Business

HNB sails skillfully through turbulent 1H

HNB Group recorded a Profit Before Tax of Rs 6.7 Bn and a Profit After Tax of Rs 6.1 Bn during the first six months of 2022 amid extremely challenging operating environment. Commenting on the first half, Aruni Goonetilleke Chairperson of HNB PLC stated, “The extraordinary market conditions have created a set of new challenges for the entire banking sector. As the external factors continue to be volatile it is important to take necessary steps to minimize the negative impact due to the risk factors. At the same time, we must be open to opportunities that arise even during a crisis situation. Our performance during the first half reflects this meticulous and prudent approach as we stay focused on delivering long term value to our stakeholders”.

The gross income of the Bank grew by 71% YoY to Rs 97.1 Bn driven by a 53% growth in interest income, 61% growth in fee income and 349% growth in exchange income. The exceptional growth in net interest income from Rs 23.2 Bn to Rs 40.2 Bn was primarily due to the increase in average AWPLR by approximately 16 percentage points in line with the tight monetary policy adopted by the Central Bank of Sri Lanka.

The Fee income also recorded a steady growth increasing to Rs 7.3 Bn for the 6 months mainly on account of improved trade and card income. The total exchange income improved to Rs 15.3 Bn from Rs 3.4 Bn during the first half of 2021, as the rupee depreciated by over 80% during the period. Accordingly, the total operating income improved to Rs 63.3 Bn recording a 100% YoY growth.

The Bank made a total impairment of Rs 40.1 Bn for the first six months of the year compared to a charge of Rs 6.3 Bn in the previous year. The total impairment charge for the period included an impairment of Rs 27.3 Bn on account of the foreign currency denominated government securities held by the Bank pursuant to the suspension of external debt repayment by the Government of Sri Lanka and the sovereign downgrade. Considering the volatilities and the economic factors, the Bank recognized an impairment of Rs 22.7 Bn on account of loans and advances for 1H 2022 compared to the provision of Rs 6.2 Bn made in the corresponding period of 2021. An amount totaling to Rs 10.8Bn relating to the exchange impact on impairment of foreign currency loans and investments was set off against the exchange income for the period. The net stage III ratio of the Bank improved to 2.46% from 2.55% as at end of December 2021 while the provision coverage on stage III loans improved from 56% to 63% maintaining the position as one of the best in terms of asset quality among peers.

The operating expenses for the 1H of 2022, increased by 26% to Rs 14.9 Bn mainly due to devaluation of the currency, higher energy costs and increase in staff expenses subsequent to salary revisions effected at the beginning of the year. Nevertheless, the cost to income ratio of the Bank improved by approximately 14 percentage points to 23.5% as total operating income recorded a higher growth during the period.

Business

Beira Lake restoration, ‘a crucial urban environmental intervention’

Sri Lanka’s decision to invest Rs. 2.5 billion in restoring the heavily polluted Beira Lake marks one of the most significant urban environmental interventions in recent years, underscoring a growing recognition that ecological rehabilitation is also an economic imperative.

The multi-pronged project—covering the closure of illegal sewage discharge points, large-scale dredging, and the installation of aeration systems—is expected to not only revive aquatic life but also unlock commercial, tourism and real estate value in the heart of Colombo.

Officials say the initiative is designed to transform Beira Lake from a long-neglected liability into a productive urban asset.

A senior official from the Ministry of Environment told The Island Financial Review that untreated wastewater and illegal sewer connections had been the primary contributors to the lake’s degradation for decades. “Closing these illegal sewage points is the most critical intervention. Without that, any dredging or aeration would only offer temporary relief, the official said, adding that enforcement will be carried out in coordination with the Colombo Municipal Council (CMC) and other regulatory agencies.

From a business perspective, the clean-up is being viewed as a catalyst for urban regeneration. Urban Development Authority (UDA) sources noted that a healthier Beira Lake would significantly enhance the attractiveness of surrounding commercial developments, hospitality projects and public spaces. “Environmental remediation directly impacts land values and investor confidence. A clean, living lake changes the entire economic profile of the area, an UDA official said.

The dredging component of the project is aimed at removing decades of accumulated sludge, which has reduced water depth and contributed to foul odours and fish die-offs. According to officials involved in project planning, the dredged material will be disposed of following environmental guidelines to avoid secondary pollution risks—an issue that has undermined similar efforts in the past.

Meanwhile, the installation of modern aerators is expected to improve dissolved oxygen levels, a key requirement for sustaining fish and other aquatic organisms. “Restoring aquatic life is not just about biodiversity; it is about creating a water body that can safely support recreational activities and public engagement, a senior CMC engineer explained.

Economists point out that the Rs. 2.5 billion allocation, while substantial, should be seen against the long-term cost savings and revenue potential. Reduced public health risks, lower water treatment costs downstream, increased tourism activity and higher commercial footfall could deliver returns that far exceed the initial outlay.

By Ifham Nizam

Business

Expectation of positive Q3 corporate results jerks bourse to life

CSE activities kicked off on a negative note initially but later experienced some recovery yesterday because most investors were anticipating positive third quarter result shortly, market analysts said.

