Business

HNBA Group records impressive 3Q22 results

HNB Assurance PLC (HNBA) and its fully owned subsidiary HNB General Insurance Limited (HNBGI) reported a consolidated Gross Written Premium (GWP) of Rs 11.3 Bn marking a steady growth of 26% and a consolidated Profit After Tax (PAT) of Rs 1.5 Bn marking a growth of 228% during the nine months ended 30th September 2022 compared to the comparative period last year.

A press release from HNBA said:. Rose Cooray Chairperson of HNBA and HNBGI, expressed her views on the financial performance of the Group stating, “despite of the negative impact caused by the economic turbulence of the country and the challenges faced, both companies have performed extremely well in terms of both topline and bottom line. Both HNBA and HNBGI were able to increase their respective market shares by growing well above the market averages. Group PBT grew by 167% for the period reaching Rs 1.9 Bn compared to Rs 731.4 Mn in the corresponding period last year. The key reason for the exceptional growth is the transfer of Rs 1.1 Bn surplus from Life policyholders fund, subsequent to the valuation of the Life Fund as at 30th September 2022. It must be noted that no surplus transfer from Life policyholders was made in 3Q 2021 as it was done in December 2021.These profits posted were after incurring Rs 4 Bn as Net Insurance Benefits and Claims to our policyholders in 2022, compared to Rs 2.9 Bn in the corresponding period. The Group’s strategic emphasis is on increasing growth across key products and services while delivering a superior customer service through digital enablement and process efficiency”.

Sharing his views, Chief Executive Officer of HNBA Lasitha Wimalaratne said: “I am happy to note that the resilience of our core business model has led to yield these remarkable results despite the challenges we had to face in the previous months. While the business keeps retooling itself with tech transformations and keeping abreast of market trends, HNBA’s GWP increased by 32% achieving Rs 6.6 Bn. HNBA posted a PAT of Rs 1.2 Bn recording a 483% growth with the surplus transfer from the Life Fund. The Company’s Life Insurance Fund stands at Rs 23.1 Bn at the end of Q3 of 2022. Contributing to this momentum HNBA’s Capital Adequacy Ratio (CAR) stood at 283%”.

HNBA is the only insurance company to be listed amongst the Top 70 Best

Workplaces in Asia whilst also being recognised amongst the Top 50 Best Workplaces in Sri Lanka. The Company was also awarded as the best Digital Marketing Brand in the Insurance Industry and was recognised as the best Bancassurance team for two consecutive years by Global Banking and Finance Review. Wimalaratne also extended his sincere appreciation to the Agency and Partnership Channels, Support service teams and the HNB Management for their contribution to deliver these impressive results.

Commenting on these results, Chief Executive Officer of HNBGI Sithumina Jayasundara ssid that “the company was able to maintain a sustainable financial growth in 2022 compared to 2021 and that he is confident with the solid business strategies in place, the business will continue to grow to greater heights. Appreciating the dedication and efforts of both Strategic Business Units, Support Services and Operations Units, Mr. Jayasundara also stated that the business delivered a great performance during Q3 2022 recording a GWP of Rs. 4.8 Bn. Further reviewing the performance of the business, HNBGI recorded PAT of Rs. 417.6 Mn compared to Rs. 372.2 Mn last year. The Company’s Capital Adequacy Ratio (CAR) stood at 266% well above the regulatory requirement”.

Business

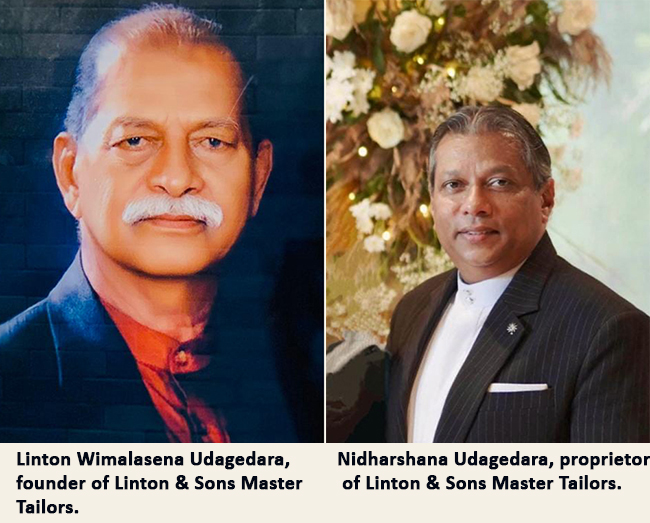

Seven decades of sartorial excellence: The legacy of Linton Master Tailors in Kandy

In the 1950s, Linton Wimalasena Udagagedara served as the tailoring instructor at the rehabilitation unit of the Bogambara Prison. Known affectionately by all as “Linton Master,” he laid the foundation for a legacy that would eventually redefine men’s fashion in the hill capital.

