Business

How Should Sri Lanka Finance the COVID-19 Vaccination Rollout?

Notably, the government did not budget for a vaccination strategy in its National Budget for 2021. As such, any spending would have to be allocated through an emergency budgetary allocation. The government could potentially reallocate funding from other sectors or even reallocate from within the health sector. These reallocations, for example, could occur through built-in fiscal space for public investments in the budget, postponements or revisions to non-essential government spending initiatives such as non-essential small-scale infrastructure projects

By Harini Weerasekera and Kithmina Hewage

An effective vaccination strategy is a necessity for countries to move beyond COVID-19. However, it also requires careful policymaking to balance the financial cost of purchasing and delivering vaccines while stimulating economic growth. This article, based on a recent IPS analysis, provides an overview of the approximate costs associated with the COVID-19 vaccination rollout in Sri Lanka and evaluates policy options to finance the initiative.

Assessing Costs

While there is no universally agreed level, considering the emergence of new variants, many experts agree that a country should vaccinate around 80% of its population to achieve herd immunity against COVID-19. This translates to 17.5 million Sri Lankans. Thus far, Sri Lanka has received or is expected to receive vaccine donations and other financial assistance from the likes of the World Health Organization’s COVAX Facility to cover approximately 20% of the population.

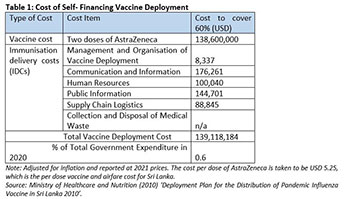

Based on publicly available proxy data, as detailed in Table 1 below, assuming that 20% of the population will be financed through the WHO COVAX scheme, the total cost of self-financing another 60% of the population is USD 139.1 million. These costs include both the cost of purchasing the cheapest vaccine (AstraZeneca- Oxford) and the immunisation delivery costs.

Oxford) and the immunisation delivery costs.

In a recent study, the World Bank estimates that for the South Asian region, the average per person vaccination cost amounts to USD 12 to receive one dose of the COVID-19 vaccine, under certain assumptions. This costing consists of the full vaccine deployment cost per person, which includes the vaccine dosage cost along with the international airfare and other delivery costs.

Using this basis of costing, financing two doses of the vaccine for 60% of Sri Lanka’s population would amount to USD 336 million. This is over double the minimum estimate made earlier using local proxy data. As such, a range of USD 140-336 million (LKR 27-66 billion) can be treated as a minimum and maximum estimate range for financing the long-term vaccination strategy in Sri Lanka. This amounts to 0.6-1.4% of total government expenditure for 2020, which is a relatively small proportion of the country’s total government expenditure. For context, the health sector was allocated 4.8% of total government expenditure in 2020. That said, the estimated costs range between 12 and 29.5% of the Ministry of Health’s total expenditure for 2021.

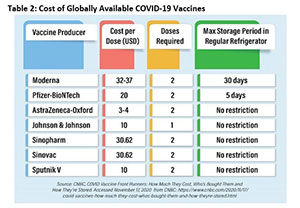

Furthermore, given difficulties in securing all necessary vaccines from a single producer (e.g. AstraZeneca) due to supply shortages, Sri Lanka has already moved towards purchasing Sputnik V and Pfizer vaccines, which are more expensive than AstraZeneca, and therefore will increase costs. The cost increase will be significant given that other vaccines are two to six times more expensive than a dose of Astra-Zeneca (Table 2).

Given these realities, Sri Lanka will need to cover these costs through one or a combination of: (a) reallocating existing budgetary commitments; (b) receiving more bilateral and multilateral vaccine donations or financial assistance; or (c) self-financing through targetted tax policies and future borrowings.

Reallocating Budgetary Commitments

Notably, the government did not budget for a vaccination strategy in its National Budget for 2021. As such, any spending would have to be allocated through an emergency budgetary allocation. The government could potentially reallocate funding from other sectors or even reallocate from within the health sector. These reallocations, for example, could occur through built-in fiscal space for public investments in the budget, postponements or revisions to non-essential government spending initiatives such as non-essential small-scale infrastructure projects.

