Business

BOC to break negative cycle and grow its SME loan book by Rs. 5 billion-and counting

Rs. 4 billion for SMEs Rs. 1 billion for startups

Interest rates as low as 12.0- 12.5% over 5 years 5% below market rates

By Sanath Nanayakkare

The Bank of Ceylon (BOC) yesterday called a press conference at a short notice to break good news for Sri Lanka’s SME sector, women-led businesses and startups hungry for capital to give impetus to their growth plans after Sri Lanka has gone through a tough cycle of crises.

The Bank has just rolled out an SME fund of Rs. 5 billion at 12.0 -12.5% interest rates which the Bank said would certainly increase if there is more demand from the businesses to take their businesses to the next level.

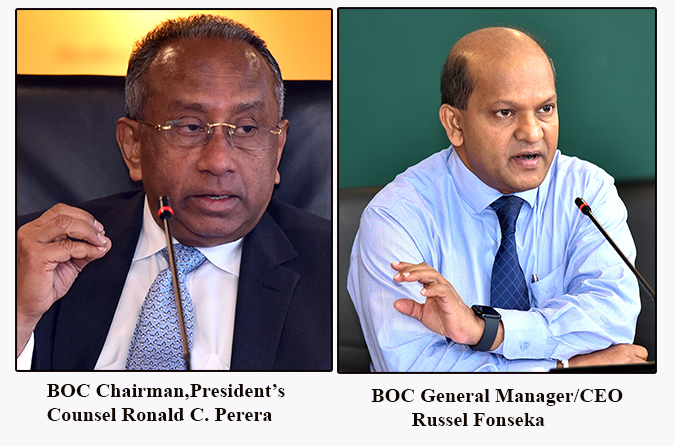

BOC Chairman, President’s Counsel Ronald C. Perera addressing the media at BOC head office said,” As you know the past few years have been a huge challenge for the whole country including the banking sector. The interest rates went up sky-high and now after the domestic debt optimization (DDO) interest rates have started coming down. We are hopeful it will kick off the business sector so that entrepreneurs will be able to borrow funds at reasonable rates to carry out their commercial activities.

We at the Bank of Ceylon have especially thought about the Small and Medium Enterprise sector (SMEs) not only in the western province but also in all other provinces because they are the backbone of the economy of the country. Before the DDO was announced, interest rates hovered around 25-28%, and by August 9, 2023 it had come down to 16.9%. Now we have worked out a special SME loan scheme totaling Rs. 5 billion to be disbursed at 12% which is 5% below the market rate. Each qualifying SME in this loan scheme can seek a loan up Rs. 25 million. If they have collateral, they will get their loan at 12% and those without collateral will get it at 12.5%. According to the demand, we will certainly increase the SME loan volume beyond Rs. 5 billion. Let’s first see how things would turn out in the initial phase.”

“Further, there is another loan scheme to support the startups with up to Rs. 2 million rupees at the same interest rates. Both these loans are given for 5-year periods. We are looking to give priority to young entrepreneurs and businesses headed by women. We have allocated 4 billion rupees for SME loans and 1 billion rupees for the startups. This means a total of Rs. 5 billion will be disbursed in this exercise. We hope it will help drive SMEs catering to the local market as well as export-oriented SMEs and startups that need financing to grow into the next phase. The fund allocation will be implemented in a first-come first-served basis. One customer can get only one loan under this category.

This financing is provided for new businesses and not for settlements or re-pricing of existing businesses. We will abide by the normal banking practices stipulated by the Central Bank such as getting CRIB reports of borrowers and guarantors. The applicants must demonstrate that they have necessary qualifications and experience in the relevant field and have a valid business registration. They need to be able to produce environmental compliance reports etc., in case it would be required.

The borrowers would be required to provide 25% equity of their respective projects. We will not permit the purchase of land or vehicles under this scheme, but the funds can be used to put up infrastructure with the approval and due diligence by the Bank. The applicants have to come up with a business plan to show how he or she will maintain the operational activities of the business and the cashflow in a stable manner.”

“These loan schemes have just rolled out this week. Actually this was initiated after the government and the Central Bank asking us to reduce interest rates and support the economic recovery as the time is right to do so. In fact, we have gone beyond the desired levels and are offering these loans 5% below the market rate.”

“There are already a number of other SME financing facilities given at concessionary interest rates which had started earlier. In addition to that, we provide non-financial assistance to SMEs under the BOC SME Circle. It gives them the know-how to operate their businesses successfully and to expand their businesses,” BOC Chairman said.

BOC General Manager/CEO Russel Fonseka said that the Bank was able to safeguard their customers during the multiple crises and when the interest rates shot up to very high levels, because they didn’t shift that burden on to their customers, but absorbed that loss into the Bank and provided a cushion for the troubled businesses.”

“That was how BOC able to keep its customers battling the economic crisis to survive and to keep our non-performing loans (NPLs) at a very low level. We have always stayed true to our core value of ‘thin margins, high volumes’ which has worked for the benefit of the Bank, its customer base and the overall economy,” the GM said.

Business

Code of Ethics for capital market influencers in the pipeline

The Securities and Exchange Commission (SEC) of Sri Lanka is planning to introduce a Code of Ethics or a set of guidelines for the activities of capital market influencers to protect the public from ongoing scams involving the swindling money from potential investors in the share market.

“The market regulator has already identified Blue Ocean Securities Limited and Gladius South Asia as involved in such scams, which are being investigated by the relevant authorities, said Deputy Director General of the SEC Tushara Jayaratne.

The Deputy Director General also said that Gladius was using their their logo in a fraudulent manner to promote their business as well.

