Business

CBSL continues accommodative monetary policy stance

Monetary Policy Review: October 2020

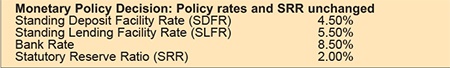

The Monetary Board of the Central Bank of Sri Lanka, at its meeting held on 21 October 2020, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 4.50 per cent and 5.50 per cent, respectively, thereby continuing the prevailing accommodative monetary policy stance.

The Board noted the decline in overall market lending rates, following the unprecedented monetary easing measures taken by the Central Bank thus far during the year, and expects the broadbased downward adjustment in market lending rates to continue, thereby ensuring affordable credit flows to productive sectors of the economy in the prevailing low inflation environment.

Global monetary policy continues to remain accommodative as global growth prospects remain bleak with the resurgence of COVID-19 in many parts of the world

The global economy, as per the World Economic Outlook (WEO) of the International Monetary Fund (IMF) released in October 2020, is projected to contract by 4.4 per cent in 2020. The outlook for growth in 2020 is less severe than the IMF’s previous forecast, supported by large scale policy stimuli implemented worldwide. However, the recent surge in COVID-19 cases globally has prompted several countries to reimpose lockdowns, which may dampen global growth prospects.

Against this background, most central banks across the globe are expected to continue their accommodative monetary policy stance in the foreseeable future.

The Sri Lankan economy is expected to move along a faster recovery path, despite the latest surge in COVID-19 cases locally that could hamper near term growth prospects.

The release of GDP estimates for the second quarter of 2020 by the Department of Census and Statistics (DCS) has been delayed. It is likely that the second quarter of 2020 has recorded a greater contraction than in the first quarter, followed by a recovery in the third quarter of the year. However, as per the DCS, the unemployment rate, which was estimated at 5.7 per cent in the first quarter of 2020, has declined to 5.4 per cent in the second quarter. The level of employment has also remained broadly unchanged in the second quarter compared to the large decline reported for the first quarter. These suggest that economic activity has remained without much deterioration in the second quarter. Other developments observed in leading indicators and high frequency data since the relaxation of the countrywide lockdown measures suggest that Sri Lanka is on a path towards economic revival. The unexpected COVID-19 cluster that has emerged recently could somewhat affect this momentum in the near term, but the expeditious measures that are being taken by the government to contain the spread could limit this impact.

External sector remains resilient with improved liquidity in the foreign exchange market

Better than expected outcomes in the external sector, as reflected by the incoming data, are indicative of the resilience of the external sector amidst growing worldwide uncertainties triggered by the outbreak of COVID-19. Alongside the improvement in earnings from merchandise exports, restrictions imposed on the importation of non-essential goods and low crude oil prices helped narrow the trade deficit substantially during the nine months ending September 2020. Services exports, excluding the tourism sector, continued to record a healthy growth led by computer and logistic services related activities. Workers’ remittances continued to record a notable acceleration since June 2020. In the meantime, Sri Lanka successfully settled the International Sovereign Bond (ISB) of US dollars 1 billion matured in early October 2020, continuing the unblemished record on debt servicing. The exchange rate remained stable and the depreciation of the Sri Lankan rupee against the US dollar is limited to 1.5 per cent thus far during the year. In this background, the Central Bank continued to purchase a sizeable volume of foreign exchange from the domestic market. Gross official reserves were estimated at US dollars 6.7 billion at end September 2020, which provided an import cover of 4.6 months.

Inflation is expected to remain within the desired range

Headline inflation, based on the Colombo Consumer Price Index (CCPI), decelerated in September 2020, on a year-on-year basis, while there was some acceleration in the National Consumer Price Index (NCPI) based headline inflation due to the rise in food prices. Meanwhile, core inflation based on both CCPI and NCPI continued to remain low, reflecting subdued demand conditions. The recent increase in food prices is expected to be short-lived supported by domestic supply side developments as well as the recent reduction in prices of several essential goods. Accordingly, inflation is expected to remain broadly within the desired range of 4-6 per cent in the near term and over the medium term with appropriate policy measures.

Headline inflation, based on the Colombo Consumer Price Index (CCPI), decelerated in September 2020, on a year-on-year basis, while there was some acceleration in the National Consumer Price Index (NCPI) based headline inflation due to the rise in food prices. Meanwhile, core inflation based on both CCPI and NCPI continued to remain low, reflecting subdued demand conditions. The recent increase in food prices is expected to be short-lived supported by domestic supply side developments as well as the recent reduction in prices of several essential goods. Accordingly, inflation is expected to remain broadly within the desired range of 4-6 per cent in the near term and over the medium term with appropriate policy measures.

