Business

Aitken Spence Travels welcomes three cruise ships on a single day at Colombo Port

Aitken Spence Travels, welcomed simultaneous arrivals of three cruise ships—Vasco Da Gama, Mein Schiff 5, and MS Seven Seas Navigator on December 10 at the port of Colombo. Vasco Da Gama and Mein Schiff 5 docked at the Colombo port by 7.00am and MS Seven Seas Navigator docked at 1.30pm with approximately 4,000 passengers from all three vessels on one day.

A company press release said: ‘The cruise season began last month with the arrival of ‘Resilient Lady’ from Virgin Voyages, a part of Sir Richard Branson’s renowned group. The visit of Marella Discovery 2 that arrived in early had special significance, marking its first return to Sri Lanka post-Covid and the first turnaround operation in the country. Operated by TUI, this cruise brought three flights to Colombo for disembarking cruise passengers.

‘Notably, the Vasco Da Gama cruise marks its maiden call to Sri Lankan shores allowing its passengers an opportunity to immerse themselves in the vibrant city of Colombo before continuing their voyage to the Trincomalee port. They will explore the wonders of Minneriya, Dambulla, Sigiriya, Polonnaruwa, and the enchanting sights of the East Coast. Further, this cruise will have turnaround operation in Male, Maldives.

‘The seamless arrangement of hosting three cruise ships at the same time all in one day is a testament to Aitken Spence Travels’ exceptional ability to cater to the diverse desires of large groups of concurrent visitors.

‘As the month progresses, the company looks forward to the arrival of MS Nautica on December 17th. This vessel is set to navigate the waters of Sri Lanka for three days, making stops at the ports of Colombo and Hambantota.

‘Aitken Spence Travels is committed to providing an extensive array of curated excursions, inviting all visitors to indulge in the diverse landscapes and rich culture of Sri Lanka. The lineup of 14 cruise calls to the ports of Colombo, Hambantota, and Trincomalee with the various cruise agents will continue till the end of December 2023 bringing in seas of tourists to the country.

‘Commenting on this significant achievement Nalin Jayasundera, Managing Director of Aitken Spence Travels stated that “We are hoping to serve over 10,000 cruise passengers throughout these two months. We are delighted that all these cruise operators are selecting Sri Lanka as part of their cruise itineraries. We have been aggressively promoting the destination and continuously working with the operators to build confidence on the destination for them to pick Sri Lanka. This is not an easy task as we need to be competitive, offering our prices almost twelve months ahead. Once this happens, we cannot revise our rates for any reason despite our operating environmental changes such as taxes, increased entrance fees etc. Our focus is to popularise the destination to attract more cruises”.

‘Ms. Stasshani Jayawardena, Jt. Deputy Chairperson and Jt. Managing Director of Aitken Spence and Head of Tourism and Leisure for the Group, commented that “We are hopeful that the Government would develop infrastructure of the Colombo port to be a cruise hub enabling us to compete with international ports in the region and attract a greater number of cruises contributing to the growth of Sri Lanka’s tourism sector. We are confident and grateful to the Government, Dept. of Immigration & Emigration Sri Lanka, Sri Lanka Ports Authority, Sri Lanka Customs, Sri Lanka Tourism Promotion Bureau, the Tri forces and the Port Agency Services along with all other stakeholders that were supportive and instrumental to help our clients get the best guest experience in Sri Lanka”.

‘The company’s commitment towards cruise calls will continue until the end of April 2024. The positive impacts of these cruise calls are benefiting a broad spectrum of stakeholders, including transporters, hoteliers, wildlife parks, jeep drivers, excursion providers, cultural show artists, guides, and much more contributing to the industry positively.’

Business

Embedding human rights, equity and integrity into business leadership

At its 2026 Social Sustainability Programme Kick-Off, the UN Global Compact Network Sri Lanka convened business leaders to advance the translation of global ambition into practical corporate action on inclusion, integrity and human rights.

On 24 February 2026, the UN Global Compact Network Sri Lanka (Network Sri Lanka) convened business leaders at Barefoot Garden Café for its 2026 Social Sustainability Programme Kick-Off, delivered in collaboration with Good Life X.

The gathering did more than introduce a calendar of events. It positioned Sri Lanka’s corporate community within the broader direction of the UN Global Compact’s 2026–2030 global strategy — a strategy anchored in three imperatives: equipping companies to act, catalyzing collective action, and advancing the business case for responsible leadership.

