Business

Bridging the Gaps: The COVID-19 crisis and Sri Lanka’s healthcare response

By Priyanka Jayawardena

Like many other countries, Sri Lanka faces numerous challenges in the battle against COVID-19. The pandemic has caused deep uncertainty and presented a colossal challenge for the country’s healthcare system. With the rapid increase in cases and the emergence of new variants, Sri Lanka began to face shortages of medical resources, including hospital beds and medical equipment.

The vaccination programme was beset with a host of problems early on due to the irregular and inconsistent supply of vaccines, disorganised deployment and deviation from the scientifically agreed prioritisation. There was also alleged misreporting of COVID-19 daily statistics in the Gampaha district and Eastern Province. The absence of real-time data acted as a hindrance to obtain a reliable risk assessment in the country. Against this backdrop, this blog examines the gaps in the ongoing pandemic control programme and outlines ways to bridge these gaps so that more lives could be saved from COVID-19.

The vaccination programme was beset with a host of problems early on due to the irregular and inconsistent supply of vaccines, disorganised deployment and deviation from the scientifically agreed prioritisation. There was also alleged misreporting of COVID-19 daily statistics in the Gampaha district and Eastern Province. The absence of real-time data acted as a hindrance to obtain a reliable risk assessment in the country. Against this backdrop, this blog examines the gaps in the ongoing pandemic control programme and outlines ways to bridge these gaps so that more lives could be saved from COVID-19.

COVID-19 Vaccination Programme

By mid-August 2021, more than 12 million Sri Lankans (55% of the population) had been vaccinated with at least the first dose. Other than the delayed supply of vaccines, there were issues related to getting approval for vaccine use and the vaccination prioritisation process. Moreover, many people were seen queuing up at vaccination centres aggravating health risks due to the lack of a properly planned system for vaccine deployment and the lack of an online appointment system. More recently, the government has taken several measures to improve the rollout, including expediting the procurement process and improving administration with the support of the defence services.

Gaps in Pandemic Control

Sri Lanka’s rate of COVID-19 screening has remained inadequate to prevent the spread of the virus. Systematic surveillance is crucial for the rapid identification and detection of suspected COVID-19 cases. With newer variants found to be more transmissible and deadlier, there is a need to identify mutants and track the nature of transmission. Currently, the University of Sri Jayewardenepura is the only institution equipped with laboratory facilities to conduct genomic sequencing to identify new variants.

Countries like Singapore, New Zealand and Australia systematically monitor the pandemic through extensive testing and contact tracing. These countries are conducting 10-100 times more tests than other countries with a similar number of new confirmed cases. Sri Lanka’s extent of testing relative to the scale of the outbreak (positive rate was around 10%), is on par with Thailand and Malaysia but lower than India, Vietnam and Cambodia where the positive rate is below 5%.

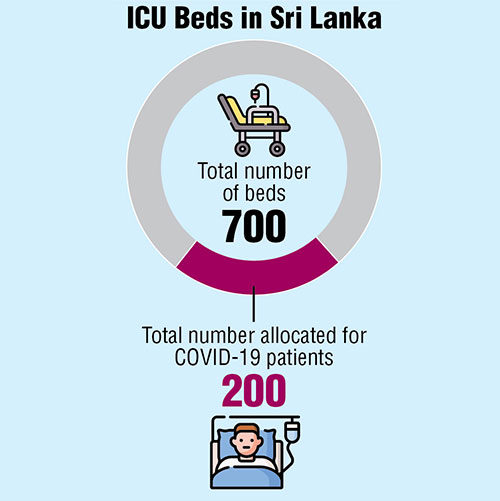

Further, a major challenge to the existing healthcare system is inadequate ICU beds, ventilators, oxygen supplies and other necessities required to care for patients with severe respiratory failure. The availability of ICU capacity plays a crucial role in critical cases, and constant and uninterrupted availability of oxygen supplied beds is needed to avert a disaster. Currently, less than 200 ICU beds are in isolation units for patients with severe COVID-19 symptoms, whereas just around 700 ICU beds are available in the hospital system of the entire country.

Equally, it is vital to have timely access to real-time data so that meaningful insights can be drawn but due to capacity constraints and administrative issues, PCR test results are reported to be delayed. In some districts, the delays are said to be longer than one week. Thus, delays in generating test results are a grave concern and represent a major obstacle in the COVID-19 control process. There is a growing need for immediate and accessible healthcare and digital healthcare resources to effectively respond to the challenges posed by COVID-19. However, Sri Lanka’s health information systems are weak and under-funded and the lack of an adequate central health database and IT infrastructure has hampered digital health services.