In 1958, Linton Master ventured into private business by renting a small shop in Trincomalee Street, Kandy, under the name “Linton Master Tailors.”

Supported by a handful of employees and the unwavering strength of his wife, Srima Alwala, the business began its humble journey. In those early days, Linton Master would travel from Kandy to Pettah, Colombo, walking miles to handpick high-quality fabrics at affordable prices. Though the initial years were a struggle, he never compromised on quality.

Due to his commitment to superior craftsmanship and impeccable finishing, “Linton Master’s Shop” in Trincomalee Street soon became a household name across the Kandy region. By the 1970s, the thriving business moved to Yatinuwara Veediya. As the enterprise grew, Linton Master eventually purchased the rented building and the adjacent premises. In the 1990s, the brand reached its zenith, becoming a hallmark of excellence.

Following the passing of Linton Master in 2009, the business transitioned into a new era. Today, it stands proud at the same familiar location in Yatinuwara Veediya, rebranded as “Linton & Sons Master Tailors.” His legacy is carried forward by his children; while one son manages a printing press and a daughter runs a bridal wear brand under the Linton name, his son Nidarshana Udagagedara has significantly expanded the core tailoring business.

Today, Kandy is home to three main institutions bearing the prestigious Linton brand. Linton & Sons Master Tailors, now employing around 20 skilled professionals, is a nationally recognized name. Known for their international standards, it is said that anyone who gets a full suit tailored at Linton & Sons invariably returns for their second.

The business that once started with fabric handpicked from Pettah now utilizes world-renowned international brands. Linton & Sons is currently the only tailor shop in Kandy that creates garments using prestigious fabrics such as Raymonds, Pacific Gold, Medici, and Macone.

Current Chairman Nidarshana Udagagedara notes that they serve a loyal customer base, with complete groom’s suit packages ranging from Rs. 30,000 to Rs. 90,000. With a highly experienced team, they now offer an exclusive one-day service, allowing customers to have bespoke designs created to their exact specifications in record time.

Spanning seven decades, the Linton lineage, which has brought fame to Kandy, has now successfully expanded from the second generation to the third, ensuring that the master’s stitch continues to define elegance for years to come.

By S.K. Samaranayake

Business

LANKATILES Captivates Architect 2026 with a Spectacular Celebration of Fine Living

At the prestigious Architect 2026 Exhibition, LANKATILES unveiled an immersive Concept Studio of contemporary design, where every surface spoke in allusive ways of exquisite craftsmanship and architectural vision.

Among a host of outstanding participants, the Concept Studio was recognized with two of the exhibition’s highest accolades: Overall Best Stall and Best Trade Stall Displaying Local Products. This is a resounding testament to five decades of trust, quality, and innovation.

The Concept Studio was thoughtfully zoned to evoke the ambiance of curated interiors and sophisticated entryways, unveiling the latest designs introduced to the market. Visitors were guided through a seamless spatial journey, beginning with the Living Zone, where expansive surfaces harmonized durability with refined design to elevate everyday living. The Kitchen Ambience Zone presented a contemporary culinary environment enriched with elegant finishes, demonstrating how functionality and elevated aesthetics coexist in modern homes.

The experience continued into the Bedroom Zone, an intimate and serene setting curated with soothing palettes and luxurious surfaces to create a tranquil retreat defined by comfort and understated elegance. Complementing this was the Bathware Zone — a sanctuary of calm showcasing precision-crafted porcelain surfaces that seamlessly blended purity of form with superior performance, redefining modern bathroom sophistication.

Extending beyond interiors, the Poolside Zone highlighted elegant outdoor settings framed by resilient, high-performance tiles, where aesthetic excellence met enduring strength in expressive interpretations of contemporary luxury. Featuring the latest Mosaic designs alongside the grand large-format tile series, Majestica, each zone illustrated how LANKATILES transforms raw materials into architectural poetry, reinforcing its leadership in innovation and design excellence.

Another defining feature of the Concept Studio was the AI-powered Tile Visualizer; an advanced digital interface designed to offer architects and homeowners an intelligent and immersive visualization experience that redefines the way interiors are selected and conceptualized. Within minutes, users can upload an image of their dream space and instantly explore precisely matched tile designs and colour palettes tailored to their aesthetic preferences.

