Business

Bank of Ceylon celebrates 83rd Anniversary steering strongly and steadily

Sri Lanka’s No. 1 Bank, Bank of Ceylon, marks its 83rd Anniversary today. The Bank will celebrate the occasion beginning with a multi-religious ceremony at the Bank’s Head Office with the participation of distinguished guests comprised of customers and well- wishers.

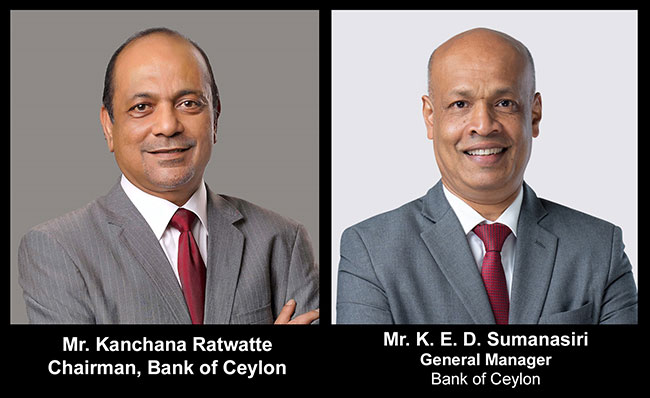

The event will be held with the patronage of the Bank’s Chairman, Kanchana Ratwatte, Members of the Bank’s Board of Directors, the General Manager, K. E. D. Sumanasiri, and the Corporate and Executive Management and Bank officials. In line with the ceremony, the branch network will also celebrate this important milestone at their own premises with the participation of customers and well-wishers.

To mark this special day, BOC will symbolically launched “My Health” account emphasising its innovative spirit in delivering novel value additions to customers. In addition, the Bank will also launche BOC Foreign Circle, a specialised unit geared to delivering superior quality to overseas based customers.

Of further note is the opening of the newly refurbished Bank’s historically significant 1st branch at 41, Bristol Street, Colombo 1, known as the “City Office” on the same day.

BOC Chairman Kanchana Ratwatte said, “I believe it is a commendable achievement for a corporate brand to reach its 83rd anniversary in its journey. As a trailblazer in the industry and a dedicated corporate citizen, Bank of Ceylon (BOC) commemorates this day with humility. With a rich heritage that has evolved along with Sri Lankan culture, and as the No. 1 Bank in the country, BOC’s purpose has always been to enrich the lives and the livelihood of the citizens of Sri Lanka. Hence, innovation and developments towards digitalisation is an organic process within the bank. I wish to take this opportunity to thank our valued customers and all other stakeholders on behalf of the Bank for the confidence placed on the bank and inspiration given to continue the Bank’s legacy”.

“Our Journey as the No. 1 Bank in the country has always been a challenging, yet inspiring one,” stated the General Manager of Bank of Ceylon, K. E. D. Sumanasiri.

“We must thank all our staff members especially, including those who were there since the inception, our loyal customers and valued stakeholders for setting the foundation that the Bank could build itself strongly and steadily to survive and thrive even during strenuous times. Bank of Ceylon ensures that it upholds the values that it was built on and ensures that it has a strong footing both locally and internationally. As the largest bank that boasts of an asset base that exceeds four trillion rupees, BOC ensures that it redistributes its wealth to enhance the country’s wellbeing, through a strong inter-connected branch and digital network and a product portfolio that is developed to cater to the needs of our customers around the clock, wherever they are. We have introduced new initiatives such as “SME Circle” and “Export Circle” by taking a step to further develop entrepreneurship within the local SME and export sectors. This was an extension of BOC’s decision to assist customers through specialised concessionary schemes to overcome continuous economic challenges that took place in recent times. As a prominent financial institution, we are also committed to build a financially and digitally inclusive community aiming for a positive impression on economy.” Sumanasiri further added.

