Opinion

Effort by All Ceylon Buddhist Congress to help govt. of Sri Lanka escape from dollar trap

By DR L M K Tillekeratne

Chairman of the National Development Committee of the ACBC

It is a well-known fact that one the problems faced by Sri Lanka today is caused mainly by shortage of electricity for domestic purposes and industries. Three decades ago, only 20 % of houses had electricity for lighting. But, today over 95 % of houses in the whole country have electricity. Total electric power the country needs is about 2,750 MW a day. In order to generate 65% of it by using diesel and coal, the cost involved now is tremendous and that is the main reason for the creation of dollar shortage in the country. Besides, when Russia’s invasion in Ukraine six months ago equally attributed to the fuel shortage in the whole world thus creating enormous social and economic impacts, and petroleum prices in the Sri Lankan market increased by over 300%, which is bound to increase further at an alarming pace.However, while having enough bright sunlight all over Sri Lanka throughout the year to generate solar power and enough wind power particularly in areas like Mannar and Puttlam districts, only 40% of our electricity requirements are supplied by non-conventional renewable energy, while 65% of the balance need is produced by burning imported fuel oil and coal at a cost of Rs 80 to 100 per unit, thereby subjecting the environment of the country to a great threat by increasing the level of Green House gases to our atmosphere. Further, this conversion of generating electricity by burning oil and coal thereby lowering the liberation of Green House gases to the atmosphere will enable Sri Lanka to earn huge amount of Dollars by trading Carbon.

According to energy experts, it is expected to reduce this 65% of the energy requirement by burning fuel oil and coal down to 40% thus using more renewable energy by year 2030, thereby lowering the cost of producing a unit of electricity to about Rs 35.00.

Surprisingly, according to hydro power generating experts, there are over 400 streams and small waterfalls distributed all over the country without exploiting yet for setting up of mini hydro power generators. If these over 400 water sources are converted to hydro power generators producing not less than 1000 mega Watts of power are started, and by converting the wind power and solar power available in unlimited quantities, Sri Lankans can earn more foreign exchange by selling the extra electric power available to neighboring countries.

Hence, at present most of the dollars available are spent for importing diesel and coal to the tune of USD 6,000 million per annum. It should be mentioned here that out of this USD 6000 million, about 4,500 million is used for transport leaving a balance of USD 1,500 million to import fuel oil for power generation. According to energy experts, USD 1,500 million could easily be saved here for the other priority areas of the country, if mini hydro power generators are set up in those streams which are idling now. However, sadly no payments have been made for the power generated and supplied to the national grid by the few existing mini hydro power plants; they have supplied power to the tune of over Rs 20 billion for several months and hence some of them have been compelled to close their power plants.

Based on this objective, the ACBC, the premier Buddhist and Social organization in the country realized the need to create awareness of the options available and organized an exhibition of inventions last week on generating power utilizing those three natural sources and to display the public as to how they could conserve scarcely available electricity thereby saving extra money spent for generating power wasted due to lack of knowledge.

This event was not merely organized as an exhibition but to showcase the new inventions to the public, but as a workshop for the interested water source owners to select the appropriate invention suit to them best according to the conditions available in his source of water/ solar power/ or wind. Once the prospective investor identifies the suitable invention ideally needed to his needs, the power expert committee of the ACBC is planning to provide them with every technical support they need to do the feasibility study and even to the level of selecting machines etc. up to the level of setting up the complete power station. Further, the Bank of Ceylon has already agreed to provide them with a soft loan of Rs 3 million at 16% interest rate for setting up of the power unit.

It should be mentioned here with appreciation that the Ministry of Power and Energy has already decided to pay Rs 35 per unit of renewable energy produced from the 17.39 paid previously and also to pay all the back accumulated payments due to power generators. ACBC takes an innocent pride to place on record that the power generation project designed and launched by the expert panel members of the ACBC consists of renowned scientists and engineers who have earned distinctive reputation in their respective disciplines. This particular project perhaps is one of the key projects engineered by the ACBC in its proudest history of over 100 years with a view to finding solutions to the macro-economic issues whilst enhancing income generation at the peripheral level so that it would provide a helping hand to reduce the poverty level of the country.