Business

ComBank takes lending to new levels in mission-focused 2025

The Commercial Bank of Ceylon achieved another performance milestone in 2025, becoming the first private sector bank in the country to expand its loan book beyond Rs. 2 Tn., with a growth of Rs. 541 Bn. over 12 months at a monthly average of over Rs. 45 Bn., demonstrating its commitment to national economic resurgence.

Recording the highest annual loan growth in absolute terms in the history of the institution, the Bank said gross loans and advances for the year ending 31st December 2025 grew by 36.37% to Rs. 2.028 Tn., taking total assets to Rs. 3.258 Tn. This reflected an increase of Rs. 468 Bn. or 16.78% and demonstrated more than double the growth recorded in 2024. The Bank’s net assets value per share improved to Rs. 198.30 from Rs. 170.94 at end 2024.

Deposits grew by 16.65% or Rs. 372 Bn. over the 12 months to end the year at Rs. 2.6 Tn., reflecting an average deposit growth of over Rs. 30 Bn. per month despite relatively lower interest rates, the Bank said. The CASA ratio of the Bank, which is considered to be the industry’s best, stood at 39.65% from 38.07% as at 31st December 2024.

Commenting on the Bank’s performance in 2025, Mr Sharhan Muhseen, Chairman of Commercial Bank said: “We remain focused on the fundamentals that sustain shareholder value: earnings resilience, balance sheet strength, disciplined risk management and a strategy that is responsive to evolving customer and market needs. Our 2025 performance affirms the value of that focus.”

Sanath Manatunge, Managing Director/CEO of Commercial Bank said: “In 2025, we proved that scale and discipline can move together, growing lending and accelerating digital activity while strengthening asset quality and balance sheet resilience. This is how we build durable value, supporting productive growth without compromising governance and risk standards.”

In a filing with the Colombo Stock Exchange (CSE) the Bank said it recorded gross income of Rs. 354.81 Bn. for the year ending 31st December 2025 reflecting growth of 13.70% over the normalised figure for 2024, after adjusting for the impacts of restructuring of Sri Lanka International Sovereign Bonds (SLISBs) accommodated in that year, in order to avoid potential distortion of growth figures. Net gains / (losses) from derecognition of financial assets in the Income Statement for 2024 (as reported) included a derecognition loss on restructuring of SLISBs amounting to Rs. 45.108 Bn.

On the same basis, interest income for the 12 months grew by 8.91% to Rs. 293.61 Bn. helped by substantial growth in the Bank’s loan book. Interest expenses grew by a nominal 1.47% to Rs. 157.32 Bn., enabling the Bank to post a net interest income of Rs. 136.29 Bn., an increase of 18.97%.

The Bank reported net fee and commission income of Rs. 27.50 Bn. for the year, an improvement of 22.05%, with increased income from credit and debit card-related services and commission income from loans & advances and deposits related services as the main contributors to this growth. Other income grew by 119.77% to Rs. 20.24 Bn. after adjusting for the impact of Rs. 45.108 Bn. on debt restructuring on the 2024 figure. Net other operating income including exchange profit on revaluation of assets and liabilities increased by 134.43% to Rs. 17.16 Bn. from the normalised 2024 figure of Rs. 7.32 Bn.

Total operating income improved by 81.87% to Rs. 184.03 Bn. and the Bank’s impairment charges and other losses amounted to Rs. 22.51 Bn. for the year under review. In 2024, the Bank increased its provisioning for impairment on a prudential basis for loans and advances, as a consequence of which impairment charges for 2025 reflected a drop of 19.33% over the previous year’s normalised figure of Rs. 27.90 Bn. Impairment charges and other losses for 2024 included a reversal of Rs. 87.215 Bn. on restructuring of SLISBs (as reported).

As a result, the Bank posted a net operating income of Rs. 161.52 Bn. for the 12 months, an improvement of 36.42% over the normalised figure for 2024. Operating expenses, at Rs. 54.59 Bn., increased by only 9.94% due to prudent cost management initiatives, resulting in operating profit before taxes on financial services growing by a noteworthy 55.55% to Rs. 106.93 Bn. over the normalised figure for 2024.

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

Business3 days ago

Business3 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News2 days ago

News2 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

Business4 days ago

Business4 days agoWar in Middle East sends shockwaves through Sri Lanka’s export sector