Business

CSE closes on the up, driven by bullish investor sentiment

by Hiran H.Senewiratne

The CSE yesterday closed on the up, thanks to a strong recovery following bullish sentiments indicated in the morning, while during the middle of the session profit- takings were witnessed in LOLC Group counters, mainly Browns Investments, Brown and Company, LOLC Holdings and Vallibel One. However, during the latter part of the day the CSE slowly recovered and ended on a positive note, stock market analysts said.

The All- Share Price Index finished on a 53.76- point gain or 0.5 per cent and the S&P SL20 rose to 19.47 points. Turnover was healthy at Rs. 6 billion involving 873 million shares with a single crossing. The crossing was reported in Alumex PLC, which crossed three million shares to the tune of Rs 48 million and its shares traded at Rs 16.

It is said the ASPI crossed the 11,000-mark once again and returned to positive territory after witnessing three sessions of losses, while the more liquid S&P SL20 index also resumed its record-breaking run and posted a gain of more than 1%, largely helped by price increases recorded in Expolanka.

In the retail market, top seven companies that mainly contributed to the turnover were, Expolanka Rs 835 million (2.7 million shares traded), Browns Investments Rs 645 million (44.3 million shares traded), Sunshine Holdings Rs 431 million (10.5 million shares traded), Royal Ceramic Rs 262 million (3.7 million shares traded),Commercial Leasing and Finance Rs 26.2 million (7.8 million shares traded), SMB Finance Rs 250 million (217 million shares traded) and Brown and Company Rs 214 million (68,000 shares traded).

During the day, plantation sector counters, especially Sunshine Holdings and Watawala Plantations, performed well. Sunshine Holdings share price appreciated by eight percent or Rs 3.30. Its shares started trading at Rs 38 and at the end of the day they shot up to Rs 41.30 and Watawala Plantations shares appreciated by Rs 9 or eight per cent. Its share price shot up to Rs 118 from Rs 109. Further, SMP Leasing and Finance shares appreciated by 20 per cent or 20 cents. Its share price appreciated to Rs 1.20 from Rs 1.

Expolanka, Richard Pieris and Melstacorp were the main contributors to the All- Share Price Index. During the day 873 million share volumes changed hands in 44000 transactions. Separately, Windforce Ltd. and Vallibel One announced their interim dividends of 55 cents and Rs. 1.50 per share respectively.

It is said that high net worth and institutional investor participation remained subdued for the day while mixed interest was observed in Expolanka Holdings, Brown & Company and Vallibel One, while retail interest was noted in Commercial Leasing & Finance, SMB Leasing and Browns Investments.

Yesterday the US dollar rate was Rs 202.94, which was controlled by the Central Bank. The foreign currency shortage is having a negative impact on business, irrespective of the type of business, in relation to imports and exports. Our construction and import trading businesses are being disrupted and other measures that have come around have made the situation even worse, market sources said.

Business

Arvind Subramanian: Why hasn’t Sri Lanka’s democracy acted as a hedge against economic chaos?

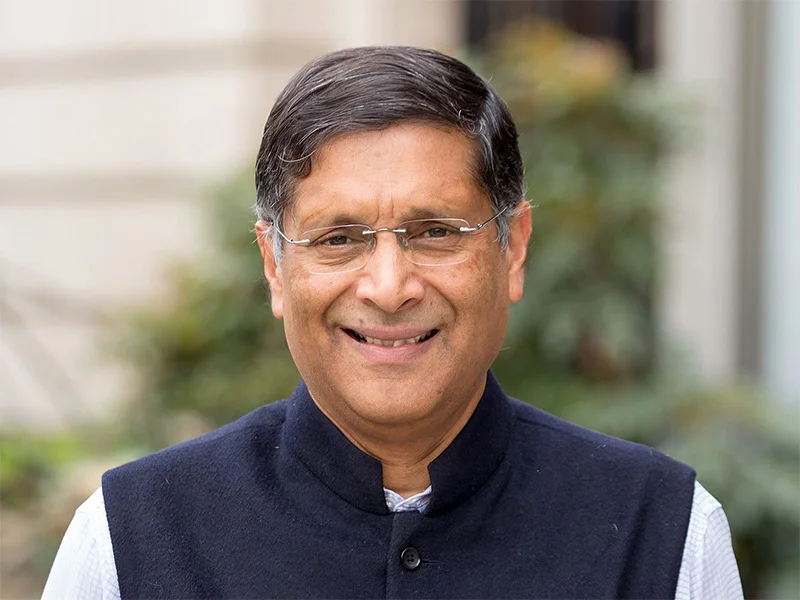

In a sobering and intellectually provocative lecture delivered yesterday at the Central Bank of Sri Lanka, Dr. Arvind Subramanian, former Chief Economic Advisor to the Government of India, posed a “haunting” question to the nation’s policymakers: Why has one of the world’s oldest democracies outside the West failed to leverage its political system to ensure economic stability?