From the inception of the Bank, with the opening of its first branch, the “City Office Branch”, Bank of Ceylon has increased its footprint to include a network of up to 649 branches, and 1,415 ATMs, CDMs and CRMs across the country. Its overseas presence includes branches in Chennai, Male, Hulhu-Male, Seychelles and a banking subsidiary in London. BOC has systematically established its roots within every facet of banking and finance, simultaneously building a strong affiliation with the international banking network. With these strong ties BOC leads the trade finance and inward remittances market in Sri Lanka.

Adopting the latest digital banking technologies, the Bank successfully embarked into green banking where it accommodated strategies to reduce its carbon footprint and increase its usage of renewable energy. BOC has built its strategic green banking initiatives according to United Nation’s SDG guidelines to ensure that the intended value is generated to all stakeholders.

Being recognised by Brand Finance Lanka as the Country’s No. 1 Banking Brand with a brand value of over Rs. 53 billion, Bank of Ceylon boasts of a strong balance sheet with assets worth over Rs. 4 trillion and deposits of over Rs. 3 trillion.

“The Banker” Magazine U.K. named Bank of Ceylon as the “The Bank of the Year 2021” and also recognised it among the “Top 1000 Banks” in the world with a country ranking of No. 1, again by “The Banker” magazine, UK.

“SLIM-Kantar People’s Awards 2022”, adjudged Bank of Ceylon as the “People’s Service Brand of the Year 2022” and “the People’s Banking Services Brand of the Year 2022,” which are two prominent awards in the ceremony based on a people’s vote.

Business

Relief measures to assist affected Small and Medium Enterprises

As agreed with the Sri Lanka Banks’ Association (Guarantee) Ltd. (SLBA), to provide relief measures to affected SMEs by licensed commercial banks and licensed specialised banks, Circular No. 04 of 2024 dated 19.12.2024, and its addendum, Circular No. 01 of 2025 dated 01.01.2025 were issued by the Central Bank of Sri Lanka to ensure the effective implementation of the relief measures specified in the cited Circulars in a consistent manner across all licensed banks.

In case of any rejections or disputes, borrowers are requested to contact the respective banks and to appeal to the Director, Financial Consumer Relations Department of CBSL (FCRD), if required through the following channels:

Based on the repayment capacity and the submission of an acceptable business revival plan by the borrower, the relief measures extended to affected SMEs include rescheduling of credit facilities up to a period of 10 years, extending the time to commence repayments based on the capital outstanding, waiving off unpaid interest subject to conditions, and providing new working capital loans. Despite the availability of the above relief measures, limited number of borrowers had approached licensed banks to avail themselves of these benefits to date.

In addition to the above measures, with the gradual recovery of the economy, in order to facilitate the sustainable revival of businesses that were adversely affected during the recent past, several other measures were taken by CBSL together with the banking industry.

Accordingly, inter alia, strengthening the Post Covid 19 revival units of licensed banks, CBSL issued Circular No. 02 of 2024 dated 28.03.2024 on “Guidelines for the Establishment of Business Revival Units of Licensed Banks” mandating banks to establish Business Revival Units (BRUs) to assist viable businesses that are facing financial and operational difficulties.

Under BRUs, banks may provide support to viable businesses, such as restructuring and rescheduling of credit facilities including the adjustment of interest rates, maturity extensions, providing interim financing, advisory services etc., subject to the condition that such borrowers are required to submit acceptable business plans and feasible repayment plans. As reported by banks, by the end of 2024, around 6,000 facilities had been facilitated through these BRUs.

The above cited Circulars and Guidelines can be accessed via https://www.cbsl.gov.lk

Business

Visa commits to support women entrepreneurs in Sri Lanka

Visa (NYSE: V), the global leader in digital payments reiterated its support to women entrepreneurs across Sri Lanka as a part of its International Women’s Month celebrations across the world, by stating a firm commitment towards financial inclusion and digitization of women-led businesses, and hosted women from different walks of life in a specially curated event at Colombo.