With these important decisions taken by the government to encourage renewable energy production in all unexploited natural energy sources, it is not a difficult task to generate nearly 1000 MW of power within the next two to three years. Minimizing energy wastes by households and industries through the educational campaign initiate by the ACBC recently, another sizable saving of electrical energy saving could be achieved. Hence, the Development committee of the ACBC is optimistic in saving substantial portion of the dollars spent on Oil and Coal imports thereby making savings available in the country to help Sri Lanka to be the Wonder of Asia by year 2050.

Opinion

Sri Lanka Cricket needs a bitter pill

A systemic diagnosis of a fading legacy

The outcome of the 2026 T20 World Cup, coupled with the trajectory of the sport in recent years, provides harrowing evidence that Sri Lankan cricket is suffering from a terminal malignancy.The Doomsday clock for Sri Lankan cricket has not just started ticking—it has reached its final hour.

Therefore this note is written to call the attention of the cricketing elite who love the sport.

The current state of affairs suggests a pathology so deep-seated that conventional remedies—be it revolving-door coaching changes or fleeting, opportunistic victories—can no longer arrest its spread.

What we are witnessing is not a mere slump in form or a temporary lapse in rhythm; it is a profound systemic collapse that threatens the very foundation of our national pastime.

The Illusion of Recovery: The “Sanath Factor” as Palliative Care:

Since late 2024, the appointment of Sanath Jayasuriya as Head Coach injected a much-needed surge of adrenaline into the national side.

Statistically, the highlights were historic: a first ODI series win against India in 27 years, a Test victory at The Oval after a decade, and a clinical 2-0 whitewash of New Zealand.

However, a data-driven autopsy reveals that these will be “palliative” successes rather than a cure.

Under Jayasuriya’s tenure, the team maintained a win rate of approximately 50 percent (29 wins in 60 matches).

While analysts optimistically labeled this a “transitional phase,” the recent T20 series against England and Pakistan exposed the raw truth: in high-pressure “crunch” moments, the team’s performance metrics—specifically Strike Rate (SR) and Fielding Efficiency—regress to amateur levels.

We are not transitioning; we are stagnating in a professional abyss.

The Scientific Gap:

Why India and Australia Lead

The disparity between Sri Lanka and global giants such as the BCCI and Cricket Australia (CA) is now rooted in High-Performance Science and Algorithmic Management.

Predictive Analytics & Biometrics

In Australia, fast bowlers utilise wearable sensors to monitor workload and biomechanical stress.

AI models analyse this data to predict stress fractures before they occur.

Sri Lanka, conversely, continues to cycle through injured pacemen with no predictive oversight.

Virtual Reality (VR) Training

While Australian batters use VR to simulate the trajectories of elite global bowlers, Sri Lankan players remain tethered to traditional net sessions on deteriorating domestic tracks.

Data-Driven Talent Identification:

India’s “transmission system” utilises automated data analysis across thousands of domestic matches to identify players who thrive under specific pressure indices.

In Sri Lanka, 85 percent of national talent still originates from just four districts—a statistical failure in talent scouting and geographic expansion.

Infrastructure vs. Intellect:

A Misallocation of Capital

Sri Lanka Cricket (SLC) boasts massive reserves, yet its investment strategy is fundamentally flawed.

Capital is funneled into “bricks and mortar”—grand stadiums and administrative buildings—rather than the human capital of the sport.

We build colosseums but fail to train the gladiators.

The domestic structure remains a “spin trap.”

By producing “rank turners” to suit club politics, we have effectively de-skilled our batters against elite pace and rendered our spinners ineffective on the flat, true wickets required for international success.

The Leadership Deficit:

A Failure of Succession Planning

The crisis of leadership post-Sangakkara and Mahela is a byproduct of poor “Succession Science.”

