Business

Bangladesh – Sri Lanka Preferential Trade Agreement: Gains and policy challenges

By Asanka Wijesinghe and Chathurrdhika Yogarajah

0espite enhanced trade partnerships in South Asia, intra-regional trade is far from reaching its theoretical potential. Similar production patterns and competitive sectors can be the causes. However, bilateral discussions to further lower trade costs continue. The ongoing Bangladesh-Sri Lanka discussions on a preferential trade agreement (PTA) will benefit from knowing the potential gains from reducing bilateral trade costs. In addition, knowledge of products with higher potential for export gains will help optimise the economic benefits from a trade deal.

Bangladesh – Sri Lanka Trade:

The Current Status

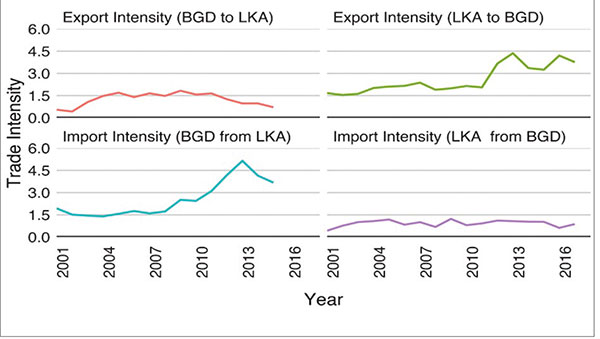

In 2018, when discussions on a PTA began to firm up, Sri Lanka’s exports to Bangladesh were USD 133 million, while imports from Bangladesh were USD 37 million. Despite the low trade volume, Sri Lanka’s exports to Bangladesh have grown (Figure 1). In addition, Sri Lanka records a bilateral trade surplus with Bangladesh, which is encouraging given the country’s trade deficit concerns. However, weak growth of exports from Bangladesh to Sri Lanka can be seen from 2001 to 2016 (Figure 1).

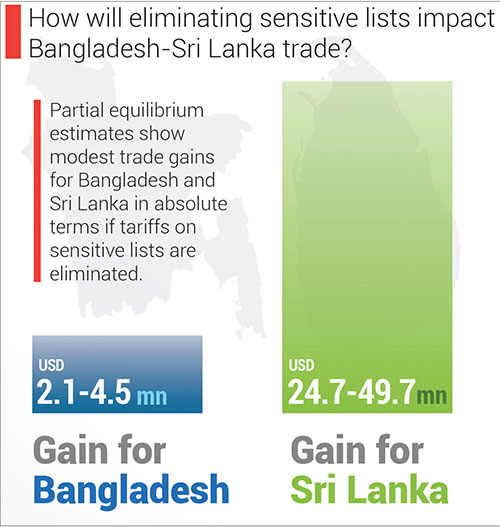

The current trade deals between the two countries are still partially restrictive. Both countries keep a sensitive list of products that are not eligible for tariff cuts. Sri Lanka maintains a list of 925 products sanctioned by SAFTA (South Asian Free Trade Area) while Bangladesh keeps 993 products. Sri Lanka’s sensitive list covers USD 6.2 million or 23.8% of imports from Bangladesh. The sensitive list of Bangladesh covers USD 77.6 million or 62% of imports from Sri Lanka. Thus, the elimination of sensitive lists may benefit Sri Lanka more.

Figure 1: Trade Intensity between Bangladesh and Sri Lanka

Source: Authors’ Illustration using Trademap Data.

Theoretically, bilateral alliances deepen trade by removing weaknesses in existing multilateral trade arrangements. A trade deal between Bangladesh and Sri Lanka can simplify trade regulations further. In addition, Bangladesh needs alternative preferential access as graduation from Least Developed Country (LDC) status will take away preferential access to its key markets. For Sri Lanka, increasing bilateral participation in production value chains, especially in the textiles sector, might be an economic motivation. Financial support extended by Bangladesh to manage Sri Lanka’s foreign currency pressures might be a political motivation for a trade deal.

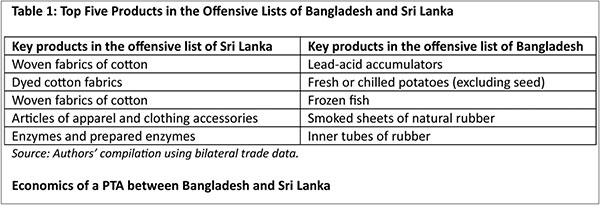

Eliminating sensitive lists can lead to trade creation, although it may not happen due to political and economic reasons. When it comes to tariff cuts, both countries will act defensively as certain products in the sensitive lists are vital for employment and revenue generation. Thus, the success of a trade deal depends on how many products with high export potential are under its purview. In this direction, a group of products with specific characteristics can be identified as an offensive list. For example, Sri Lanka’s offensive list includes products that Bangladesh imports from anywhere in the world, produced by Sri Lanka with a capacity for expansion. Sri Lanka has a comparative advantage in exporting that good, and Bangladesh already has a tariff on the product.

