Business

Banking sector counters boost CSE trading; market indices in notable rise

By Hiran H. Senewiratne

CSE trading activities were positive throughout yesterday because the current economic environment is pushing the index up, especially with respect to the banking counters, a market analyst said.

Banking sector counters are rising over the possibility of the IMF agreement coming to a conclusion in the first quarter of the year as the Central Bank had predicted, market watchers said.Due to positive developments in the external and internal markets, buying interest and turnover levels have improved, they added.

Amid those developments both indices moved upwards. The All- Share Price Index went up by 72.37 points and S and P SL20 rose by 15.8 points. It was reported that the ASPI closed trading at the 9000 points mark for the first time since October 14, 2022. Turnover stood at Rs 1.8 billion with one crossing. The crossing was reported in Melstacorp, which crossed one million shares to the tune of Rs 57.5 million; its shares traded at Rs 53.40.

In the retail market top seven companies that mainly contributed to the turnover were; Lanka IOC Rs 277 million (1.3 million shares traded), JKH Rs 237 million (1.6 million shares traded), Softlogic Capital Rs 128 million (7.9 million shares traded), Sampath Bank Rs 105 million (2.3 million shares traded), Expolanka Holdings Rs 68 million (355,000 shares traded), Softlogic Life Insurance Rs 59.9 million (480,000 shares traded), and Expack Corrugated Cartons Rs 57.8 million (3.6 million shares traded). During the day 67 million share volumes changed hands in 19000 transactions.

The market was on red during the previous sessions over delays in financial assurances coming from China, which are mandatory for a US $2.9 billion IMF loan. Besides, a rise in protests against the current tax hike kept investors in check, analysts said.

After the recent fuel revisions, the LIOC counter has seen some interest, pushing the counter up.It is said that high net worth and institutional investor participation was noted in JKH. Mixed interest was observed in Softlogic Life Insurance, Lanka IOC and Expolanka Holdings, while retail interest was noted in Softlogic Capital, Industrial Asphalts and SMB Leasing nonvoting.

The Capital Goods sector was the top contributor to the market turnover (due to JKH) while the sector index gained 0.56 per cent. The share price of JKH increased by 50 cents to Rs. 140.The Insurance sector was the second highest contributor to the market turnover (due to Softlogic Life Insurance), while the sector index increased by 2.56 per cent. The share price of Softlogic Life Insurance gained by Rs. 3.75 (3.11 per cent) to settle at Rs. 124.25. Investors are also expecting a rate cut in the next Monetary Policy Review, analysts said.

Business

Lanka’s largest solar park set to transform energy landscape and local economy in Hambantota

A new era in Sri Lanka’s renewable energy is unfolding in the Gonnoruwa Division of Hambantota District, where construction has begun on the country’s largest solar power park. Spanning 450 acres and designed to generate 150 megawatts (MW) of electricity, the US$150 million private-sector-led project is poised to become a cornerstone of the nation’s sustainable energy ambitions.

Officials say the solar park, guided by the Sustainable Energy Authority and the Mahaweli Authority, will make its first contribution to the national grid by the end of this year, with full capacity expected by 2026. Once completed, the facility will rank among Sri Lanka’s largest renewable energy installations, second only to the 210 MW Victoria Dam and the 150 MW Upper Kotmale hydropower project.

The initiative is being framed as a strategic response to recurring power cuts in the Southern Province during annual drought periods. With a projected 20% contribution to the country’s daytime electricity demand, the solar park is expected to significantly stabilize the grid, reduce reliance on fossil fuels, and contribute to the country’s renewable energy targets.

Project Engineer Thilanka Bandara confirmed that preliminary land preparation and boundary works have been completed, with 50 MW already feeding into the national grid. The investment, fully funded through foreign direct investment, local bank loans, and equity capital, requires no government funding. Two private firms are sharing the development, contributing 70 MW and 80 MW respectively.

Bandara highlighted a unique feature of the project: the transmission infrastructure, estimated at US$16 million, is entirely financed by the investors, marking a departure from conventional grid-connected projects. The park will also employ state-of-the-art ground-mounted solar technology, considered the most advanced currently deployed in Sri Lanka.

In a first for Sri Lanka, the solar panels will be installed five feet above the ground, allowing partial-shade crops to be cultivated underneath. Technical Officer Sithmina Bandara explained that this setup will enable the cultivation of food plants such as mushrooms, which thrive in shaded conditions, creating a model for integrated solar-agriculture systems. Agricultural experts have already provided guidance on implementing this initiative, which combines energy production with local food security.

The project is expected to generate 750 to 1,000 direct and indirect jobs, with 400–500 already employed in the initial phase. Long-term maintenance work will provide further employment opportunities, offering a substantial economic boost to the Hambantota region. Environmental management measures are also in place to prevent elephants from entering nearby villages, ensuring harmony between development and wildlife.