Australia maintains a “Culture of Continuity,” backing leadership even through lean periods to ensure stability.

India employs a rigid “Succession Roadmap,” ensuring the next generation is integrated into the system long before the veterans depart.

In contrast, SLC operates on a “carousel of convenience,” changing captains and coaches to distract from administrative failures.

This lack of imaginative management stems from a low literacy in modern Sports Governance.

From a philosophical perspective, our established cricketing traditions have failed to absorb the antithesis of the modern, hyper-professionalized global game.

As a result, a truly modern Sri Lankan brand of cricket has failed to materialise.

Instead, we are trapped in what is called a “Static Synthesis,” where the administration clings to the glories of 1996 and 2014 as a shield against the necessity of change.

This is not a transition; it is a refusal to evolve

We are witnessing the alienation of the sport from its people, where the “Master” (the administration) has become detached from the “Slave” (the grassroots talent and the fans).

The Verdict:

A National Emergency

The “cancer” in Sri Lankan cricket is a trifecta of political interference, irrational management, and a refusal to embrace the Fourth Industrial Revolution (AI, VR, and Big Data).

As someone who contributed to the formation of the Sri Lankan Professional Cricketers’ Association, I see the current trajectory as a betrayal of the players’ potential and the nation’s heritage.

Sri Lanka Cricket does not need another “review committee” or a new coach to act as a human shield for the board.

It needs a “Bitter Pill”—an aggressive, independent restructuring that prioritises scientific professionalisation over cronyism.

Without this, our cricket will remain at the bottom of the well, looking up at a world that has moved light-years ahead.

Shiral Lakthilaka

LLB, LLM/MA

Attorney-at-Law

Former Advisor to H.E. the President of Sri Lanka

Former Member of the Western Provincial Council

Executive Committee member of the Asian Social Democratic Political Parities

Opinion

Unable to forget the dead

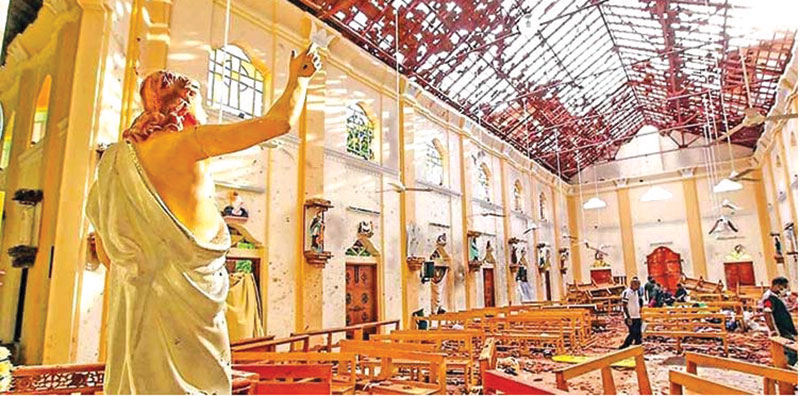

The present government was elected on a commitment to prioritise truth, justice, and accountability to which it is being held by the Catholic Church in particular. This may account for the renewed momentum in investigations into the 2019 Easter Sunday bombings which was one of the gravest acts of violence in Sri Lanka’s recent history. A story on the recent developments in the Easter Sunday bombing investigation refers to a father whose six year old daughter died in the explosions that killed 279 people. The news report quotes him saying, “If she were alive today, she would be 13. You cannot suppress the truth for long. Now it’s starting to come out. We want the full truth and justice. Our children did not die in vain.” https://www.ucanews.com/news/sri-lanka-arrests-ex-intelligence-chief-over-2019-easter-bombings/112031 His words capture the ache of continuing grief and the stubborn refusal to let memory fade into oblivion.

