Business

Dhammika’s seven-pronged strategy to overcome SL’s foreign exchange crisis

Mr. Dhammika Perera, the controlling shareholder of the Hayleys group and a multitude of other listed companies who is widely speculated to be the country’s wealthiest individual, has proposed a seven-pronged strategy to overcome Sri Lanka’s foreign exchange crisis in a wide-ranging interview with the Irida Divayina Sangrahaya.

In terms of market value of his quoted share portfolio he will be among the wealthiest, if not the wealthiest in the country, analysts say. He is also on record claiming he’s the biggest taxpayer here but it is unclear whether this is in corporate or personal terms. Most published ‘rich lists’ in SL calculate wealth on market value of quoted shares. But many other factors including real estate holdings, shares of unquoted companies and much more should be included in any accurate computation.

Perera who says he can identify “a multitude of ways” to earn and save dollars says in the interview that “it is only now that everyone feels earning dollars is important.”

“For the last 73 years, the country has not had a plan to earn foreign currency. Therefore, only now when an issue arises, a country like ours wants to earn dollars inside the country. Previously, there was no plan to earn dollars for the country. Every year there is a deficit of about US$ 1.8 billion to US$ 2 billion. But a debt of US$ 2 billion sorts out the problem every time. Hence it was not necessary for anyone to generate dollars inside the country. But I think, now the country is most aware of the need to generate dollars in the country, Perera said.

The Dhammika strategy covers a wide compass. This includes building a “University Town” reachable within 30 minute from the BIA with five internationally ranked universities; establishing a budget airline hub; providing opportunities for the private sector educational industry to teach ICT courses; building two hospitals like Singapore’s Mount Elizabeth with internationally recognized facilities; improving the fisheries industry; and making SL the country with Asia’s best business environment; he further sees unexploited potential in the coconut industry.

He has thus outlined his seven prongs:

1. If the government will build a university town consisting of five universities, the country can save US$2.25 billion. Annually, around 25,000 students leave the country to study abroad. Accordingly, a sum of US $ 30,000 per student per year is drawn to foreign countries from Sri Lanka. The government should build a university town consisting of five universities in a location that is reachable within 30 minutes from Bandaranaike International Airport at Katunayake, where 150,000 students can receive education at once (30,000 students at each university).

The management of these five universities should be given to the top five universities with internationally recognized ratings. A programme needs to be initiated to attract 25,000 foreign students a year. Including 25,000 Sri Lankan students altogether for all the 50,000 students, an educational loan scheme needs to be provided from public and private banks at a concessional rate. Due to this programme, 25,000 foreign students will enter our country and this will help the country to have annual earnings of US$ 2.25 billion.

2. Establish a budget airline hub to earn US$2 billion into the country. Fifty percent of the tourists that travel to countries like Thailand, Vietnam, Singapore and Malaysia use budget airline services. In Sri Lanka, out of the total 80,000 hotel rooms, only 20,000 are of a five or four-star class. The remaining 60,000 hotel rooms are three or below star rating. For instant growth in the tourism industry and by aiming for hotel rooms with a three or below star rating, the Ratmalana Airport should be developed as an International Budget Aviation Center as soon as possible. This will attract further around one million tourists into our country apart from the current annual tourist arrivals. From this, the tourism industry can earn US$ 2 billion.

3. By providing the opportunity for the private sector educational institutions to teach ICT courses provided by all state universities in the country, we will be able to earn US$2 billion. Currently, in the job market, there is a high demand for jobs in ICT, engineering and programming fields. By utilizing ICT, engineering and programming courses provided by all state universities in the country a programme to award external degrees needs to be initiated through private educational institutions.

Thereafter, every six months an examination will be conducted according to the examination procedures accepted by the state universities and for those who pass this examination, an external degree will be awarded. By this in the next five years, 200,000 students will be able to obtain the required qualifications for jobs in the IT industry. From which earnings of US$ 2 billion can be achieved.

4. Develop the coconut industry to earn US$ 600 million. Under prevailing conditions, 1.5 million coconut seedlings are planted annually. Under a five-year special government subsidy program, four million coconut seedlings will be planted per year. Accordingly, in total 20 million coconut seedlings will be planted in five years, from which additional 1.2 billion nuts will be added to the coconut related industry. By adding coconuts to the industry at a value of US$ 0.50 per nut, through this five-year plan revenue of US$ 600 million can be achieved.

