Business

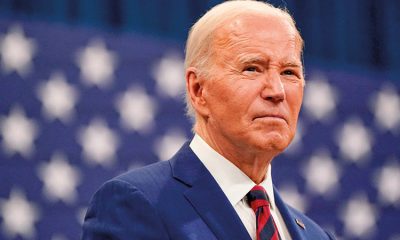

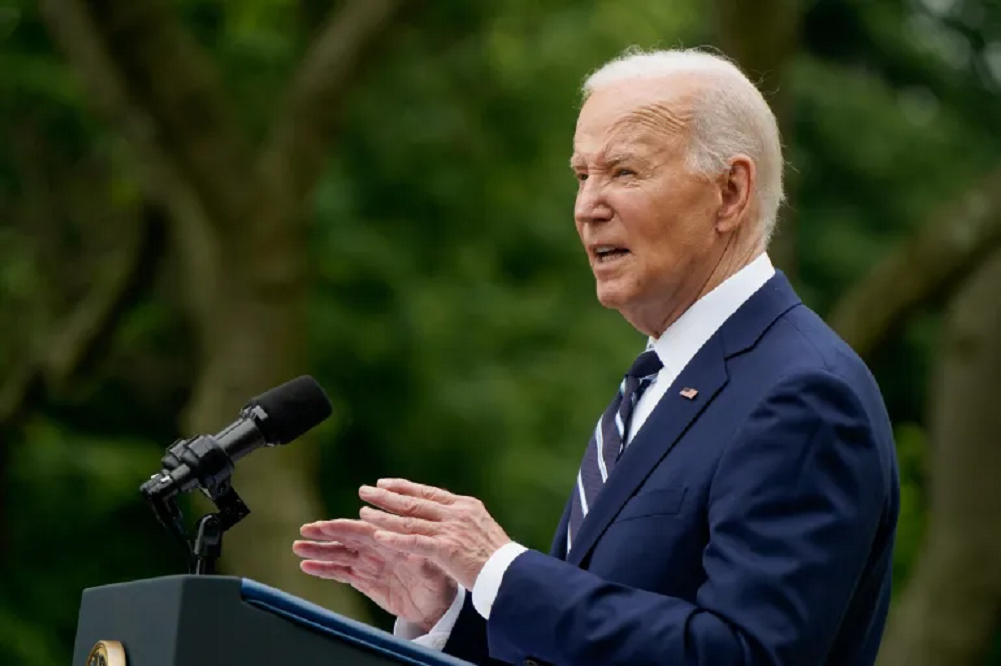

Biden slaps new tariffs on Chinese imports, ratcheting trade war

President Joe Biden has slapped major new tariffs on Chinese electric vehicles, advanced batteries, solar cells, steel, aluminium and medical equipment, taking potshots at Donald Trump along the way as he embraced a strategy that’s increasing friction between the world’s two largest economies.

The Democratic president said on Tuesday that Chinese government subsidies ensure the nation’s companies do not have to turn a profit, giving them an unfair advantage in global trade.

“American workers can outwork and out-compete anyone as long as the competition is fair,” Biden said in the White House Rose Garden. “But for too long, it hasn’t been fair. For years, the Chinese government has poured state money into Chinese companies … it’s not competition, it’s cheating.”

China immediately promised retaliation. Its Ministry of Commerce said Beijing was opposed to the tariff hikes by the United States and would take measures to defend its interests.

Biden will keep tariffs put in place by his Republican predecessor Donald Trump while ratcheting up others, including a quadrupling of EV duties to more than 100 percent and doubling the duties on semiconductor tariffs to 50 percent.

The new measures affect $18bn in imported Chinese goods including steel and aluminium, semiconductors, electric vehicles, critical minerals, solar cells and cranes, the White House said. The EV figure, while headline-grabbing, may have more political than practical impact in the US, which imports very few Chinese EVs.

The US imported $427bn in goods from China in 2023 and exported $148bn to the world’s number-two economy, according to the US Census Bureau, a trade gap that has persisted for decades and become an ever more sensitive subject in Washington.

US Trade Representative Katherine Tai said the revised tariffs were justified because China was stealing US intellectual property. But Tai recommended tariff exclusions for hundreds of industrial machinery import categories from China, including 19 for solar product manufacturing equipment.

The tariffs come in the middle of a heated campaign between Biden and Trump, his Republican predecessor, to show who’s tougher on China.