The desire for justice, especially for loved ones killed by the actions or omissions of others, is universal. It is seen in the mothers of the North, in Jaffna and other towns, who have sat by the roadside year after year asking what happened to their children who disappeared in 2009 when the war ended or even earlier as when 158 people were taken from the temporary refugee camp in Eastern University in Vantharumoolai, Batticaloa, on September 5, 1990 never to be seen again. The reality, however, is that the suffering of individuals is easily submerged in the larger schemes of power. Governments are concerned about retaining political power, security forces close ranks, and societies are encouraged to forget in the name of stability, economic recovery, or national pride.

In Sri Lanka that forgetting has not taken place. Due to the sustained efforts of the Catholic Church and the families of the victims, the demand for truth and justice regarding the Easter Sunday attacks has not gone away. It has persisted through indifference, hostility, and at times intimidation. It is perhaps this persistence that has made the arrest of retired Major General Suresh Sallay a significant moment for those who have not forgotten. The arrest of General Sallay, who once headed military intelligence and later the State Intelligence Service, has been controversial. He is widely credited with playing a significant role in dismantling the LTTE’s networks and is regarded by some as one of the country’s most capable intelligence officers.

Persisting Doubts

From the very day of the Easter bombings in April 2019, there has been a doubt that the attacks were too meticulously planned to have been carried out solely by a ragtag group of youth or radicalised men acting on their own. The suspicion of a “grand conspiracy” has existed from the beginning and was voiced even by senior legal officials involved in the investigations. The attacks were claimed to be staged by ISIS, whose leader issued a statement claiming credit for them as part of a global ideological struggle. But this did not answer the central question about why known Muslim extremists were not apprehended when the war with the LTTE had ended many years before and they were no longer needed as a counterforce and why repeated intelligence warnings from India were ignored.

For seven years successive governments failed to move beyond the finding of negligence on the part of those who were in charge of national security. Investigations stalled and key questions remained unanswered. A parliamentary committee questioned whether sections within the intelligence community, supported by some politicians, sought to undermine investigations.

The Supreme Court held several government leaders and senior officials guilty of negligence and dereliction of duty, imposing heavy fines. That judgment established that the state failed its citizens. But negligence is one thing. Deliberate connivance is another. The present government was elected in 2024 on a promise that the truth behind the Easter attacks would be uncovered. President Anura Kumara Dissanayake committed himself publicly to accountability.

As several foreigners including US and UK citizens also lost their lives in the bombings, foreign intelligence agencies from the United States, the United Kingdom and other countries came to Sri Lanka soon after the attacks to conduct their own inquiries. The US has filed charges against three Sri Lankans. So far, international findings have not identified an external mastermind directing the plot from abroad. The focus remains on possible failures or complicity within.

Indeed, by arresting a former intelligence head who was widely credited with playing a significant role in dismantling the LTTE, the government has taken a considerable political risk. Opposition politicians and nationalist voices have framed the arrest as a betrayal of the security forces and an attempt to appease external actors. Others have suggested that it is a diversion from present economic or political challenges.

Beyond Easter

The Catholic Church, which most directly represents the victims of the Easter attacks, has expressed support for the renewed investigations. The involvement of the Church has helped to take the issue beyond the realm of partisan party politics and to one of the search for truth and justice. But this search for the truth cannot be limited to the Easter bombings. It needs to extend beyond this particular bombing, heinous though it was. A state that investigates only one atrocity while ignoring others signals that some lives matter more than others. That is a dangerous message in a country that has been divided along ethnic and religious lines. Truth seeking is not a betrayal of those who fought in difficult circumstances. It is an affirmation that the rule of law applies to all. It strengthens institutions by cleansing them of suspicion. It restores trust between citizens and the state.

Sri Lanka’s modern history is marked by many unresolved crimes. Large scale killings, enforced disappearances, and extrajudicial actions during the period of the ethnic war remain unaccounted for. There were churches and orphanages bombed during the war. There were hundreds taken from camps or who surrendered only to disappear forever. Thousands of families continue to live without answers. The mothers of the disappeared have not gone away.