Titled ‘Reviving Growth While Maintaining Stability,’ the lecture moved beyond technical prescriptions. Dr. Subramanian, now a Senior Fellow at the Peterson Institute for International Economics, admitted that his experience with the complexities of the Indian economy had made him “humble and somber,” leading him to focus on the broader socio-political structures that dictate a nation’s fate.

Dr. Subramanian argued that in India, democracy acted as a vital pressure valve that prevented both extreme political violence and economic chaos. He noted that while the process of nation-building is historically violent – citing the West’s decimation of populations and China’s estimated 40–75 million deaths between 1950 and 1976 – India managed to maintain a relatively low degree of mass violence.

“Democracy had a key role to play in that,” he asserted. “It is one of India’s major achievements.”

The speaker extended this logic to the economic sphere, suggesting that Indian democracy created a “societal demand” for low inflation.

In India, he noted, there is a pervasive political belief that if inflation crosses the 5 percent threshold, the government is likely to lose the next election. This political accountability forced the Central Bank and the State to maintain macro-stability.

The crux of Dr. Subramanian’s address was the “intellectual puzzle” of why Sri Lanka, which received universal franchise well before India, did not experience the same stabilising effects of democracy.

He presented two charts that he described as “haunting.” The first revealed that Sri Lanka has spent 60 percent of its time under IMF programmes, indicating a state of “perennial macro-economic stress.” In contrast, India has not sought an IMF programme in the 35 years following its 1991 reforms.

“Why does Indian society demand low inflation and macro-stability, while the same doesn’t happen in Sri Lanka?” he asked. Despite its long democratic tradition, Sri Lanka has consistently seen higher inflation and greater financial instability than its neighbour.

Dr. Subramanian also highlighted a stark difference in how both nations treat foreign capital. Pointing to data on external debt stock as a share of Gross National Income (GNI), he illustrated that Sri Lanka has been consistently and significantly more reliant on foreign capital than India or China.

While some argue that Sri Lanka’s small size necessitates a reliance on foreign capital, Dr. Subramanian remained unconvinced, noting that India also suffered from low domestic savings for decades but chose a more cautious path.

“India has been much more cautious in opening up to foreign capital,” he explained. While foreign capital can drive growth, it brings the “downside of risk and volatility” as capital flows in and out – a reality that came to haunt Sri Lanka in recent years through its high exposure to foreign currency-denominated debt.

The lecture concluded not with a list of “1, 2, 3 points” for recovery as the wider audience had expected, but with a challenge to the Sri Lankan intelligentsia. If democracy is meant to be a safeguard against political and economic disorder, the breakdown of that mechanism in Sri Lanka requires deep introspection.

“Different societies differ,” Dr. Subramanian concluded. “But if democracy had a key role in avoiding volatility in India, why shouldn’t it have been so in such an old democracy as Sri Lanka? It is worth pondering over,” he said.

By Sanath Nanayakkare

Business

HSBC kicks off ‘Clean Waterways’

HSBC will launch ‘Clean Waterways’ in partnership with the Beira Lake Restoration Task Force that was convened by the Governor of the Western Province to restore Beira Lake. HSBC in partnership with Clean Ocean Force will build and operate two solar powered, zero emission, waterway cleaning boats, which are the first of their kind in Sri Lanka. They will be used extensively in support of restoring the Beira Lake ecosystem and its surrounding environment.

Once a picturesque centerpiece in Colombo, Biera Lake is now suffering from significant pollution. Urbanization and lack of effective waste management practices have led to large volumes of plastic and floating organic debris, untreated sewage and industrial effluents contaminating the water. Resultant algal blooms, unchecked hyacinth growth and water stagnation further give the lake a detrimental odour and appearance. The pollution has degraded water quality, harmed aquatic life posing health risks to residents living in proximity by attracting disease-carrying fauna.

The Biera Lake Restoration Task Force was convened by the Governor of the Western Province with the purpose of delivering cleaner waterways in the urban environment. It is vital to educate and support change for communities that reside near the Beira Lake. To achieve this, a dedicated community outreach programme will reach over 5000 wider residents through awareness building and education which is anticipated to reduce ‘waste at source’.