Most market interest rates have declined, reflecting the impact of the measures taken by the Central Bank thus far during the year

In response to the monetary easing measures effected to bring down borrowing costs of businesses and households, both market deposit and lending rates adjusted notably so far during the year. The Average Weighted Prime Lending Rate (AWPR) declined to historic lows in recent weeks, while new lending rates also adjusted downward in line with the expectations of the Central Bank. The imposition of lending rate caps on selected financial products in August 2020 has also helped bring down the overall lending rates in the market. Further space remains for market lending rates to decline, particularly with the high level of excess liquidity in the money market, which is deposited with the Central Bank at the SDFR of 4.50 per cent at present.

Credit to the private sector picked up notably in August 2020 and the upward trend is expected to continue supported by low interest rates

Following the contractions recorded in the preceding three months, credit disbursed to the private sector expanded notably in August 2020, reflecting the impact of low lending rates as well as concessional credit schemes. The expansion of credit to the private sector is expected to continue in the period ahead, despite the recent rise in COVID-19 infections, which is expected to be short-lived. Meanwhile, the overall domestic credit continued to expand sharply driven by the substantial increase in credit to the public sector. Accordingly, the growth of broad money further accelerated in August 2020.

Policy rates maintained at current levels

In consideration of the current and expected macroeconomic developments highlighted above, the Monetary Board, at its meeting held on 21 October 2020, was of the view that the current accommodative monetary policy stance is appropriate. Accordingly, the Board decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 4.50 per cent and 5.50 per cent, respectively. The Central Bank will continue to monitor domestic and global macroeconomic and financial market developments and take further measures appropriately to ensure that the economy promptly reverts to a sustained high real GDP growth path, while maintaining inflation in the 4-6 per cent range under its flexible inflation targeting framework.

Business

New policy framework for stock market deposits seen as a boon for companies

The government’s new policy framework to allocate a maximum interest rate for stock market deposits would pave the way for companies and investors to plan their future business activities, a senior stockbroker said.

‘Accordingly, the Colombo Stock Exchange (CSE) has entered a period of strong revival, supported by economic stabilization and rising investor confidence while significant market reforms would support the new policy framework on interest, Assistant Vice President Softlogic Stockbrokers, Eardly Kern, told The Island Financial Review.

He said that the imposition of maximum interest rates for stock market deposits would prevent the interest rates from moving upwards, thus paving the way for investors to invest in stocks with a lot of confidence.

Kern added: ‘The CSE outlook would provide expanding opportunities for investors as Sri Lanka positions itself for market-led investor platforms.

‘Improving macro fundamentals, such as lower interest rates, rising corporate earnings and historically attractive valuations, have been key catalysts in driving investment into the equities market.

‘These tailwinds, together with ongoing economic reforms, have helped re-establish confidence among both local and foreign investors.

‘Over the past two years, the number of CDS accounts has surpassed 949,000, with digital on-boarding through the CSE mobile app driving the latest surge.

‘Further, foreign inflows for 2024 amounted to USD 66.5 million, while Rs 175 billion was raised through capital market activity, including 16 new listings. With a target of 20 IPOs on the horizon, the CSE anticipates several new companies entering the market by early 2026.

‘The All Share Price Index (ASPI) delivered an impressive 49.7 percent return in 2024, ranking the CSE as the second-best performing market in Asia for the year. By November 2025, the index had risen a further 45.65 percent amounting to an extraordinary two-year return of approximately 95 percent.

‘The S&P SL20 Index recorded a parallel recovery, gaining 58.5 percent in 2024 and 31.84 percent so far in 2025.

‘ Despite the rally, the CSE continues to trade below its 10-year average PER and valuations remain significantly more attractive than in regional markets, such as, India, Malaysia, Vietnam, and China.

‘ Turnover has surged to Rs 1.06 trillion in 2025 (as of mid-November), nearly doubling the figure recorded in 2024. Market capitalization grew 34 percent n 2024, despite only around 40,000 active investors capturing most of the gains—highlighting the potential for broader participation.

‘ Corporate earnings have also strengthened markedly. After generating Rs 686 billion in earnings during 2024—a 50% year-on-year increase—listed entities are projected to deliver between Rs 775–800 billion in 2025. Earnings for the first half of 2025 have already grown 57 percent year-on-year.’