They sit in the heat and rain because they cannot forget their children and want to know what happened to them. Their persistence mirrors that of the Easter victims’ families. Both ask the same question. Who was responsible and why. For too long Sri Lanka has avoided these questions, arguing that reopening the past would endanger stability and that the path to success is to focus on the future.

But memory and the desire for truth and justice does not die. By prioritising truth and justice as governing principles, the government can begin to restore faith in public institutions. This requires investigating what happened and why accountability was denied. Healing the wounds for Sri Lanka does not lie in forgetting the dead. Justice is not only punitive. It is also restorative. It allows societies to move forward without carrying unspoken burdens.

The Easter Sunday victims, the disappeared of the war years, and all those lost to political violence belong to the same community of Sri Lankan citizens that the government has pledged to treat equally. This calls for a consistent standard of truth. By pursuing the Easter investigation wherever it leads and by reopening and resolving the unresolved crimes of the war years, the government can set the country on a path of redemption.

by Jehan Perera

Opinion

Sri Lanka – world’s worst facilities for cricket fans

Having watched Sri Lanka play in multiple World Cups (both formats) in six countries over the past 15 years, I regret that the worst facilities for fans are in the ongoing edition in Sri Lanka. I’m in my mid 60s and over many decades have watched our team play in every international cricket venue in Sri Lanka and several abroad. Even in developing countries such as in the Caribbean and Bangladesh, where I saw us triumph in 2014, there seems to be more concern for ordinary spectators and their basic expectations.

On this occasion, I travelled from the other side of the world and had to plan ahead. In the past editions, I recall tickets going on sale well ahead, but on this occasion, only a couple of months for some games and a couple of weeks for others. Even then, only low priced categories were released initially and I snapped them up, only to find better seats released a few days later. When I tried to buy those, I was told by the system that the maximum ticket quota is exceeded. I had to ask a friend to buy the tickets for me and transfer, hence paying multiple times for the same game. Why can’t all tickets be made available transparently to all fans at one time and sold to the 1st comers? Is there some racket in sending tickets “underground” initially to be resold at higher prices or given away free to cronies? I am tempted to believe this as in smaller grounds like P Sara and Galle, I have found in past bilateral tours such as vs England, where tickets are in high demand, the better tickets are never offered for public sale. But at the venue, I find many empty good seats. I understand that hundreds of tickets are given away as compliments to past cricketers families and friends and families of SLC big wigs, who routinely never turn up, depriving the opportunity to fans who are ready to pay for those same seats.

The most agonising part is entering and leaving the grounds which at both Premadasa and Pallekele this year was an absolute nightmare, with high possibilities of stampedes causing serious injuries or worse. Is the ICC not concerned – at least for the sake of avoiding legal liabilities? In past decades I remember long metal barricaded pathways set up a little away from the gates to force fans to queue up for body search, etc. This ensures more orderly entry as Sri Lankans are notorious for queue-jumping. Instead this time round it was a free-for-all for. The next shock is upon entry; there are clearly more people in each stand than the available seats. If you don’t arrive early and grab a seat, you end up standing in the aisles or stairs with an obstructed view and crushed on all sides. I saw some elderly foreign fans walk off half way in disgust. There was a time when in most stands at the R. Premadasa Stadium, a ticket guaranteed a seat. Now, it is not so even in the highest priced Grandstand. Seat numbers have been obliterated. With all the financial stability of the SLC that they claim in media, can’t they afford to repaint the seat numbers and set up some physical queuing pathways? Or is it that they are simply unconcerned about the suffering of ordinary fans? Or do they prefer free seating so that it’s easier to admit favoured individuals free of charge? At a world cup in New Zealand, I observed they had engaged many volunteers, young and old to act as guides/ ushers in and around the stadium. This is a common practice even in Olympics. Apart from trips for multiple board members, their families and other companions, can’t SLC spend a little to send some operational level staff to study and apply the best practices of other member countries to improve things at our local facilities? Moving onto toilets, without exaggeration, Pallekelle had 3 inches of filthy water (maybe urine) on the men’s toilet floor to wade through. In Sri Lanka, it is essential to have the constant presence of several janitors to ensure clean toilets. There wasn’t even one in sight. At the previous edition of this tournament in St. Lucia, West Indies, a small island where Sri Lanka played, I found impeccably clean toilets at the Gros Islet grounds.