Asked to respond to Trump’s comments that China was eating the US’s lunch, Biden said of his rival, “He’s been feeding them a long time.” The Democrat said Trump had failed to crack down on Chinese trade abuses as he had pledged he would do during his presidency.

Karoline Leavitt, the Trump campaign’s press secretary, called the new tariffs a “weak and futile attempt” to distract from Biden’s own support for EVs in the United States, which Trump says will lead to layoffs at car factories.

Administration officials said their measures are combined with domestic investment in key industries and unlikely to worsen a bout of inflation that has already angered US voters.

Biden has struggled to convince voters of the efficacy of his economic policies despite a backdrop of low unemployment and above-trend economic growth. A Reuters/Ipsos poll last month showed Trump had a seven percentage-point edge over Biden on the economy.

[File pic] China’s BYD overtook Tesla as the biggest seller of electric vehicles (Aljazeera)

[File pic] China’s BYD overtook Tesla as the biggest seller of electric vehicles (Aljazeera)

Analysts have warned that a trade tiff could raise costs for EVs overall, hurting Biden’s climate goals and his aim to create manufacturing jobs.

Biden has said he wants to win this era of competition with China but not to launch a trade war. He has worked in recent months to ease tensions in one-on-one talks with Chinese President Xi Jinping.

Both 2024 US presidential candidates have departed from the free-trade consensus that once reigned in Washington, a period capped by China’s joining the World Trade Organization in 2001. Trump’s broader imposition of tariffs during his 2017-2021 presidency kicked off a tariff war with China.

As part of the long-awaited tariff update, Biden will increase tariffs this year from 25 percent to 100 percent on EVs, bringing total duties to 102.5 percent, from 7.5 percent to 25 percent on lithium-ion EV batteries and other battery parts and from 25 percent to 50 percent on photovoltaic cells used to make solar panels. Some critical minerals will have their tariffs raised from nothing to 25 percent.

More tariffs will follow in 2025 and 2026 on semiconductors, as well as lithium-ion batteries that are not used in electric vehicles, graphite and permanent magnets, as well as rubber medical and surgical gloves.

A number of lawmakers have called for massive hikes on Chinese vehicle tariffs or an outright ban over data privacy concerns. There are relatively few Chinese-made light-duty vehicles being imported now.

The United Auto Workers, a politically important union that endorsed Biden, said the tariff moves would ensure that “the transition to electric vehicles is a just transition.”

(Aljazeera)

Business

‘Sri Lanka’s forests are undervalued economic assets — and markets are paying the price’

Sri Lanka’s economic strategy continues to focus on exports, productivity and fiscal consolidation.

Yet one of the country’s most valuable assets — its forests and traditional forest-based farming systems — remains largely absent from economic planning. This is no longer an environmental oversight. It is a business risk.

At a recent Dilmah Genesis Thought Leadership Series lecture in Colombo, tropical ecology expert Professor Friedhelm Goeltenboth delivered a clear message: once forests are destroyed, the economic value they provide is lost permanently.

What replaces them — monoculture plantations — may appear efficient, but over time they generate declining yields, rising input costs and growing exposure to climate shocks.

From a financial perspective, this is asset depletion, not development.

Monoculture systems simplify production but externalise costs. Soil erosion, fertiliser dependency, water stress and biodiversity loss eventually hit farmers, banks, insurers and the state.

Sri Lanka is already seeing the consequences through falling productivity and rising agricultural vulnerability.

Forest-integrated farming offers a different model — one that treats land as a multi-income asset.

Spices such as cinnamon, pepper, cardamom and nutmeg can be grown under shade alongside fruit, timber and fibre crops, stabilising income while protecting soil and water. For lenders and insurers, diversified systems reduce risk. For exporters, they support traceability, sustainability certification and premium pricing.

The strongest business opportunity lies in carbon markets. Voluntary carbon markets allow companies to offset emissions by funding verified forest conservation and restoration.

Across Southeast Asia, communities now earn income simply by protecting forests that store carbon.

Sri Lanka has the scientific capacity to enter this space. Farmers can collect data; experts can certify it. What is missing is a coordinated national framework that allows communities and corporates to participate efficiently.

Carbon revenue will not replace agriculture, but it can stabilise it — providing income during crop maturation and creating a new form of export: environmental services.

Ignoring this opportunity carries downside risk.