By Hiran H Senewiratne

Business

Dialog reinforces commitment to heritage through Kelaniya Duruthu Festival

Dialog Axiata PLC, Sri Lanka’s #1 connectivity provider, has reinforced its enduring commitment to preserving national culture by sponsoring the Kelaniya Duruthu Festival, aligning long standing patronage with purposeful community engagement to honour religious heritage, support cultural continuity, and strengthen shared values.

The annual Kelaniya Duruthu Festival, one of Sri Lanka’s most significant religious and cultural observances, was held on 8th, 9th and 11th January 2026, marking a congregation of thousands of devotees and visitors at the historic Kelaniya Raja Maha Vihara. As a long-term patron, Dialog continues to provide sponsorship support, enabling the seamless organisation of the festival while uplifting traditions deeply rooted in the nation’s cultural identity.

Through its continued support of the Kelaniya Duruthu Festival, Dialog underscores its role as a responsible corporate citizen dedicated to safeguarding Sri Lanka’s cultural and religious heritage for future generations. This commitment is further reflected in Dialog’s long-term patronage of national events such as the Kandy Esala Perahara, Nawam Maha Perahara at Gangaramaya, Katharagama Esala Perahara and Gatabaru Esala Perahara. Complementing these efforts, Dialog has also undertaken heritage preservation initiatives including the construction of the vestibule at Dimbulagala Aranya Senasanaya, the launch of a website and directory of Amarapura Maha Nikaya Temples, and the restoration of the Anuradhapura Maha Vihara Sannipatha Shalawa.

Business

Sri Lanka launches its first-ever Smart Bus Ticketing System

A National Breakthrough in Public Transport Digitalization Powered by Ceylon Business Appliances with Nimbus Ventures.

Sri Lanka has taken a historic step forward with the launch of its first Smart Bus Ticketing System, enabling passengers to pay fares using contactless cards, digital wallets, and QR payments. This advancement places the country among global leaders in smart mobility.

The initiative was made possible through collaboration with the Government of Sri Lanka, leading banking partners, and the technology leadership of Ceylon Business Appliances (CBA) and Nimbus Ventures, who serve as the Technology, Software, Hardware, and Operational Partners behind the nation’s first Open Loop Transit Payment System.

For decades, CBA has been at the forefront of Sri Lanka’s digital transformation efforts—bringing modern, global-standard technologies that have strengthened the nation’s digital infrastructure.

Speaking to the media at the launch, Sardha Fernando, Managing Director of CBA, stated:

“This is not just a ticketing upgrade—it is a complete digital evolution of public transport in Sri Lanka. For years, CBA has been committed to introducing advanced technologies to the country, and today, we are proud to bring a globally recognized, secure, and seamless smart transit solution to our people. With every tap, we are enabling convenience, transparency, and a more connected future for all Sri Lankans.”

He added:

“This milestone reflects our ongoing mission: to help build a digitally empowered Sri Lanka that is ready to embrace the technologies shaping the world.”

‘Ruwath Fernando, CEO/Director of CBA, highlighted:

“This project demonstrates that Sri Lanka is ready to adopt and operate on par with global smart mobility technologies. Our commitment has always been to bring the world’s best software systems and innovations into Sri Lanka—solutions that are secure, scalable, and built to international standards.”

He continued:

“By introducing a state-of-the-art open-loop transit payment platform, we are proving that Sri Lanka can not only embrace but also successfully operate advanced digital ecosystems. This is a defining moment in positioning the country as a technology-proof nation prepared to trial and adopt global digital advancements.”

CBA extends heartfelt congratulations to the banking partners who trusted this vision—

Sampath Bank, Commercial Bank, Bank of Ceylon, People’s Bank, and DFCC Bank— on the successful launch of their new ticketing application.

This application integrates seamlessly with the PAX A910S ticketing device, powered by a robust CBA– Nimbus ventures software solution, engineered for scale, reliability, and national deployment..

-

Business4 days ago

Business4 days agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

News4 days ago

News4 days agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Features4 days ago

Features4 days agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

Features4 days ago

Features4 days agoSubject:Whatever happened to (my) three million dollars?

-

News4 days ago

News4 days agoLevel I landslide early warnings issued to the Districts of Badulla, Kandy, Matale and Nuwara-Eliya extended

-

News4 days ago

News4 days ago65 withdrawn cases re-filed by Govt, PM tells Parliament

-

Opinion6 days ago

Opinion6 days agoThe minstrel monk and Rafiki, the old mandrill in The Lion King – II

-

News4 days ago

News4 days agoNational Communication Programme for Child Health Promotion (SBCC) has been launched. – PM