5. Construct hospitals with internationally recognized facilities to earn US$ 200 million. Building two such hospitals with internationally recognized facilities such as Mount Elizabeth Hospital in Singapore at the expense of the government nd managed by an internationally recognized hospital will limit people from going to foreign countries to obtain medical treatment. By this initiative, the country can save US$ 100 million. Also, through the brand promotion of these hospitals with high quality medical and nursing services in the countries within the region, we will be able to attract foreigners to receive medical treatments in Sri Lanka. This would enable our country to earn US$ 100 million. Therefore, Sri Lanka can earn total revenue of US$ 200 million through this project.

6. Improve the fisheries industry to earn US$ 1 billion. Currently, the annual fish harvest in India is 2,000 Kgs per square kilometer of ocean. The annual fish harvest in Sri Lanka is 900 kgs per square kilometer. Introduce a new multi-purpose licensing system in addition to the existing licensing system for large multi-day vessel owners engaged in deep-sea fishing.

Through this license, they can double the number of multi-day vessels they have, but only one vessel can be anchored in the fisheries harbor at a time. Through this, they can use the additional vessel for deep-sea fishing. Also, a program should be initiated to equip small fishing vessels with GPS-enabled Gemini Fish Finder equipment with four satellites to enable the fishermen to locate shoals of fish in the sea; this will help them to efficiently double their fish harvest. This will result in an additional 500 million kilograms of fish harvest, which could generate US$ 1 billion in revenue.

7. Make Sri Lanka the country with the best business investment environment in Asia to earn US$ 3 billion. By increasing the tax holidays and other benefits available for BOI investors and by improving the rank of Sri Lanka in the ‘Ease of Doing Business Index’ Sri Lanka can earn US$ 1 billion worth of new investment projects.

Within five years, through these new investment projects, US$ 2 billion worth of export revenue can be generated. Therefore, Sri Lanka can generate revenue of US$ 3 billion through these new investment projects.

Business

Oil prices jump above $100 for first time in four years

Global oil prices have jumped above $100 (£75.11) a barrel for the first time since 2022 as the escalating US-Israeli war with Iran has fuelled fears of prolonged disruption to shipments through the Strait of Hormuz.

Iran on Sunday named Mojtaba Khamenei to succeed his father Ali Khamenei as Supreme Leader, signalling that a week into the conflict hardliners remain in charge of the country.

The US and Israel launched fresh waves of airstrikes across Iran over the weekend, hitting multiple targets including oil depots.

Major disruption to energy supplies from the region threatens to push up prices for consumers and businesses around the world.

Early on Monday in Asia, Brent crude was around 15.5% higher at $107.16, while Nymex light sweet was up by more than 17% at $106.77.

Stock markets in the Asia-Pacific region fell sharply in early trading on Monday, with Japan’s Nikkei 225 index down by more than 5% and the ASX 200 in Australia more than 3.5% lower.

Many in the markets predicted that oil would hit the $100 a barrel mark this week.

In the event it took about a minute to jump 10%, and then another 15 minutes to rise a further 10% in early Asian trading.

Last week the markets had been relatively relaxed about the seeming nightmare scenario for millions of barrels of crude and liquefied natural gas trapped in the Gulf, unable or unwilling to transit the Strait of Hormuz.

But the escalations over the weekend, alongside scenes of destruction of energy infrastructure both in Iran and across the Gulf, saw the markets take rapid fright.

The question now is where does this go? Some analysts argue that if the shutdown in the strait lasts until the end of March, we could see record oil prices above $150 a barrel.

The existing rise is likely to further increase petrol prices, and those of important derivative products such as jet fuel and vital precursors for fertilisers.

The physical supplies from the Gulf are mainly consumed in Asia.

Already however there are signs that Asian consumers are bidding up prices for US gas, with some tankers originally heading for Europe turning around in the mid-Atlantic.

US President Donald Trump responded to the jump in prices by saying that short term rises were a “small price to pay” for removing Iran’s nuclear threat.

His energy secretary told US broadcasters on Sunday that Israel, not the US, was targeting Iran’s energy infrastructure, amid some concern about rising domestic pump prices caused by the war.

(BBC)

Business

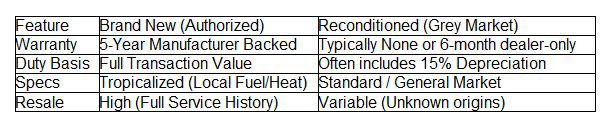

CMTA warns buyers of long-term costs hidden in reconditioned vehicle imports

The Ceylon Motor Traders’ Association (CMTA) has issued a stark cautionary note to prospective vehicle buyers, warning that the initial price advantage of reconditioned imports often masks significant long-term financial risks.

By highlighting a “structural imbalance” in the current duty valuation system – which allows near-identical vehicles to be imported under a 15% automatic depreciation bracket – the CMTA argues that the lack of manufacturer-backed warranties and tropicalised specifications in the grey market could lead to a “reconditioned trap” for unsuspecting consumers. For the savvy buyer, the association suggests that the true cost of ownership is increasingly tilting the scales in favour of brand-new vehicles from authorised agents.

If two identical 2026 models are sitting on different lots, and one is significantly cheaper because it was technically “registered and de-registered” abroad, the frugal buyer’s instinct is to take the discount. But the CMTA argues that this 15% depreciation benefit – intended for genuine used cars – is being leveraged as a loophole for zero-mileage vehicles.

For the savvy buyer, this raises a fundamental question of transparency. If the entry price of a vehicle is built on a “procedural” technicality rather than actual wear and tear, where else is the transparency lacking? Does the lower price reflect a genuine saving passed to the consumer, or does it mask a lack of manufacturer-backed after-sales support?

When a buyer chooses an authorised agent, they are essentially purchasing an insurance policy against the unknown. With a five-year manufacturer warranty, the financial burden of a faulty transmission or a software glitch stays with the global giant that built the car, not the local owner. In an era where vehicles are increasingly “computers on wheels,” the technical specialised tools and genuine parts held by authorised agents are no longer a luxury – they are a necessity for longevity.

The CMTA’s perspective also invites the buyer to look at the “Big Picture.” Every time a vehicle is imported under an under-declared value or an artificial depreciation bracket, it isn’t just a loss for the Treasury; it is a blow to the country’s foreign exchange discipline.

“A savvy buyer today is more informed than ever. They realize that a “cheap” import with no service history and no tropicalised specifications may eventually become a “minus” on the balance sheet. Frequent repairs and lower resale value can quickly evaporate the initial few lakhs saved at the point of purchase. Ultimately, the choice between brand new and used is a choice between certainty and speculation,” the Association says.

The CMTA is advocating for a level playing field where duty is based on true transaction value. Until that day comes, the burden of due diligence rests on the consumer. To be a “savvy buyer” in 2026 means looking past the showroom shine and asking: Who stands behind this car if something goes wrong tomorrow?

In conclusion, CMTA says,” For those seeking long-term peace of mind, the “brand new” path – supported by a transparent duty structure and a solid warranty – remains the gold standard for steering Sri Lanka’s complex automotive landscape.”

Before signing the papers on a reconditioned vehicle, the CMTA suggests buyers evaluate the four “minus” factors against a “brand new” purchase:

By Sanath Nanayakkare

Business

Spa Ceylon launches initiative to support women entrepreneurs

Spa Ceylon has unveiled ‘Her Business Matters’, a nationwide initiative running throughout March 2026 to provide growth support for women-led businesses in Sri Lanka.

The program will select five women entrepreneurs weekly for brand amplification through Spa Ceylon’s marketing reach, influencer partnerships, and community network. Eligible applicants must be female founders manufacturing or producing locally.

Selected participants will attend a development workshop in Colombo featuring business leaders and industry experts covering social media strategy, advertising, compliance, brand positioning, and scaling. Spa Ceylon resource personnel will also host category-specific fringe events.

Co-Founder & Group Director Shalin Balasuriya stated the initiative moves “beyond surface-level marketing” to create lasting community impact, inspired by the brothers’ upbringing with an entrepreneurial mother.

Applications are accepted via Spa Ceylon’s social media platforms throughout this month.

-

News3 days ago

News3 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

News4 days ago

News4 days agoLegal experts decry move to demolish STC dining hall

-

News3 days ago

News3 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

News2 days ago

News2 days agoPeradeniya Uni issues alert over leopards in its premises

-

Business5 days ago

Business5 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News3 days ago

News3 days agoLibrary crisis hits Pera university

-

News2 days ago

News2 days agoWife raises alarm over Sallay’s detention under PTA

-

Business5 days ago

Business5 days agoWar in Middle East sends shockwaves through Sri Lanka’s export sector