Mark Surgenor, Chief Executive Officer, HSBC Sri Lanka stated “With over 130 years presence in Sri Lanka, HSBC understands the importance of Beira Lake to Colombo’s urban environment. Supporting cleaner waterways is a vital step towards restoration of that environment. Through this first ever public-private partnership, multiple stakeholders are coming together to work towards restoring this iconic lake. We have committed to support the Beira Lake Restoration Task force, not just with the much-needed funding, but also bringing best practices through our experience with similar projects in other markets that we operate in. The community outreach programme planned alongside the project is a critical step towards making this impact sustainable. HSBC has always been at the forefront of innovation in Sri Lanka and we look forward to continuing that for our next 130 years here”

Business

CORALL Conservation Trust Fund – a historic first for SL

Sri Lanka has moved to strengthen the financial backbone of its marine conservation efforts with the establishment of the country’s first CORALL Conservation Trust Fund, a landmark initiative that positions coral reef protection firmly within the framework of sustainable finance and long-term economic value creation.

The Trust Deed establishing the CORALL (Conservation of Reefs for All Lives and Livelihoods) Conservation Trust Fund was signed on December 31, 2025, by Environment Foundation (Guarantee) Limited (EFL) as Settlor together with the inaugural Board of Trustees. The Fund is designed to support the conservation of Pigeon Island National Park, Bar Reef Marine Sanctuary and Kayankerni Marine Sanctuary, along with their associated seascapes—areas that are central not only to marine biodiversity but also to fisheries, tourism and coastal protection.

From a business and policy perspective, the Trust Fund represents a decisive shift away from short-term, donor-driven conservation projects towards a structured and enduring financing mechanism. It is a key component of the Sri Lanka Coral Reef Initiative (SLCRI), a six-year national programme funded by the Global Fund for Coral Reefs and implemented by the International Union for Conservation of Nature (IUCN), but critically, the Trust itself is structured to continue well beyond the project’s lifespan, offering a permanent vehicle for mobilising state, private sector and international sustainability-linked funding.

Coral reefs within the three targeted seascapes have been increasingly degraded by destructive fishing methods such as blast fishing, overfishing, coastal pollution, unregulated tourism and unplanned coastal development. These pressures carry significant economic consequences, undermining fish stocks, tourism revenues and the natural coastal protection that reefs provide. Project partners note that a major driver of this degradation is the limited understanding among communities and institutions of the true economic value of coral reefs as natural capital that underpins livelihoods and resilience.

EFL, as an implementing partner to IUCN, played a central role in shaping the Trust’s institutional and financial architecture. It carried out a comprehensive legal, policy and institutional review, provided recommendations on the structure of Conservation Trust Funds, and drafted both the Trust Deed and an operational manual embedding governance, accountability and transparency safeguards. These features are seen as critical in building investor and donor confidence, particularly at a time when environmental, social and governance (ESG) considerations are increasingly influencing capital flows.

The Board of Trustees, selected by IUCN and the SLCRI National Steering Committee following a public call for applications, brings together expertise from investment banking, commercial banking and marine science. The Trustees—Palitha Gamage, Prof. (Ms.) Sevvandi Jayakody, Nalin Karunatileka, Dr. (Ms.) Nishanthi Perera, Chanaka Wickramasuriya and Nishad Wijetunga—will oversee grant funding for conservation and restoration proposals submitted by Special Management Area Coordinating Committees, while also ensuring robust monitoring and evaluation to safeguard long-term financial and ecological sustainability.

“This marks a significant step in sustainable financing to conserve coral reef ecosystems which are critical for marine biodiversity conservation, coastal protection, climate resilience, and the livelihoods of coastal communities, said Dr. Shamen Widanage, Country Representative of IUCN Sri Lanka, highlighting the wider economic and social returns expected from the initiative.

EFL chairperson Deshini Abeyewardena said the Trust Fund reflects a broader shift towards innovative financing models for environmental protection.

“EFL is honoured to have been selected by IUCN to implement this landmark initiative. The establishment of the CORALL Conservation Trust Fund reflects EFL’s long-standing commitment to advancing environmental justice through strong governance, legal safeguards and innovative financing mechanisms. As Sri Lanka faces increasing pressures on its marine ecosystems, this Trust provides a credible and transparent platform to secure sustained investment for coral reef conservation, she said.

By Ifham Nizam

-

Editorial5 days ago

Editorial5 days agoIllusory rule of law

-

News6 days ago

News6 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Editorial6 days ago

Editorial6 days agoCrime and cops

-

Features5 days ago

Features5 days agoDaydreams on a winter’s day

-

Editorial7 days ago

Editorial7 days agoThe Chakka Clash

-

Features5 days ago

Features5 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features4 days ago

Features4 days agoExtended mind thesis:A Buddhist perspective

-

Features5 days ago

Features5 days agoThe Story of Furniture in Sri Lanka