At its core, the 2026 Social Sustainability agenda is designed to move companies from commitment to capability.

Within the Diversity & Inclusion Working Group, this means building practical pathways toward equal pay for equal work and strengthening male allyship as a governance issue rather than a cultural afterthought. It means examining sexual and reproductive health, disability inclusion, and mental health not as employee benefits, but as structural determinants of productivity and retention. It means sharpening strategic communications so inclusion is embedded in brand integrity. It also means applying science-based behavioural change approaches to shift organizational culture in measurable ways.

Across the Business & Human Rights Working Group, equipping companies takes the form of deepened engagement on decent work and living wage implementation, strengthening human rights due diligence processes, and addressing emerging risk areas such as AI and digital rights. It extends to reinforcing business integrity and anti-corruption frameworks, understanding the social dimensions of a just transition, and recognizing the link between child rights, nutrition, and workforce productivity.

Business

Union Bank to raise LKR 3 Bn via Basel III Compliant Debenture Issue

Union Bank of Colombo PLC announced its proposed Debenture Issue 2026, a strategic move aimed at raising up to LKR 3 billion. This issue is designed to bolster the Bank’s Tier II capital base and provide a robust financial foundation for its upcoming growth initiatives.

The offering consists of Basel III compliant, listed, rated, unsecured, subordinated, redeemable high-yield debentures with Non-Viability Conversion. The instrument has been assigned a rating of BB (lka) by Fitch Ratings (Lanka) Ltd, reflecting the bank’s creditworthiness and the structured nature of the subordinated debt.

Investors can choose from three distinct interest structures starting from a high-yield 13% fixed rate per annum (Type A). This option is paid annually, while Type B offers a 12.5% fixed rate paid semi-annually (12.89% AER). For those seeking market-linked returns, Type C provides a floating rate of the 182-days Treasury Bill rate plus a 400-basis point margin, also paid semi-annually.

The debentures are priced at LKR 100 per unit with a 5-year tenure (2026–2031). The initial issue size is set at 20,000,000 debentures with an option to raise 10,000,000 at the discretion of the Bank and is scheduled to open on 10 March 2026.

Shanka Abeywardene, Chief Financial Officer of Union Bank stated “This debenture issue marks a significant step in the Bank’s journey towards enhanced financial stability. By strengthening its capital adequacy, Union Bank is well-positioned to navigate evolving market conditions while fuelling its long-term strategic objectives for sustainable growth”

Business

Sanjay Kulatunga appointed to WindForce Board

WindForce PLC announced the appointment of Sanjay Kulatunga as an Independent, Non-Executive Director to its Board with effect from 03rd March 2026, following the resignation of Dilshan Hettiaratchi. The appointment further strengthens the Company’s governance framework, strategic oversight, and long-term decision-making capabilities.

Kulatunga brings an established track record as a founder, entrepreneur, and senior executive across financial services and export-oriented industries. He is the Chief Executive Officer and Co-Founder of LYNEAR Wealth Management, a boutique investment firm established in 2013, which has since grown to become one of Sri Lanka’s largest private wealth management institutions, serving high-net-worth individuals as well as local and international institutional clients.

Prior to founding LYNEAR, Kulatunga played a pivotal role in the establishment of Amba Research, an investment research offshoring firm rooted in Sri Lanka and now operating as part of Acuity Analytics.

Over the years, he has contributed extensively to several key national institutions. His previous appointments include serving on the Financial Sector Stability Consultative Committee of the Central Bank of Sri Lanka, as well as the Board of Investment of Sri Lanka and the Securities and Exchange Commission of Sri Lanka.

-

Features3 days ago

Features3 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features6 days ago

Features6 days agoAn innocent bystander or a passive onlooker?

-

Opinion3 days ago

Opinion3 days agoSri Lanka – world’s worst facilities for cricket fans

-

Business6 days ago

Business6 days agoAn efficacious strategy to boost exports of Sri Lanka in medium term

-

Features4 days ago

Features4 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features4 days ago

Features4 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone

-

Features3 days ago

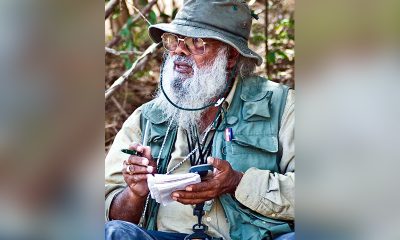

Features3 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul