News

CB reduces interest rates by 100 basis points to tackle inflation and ease borrowing costs

The Monetary Policy Board of the Central Bank, at its meeting held on Thursday (23), decided to reduce the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 100 basis points (bps) to 9.00 percent and 10.00 percent, respectively, CB said in a press release.

It said: The Board arrived at this decision following a careful analysis of the current and expected developments in the domestic and global economy, with the aim of achieving and maintaining inflation at the targeted level of 5 percent over the medium term, while enabling the economy to reach and stabilise at the potential level.

The Board took note of possible upside risks to inflation projections in the near term due to supply-side factors stemming from the expected developments, domestically and globally. However, the Board viewed that such near term risks would not materially change the medium-term inflation outlook, as inflation expectations of the public remain anchored and economic activity is projected to remain below par in the near to medium term. Further, the Board viewed that with this reduction of policy interest rates, along with the monetary policy measures carried out since June 2023, sufficient monetary easing has been effected in order to stabilise inflation over the medium term.

Hence, the Monetary Policy Board underscored the need for a swift and full pass through of monetary easing measures to market interest rates, particularly lending rates, by the financial institutions, thereby accelerating the normalisation of market interest rates in the period ahead.

Headline inflation continues to remain low, reflecting subdued demand conditions. Headline inflation, as measured by the year-on-year change in the Colombo Consumer Price Index (CCPI, 2021=100), was recorded at 1.5 percent in October 2023 compared to 1.3 percent in September 2023.

Food inflation continued to be negative (year-on-year) for the fourth consecutive month in October 2023. The National Consumer Price Index (NCPI, 2021=100) based headline inflation (year-on-year) was recorded at 1.0 percent in October 2023, compared to 0.8 percent in September 2023.

Both CCPI and NCPI based core inflation (year-on-year), which reflects underlying demand pressures in the economy, moderated further in October 2023, reflecting the subdued demand pressures in the economy. A one-off upward movement in inflation is expected in the near term, driven mainly by the changes to the Value Added Tax (VAT) proposed by the Government effective January 2024. The spillover effects of tax measures and other developments are likely to be muted due to subdued underlying demand pressures; hence, this rise in inflation is expected to be transitory. Accordingly, headline inflation over the medium term is expected to converge towards the targeted level of 5 percent, supported by appropriate policy measures.

Market interest rates are expected to normalise in the period ahead. Market interest rates continued to adjust downwards, and most benchmark interest rates have declined significantly. Meanwhile, the yields on government securities are also adjusting downwards with falling risk premia. The reduction of policy interest rates by 100 bps in this monetary policy review is expected to create further space for market interest rates to adjust downward and normalise in the period ahead. Reflecting the transmission of the relaxed monetary policy stance, outstanding credit to the private sector by the banking sector expanded on a monthly basis in September as well as in October 2023 based on provisional data. With the moderation of market lending interest rates, credit to the private sector is expected to increase further in the period ahead, thereby supporting the envisaged rebound of domestic economic activity.

The Board anticipates a swift, sizeable and broad-based reduction in overall market lending interest rates in line with the monetary policy easing measures effected since June 2023. Such adjustment in interest rates is imperative to ease the domestic monetary conditions further. The Board stressed the need for all licensed banks to take swift measures to reduce market lending interest rates to ensure that the benefits of the series of monetary policy easing measures are adequately passed on to businesses and households.

Latest News

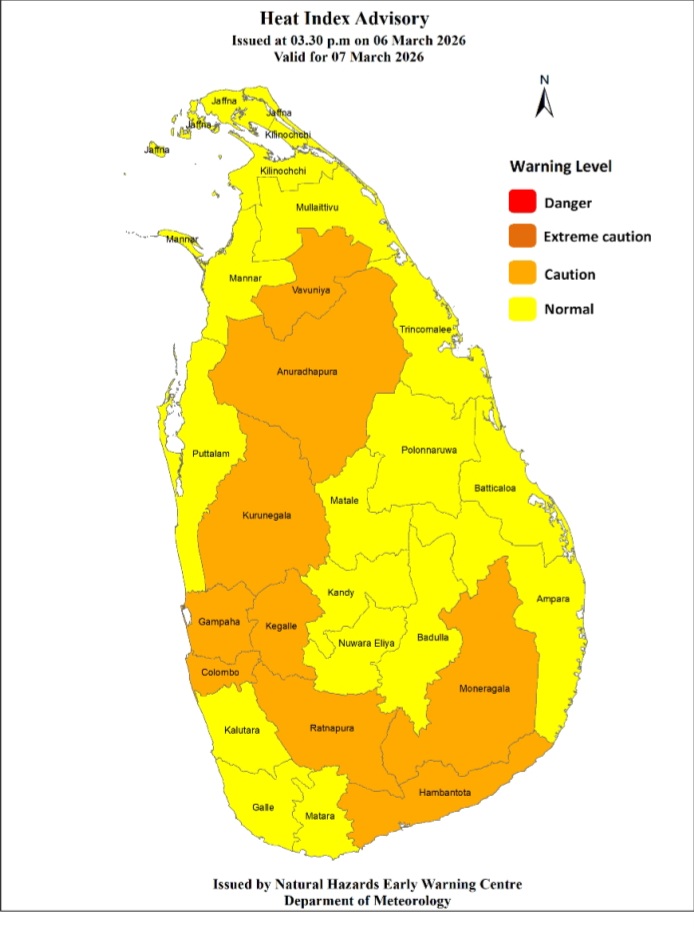

Heat Index at ‘Caution Level’ in the Sabaragamuwa province and, Colombo, Gampaha, Kurunegala, Anuradhapura, Vavuniya, Hambanthota and Monaragala districts

Warm Weather Advisory Issued by the Natural Hazards Early Warning Centre of the Department of Meteorology at 3.30 p.m. on 06 March 2026, valid for 07 March 2026.