Avanthi Colombage, Country Manager for Visa in Sri Lanka and Maldives stated, “At Visa, we believe in being the best way to pay and be paid by uplifting everyone, everywhere. This year, we celebrated International Women’s Month to support the very capable businesswomen in our country, with an event titled ‘Overcoming Barriers to Growth’ along with Square Hub, an incubator and business accelerator.”

The event by Visa brought together 35 upcoming women entrepreneurs across various sectors, including fashion, e-commerce, fintech, technology, manufacturing, and agriculture. While prominent industry experts shared views, learnings and experiences from their own journeys, the event also facilitated open discussions and networking among entrepreneurs, on how they can build and sustain thriving businesses.

Avanthi elaborates that Visa has built a firm foundation in supporting female entrepreneurship and the empowerment of women in Sri Lanka and understands the challenges women-owned businesses face when seeking capital, access, networks and guidance and continues to actively uplift women in Sri Lanka. Globally and in Sri Lanka, Visa believes that the participation of women is key to the growth of an economy. Avanthi adds, “Two years ago, when we celebrated 35 years of Visa in Sri Lanka, we announced a grant for The Asia Foundation to assist women-led small and medium businesses (SMBs) throughout the country. This initiative offered vital seed funding, skills training, and financial inclusion opportunities for women entrepreneurs, helping remove some major barriers to their success,” she recalled.

Business

Environmentalists renew concerns over Adani Group’s proposed Mannar wind power project

Environmental groups, including the Wildlife and Nature Protection Society (WNPS), the Centre for Environmental Justice (CEJ) and the Environmental Foundation Ltd. (EFL), are raising renewed concerns about the potential ecological impact of large-scale wind energy development on Mannar Island. Conservationists argue that the island, home to a unique and sensitive ecosystem, faces serious risks from industrial projects that may disrupt biodiversity and endanger local wildlife.

At the heart of the controversy is whether the environmental issues raised by Adani Group’s proposed wind energy project in Mannar were being adequately considered. Critics argue that tariff negotiations and economic interests overshadowed ecological assessments, potentially leading to a project that might compromise the island’s rich natural heritage.

“Can wind energy coexist with Mannar Island’s fragile ecosystem? asked environmental scientist Hemantha Withanage of the CEJ.

He told The Island Financial Review: “We must ensure that our transition to renewable energy does not come at the cost of irreplaceable biodiversity.”

Other conservationists have pointed out that environmentalists are often misrepresented as obstructionists in debates over development. “Are we being painted as enemies of progress, or is the public being misled about the real consequences of such projects? questioned Dr. Rohan Pethiyagoda, a leading environmental advocate.

With Adani’s possible withdrawal from the project, there is now an opportunity to reevaluate Sri Lanka’s approach to sustainable energy. Experts emphasize the need for a smarter, science-driven path that prioritizes both renewable energy and environmental conservation.

A joint media conference, scheduled for today at the Dutch Burgher Union, Colombo, aims to address these concerns. Organized by WNPS, CEJ, EFL and Pethiyagoda, the event will explore questions such as whether the project might resurface under a new guise and who the true beneficiaries of such large-scale energy initiatives are.

By Ifham Nizam

-

Sports3 days ago

Sports3 days agoSri Lanka’s eternal search for the elusive all-rounder

-

News4 days ago

News4 days agoGnanasara Thera urged to reveal masterminds behind Easter Sunday terror attacks

-

News2 days ago

News2 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

Business5 days ago

Business5 days agoAIA Higher Education Scholarships Programme celebrating 30-year journey

-

News3 days ago

News3 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features3 days ago

Features3 days agoSanctions by The Unpunished

-

Latest News1 day ago

Latest News1 day agoIPL 2025: Rookies Ashwani and Rickelton lead Mumbai Indians to first win

-

Features3 days ago

Features3 days agoMore parliamentary giants I was privileged to know