Towards a Stronger Healthcare Response

The healthcare system has to be streamlined to ensure a successful vaccination deployment and a smooth inoculation programme with online appointments including over the phone appointment facilities. Parallel to an efficient vaccination programme, an enhanced screening capacity is needed for the rapid identification of COVID-19 cases. Sri Lanka’s overall COVID-19 screening capacity remains low; therefore, expanding testing and increasing the health sector’s capacity to identify new mutants is vital to curb the pandemic. Random PCR testing too must be carried out in densely populated areas which are prone to be contagious, thereby taking additional precautionary measures.

There is a growing concern about the availability of medical supplies in emergency contexts. Sri Lanka has to effectively leverage its limited resources in response to the pandemic. The crisis response has seen local innovation in the manufacturing of ICU beds and lab consumables and there is further scope to encourage local enterprise and innovation for this purpose. For instance, a team of Sri Lankan scientists recently invented a new PCR test kit using NANO technology, which is said to drastically reduce the testing time from two hours to half an hour. There is now an opportunity to encourage local innovation and local production through such efforts, where they contribute to efficiency gains.

Furthermore, a robust laboratory strategy, which includes laboratory networking, communicating real-time information on COVID-19, quality assurance and adequate workforce capacity is important for rapid detection and case management. South Korea, for example, practised the disclosure of real-time information on COVID-19 by the government via dedicated websites, mass media, phone messages and mobile apps. Digitalisation of healthcare and effective use of technology for sharing real-time data, contact tracing and surveillance and coordinating the efficient use of clinical resources are vital for successful pandemic control. It is also necessary to improve systems to manage real-time data and decision-support systems. Improved functional integration and coordination in treatment centres and laboratory services bring in many benefits.

*This blog is based on the comprehensive chapter on “Coping with Pandemics: Sri Lanka’s Healthcare System” in IPS’ forthcoming ‘Sri Lanka: State of the Economy 2021’ report.

Link to original blog: https://www.ips.lk/talkingeconomics/2021/09/02/bridging-the-gaps-the-covid-19-crisis-and-sri-lankas-healthcare-response/

Priyanka Jayawardena is a Research Economist at the Institute of Policy Studies. Her research interests include education and skills development, labour economics, inequality analysis, health economics and child nutrition. She holds a BSc (Hon) in Statistics and an MA in Economics from the University of Colombo, Sri Lanka. (Talk to Priyanka – priyanka@ips.lk)

Business

Code of Ethics for capital market influencers in the pipeline

The Securities and Exchange Commission (SEC) of Sri Lanka is planning to introduce a Code of Ethics or a set of guidelines for the activities of capital market influencers to protect the public from ongoing scams involving the swindling money from potential investors in the share market.

“The market regulator has already identified Blue Ocean Securities Limited and Gladius South Asia as involved in such scams, which are being investigated by the relevant authorities, said Deputy Director General of the SEC Tushara Jayaratne.

The Deputy Director General also said that Gladius was using their their logo in a fraudulent manner to promote their business as well.

He said Blue Ocean has been involved in asking investors to start trading through an app named BOMate Nd. ‘Through this app, you can’t trade shares. But the money transaction goes through this app and the SEC system does not see these transactions, Jayaratne explained.

“The money is going somewhere else, Jayaratne told journalists at a media briefing yesterday held at the SEC auditorium, WTC building, Colombo.

Jayaratne said the SEC has already made complaints to both the Criminal Investigation Department (CID) of the police and the Financial Intelligence Unit (FIU) of the Central Bank.

The Deputy Director General said the second company, Gladius South Asia, has been involved in asking investors not to invest their money in the local stock market, but to do so in the markets in foreign countries.

He also said that the SEC has adopted 12 key capital market development projects to increase the number of capital market investors.

“The Introduction of a Code of Ethics and guidelines for registered investment advisers will help to develop the market in an efficient and effective way, he said.

Jayaratne, however, said that the Sri Lankan share market is not full of scams and that people can have confidence in the market.

“Our market is somewhat free and fair. From the perspective of investors, you also have a responsibility to be careful when investing in the market, he added.

By Hiran H Senewiratne

Business

Norway supports flood-affected communities in Sri Lanka

Norway is providing more than USD 2.4 million to assist those affected by severe flooding in Sri Lanka.

