Business

Arvind Subramanian: Why hasn’t Sri Lanka’s democracy acted as a hedge against economic chaos?

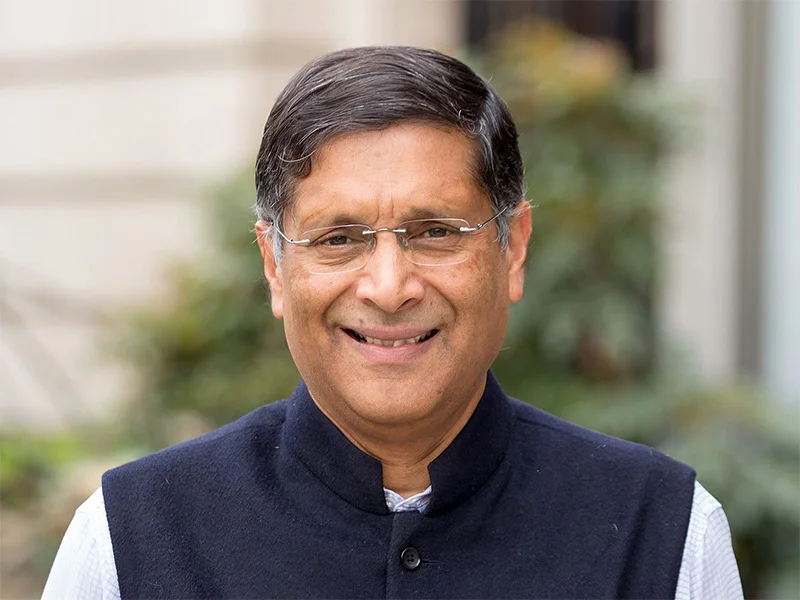

In a sobering and intellectually provocative lecture delivered yesterday at the Central Bank of Sri Lanka, Dr. Arvind Subramanian, former Chief Economic Advisor to the Government of India, posed a “haunting” question to the nation’s policymakers: Why has one of the world’s oldest democracies outside the West failed to leverage its political system to ensure economic stability?

Titled ‘Reviving Growth While Maintaining Stability,’ the lecture moved beyond technical prescriptions. Dr. Subramanian, now a Senior Fellow at the Peterson Institute for International Economics, admitted that his experience with the complexities of the Indian economy had made him “humble and somber,” leading him to focus on the broader socio-political structures that dictate a nation’s fate.

Dr. Subramanian argued that in India, democracy acted as a vital pressure valve that prevented both extreme political violence and economic chaos. He noted that while the process of nation-building is historically violent – citing the West’s decimation of populations and China’s estimated 40–75 million deaths between 1950 and 1976 – India managed to maintain a relatively low degree of mass violence.

“Democracy had a key role to play in that,” he asserted. “It is one of India’s major achievements.”

The speaker extended this logic to the economic sphere, suggesting that Indian democracy created a “societal demand” for low inflation.

In India, he noted, there is a pervasive political belief that if inflation crosses the 5 percent threshold, the government is likely to lose the next election. This political accountability forced the Central Bank and the State to maintain macro-stability.

The crux of Dr. Subramanian’s address was the “intellectual puzzle” of why Sri Lanka, which received universal franchise well before India, did not experience the same stabilising effects of democracy.

He presented two charts that he described as “haunting.” The first revealed that Sri Lanka has spent 60 percent of its time under IMF programmes, indicating a state of “perennial macro-economic stress.” In contrast, India has not sought an IMF programme in the 35 years following its 1991 reforms.

“Why does Indian society demand low inflation and macro-stability, while the same doesn’t happen in Sri Lanka?” he asked. Despite its long democratic tradition, Sri Lanka has consistently seen higher inflation and greater financial instability than its neighbour.

Dr. Subramanian also highlighted a stark difference in how both nations treat foreign capital. Pointing to data on external debt stock as a share of Gross National Income (GNI), he illustrated that Sri Lanka has been consistently and significantly more reliant on foreign capital than India or China.

While some argue that Sri Lanka’s small size necessitates a reliance on foreign capital, Dr. Subramanian remained unconvinced, noting that India also suffered from low domestic savings for decades but chose a more cautious path.

“India has been much more cautious in opening up to foreign capital,” he explained. While foreign capital can drive growth, it brings the “downside of risk and volatility” as capital flows in and out – a reality that came to haunt Sri Lanka in recent years through its high exposure to foreign currency-denominated debt.

The lecture concluded not with a list of “1, 2, 3 points” for recovery as the wider audience had expected, but with a challenge to the Sri Lankan intelligentsia. If democracy is meant to be a safeguard against political and economic disorder, the breakdown of that mechanism in Sri Lanka requires deep introspection.

“Different societies differ,” Dr. Subramanian concluded. “But if democracy had a key role in avoiding volatility in India, why shouldn’t it have been so in such an old democracy as Sri Lanka? It is worth pondering over,” he said.

By Sanath Nanayakkare

Business

Pan Asia Bank’s overall assets soar over Rs. 300 Bn and achieve a PAT of Rs.4 Bn

Pan Asia Banking Corporation PLC reported a strong financial performance for 2025, marking a year in which the Bank reinforced its position among Sri Lanka’s steadily expanding financial institutions. The Bank’s overall asset base surpassed Rs. 300 Bn, reaching Rs. 308.02 Bn its largest balance sheet to date while Profit After Tax amounted to Rs. 4.01 Bn. Earnings Per Share stood at Rs. 9.05, reflecting a solid core earnings base and disciplined balancesheet execution during a year of gradually easing macroeconomic pressures.

