Business

Govt. publishes invitation to pre-qualify and bid for 51.34 percent stake in LHCL

By Hiran H. Senewiratne

The government has published the invitation to pre-qualify and bid for a 51.34 percent stake in Lanka Hospitals Corporation (LHCL). The divestiture will be completed through a two-stage competitive bidding process.

International Finance Corporation (IFC), a member of the World Bank Group, is advising the government on the sale of LHCL and several state owned entities as a part of the SOE reforms process. This has resulted in an appreciation of its shares in the CSE, market analysts said.

It is said that the share price gained on the previous day by 7 percent or Rs. 8 to close at Rs. 120.50, following the calling for Expression of Interests from interested parties for the government stake in the entity.

The gain was on thin volumes of 209,777 shares changing hands via 392 trades for Rs. 25 million.LHCL’s highest share price in the past 52 weeks was Rs. 139 and the lowest was Rs. 86. Last week it declined by Rs. 7.25 to close at Rs. 106.50.

Amid those developments, stock market activities were positive yesterday with a healthy turnover. Both indices moved upwards after experiencing a dip in the last few days. The stock market has suffered a Rs. 254 billion loss of value so far in October due to negative investor sentiments over the lack of credible progress in resolving some major macroeconomic issues.

Both indices moved upwards. The All- Share Price Index was up by 33.26 points and S and P SL-20 up by 18.32 points. Turnover stood at Rs 1.1 billion with two crossings. Those crossings were reported in RIL Properties, which crossed 20 million shares to the tune of Rs 130 million; its shares traded at Rs 6.50 and NTB 200,000 shares crossed for Rs 20 million; its shares traded at Rs 100.

In the retail market top seven companies that mainly contributed to the turnover were; First Capital Holdings Rs 158 million (three million shares traded), First Capital Treasuries Rs 113 million (2.7 million shares traded), JKH Rs 85.5 million (448,000 shares traded), Lanka IOC Rs 81.3 million (820,000 shares traded), LB Finance Rs 54.9 million (899,000 shares traded), Capital Alliance Rs 38.6 million (656,0000 shares traded) and Expolanka Holdings Rs 36.7 million (294,000 shares traded). During the day 50.2 million share volumes changed hands in 12000 transactions.

It is said high net worth and institutional investor participation was noted in C T Holdings, JKH and LB Finance.Mixed interest was observed in First Capital Treasuries, Lanka IOC and First Capital Holdings, while retail interest was noted in Browns Investments, Eden Hotel Lanka rights and UB Finance Company.

The Diversified Financials sector was the top contributor to the market turnover (due to First Capital Treasuries and LB Finance), while the sector index lost 0.70 percent. The share price of First Capital Treasuries moved down by 30 cents to Rs. 40.70. The share price of LB Finance appreciated by 30 cents to close at Rs. 61.30.

The Capital Goods sector was the second highest contributor to the market turnover (due to JKH), while the sector index decreased by 0.48%. The share price of JKH gained 25 cents to reach Rs. 190.25.Yesterday, the US dollar buying rate was Rs 319.29 and selling rate Rs 329.81.

Business

Beira Lake restoration, ‘a crucial urban environmental intervention’

Sri Lanka’s decision to invest Rs. 2.5 billion in restoring the heavily polluted Beira Lake marks one of the most significant urban environmental interventions in recent years, underscoring a growing recognition that ecological rehabilitation is also an economic imperative.

The multi-pronged project—covering the closure of illegal sewage discharge points, large-scale dredging, and the installation of aeration systems—is expected to not only revive aquatic life but also unlock commercial, tourism and real estate value in the heart of Colombo.

Officials say the initiative is designed to transform Beira Lake from a long-neglected liability into a productive urban asset.

A senior official from the Ministry of Environment told The Island Financial Review that untreated wastewater and illegal sewer connections had been the primary contributors to the lake’s degradation for decades. “Closing these illegal sewage points is the most critical intervention. Without that, any dredging or aeration would only offer temporary relief, the official said, adding that enforcement will be carried out in coordination with the Colombo Municipal Council (CMC) and other regulatory agencies.

From a business perspective, the clean-up is being viewed as a catalyst for urban regeneration. Urban Development Authority (UDA) sources noted that a healthier Beira Lake would significantly enhance the attractiveness of surrounding commercial developments, hospitality projects and public spaces. “Environmental remediation directly impacts land values and investor confidence. A clean, living lake changes the entire economic profile of the area, an UDA official said.

The dredging component of the project is aimed at removing decades of accumulated sludge, which has reduced water depth and contributed to foul odours and fish die-offs. According to officials involved in project planning, the dredged material will be disposed of following environmental guidelines to avoid secondary pollution risks—an issue that has undermined similar efforts in the past.

Meanwhile, the installation of modern aerators is expected to improve dissolved oxygen levels, a key requirement for sustaining fish and other aquatic organisms. “Restoring aquatic life is not just about biodiversity; it is about creating a water body that can safely support recreational activities and public engagement, a senior CMC engineer explained.

Economists point out that the Rs. 2.5 billion allocation, while substantial, should be seen against the long-term cost savings and revenue potential. Reduced public health risks, lower water treatment costs downstream, increased tourism activity and higher commercial footfall could deliver returns that far exceed the initial outlay.