All necessary approvals and permits were obtained by February 2025, aligning the project with the Ceylon Electricity Board’s national generation plan. Officials confirmed that upon completion, the total output of the Solar Energy Park will rise to 200 MW, combining existing installations with the new 150 MW facility.

Experts say the Hambantota solar park represents more than just a power generation project. Its innovative design, private-sector financing, and integrated agricultural approach position it as a template for future renewable energy projects in Sri Lanka, reflecting a new model of sustainable development that balances energy, economy, and environment.

By Sirimanta Ratnasekera

Business

ESU Kandy clinches dominant victory at ‘Battle of Esoftians’

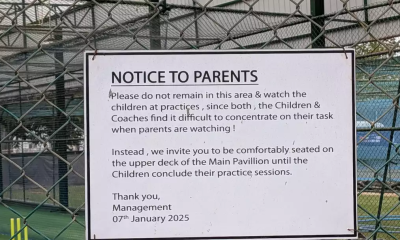

The Battle of Esoftians, an annual cricket encounter organized by ESOFT Uni Kandy, concluded with a spectacular display of cricketing prowess as the Kandy team secured a massive 245-run victory over ESOFT Metro Campus, Kurunegala. The match was held on the 15th at the University of Peradeniya Grounds.

Winning the toss and electing to bat first, the ESOFT Uni Kandy batsmen dominated the field from the outset. They showcased an explosive batting performance, posting a formidable total of 280 runs for the loss of 5 wickets in their allotted 20 overs.

In response, the Kurunegala ESOFT Metro team struggled against a disciplined bowling attack. The Kandy bowlers dismantled the opposition’s batting lineup, bowling them all out for a mere 35 runs, sealing a historic win for the Kandy campus.

The event was graced by the presence of key officials from the ESOFT management: Amila Bandara – Chief Operating Officer (ESOFT Uni), Dimuthu Thammitage – General Manager (Central Region), Lakpriya Weerasinghe – Deputy General Manager, ?Lahiru Diyalagoda

Centre Manager-Degree Division, ESOFT Metro Campus Kurunegala and Dushantha Sandaruwan – Master in Charge (ESU Kandy Cricket Club)

Team Lineups

ESOFT Uni Kandy (Winners)

Chamath Ekanayake (Captain), Dinuka Tennakoon (Vice Captain), Dushantha Sandaruwan (MIC), Chalitha Rathnayake, Pulasthi Bandara, Isuru Dehigama, Kesara Nuragoda, Aadhil Sherif, Isuru Pannala, Achintha Medawatta, Ahamed Shukri, Gowtham Hari Dharshan, Danushka Sahan, Eranda Bandara, and Damith Dissanayake.

ESOFT Metro Campus Kurunegala (Runners-up)

Adeesha Samarasekara, Savishan Madusha, Lahiru Diyalagoda, Hirun Damayantha, Naveen Madushanka, Daham Pothuwewa, Senuda Thewnaka, M.R. Abdulla, Arunodya Dasun, Mohamad Afri, Desith Perera, Lasitha Ranawaka, Anton Dilon, Shenuka Thirantha, and Kavindu Bandara.

Text and Pix By S.K. Samaranayake

Business

HNB joins Royal–Thomian “Battle of the Blues” as official banking partner

HNB PLC, Sri Lanka’s leading private sector bank, has joined as the Official Banking Partner for the 147th edition of the historic “Battle of the Blues,” the Royal–Thomian cricket encounter between Royal College, Colombo, and S. Thomas’ College, Mt. Lavinia. Commenting on the partnership, HNB’s Managing Director/CEO Damith Pallewatte highlighted the bank’s long-standing connection with cricket, including sponsorship of Sri Lanka’s first Test match against England in 1982, and emphasized HNB’s commitment to nurturing young talent and promoting school cricket. The three-day clash for the Rt. Hon. D. S. Senanayake Memorial Shield will take place from March 12–14 at the SSC Grounds, with the Mustangs Trophy one-day match following on March 28 under lights. HNB’s inaugural involvement marks a milestone in the bank’s sports marketing journey, strengthening its role in the school cricket ecosystem. The bank will enhance the spectator experience by introducing digital and cashless banking solutions, modernizing the event while preserving its rich heritage and sporting tradition.

-

Business6 days ago

Business6 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Latest News2 days ago

Latest News2 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Latest News2 days ago

Latest News2 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News2 days ago

Latest News2 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction

-

Features6 days ago

Features6 days agoGiants in our backyard: Why Sri Lanka’s Blue Whales matter to the world

-

Sports3 days ago

Sports3 days agoOld and new at the SSC, just like Pakistan

-

News5 days ago

News5 days agoIMF MD here

-

News2 days ago

News2 days agoConstruction begins on country’s largest solar power project in Hambantota