Total operating income grew to Rs. 16 Bn, supported by resilient net interest generation and sharp growth in non-interest revenue. Even though benchmark interest rates trended downward for much of the year reducing gross interest income at the market level, the Bank protected its core income through proactive liability repricing, careful funding management, and the retirement of high-cost borrowings. A healthier deposit mix supported by CASA growth helped reduce interest expenses by 4%, allowing the Bank to maintain profitability despite softer yields on loans and government securities.

A clearer picture of Pan Asia Bank’s true performance emerges once the nonrecurring sovereign debt gain recorded in 2024 is set aside. On this normalized basis, 2025 stands out as the Bank’s strongest year of underlying profitability in its 30-year history. Underlying Profit After Tax surged 35% to Rs. 4.01 Bn, while underlying Profit Before Tax climbed an impressive 52%, highlighting the Bank’s accelerating earnings momentum. Underlying EPS rose 35% to Rs. 9.05, supported by improved returns, with underlying ROE and ROA rising by 169 and 52 basis points, respectively. Together, these gains reflect the depth of the Bank’s core business strengths, broadbased revenue growth, and disciplined margin management during a year shaped by declining interestrate conditions.

Income diversification also played a pivotal role. Net fee and commission income expanded by 37%, supported by heightened lending activity, improved trade flows, stronger card-related transactions, and remarkable growth in remittance-related business. These developments helped offset the moderation in trading gains, which were affected by lower capital gains on unit trusts and government securities. A derecognition gain of Rs. 278.63 million on FVOCI assets and reduced marktomarket losses helped stabilize noninterest income, allowing the Bank to sustain earnings despite a more subdued trading environment.

Credit quality improved significantly. The Stage 3 loan ratio declined to 1.73% from 3.10% a year earlier one of the greatest improvements within the sector—reflecting the Bank’s continued emphasis on highquality underwriting, better borrower monitoring, and an effective earlywarning framework. Impairment expenses normalized following the unusually large reversal seen in 2024. ( Pan Asia Bank)

Business

SriLankan Cargo secures another South Asian First with IATA CEIV Live Animals Certification

SriLankan Cargo, the air freight arm of SriLankan Airlines, has secured another regional first by becoming the first airline in South Asia to be awarded the Center of Excellence for Independent Validators (CEIV) for Live Animals Logistics Certification from the International Air Transport Association (IATA). Regarded as the premium global standard for the air transport of live animals, the certification serves as a powerful pledge to pet parents, livestock owners, conservationists and all shippers that SriLankan Cargo will transport animals in humane, safe and stress-free conditions across its worldwide network.

Chaminda Perera, Head of Cargo at SriLankan Airlines, commented on the achievement, stating, “Earning the IATA CEIV Live Animals Certification underscores our dedication to animal welfare and operational excellence, ensuring safer handling, trained teams and peace of mind for our customers.”

Sheldon Hee, Regional Vice President, Asia-Pacific, said, “The CEIV Live Animals certification is not only about compliance, but ensures the safety and welfare of live animals transported by air. This is particularly relevant as this is a market that continues to grow with more than 200,000 live animal shipments globally in 2025. We are pleased to see SriLankan Airlines achieve this important certification and ensure the implementation of the highest standards across the supply chain.”

The certification stands out for placing animal safety and welfare at the forefront, supported by best-in-class infrastructure and operational excellence. Achieving it requires a rigorous, multi-step process of training, assessment, validation, certification and recertification, ensuring that only organisations fully compliant with the IATA Live Animals Regulations and the Convention on International Trade in Endangered Species gain membership in this highly exclusive circle of airlines, which currently numbers 12 worldwide.

SriLankan Cargo remains firmly committed to upholding the highest standards stipulated in the IATA Live Animals Regulations throughout the shipment lifecycle, from acceptance and handling to loading, transportation and final delivery. Working closely with veterinary authorities, ground handlers and cargo partners, the airline ensures every check box relating to welfare and compliance is consistently ticked.

SriLankan Cargo also operates purpose-built facilities with precise temperature control procedures and robust contingency plans, enabling animals to travel in optimal conditions, including during transit. Dedicated CEIV-trained team members oversee each movement, safeguarding comfort, wellbeing and regulatory adherence at every stage.

Business

Prime Lands Residencies reports strong earnings growth

Prime Lands Residencies PLC (CSE: PLR) reported strong financial performance for the quarter ended 31 December 2025, keeping shareholder expectations intact.

The company’s share price increased by more than 40% over the last three months, reflecting heightened investor confidence. Market expectations remained elevated given the scale of project launches over the past two years, including three towers in The Border Colombo (484 units), J’adore Negombo (333 units), The Golf Colombo 08 (64 units), Mon Vie Colombo 05 (349 units), Prime Colombo 9 (559 units), and The Seasons Colombo 08 (44 units).

Quarterly revenue grew by 43% year-on-year to Rs. 2.80 billion, compared to the corresponding period last year. This growth was primarily driven by accelerated construction progress in Towers C of The Border Colombo project, together with first time revenue recognition from The Seasons Colombo 08. Revenue from the newly launched remaining projects is yet to be recognized in line with construction milestones and the company’s prudent revenue recognition policy, establishing the growth potential in earnings in upcoming periods.

-

Life style4 days ago

Life style4 days agoMarriot new GM Suranga

-

Business3 days ago

Business3 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features4 days ago

Features4 days agoMonks’ march, in America and Sri Lanka

-

Opinion7 days ago

Opinion7 days agoWill computers ever be intelligent?

-

Features4 days ago

Features4 days agoThe Rise of Takaichi

-

Features4 days ago

Features4 days agoWetlands of Sri Lanka:

-

News4 days ago

News4 days agoThailand to recruit 10,000 Lankans under new labour pact

-

News4 days ago

News4 days agoMassive Sangha confab to address alleged injustices against monks