By Ifham Nizam

Business

Expectation of positive Q3 corporate results jerks bourse to life

CSE activities kicked off on a negative note initially but later experienced some recovery yesterday because most investors were anticipating positive third quarter result shortly, market analysts said.

Amid those developments, the market indicated mixed reactions. The All Share Price Index went down by 4.13 points, while the S and P SL20 rose by 14.02 points. Turnover stood at Rs 5.17 billion with 11 crossings.

Top seven crossings were reported in Renuka Holdings where eight million shares crossed to the tune of Rs 324 million; its shares traded at Rs 40.50, Tokyo Cement one million shares crossed to the tune of Rs 113 million; its shares traded at Rs 113, Distilleries 1.85 million shares crossed for Rs 111 million; its shares traded at Rs 60, ACL Cables 500,000 shares crossed for Rs 51.5 million, its shares sold at Rs 103 Chevron Lubricants 250,000 shares crossed for Rs 47.5 million; its shares traded at Rs 190, Ambeon Capital 738600 shares crossed at Rs 40.50 each and Melstacope 150,000 shares crossed for Rs 27 million; its shares traded at Rs 180.

In the retail market top seven companies that mainly contributed to the turnover were; Colombo Dockyard Rs 1.26 billion (12 million shares traded), ACL Cables Rs 348 million (3.3 million shares traded), HNB (Non-Voting) Rs 152 million (425,000 shares traded), Hayleys Rs 109 million (507,000 shares traded), Tokyo Cement (Non-Voting) Rs 94 million (989,000 shares traded) Lanka Realty Investments Rs 80 million (1.6 million shares traded) and Sampath Bank Rs 77 million (498,000 shares traded). During the day 135 million share volumes changed hands in 38398 transactions.

It is said that manufacturing sector counters, especially Tokyo Cement and ACL Cables, performed well. Further, Colombo Dockyard became the most preferred share for investors. The Banking sector also performed well.

Browns Beach Hotels said that the company will delist from the CSE, having made arrangements with majority shareholders Melstacope and Aitken Spence Hotel Holdings to buy back shares from minority shareholders at an exit offer price of Rs 30.

Yesterday the rupee was quoted at Rs 309.75/85 to the US dollar in the spot market, from Rs 309.72/77 the previous day, having depreciated in recent weeks, dealers said, while bond yields were down.

A bond maturing on 15.05.2026 was quoted at 8.25/35 percent.

A bond maturing on 15.02.2028 was quoted at 9.00/10 percent, down from 9.05/10 percent.

A bond maturing on 15.12.2029 was quoted at 9.65/70 percent, up from 9.65/69 percent.

A bond maturing on 01.03.2030 was quoted at 9.72/75 percent, from 9.70/76 percent.

A bond maturing on 15.03.2031 was quoted at 9.95/10.00 percent, down from 10.00/10 percent.

A bond maturing on 01.10.2032 was quoted at 10.30/50 percent.

A bond maturing on 01.06.2033 was quoted at 10.72/75 percent, down from 10.70/80 percent.

A bond maturing on 15.06.2035 closed at 11.05/10 percent, down from 11.07/11 percent.

The telegraphic transfer rates for the American dollar were 306.2500 buying, 313.2500 selling; the British pound was 409.9898 buying, and 421.3080 selling, and the euro was 354.1773 buying, 365.5655 selling.

By Hiran H Senewiratne

Business

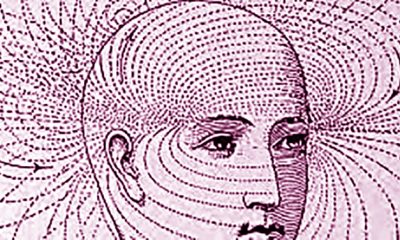

Ceylon Theatres and British Council present National Theatre Live’s ‘Hamlet’

Ceylon Theatres Limited, in partnership with British Council, is proud to present the first ever screening of National Theatre (NT) Live’s Hamlet starring Hiran Abeysekara in Asia. The first screening will happen at Regal Cinema in Dematagoda (Colombo 9) at 5:30 pm on Sunday, 25 January. Sri Lankan actor Hiran Abeysekera stars in the title role—the first Asian actor to play Hamlet in a National Theatre production.

For Sri Lankan audiences, this screening is both a celebration and a homecoming. It reflects the British Council’s long-standing commitment to nurturing creative talent, widening access to world-class culture, and building deep, people-to-people connections between Sri Lanka and the United Kingdom through theatre and the creative arts. To celebrate the inaugural screening, the British Council is inviting winners and runners-up of the All-Island Inter-School Shakespeare Drama Competition, alongside drama teachers and university actors, to attend the premiere.

Further details on screening dates, venues, and ticketing can be found at: https://ceylontheatres.com/ and on the British Council Instagram page https://www.instagram.com/britishcouncilsrilanka/ or call: 0766192370

-

Editorial3 days ago

Editorial3 days agoIllusory rule of law

-

News4 days ago

News4 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business6 days ago

Business6 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial4 days ago

Editorial4 days agoCrime and cops

-

Features3 days ago

Features3 days agoDaydreams on a winter’s day

-

Editorial5 days ago

Editorial5 days agoThe Chakka Clash

-

Features3 days ago

Features3 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features2 days ago

Features2 days agoExtended mind thesis:A Buddhist perspective