News

CB Governor finally admits the obvious

By Sanath Nanayakkare

Governor of the Central Bank Prof. W. D. Lakshman yesterday acknowledged the fact that fixed income earners, particularly senior citizens dependent on retirement pensions had been dversely affected by the prevailing low deposit interest rates.

Prof. Lakshman said so in a virtual address while announcing the Central Bank’s key strategy document ‘Roadmap for 2021 and beyond’.

“The prevailing low interest rate regime has highlighted the need for improvements in the capital markets of the country to introduce an alternative, novel, safe, and attractive financial products, particularly for savers who face low deposit rates,” the Governor said.

“The sustainable solution to this problem lies in long-term income growth and institutional developments involving mutual funds, insurance and annuity schemes, pension, and superannuation schemes. The Central Bank will continue to work with the financial sector to develop such financial products which will support such vulnerable segments in the society,” he said.

“The Government has also proposed to introduce a contributory pension scheme to assist those in public enterprises, as well as the private sector. As the Budget 2021 proposed, other social safety net schemes will be developed to support the economically vulnerable groups in a low inflation, low-interest rate environment’, he said.

“The performance of the fiscal sector during 2020 was significantly affected by the decline in government revenue amidst the economic fallout. The resultant budget deficit was financed entirely through low-cost domestic sources, which alleviated fiscal pressures to a great extent,” the governor said.

News

Colombo Stock Exchange (GL 12) donates LKR 25 million to the “Rebuilding Sri Lanka” Fund

The Colombo Stock Exchange (GL 12) has contributed LKR 25 million to the Rebuilding Sri Lanka Fund.

The cheque was handed over to the Secretary to the President Dr. Nandika Sanath Kumanayake by the Chairman of the Colombo Stock Exchange, Dimuthu Abeyesekera, the Chief Executive Officer Rajeeva Bandaranaike and Senior Vice Chairman Kusal Nissanka at the Presidential Secretariat.

News

Karu argues against scrapping MPs’ pension as many less fortunate members entered Parliament after ’56

Former Speaker of Parliament Karu Jayasuriya has written to President Anura Kumara Dissanayake expressing concerns over the proposed abolition of MPs’ pensions.The letter was sent in his capacity as Patron of the Former Parliamentarians’ Caucus.

In his letter, Jayasuriya noted that at the time of Sri Lanka’s independence, political participation was largely limited to an educated, affluent land-owning elite. However, he said a significant social transformation took place after 1956, enabling ordinary citizens to enter politics.

He warned that under current conditions, removing parliamentary pensions would effectively confine politics to the wealthy, business interests, individuals engaged in illicit income-generating activities, and well-funded political parties. Such a move, he said, would discourage honest social workers and individuals of modest means from entering public life.

Jayasuriya also pointed out that while a small number of former MPs, including himself, use their pensions for social and charitable purposes, the majority rely on the pension as a primary source of income.

He urged the President to give due consideration to the matter and take appropriate action, particularly as the government prepares to draft a new constitution.The Bill seeking to abolish pensions for Members of Parliament was presented to Parliament on 07 January by Minister of Justice and National Integration Dr. Harshana Nanayakkara.

News

Johnston, two sons and two others further remanded over alleged misuse of vehicle

Five suspects, including former Minister Johnston Fernando and his two sons, who were arrested by the Financial Crimes Investigation Division (FCID), were further remanded until 30 January by the Wattala Magistrate’s Court yesterday.

The former Minister’s , sons Johan Fernando and Jerome Kenneth Fernando, and two others, were arrested in connection with the alleged misuse of a Sathosa vehicle during Fernando’s tenure as Minister.

Investigations are currently underway into the alleged misuse of state property, including a lorry belonging to Lanka Sathosa, which reportedly caused a significant financial loss to the state.

In connection with the same incident, Indika Ratnamalala, who served as the Transport Manager of Sathosa during

Fernando’s tenure as Minister of Co-operatives and Internal Trade, was arrested on 04 January.

After being produced before the Wattala Magistrate’s Court, he was ordered to be remanded in custody until 09 January.The former Sathosa Transport Manager was remanded on charges of falsifying documents.

-

Editorial7 days ago

Editorial7 days agoIllusory rule of law

-

Features7 days ago

Features7 days agoDaydreams on a winter’s day

-

Features7 days ago

Features7 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features6 days ago

Features6 days agoExtended mind thesis:A Buddhist perspective

-

Features7 days ago

Features7 days agoThe Story of Furniture in Sri Lanka

-

Opinion5 days ago

Opinion5 days agoAmerican rulers’ hatred for Venezuela and its leaders

-

Features7 days ago

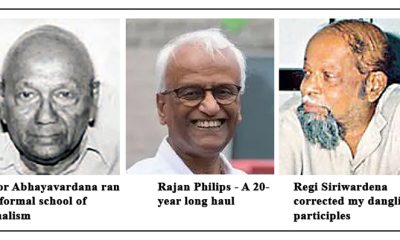

Features7 days agoWriting a Sunday Column for the Island in the Sun

-

Business3 days ago

Business3 days agoCORALL Conservation Trust Fund – a historic first for SL