However, the extent to which such revisions can be incorporated is greatly limited by the economic conditions under which this vaccination initiative is taking place. Some of these small-scale infrastructure projects, for instance, are geared towards stimulating the economy.

Sri Lanka’s post-COVID-19 economic recovery is dependent on adequate government spending to stimulate growth, and there has already been a significant amount of spending rationalisation that has taken place. Furthermore, the government will be required to ensure that the broader public health sector is not compromised in any form simply to fund the COVID-19 vaccination initiative as that may have further severe long-term repercussions.

Self-Financing

Given the current economic climate, the government is unlikely to increase direct taxes in the immediate future. Increasing indirect taxes such as import tariffs are also likely to be counter-productive since imports are restricted. Rather, a tax rationalisation on luxury goods and a sin-tax rationalisation on alcohol and cigarettes could generate a significant amount of revenue that can be directed towards the vaccination drive.

For instance, a recent study by IPS estimated that government revenue could be increased by LKR 17 billion by 2021, and LKR 37 billion by 2023, if taxes on cigarettes are streamlined and raised in line with inflation. This additional revenue can finance the vaccination strategy such that it reaches the midpoint of the study’s cost estimation range of LKR 20-67 billion.

For instance, a recent study by IPS estimated that government revenue could be increased by LKR 17 billion by 2021, and LKR 37 billion by 2023, if taxes on cigarettes are streamlined and raised in line with inflation. This additional revenue can finance the vaccination strategy such that it reaches the midpoint of the study’s cost estimation range of LKR 20-67 billion.

A targetted tax intervention achieves the dual aim of raising the required funds to vaccinate the public while simultaneously ensuring that the government’s broader macroeconomic stimulus initiatives can continue unimpeded. If the government is unwilling to finance the entire cost through a targetted tax intervention, even a partial self-financing measure would reduce the necessity for the government to depend on further loans to cover the cost.

Best Option

A basic economic impact analysis by IPS found that the vaccination rollout would generate an additional 30.6 billion in national output, and an extra value addition of LKR 26 billion. Besides, the country’s economy will benefit additionally due to the indirect impacts associated with the public health benefits of a vaccinated populace.

Considering these factors, the government is best off pursuing a medium-term self-financing option through targetted tax interventions and if required, through external financing. The challenge for Sri Lanka is to secure adequate funding without compromising on its investments in broader public health and social welfare initiatives as weaknesses on those fronts can undermine the success of vaccinating the public from COVID-19.

From a budgetary perspective, the cost of vaccinating the public fast will also be cheaper than the cost of continuous PCR testing, managing quarantine centres and cluster associated lockdowns over a prolonged period. In addition to securing funding, receiving an adequate supply of vaccine doses for the country to reach its vaccination coverage targets remains uncertain as we progress further into 2021.

To learn more, read IPS’ Policy Discussion Brief (PDB) ‘Fiscal Implications of Vaccinating Sri Lanka Against COVID-19’.

Business

Stealer malware leaked over 2 million bank cards

Kaspersky Digital Footprint Intelligence estimates that 2.3 million bank cards were leaked on the dark web, based on an analysis of data-stealing malware log files from 2023-2024. On average, every 14th infostealer infection results in stolen credit card information, with nearly 26 million devices compromised by infostealers, including more than 9 million in 2024 alone. Kaspersky released its report on the infostealer threat landscape while the technology world gathers at MWC 2025 in Barcelona.

Kaspersky experts estimate that approximately 2,300,000 bank cards have been leaked on the dark web. This conclusion is based on an analysis of the log files from data-stealing malware, dated 2023-2024, that were leaked on the dark web market. While globally the share of leaked cards is well below one percent, 95% of the observed numbers appear technically valid.

Infostealer malware is not only designed to extract financial information, but also credentials, cookies and other valuable user data, which is compiled into log files and then distributed within the dark web underground community. An infostealer can infect a device if a victim unknowingly downloads and runs a malicious file, for example one disguised as legitimate software, such as a game cheat. It can be spread through phishing links, compromised websites, malicious attachments in emails or messengers and various other methods. It targets both personal and corporate devices.

On average, every 14th infostealer infection results in stolen credit card information. Kaspersky Digital Footprint Intelligence experts found that nearly 26 million devices running Windows were infected with various types of infostealers in the past two years.