Amid those developments, the market indicated mixed reactions. The All Share Price Index went down by 4.13 points, while the S and P SL20 rose by 14.02 points. Turnover stood at Rs 5.17 billion with 11 crossings.

Top seven crossings were reported in Renuka Holdings where eight million shares crossed to the tune of Rs 324 million; its shares traded at Rs 40.50, Tokyo Cement one million shares crossed to the tune of Rs 113 million; its shares traded at Rs 113, Distilleries 1.85 million shares crossed for Rs 111 million; its shares traded at Rs 60, ACL Cables 500,000 shares crossed for Rs 51.5 million, its shares sold at Rs 103 Chevron Lubricants 250,000 shares crossed for Rs 47.5 million; its shares traded at Rs 190, Ambeon Capital 738600 shares crossed at Rs 40.50 each and Melstacope 150,000 shares crossed for Rs 27 million; its shares traded at Rs 180.

In the retail market top seven companies that mainly contributed to the turnover were; Colombo Dockyard Rs 1.26 billion (12 million shares traded), ACL Cables Rs 348 million (3.3 million shares traded), HNB (Non-Voting) Rs 152 million (425,000 shares traded), Hayleys Rs 109 million (507,000 shares traded), Tokyo Cement (Non-Voting) Rs 94 million (989,000 shares traded) Lanka Realty Investments Rs 80 million (1.6 million shares traded) and Sampath Bank Rs 77 million (498,000 shares traded). During the day 135 million share volumes changed hands in 38398 transactions.

It is said that manufacturing sector counters, especially Tokyo Cement and ACL Cables, performed well. Further, Colombo Dockyard became the most preferred share for investors. The Banking sector also performed well.

Browns Beach Hotels said that the company will delist from the CSE, having made arrangements with majority shareholders Melstacope and Aitken Spence Hotel Holdings to buy back shares from minority shareholders at an exit offer price of Rs 30.

Yesterday the rupee was quoted at Rs 309.75/85 to the US dollar in the spot market, from Rs 309.72/77 the previous day, having depreciated in recent weeks, dealers said, while bond yields were down.

A bond maturing on 15.05.2026 was quoted at 8.25/35 percent.

A bond maturing on 15.02.2028 was quoted at 9.00/10 percent, down from 9.05/10 percent.

A bond maturing on 15.12.2029 was quoted at 9.65/70 percent, up from 9.65/69 percent.

A bond maturing on 01.03.2030 was quoted at 9.72/75 percent, from 9.70/76 percent.

A bond maturing on 15.03.2031 was quoted at 9.95/10.00 percent, down from 10.00/10 percent.

A bond maturing on 01.10.2032 was quoted at 10.30/50 percent.

A bond maturing on 01.06.2033 was quoted at 10.72/75 percent, down from 10.70/80 percent.

A bond maturing on 15.06.2035 closed at 11.05/10 percent, down from 11.07/11 percent.

The telegraphic transfer rates for the American dollar were 306.2500 buying, 313.2500 selling; the British pound was 409.9898 buying, and 421.3080 selling, and the euro was 354.1773 buying, 365.5655 selling.

By Hiran H Senewiratne

Business

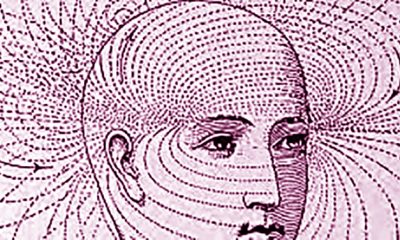

Ceylon Theatres and British Council present National Theatre Live’s ‘Hamlet’

Ceylon Theatres Limited, in partnership with British Council, is proud to present the first ever screening of National Theatre (NT) Live’s Hamlet starring Hiran Abeysekara in Asia. The first screening will happen at Regal Cinema in Dematagoda (Colombo 9) at 5:30 pm on Sunday, 25 January. Sri Lankan actor Hiran Abeysekera stars in the title role—the first Asian actor to play Hamlet in a National Theatre production.

For Sri Lankan audiences, this screening is both a celebration and a homecoming. It reflects the British Council’s long-standing commitment to nurturing creative talent, widening access to world-class culture, and building deep, people-to-people connections between Sri Lanka and the United Kingdom through theatre and the creative arts. To celebrate the inaugural screening, the British Council is inviting winners and runners-up of the All-Island Inter-School Shakespeare Drama Competition, alongside drama teachers and university actors, to attend the premiere.

Further details on screening dates, venues, and ticketing can be found at: https://ceylontheatres.com/ and on the British Council Instagram page https://www.instagram.com/britishcouncilsrilanka/ or call: 0766192370

-

Editorial3 days ago

Editorial3 days agoIllusory rule of law

-

News4 days ago

News4 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business6 days ago

Business6 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial4 days ago

Editorial4 days agoCrime and cops

-

Features3 days ago

Features3 days agoDaydreams on a winter’s day

-

Editorial5 days ago

Editorial5 days agoThe Chakka Clash

-

Features3 days ago

Features3 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features2 days ago

Features2 days agoExtended mind thesis:A Buddhist perspective