Food and beverages is the next bone of contention. Quality and range offered was pathetic compared to the past in Sri Lanka and certainly compared to world cup venues elsewhere. Only plain instant noodle, hot dogs and some Chinese Rolls were generally available and some of the vendor stalls were unbranded, causing doubt in the minds of about the origin and quality of the offerings. Beer was the next scam, at Premadasa only Corona R. 2000 per cup and Budweiser Rs, 1500 were on offer, both unknown brands to most Sri Lankans. Budweiser also ran out early in the match, leaving a Hobson’s choice for fans. Apparently, this was a global sponsorship deal, but strangely at Pallekele, there was a small, unbranded shed in a corner selling Beer (presumably local) at Rs. 500. Was this something underhand? SLC Office bearers boast of their good relationships and having influence at the top levels within ICC. They also sit on their Boards and committees. Can’t they influence better deals on offerings and prices appropriate to local crowds? Finally, at the end of many hours of suffering, we come to the chaotic exit with everybody pouring out into narrow highly populated streets around the Premadasa stadium. With all the millions they are reportedly raking in, can’t SLC attempt to collaborate with the local authorities and acquire some of the surrounding lands, offering the residents attractive deals. Sri Lanka already has a very high number of stadia per capita. Building more and more may be lucrative for some, but investing in improving say three select existing venues to international standards in different parts of the country is the need of the hour. Once I took a flight via Mattala to watch Sri Lanka play at the Sooriyawewa stadium. Built in the middle of nowhere, with no surrounding infrastructure, it fell into total neglect just a few years after it was opened. When thousands of spectators attempt to find their way home at once, it can be anticipated that all modes of public transport including Uber and Pickme get overwhelmed. I had to walk about three kilometres and try repeatedly for almost one hour to secure a ride. After watching Sri Lanka play a world cup match at Sydney Cricket Ground, (capacity 50,000) we were able to calmly walk about 15 minutes to a long line of parked busses which took us painlessly to different points of the city. At the Oval, London, three underground tube stations are within 15 m walking distance and extra trains are deployed to handle the load after matches. Are SLC officers too busy to engage in some discussion with Public and Private sector transportation providers to make some special arrangement for the weary cricket fans?

I bought tickets to watch Sri Lanka play Pakistan in their final game in this tournament, but decided that the hardship and risks of bodily injury to be endured to support our team was not worthwhile at my age. Since that triumphant day in Dhaka in 2014, not only the standard of our Cricket but the facilities and basic comforts expected by ordinary fans have sadly declined drastically.

Sujiva Dewaraja

sujiva.dewaraja@gmail.com

-

Opinion4 days ago

Opinion4 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features4 days ago

Features4 days agoAn innocent bystander or a passive onlooker?

-

Features5 days ago

Features5 days agoRatmalana Airport: The Truth, The Whole Truth, And Nothing But The Truth

-

Features6 days ago

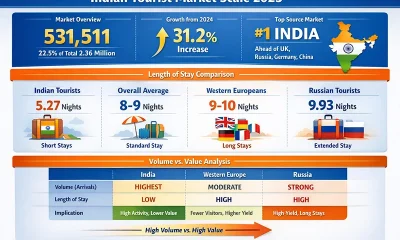

Features6 days agoBuilding on Sand: The Indian market trap

-

Opinion6 days ago

Opinion6 days agoFuture must be won

-

Business6 days ago

Business6 days agoDialog partners with Xiaomi to introduce Redmi Note 15 5G Series in Sri Lanka

-

Business5 days ago

Business5 days agoIRCSL transforms Sri Lanka’s insurance industry with first-ever Centralized Insurance Data Repository

-

Opinion1 day ago

Opinion1 day agoSri Lanka – world’s worst facilities for cricket fans