Export Gains from Tariff Elimination

If tariffs on the sensitive lists are eliminated, there will be modest export gains for Bangladesh and Sri Lanka in absolute terms. Sri Lanka will gain USD 24.7 to 49.7 million of exports to Bangladesh, while Bangladesh will gain USD 2.1 to 4.5 million of exports to Sri Lanka. Potential export gains are given in a range due to assumptions on elasticity values used in the partial equilibrium model. Elimination of sensitive lists will generate a higher tariff revenue loss to Bangladesh, ranging between USD 13.5 million to USD 19.1 million. By contrast, Sri Lanka’s revenue loss will be slight at USD 1.4 million to USD 1.9 million.

Whatever the arrangement, it is crucial to include the products with high export potential in the offensive lists (See Table 1 for the major products). Out of 39 products in Bangladesh’s offensive list, 21 are intermediate goods, while 18 are consumption goods. Similarly, 75 out of 115 products in Sri Lanka’s offensive list are intermediate goods. Tariff cuts on intermediate products may induce fragmented production between two countries, which would harness country-specific comparative advantages. Major intermediate goods in the offensive lists are dyed cotton fabrics, cartons, boxes, and cases, plain woven fabrics of cotton, denim, natural rubber, and smoked sheets of natural rubber (Table 1).

The ex-ante estimates predict modest gains for Sri Lanka and Bangladesh in absolute terms, even after completely removing the sensitive list. But complete removal is politically challenging for both countries. Moreover, Bangladesh as an LDC may expect special and differential (S&D) treatment. Thus, the outcome can be a limited PTA in line with weaknesses in existing trade agreements governing South Asian trade. The impact on trade of regional trade agreements in force is negative primarily due to stringent general regulatory measures, including rules of origin (ROO), sensitive lists, and prolonged phasing-in. Given that the estimated modest economic gains of a Bangladesh-Sri Lanka PTA do not justify a trade deal that requires substantial resources for negotiations,the PTA should have fewer regulatory measures and tariff concessions for the products on the offensive lists to maximise the economic benefits of a PTA between the two countries.

Link to the full Talking Economics blog: https://www.ips.lk/talkingeconomics/2022/01/20/bangladesh-sri-lanka-preferential-trade-agreement-gains-and-policy-challenges/

Asanka Wijesinghe is a Research Economist at IPS with research interests in macroeconomic policy, international trade, labour and health economics. He holds a BSc in Agricultural Technology and Management from the University of Peradeniya, an MS in Agribusiness and Applied Economics from North Dakota State University, and an MS and PhD in Agricultural, Environmental and Development Economics from The Ohio State University. (Talk with Asanka – asanka@ips.lk)

Asanka Wijesinghe is a Research Economist at IPS with research interests in macroeconomic policy, international trade, labour and health economics. He holds a BSc in Agricultural Technology and Management from the University of Peradeniya, an MS in Agribusiness and Applied Economics from North Dakota State University, and an MS and PhD in Agricultural, Environmental and Development Economics from The Ohio State University. (Talk with Asanka – asanka@ips.lk)

Chathurrdhika Yogarajah is a Research Assistant at IPS with research interests in macroeconomics and trade policy. She holds a BSc (Hons) in Agricultural Technology and Management, specialised in Applied Economics and Business Management from the University of Peradeniya with First Class Honours. She is currently reading for her Master’s in Agricultural Economics at the Postgraduate Institute of Agriculture, Peradeniya. (Talk with Chathurrdhika: chathurrdhika@ips.lk)

Chathurrdhika Yogarajah is a Research Assistant at IPS with research interests in macroeconomics and trade policy. She holds a BSc (Hons) in Agricultural Technology and Management, specialised in Applied Economics and Business Management from the University of Peradeniya with First Class Honours. She is currently reading for her Master’s in Agricultural Economics at the Postgraduate Institute of Agriculture, Peradeniya. (Talk with Chathurrdhika: chathurrdhika@ips.lk)

Business

Code of Ethics for capital market influencers in the pipeline

The Securities and Exchange Commission (SEC) of Sri Lanka is planning to introduce a Code of Ethics or a set of guidelines for the activities of capital market influencers to protect the public from ongoing scams involving the swindling money from potential investors in the share market.

“The market regulator has already identified Blue Ocean Securities Limited and Gladius South Asia as involved in such scams, which are being investigated by the relevant authorities, said Deputy Director General of the SEC Tushara Jayaratne.

The Deputy Director General also said that Gladius was using their their logo in a fraudulent manner to promote their business as well.

He said Blue Ocean has been involved in asking investors to start trading through an app named BOMate Nd. ‘Through this app, you can’t trade shares. But the money transaction goes through this app and the SEC system does not see these transactions, Jayaratne explained.

“The money is going somewhere else, Jayaratne told journalists at a media briefing yesterday held at the SEC auditorium, WTC building, Colombo.

Jayaratne said the SEC has already made complaints to both the Criminal Investigation Department (CID) of the police and the Financial Intelligence Unit (FIU) of the Central Bank.

The Deputy Director General said the second company, Gladius South Asia, has been involved in asking investors not to invest their money in the local stock market, but to do so in the markets in foreign countries.