“The actual number of infected devices is even higher. Cybercriminals often leak stolen data in the form of log files months or even years after the initial infection, and compromised credentials and other information continue to surface on the dark web over time. Therefore, the more time passes, the more infections from previous years we observe. We forecast the total number of devices infected with infostealer malware in 2024 to be between 20 million and 25 million, while for 2023, the estimate ranges between 18 million and 22 million,” says Sergey Shcherbel, expert at Kaspersky Digital Footprint Intelligence.

In 2024, Redline remained the most widespread infostealer, accounting for 34% of the total number of infections.

The most significant surge in 2024 was in infections caused by Risepro, whose share of total infections increased from 1.4% in 2023 to almost 23% in 2024. “RisePro is a growing threat. It was first discovered two years ago but seems to be gaining momentum. The stealer primarily targets banking card details, passwords and cryptocurrency wallet data, and may be spreading under the guise of key generators, cracks for various software and game mods,” explains Sergey Shcherbel. Another rapidly growing stealer is Stealc, which first appeared in 2023 and increased its share from nearly 3% to 13%.

Business

UTE Delivers Sri Lanka’s Largest Cat D8 Tractor to NEM Construction

Caterpillar equipment dealer UTE has delivered the country’s largest Cat D8 Track-Type Tractor to NEM Construction Pvt. Ltd., marking a significant milestone in heavy machinery. This delivery strengthens the long-standing partnership between UTE and NEM Construction, which spans over 45 years. The Cat D8 is expected to boost operational efficiency in large-scale projects. As the sole authorized dealer for Caterpillar in Sri Lanka, UTE continues to provide top-tier machinery and after-sales support. The handover is particularly notable as Caterpillar celebrates its 100th anniversary. NEM Construction’s Chairman, Raja Nanayakkara, praised the Cat D8’s superior performance and UTE’s unmatched service and parts support, which have been key to the company’s long-term collaboration. This purchase highlights the continued trust in both Caterpillar and UTE’s expertise in supporting Sri Lanka’s construction industry.

Business

ComBank’s 2023 Annual Report tops Banking sector at ACCA Sustainability Reporting Awards

The Commercial Bank of Ceylon’s prowess in comprehensive disclosure of sustainability-related information to stakeholders has won its 2023 Annual Report two top awards at the 2025 Sustainability Reporting Awards presented by the Association of Chartered Certified Accountants (ACCA).

The Bank was adjudged the overall runner-up and the winner in the Banking category at these awards, repeating the achievement of its 2022 Annual Report which was similarly honoured by the ACCA last year.

The ACCA Sustainability Reporting Awards recognise Annual Reports that clearly acknowledge and explain the economic, environmental and social impacts of the business to internal and external stakeholders, demonstrating the organisation’s policies, targets and long-term objectives towards the goal of sustainable development.

Commercial Bank’s 2023 Annual Report also won two Golds, a Silver and a Bronze at CA Sri Lanka’s ‘TAGS’ Awards 2024, excelling in the key aspects recognised by the awards programme which is dedicated to Transparency, Accountability, Governance, and Sustainability – TAGS.

The Bank won the Gold for ‘Corporate Governance Disclosure’ in the Financial Services sector, the Gold for the Best Annual Report among the private sector banks, the Silver for ‘Digitally Transformative Reporting’ across all sectors, and the overall Bronze award for Excellence in Corporate Reporting.

-

Foreign News1 day ago

Foreign News1 day agoSearch continues in Dominican Republic for missing student Sudiksha Konanki

-

News5 days ago

News5 days agoAlfred Duraiappa’s relative killed in Canada shooting

-

Opinion7 days ago

Opinion7 days agoInsulting SL armed forces

-

Features4 days ago

Features4 days agoRichard de Zoysa at 67

-

Editorial6 days ago

Editorial6 days agoGhosts refusing to fade away

-

Features4 days ago

Features4 days agoSL Navy helping save kidneys

-

Midweek Review5 days ago

Midweek Review5 days agoRanil in Head-to-Head controversy

-

Features6 days ago

Features6 days agoThe Gypsies…one year at a time