“Norway is contributing emergency assistance to people who have lost both their homes and livelihoods in Sri Lanka. A rapid response is crucial to ensure that those affected have shelter, food, healthcare and support to rebuild their communities,” said Norway’s Minister of International Development, Åsmund Aukrust.

The United Nations estimates that nearly 11 million people have been impacted by catastrophic floods and landslides across large parts of South and Southeast Asia. Sri Lanka, Indonesia, Thailand, Vietnam and Malaysia have experienced record rainfall since 17 November. In total, approximately 1,600 people have lost their lives, and 1.2 million have been forced to leave their homes. Critical infrastructure such as houses and roads has been destroyed, and health risks are increasing due to waterborne diseases and poor sanitation.

“Norway is now contributing NOK 20 million (approx. USD 2 million) to the Red Cross Movement and the UN system in Sri Lanka. These organisations have presence in the country and the capacity to respond quickly based on local needs,” Aukrust said.

Sri Lanka is among the hardest-hit countries. On 28 November, Cyclone Ditwah struck the country, bringing heavy rain and strong winds. The cyclone triggered landslides and caused the most severe floodsing in recent history. The Sri Lankan authorities have led the search and rescue operations and allocated significant resources for immediate relief. “When disasters of this magnitude occur, it is vital that the international community and countries like Norway step up and support local actors in managing the crisis,” Aukrust said.

In addition, the UN Central Emergency Response Fund (CERF) has allocated USD 4.5 million for flood response in Sri Lanka. Around one in ten dollars in the fund comes from Norway.

Norway is also assisting flood-affected communities in Sri Lanka through an immediate response mechanism in the World Food Programme (WFP). The International Labour Organization (ILO) has re-allocated around USD 100,000 in a Norway-funded job generation project, to assist flood-affected participants. Furthermore, Norway has funded a UN expert to help coordinate ongoing relief efforts in the affected areas.

Business

Janashakthi Finance appoints Sithambaram Sri Ganendran as CEO

Janashakthi Finance PLC, formerly known as Orient Finance PLC and a subsidiary of JXG (Janashakthi Group), announces the appointment of Sithambaram Sri Ganendran as the Chief Executive Officer.

Sri Ganendran, who has held the position of Chief Operating Officer since September 2024, stepped in as Acting Chief Executive Officer during the past four months.

He brings with him almost 27 years of extensive experience in banking. Throughout his extensive career, he has held senior management roles in multiple local and international banks, where he acquired in-depth knowledge in operations, branch banking (across retail and SME sectors), operational risk, business continuity management, business integration, process reengineering, operational excellence, sales governance and credit card operations. He holds a plethora of qualifications including an MBA from American City University. He is a Fellow of the Chartered Institute of Management Accountants (CIMA) in the United Kingdom, and an Associate Member of the Chartered Institute of Securities and Investments (CISI), and a member of the Association of Professional Bankers of Sri Lanka.

Rajendra Theagarajah, Chairman of Janashakthi Finance PLC, said, “We are delighted to welcome Sithambaram Sri Ganendran to this important leadership role at a pivotal moment in our journey. His wealth of experience, proven track record, and people-focused leadership style make him well suited to strengthen and guide Janashakthi Finance, ensuring efficient continuity in all ongoing operations.”

The appointment of Sri Ganendran as Chief Executive Officer, reinforces Janashakthi Finance’s deep commitment to seamless operations and growth. It also underscores its dedication to vision of delivering trusted financial solutions, while continuously exploring opportunities for innovation and expansion to serve its customers and communities more efficiently.

-

Features5 days ago

Features5 days agoWhy Sri Lanka Still Has No Doppler Radar – and Who Should Be Held Accountable

-

Features7 days ago

Features7 days agoDitwah: A Country Tested, A People United

-

News22 hours ago

News22 hours agoPakistan hands over 200 tonnes of humanitarian aid to Lanka

-

News7 days ago

News7 days agoRs 1. 3 bn yahapalana building deal under investigation

-

Midweek Review2 days ago

Midweek Review2 days agoHow massive Akuregoda defence complex was built with proceeds from sale of Galle Face land to Shangri-La

-

News22 hours ago

News22 hours agoPope fires broadside: ‘The Holy See won’t be a silent bystander to the grave disparities, injustices, and fundamental human rights violations’

-

Opinion7 days ago

Opinion7 days agoComfort for some, death for others: The reality of climate change

-

Business7 days ago

Business7 days agoFluctuating fortunes for bourse in the wake of selling pressure