Law

Ermiza Tegal, Attorney-at-Law

Darshana Kuruppu, Attorney-at-Law

Sandamal Rajapakse, Attorney-at-Law

-

Fashion7 days ago

Fashion7 days agoRamani Fernando adding a touch of timeless elegance for brides

-

Business6 days ago

Business6 days agoNestlé Lanka fosters positive behavioural change towards responsible waste management

-

Features7 days ago

Features7 days agoComment: V V Ganeshananthan’s Brotherless Night

-

News5 days ago

News5 days agoCardinal: Bridge project poses danger to sovereignty and Independence of Sri Lanka

-

News3 days ago

News3 days agoAnti-corruption outfit to report fraud during MR regime to CID

-

Opinion7 days ago

Opinion7 days agoWHEN WILL SRI LANKANS EVER LEARN?

-

News5 days ago

News5 days agoUK rejects appeal for lifting ban on LTTE

-

Business6 days ago

Business6 days agoDigiEcon 2024 Investment Summit to have speakers from diverse industries