He also said that the SEC has adopted 12 key capital market development projects to increase the number of capital market investors.

“The Introduction of a Code of Ethics and guidelines for registered investment advisers will help to develop the market in an efficient and effective way, he said.

Jayaratne, however, said that the Sri Lankan share market is not full of scams and that people can have confidence in the market.

“Our market is somewhat free and fair. From the perspective of investors, you also have a responsibility to be careful when investing in the market, he added.

By Hiran H Senewiratne

Business

Norway supports flood-affected communities in Sri Lanka

Norway is providing more than USD 2.4 million to assist those affected by severe flooding in Sri Lanka.

“Norway is contributing emergency assistance to people who have lost both their homes and livelihoods in Sri Lanka. A rapid response is crucial to ensure that those affected have shelter, food, healthcare and support to rebuild their communities,” said Norway’s Minister of International Development, Åsmund Aukrust.

The United Nations estimates that nearly 11 million people have been impacted by catastrophic floods and landslides across large parts of South and Southeast Asia. Sri Lanka, Indonesia, Thailand, Vietnam and Malaysia have experienced record rainfall since 17 November. In total, approximately 1,600 people have lost their lives, and 1.2 million have been forced to leave their homes. Critical infrastructure such as houses and roads has been destroyed, and health risks are increasing due to waterborne diseases and poor sanitation.

“Norway is now contributing NOK 20 million (approx. USD 2 million) to the Red Cross Movement and the UN system in Sri Lanka. These organisations have presence in the country and the capacity to respond quickly based on local needs,” Aukrust said.

Sri Lanka is among the hardest-hit countries. On 28 November, Cyclone Ditwah struck the country, bringing heavy rain and strong winds. The cyclone triggered landslides and caused the most severe floodsing in recent history. The Sri Lankan authorities have led the search and rescue operations and allocated significant resources for immediate relief. “When disasters of this magnitude occur, it is vital that the international community and countries like Norway step up and support local actors in managing the crisis,” Aukrust said.

In addition, the UN Central Emergency Response Fund (CERF) has allocated USD 4.5 million for flood response in Sri Lanka. Around one in ten dollars in the fund comes from Norway.

Norway is also assisting flood-affected communities in Sri Lanka through an immediate response mechanism in the World Food Programme (WFP). The International Labour Organization (ILO) has re-allocated around USD 100,000 in a Norway-funded job generation project, to assist flood-affected participants. Furthermore, Norway has funded a UN expert to help coordinate ongoing relief efforts in the affected areas.

Business

Janashakthi Finance appoints Sithambaram Sri Ganendran as CEO

Janashakthi Finance PLC, formerly known as Orient Finance PLC and a subsidiary of JXG (Janashakthi Group), announces the appointment of Sithambaram Sri Ganendran as the Chief Executive Officer.

Sri Ganendran, who has held the position of Chief Operating Officer since September 2024, stepped in as Acting Chief Executive Officer during the past four months.

He brings with him almost 27 years of extensive experience in banking. Throughout his extensive career, he has held senior management roles in multiple local and international banks, where he acquired in-depth knowledge in operations, branch banking (across retail and SME sectors), operational risk, business continuity management, business integration, process reengineering, operational excellence, sales governance and credit card operations. He holds a plethora of qualifications including an MBA from American City University. He is a Fellow of the Chartered Institute of Management Accountants (CIMA) in the United Kingdom, and an Associate Member of the Chartered Institute of Securities and Investments (CISI), and a member of the Association of Professional Bankers of Sri Lanka.

Rajendra Theagarajah, Chairman of Janashakthi Finance PLC, said, “We are delighted to welcome Sithambaram Sri Ganendran to this important leadership role at a pivotal moment in our journey. His wealth of experience, proven track record, and people-focused leadership style make him well suited to strengthen and guide Janashakthi Finance, ensuring efficient continuity in all ongoing operations.”

The appointment of Sri Ganendran as Chief Executive Officer, reinforces Janashakthi Finance’s deep commitment to seamless operations and growth. It also underscores its dedication to vision of delivering trusted financial solutions, while continuously exploring opportunities for innovation and expansion to serve its customers and communities more efficiently.

-

Business7 days ago

Business7 days agoCabinet approves establishment of two 50 MW wind power stations in Mullikulum, Mannar region

-

Features4 days ago

Features4 days agoWhy Sri Lanka Still Has No Doppler Radar – and Who Should Be Held Accountable

-

Features6 days ago

Features6 days agoDitwah: A Country Tested, A People United

-

News6 days ago

News6 days agoRs 1. 3 bn yahapalana building deal under investigation

-

News7 days ago

News7 days agoCabinet approves the transfer of the constructions and land reserved for the Kiinniya University to the Ministry of Foreign Affairs, Foreign Employment, and Tourism

-

Business6 days ago

Business6 days agoFluctuating fortunes for bourse in the wake of selling pressure

-

Opinion6 days ago

Opinion6 days agoComfort for some, death for others: The reality of climate change

-

News6 days ago

News6 days agoFormer SAARC SG Esala Weerakoon calls for ‘South Asian Climate Compact’