He said Blue Ocean has been involved in asking investors to start trading through an app named BOMate Nd. ‘Through this app, you can’t trade shares. But the money transaction goes through this app and the SEC system does not see these transactions, Jayaratne explained.

“The money is going somewhere else, Jayaratne told journalists at a media briefing yesterday held at the SEC auditorium, WTC building, Colombo.

Jayaratne said the SEC has already made complaints to both the Criminal Investigation Department (CID) of the police and the Financial Intelligence Unit (FIU) of the Central Bank.

The Deputy Director General said the second company, Gladius South Asia, has been involved in asking investors not to invest their money in the local stock market, but to do so in the markets in foreign countries.

He also said that the SEC has adopted 12 key capital market development projects to increase the number of capital market investors.

“The Introduction of a Code of Ethics and guidelines for registered investment advisers will help to develop the market in an efficient and effective way, he said.

Jayaratne, however, said that the Sri Lankan share market is not full of scams and that people can have confidence in the market.

“Our market is somewhat free and fair. From the perspective of investors, you also have a responsibility to be careful when investing in the market, he added.

By Hiran H Senewiratne

Business

Norway supports flood-affected communities in Sri Lanka

Norway is providing more than USD 2.4 million to assist those affected by severe flooding in Sri Lanka.

“Norway is contributing emergency assistance to people who have lost both their homes and livelihoods in Sri Lanka. A rapid response is crucial to ensure that those affected have shelter, food, healthcare and support to rebuild their communities,” said Norway’s Minister of International Development, Åsmund Aukrust.

The United Nations estimates that nearly 11 million people have been impacted by catastrophic floods and landslides across large parts of South and Southeast Asia. Sri Lanka, Indonesia, Thailand, Vietnam and Malaysia have experienced record rainfall since 17 November. In total, approximately 1,600 people have lost their lives, and 1.2 million have been forced to leave their homes. Critical infrastructure such as houses and roads has been destroyed, and health risks are increasing due to waterborne diseases and poor sanitation.

“Norway is now contributing NOK 20 million (approx. USD 2 million) to the Red Cross Movement and the UN system in Sri Lanka. These organisations have presence in the country and the capacity to respond quickly based on local needs,” Aukrust said.

Sri Lanka is among the hardest-hit countries. On 28 November, Cyclone Ditwah struck the country, bringing heavy rain and strong winds. The cyclone triggered landslides and caused the most severe floodsing in recent history. The Sri Lankan authorities have led the search and rescue operations and allocated significant resources for immediate relief. “When disasters of this magnitude occur, it is vital that the international community and countries like Norway step up and support local actors in managing the crisis,” Aukrust said.

In addition, the UN Central Emergency Response Fund (CERF) has allocated USD 4.5 million for flood response in Sri Lanka. Around one in ten dollars in the fund comes from Norway.

Norway is also assisting flood-affected communities in Sri Lanka through an immediate response mechanism in the World Food Programme (WFP). The International Labour Organization (ILO) has re-allocated around USD 100,000 in a Norway-funded job generation project, to assist flood-affected participants. Furthermore, Norway has funded a UN expert to help coordinate ongoing relief efforts in the affected areas.

Business

Janashakthi Finance appoints Sithambaram Sri Ganendran as CEO

Janashakthi Finance PLC, formerly known as Orient Finance PLC and a subsidiary of JXG (Janashakthi Group), announces the appointment of Sithambaram Sri Ganendran as the Chief Executive Officer.

Sri Ganendran, who has held the position of Chief Operating Officer since September 2024, stepped in as Acting Chief Executive Officer during the past four months.

He brings with him almost 27 years of extensive experience in banking. Throughout his extensive career, he has held senior management roles in multiple local and international banks, where he acquired in-depth knowledge in operations, branch banking (across retail and SME sectors), operational risk, business continuity management, business integration, process reengineering, operational excellence, sales governance and credit card operations. He holds a plethora of qualifications including an MBA from American City University. He is a Fellow of the Chartered Institute of Management Accountants (CIMA) in the United Kingdom, and an Associate Member of the Chartered Institute of Securities and Investments (CISI), and a member of the Association of Professional Bankers of Sri Lanka.

Rajendra Theagarajah, Chairman of Janashakthi Finance PLC, said, “We are delighted to welcome Sithambaram Sri Ganendran to this important leadership role at a pivotal moment in our journey. His wealth of experience, proven track record, and people-focused leadership style make him well suited to strengthen and guide Janashakthi Finance, ensuring efficient continuity in all ongoing operations.”

The appointment of Sri Ganendran as Chief Executive Officer, reinforces Janashakthi Finance’s deep commitment to seamless operations and growth. It also underscores its dedication to vision of delivering trusted financial solutions, while continuously exploring opportunities for innovation and expansion to serve its customers and communities more efficiently.

-

Features5 days ago

Features5 days agoWhy Sri Lanka Still Has No Doppler Radar – and Who Should Be Held Accountable

-

Features7 days ago

Features7 days agoDitwah: A Country Tested, A People United

-

News21 hours ago

News21 hours agoPakistan hands over 200 tonnes of humanitarian aid to Lanka

-

News7 days ago

News7 days agoRs 1. 3 bn yahapalana building deal under investigation

-

Midweek Review2 days ago

Midweek Review2 days agoHow massive Akuregoda defence complex was built with proceeds from sale of Galle Face land to Shangri-La

-

News21 hours ago

News21 hours agoPope fires broadside: ‘The Holy See won’t be a silent bystander to the grave disparities, injustices, and fundamental human rights violations’

-

Opinion7 days ago

Opinion7 days agoComfort for some, death for others: The reality of climate change

-

Business7 days ago

Business7 days agoFluctuating fortunes for bourse in the wake of selling pressure