Biodiversity loss, pollinator decline and climate volatility threaten long-term agricultural productivity. Forests are not sentimental assets; they are economic infrastructure.

Sri Lanka’s recovery cannot be built on short-term extraction. If the country wants resilient growth, it must start recognising the real value of what is still standing, he added.

By Ifham Nizam

Business

Pavan Rathnayake earns plaudits of batting coach

Sri Lanka batting coach Vikram Rathour has hailed middle-order batter Pavan Rathnayake as one of the finest players of spin in the modern game, saying the youngster’s nimble footwork and velvet touch were a “breath of fresh air” for a side long troubled by the turning ball.

Drafted in for the second T20I after Sri Lanka’s familiar struggles against spin, Rathnayake looked anything but overawed by England’s seasoned tweakers, skipping down the track with sure feet and working the ball into gaps with soft hands.

“He is one of the better players when it comes to using the feet,” Rathour told reporters. “I haven’t seen too many in this generation do it as well as he does. That is really impressive and a good sign for Sri Lankan cricket.”

Sri Lanka went down in a last-over nail-biter but there were silver linings despite the hosts being a bowler short. Eshan Malinga was forced out after dislocating his left shoulder and has been ruled out for at least four weeks, a blow that ends his World Cup hopes. Dilshan Madushanka, Pramod Madushan and Nuwan Thushara have been placed on standby.

Power hitting remains Sri Lanka’s Achilles’ heel and Rathour, who carries an impressive CV from India’s T20 World Cup triumph two years ago, pointed to a few grey areas in the batting blueprint.

Power hitting remains Sri Lanka’s Achilles’ heel and Rathour, who carries an impressive CV from India’s T20 World Cup triumph two years ago, pointed to a few grey areas in the batting blueprint.

“There are two components to T20 batting,” he said. “One is power hitting, but the surfaces here, especially in Colombo, are not that conducive to clearing the ropes. The wickets are slow and the ball doesn’t come on to the bat. The other component, just as important, is range as a batting unit.”

Even when Sri Lanka lifted the T20 World Cup in 2014 they were not blessed with a dressing room full of big hitters, relying instead on sharp running, clever placement and a mastery of spin. Rathour preached a similar mantra.

“If you are not a team that hits a lot of sixes, you can still find plenty of fours by utilising the whole ground,” he said. “Most of them sweep well, reverse sweep and use their feet. That is encouraging. If you don’t have the brute power, you can make up for it by using angles and scoring square of the wicket.

“These wickets perhaps suit that style more. They are not the easiest surfaces to hit sixes, and I’m okay with that. If they can use their feet and the angles well, that is as good.”

Rex Clementine

at Pallekele

Business

Unlocking Sri Lanka’s dairy potential

Sri Lanka’s dairy and livestock sector is central to food security, rural livelihoods, and national nutrition, yet continues to face challenges related to productivity, climate vulnerability, market access, and financing.

In this context, Connect to Care and DevPro have entered into a formal partnership through a Memorandum of Understanding (MoU) to support Sri Lanka’s journey towards dairy self-sufficiency.

A core objective of DevPro is to strengthen inclusive and resilient dairy value chains by empowering smallholder farmers through technical assistance, capacity building, climate-resilient practices, and market-oriented approaches, building on its extensive field presence across Sri Lanka.

A core objective of Connect to Care is to support the achievement of dairy self-sufficiency by 2033, as outlined in the national development manifesto, with an interim target of 75% self-sufficiency by 2029.

By strengthening local dairy production and value chains, this effort will also help reduce Sri Lanka’s dependence on imported dairy products, while improving farmer incomes and domestic supply resilience.

The partnership will focus on climate-smart dairy development, multi-stakeholder coordination, and exploring blended finance and PPP models—providing a structured platform for development partners and the private sector to engage in scalable action.

-

Opinion5 days ago

Opinion5 days agoSri Lanka, the Stars,and statesmen

-

Business6 days ago

Business6 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Business4 days ago

Business4 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business23 hours ago

Business23 hours agoSLIM-Kantar People’s Awards 2026 to recognise Sri Lanka’s most trusted brands and personalities

-

Business4 days ago

Business4 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business4 days ago

Business4 days agoArpico NextGen Mattress gains recognition for innovation

-

Business3 days ago

Business3 days agoAltair issues over 100+ title deeds post ownership change

-

Business3 days ago

Business3 days agoSri Lanka opens first country pavilion at London exhibition