The public are warned that the Heat index, the temperature felt on human body is likely to increase up to ‘Caution level’ at some places in the Sabaragamuwa province and in Colombo, Gampaha, Kurunegala, Anuradhapura, Vavuniya, Hambantota and Monaragala districts.

The Heat Index Forecast is calculated by using relative humidity and maximum temperature and is the condition that is felt on your body. This is not the forecast of maximum temperature. It is generated by the Department of Meteorology for the next day period and prepared by using global numerical weather prediction model data.

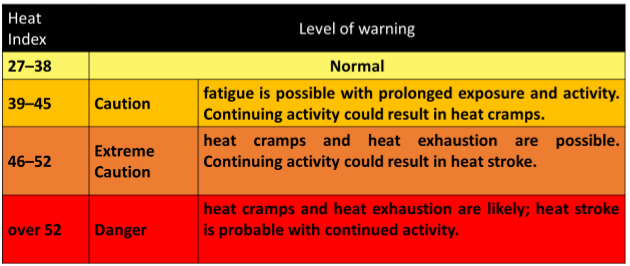

Effect of the heat index on human body is mentioned in the above table and it is prepared on the advice of the Ministry of Health and Indigenous Medical Services.

ACTION REQUIRED

Job sites: Stay hydrated and takes breaks in the shade as often as possible.

Indoors: Check up on the elderly and the sick.

Vehicles: Never leave children unattended.

Outdoors: Limit strenuous outdoor activities, find shade and stay hydrated.

Dress: Wear lightweight and white or light-colored clothing.

Note: In addition, please refer to advisories issued by the Disaster Preparedness & Response Division, Ministry of Health in this regard as well. For further clarifications please contact 011-7446491

Latest News

Prompt solutions will be provided for the salary anomalies prevailing within the teacher and principal services — PM

Prime Minister Dr. Harini Amarasuriya stated that the government has paid close attention to the salary anomalies prevailing within the teacher and principal services and that prompt solutions will be provided following extensive discussions held with trade unions.

The Prime Minister made these remarks while responding to questions raised in Parliament on Friday (06).

Presenting data on existing vacancies in the education sector, the Prime Minister explained the current situation.

There are 903 vacancies existing in the Sri Lanka Education Administrative Service (SLEAS) and 3,790 vacancies in Sri Lanka Principals’ Service (SLPS).

In order to fill the vacancies which still remain due to various reasons, including selected officers not accepting appointments after the examinations and interviews conducted since 2021, interviews are scheduled to be held in the second week of March 2026.

Further, in order to fill the vacancies for the years 2021 and 2025, competitive examinations will be conducted in the future with the approval of the Public Service Commission.

At present, entry into the Principals’ Service is considered as a new recruitment. As a solution to the salary-related issue arising in this regard, a new Cabinet paper is being prepared seeking approval to consider appointments to the Principals’ Service as a promotion, thereby enabling appropriate salary conversion.

The Prime Minister also emphasized that sustainable solutions are required not only for salary issues in the education sector but also for salary-related concerns in several other sectors. Accordingly, the government plans to appoint a new Salary Commission. Through this commission, the government expects to provide lasting solutions to the issues faced by teachers and principals within this year.

In accordance with the service minute of the Principals’ Service, several training programmes have been made mandatory for the professional development of principals.

These include, Induction training at the beginning of service, capacity development training prior to promotion to Grade II and Grade I, and periodic awareness programmes conducted at provincial and zonal levels.

The Prime Minister further stated that discussions are undertaking with the Department of Management Services regarding the proposals submitted by principals’ associations. Based on the responses received, the government is prepared to take the necessary steps through the Cabinet of Ministers.

[Prime Minister’s Media Division]

News

UNP concerned about govt.’s silence over US sub sinking Iranian warship in Lanka’s EEZ

The UNP yesterday (06) voiced concern over, what it described as, the continued silence of the Sri Lankan government regarding the sinking of an Iranian vessel by a US submarine within Sri Lanka’s Exclusive Economic Zone (EEZ).

In a statement, the UNP questioned whether the government had been informed, in advance, by the United States of the military action carried out within Sri Lanka’s EEZ, particularly within the framework of the Colombo Security Conclave.

The party warned that such developments had effectively turned Sri Lanka’s EEZ into a war zone, posing potential risks to commercial maritime activity.

Full text of the UNP statement: The United National Party is concerned over the continued silence of the Sri Lankan government regarding the sinking of an Iranian vessel by a US submarine in our Exclusive Economic Zone (EEZ). The government must disclose to the Sri Lankan public whether they were informed by America prior to the military action that was carried out in the country’s EEZ, and within the ambit of the Colombo Security Conclave.

These actions have resulted in our EEZ being turned into a warzone which will have a detrimental impact on our commercial interests. Shipping costs and insurance are expected to increase, impacting the country’s economy, including the cost of living.

The government of Sri Lanka must seek assurance from the United of States of America that further military action will not be conducted in the vicinity of the country. The government must also discuss the potential economic impact with the relevant shipping companies and insurance authorities.

-

Features5 days ago

Features5 days agoBrilliant Navy officer no more

-

Opinion5 days ago

Opinion5 days agoSri Lanka – world’s worst facilities for cricket fans

-

News2 days ago

News2 days agoLegal experts decry move to demolish STC dining hall

-

Features5 days ago

Features5 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

Business3 days ago

Business3 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

Features6 days ago

Features6 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features6 days ago

Features6 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone

-

News1 day ago

News1 day agoUniversity of Wolverhampton confirms Ranil was officially invited