Business

Aitken Spence reports robust performance with a 10.4% growth in EBITDA to reach Rs. 8.9 Bn in the first half of 2024/25

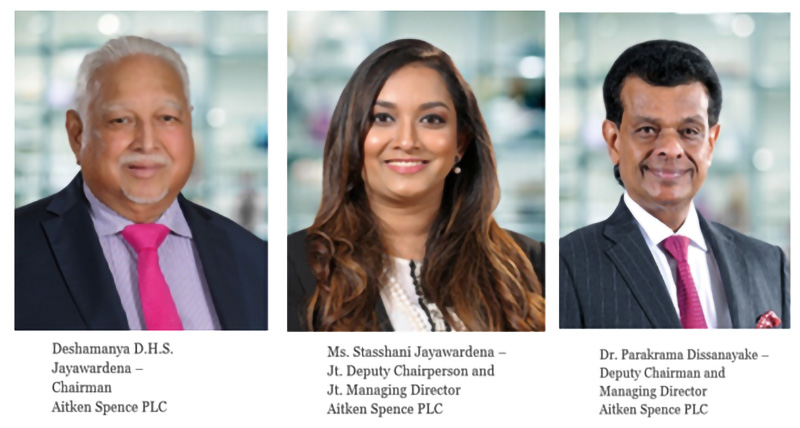

Aitken Spence PLC, a leading conglomerate with a diverse regional presence, reported an EBITDA (excluding impacts from foreign currency exchange gains and losses) of Rs. 8.9 billion for the six months ending 30th September 2024, reflecting a growth of 10.4%. EBITDA includes earnings from equity accounted investees; however, excludes interest expenses, tax, depreciation, and amortization. The Group’s profit from operations (excluding forex) improved significantly by 38.7% from Rs.2.5 billion to Rs. 3.5 billion for the six months ending 30th September.

The Group’s Maritime & Freight Logistics sector reported a PBT of Rs. 2.3 billion for the six months ending 30th September 2024. This performance was affected by a decline in business volumes and exchange rate fluctuations.

The Group’s Strategic Investment sector achieved a PBT of Rs. 728 million, reflecting a growth exceeding 100%. This impressive performance for the first six months of the year was largely driven by the improved results of hydro power companies and the settlement of previously delayed interest received by the other companies within the Group’s renewable energy segment.

The Group’s Tourism sector demonstrated a notable improvement, recording a decrease in losses of 36.9% for the six months ending 30th September 2024. The hospitality segment benefited from increased occupancy rates and higher average room rates, leading to better results for local hotels compared to last year.

However, the destination management segment faced several challenges this period. Macroeconomic factors, including the re-introduction of an 18% VAT on the sector, which could not be added to previously contracted rates with tour operators, significantly impacted results. Additionally, the ongoing conflicts in the Red Sea adversely affected cruise tourism and charter flights from Eastern Europe, further affecting the segment’s performance.

The Group’s Services sector recorded a loss of Rs. 52.1 million, primarily due to increased costs in the elevator segment, driven by additional costs incurred on the accelerated completion of several high-rise buildings in Colombo. Additionally, the sector was affected by a lower exchange rate on remittances in the money transfer business.

During this period, the Group’s Proft Before Tax (PBT) (excluding forex) of Rs. 1.5 billion saw a remarkable improvement recording a complete turnaround from the loss of Rs. 1.2 billion recorded in the previous year.

Sustainability

The Group remains committed to environmental, social, and economic sustainability. Led by Executive Director Dr. Rohan Fernando and reporting to both the Group Supervisory Board and the Main Board, the Group formed a Sustainability Council, comprising of Sectoral Managing Directors and C-Suite officials, to oversee sustainability-related targets, KPIs, and decisions. During the quarter, the Council was sensitised on the IFRS S1 and S2 standards with external topic experts. Within the Group’s Disaster Risk Reduction strategy, the Group conducted its first earthquake drill and night-time fire drill at Aitken Spence Towers. The Group also updated dashboards on its data management platform to monitor non-financial performance indicators. The Group’s total energy consumption within the organisation for 2Q at 376,507 GJ saw a 16% increase from 2Q, 2023-2024 due to increase in operations within the Tourism and Strategic Investments Sectors. Comparatively, the water consumption within the Group in 2Q at 854,243m3 was 34% less than 2Q, 2023-2024. More stringent actions are planned to align with the Group’s pathways for net zero and net positive impact goals. Further, supporting collaborative efforts of the country, Aitken Spence continued to host the Climate Emergency Task Force meetings of the UN Global Compact at Aitken Spence Towers to encourage fostering the discourse on climate action among businesses.

Spence Luminary

In order to create a culture of mentoring, Group HR established a pool of mentors under the ‘Spence Luminary’ banner to guide fellow Spensonians in navigating their careers and realising their full potential. This initiative commenced with a programme tailor-made to equip 50 senior leaders with mentoring/coaching skills. Subsequently, an online platform was launched to connect Spensonian across Aitken Spence with potential mentors/coaches.

Spence Ascend

As part of Aitken Spence DE&I agenda and ongoing theme #SpenceWomenatWork, 40 female Spensonians in the managerial category were provided the opportunity to follow a leadership development programme akin to a mini-MBA curated by Group HR in collaboration with the Postgraduate Institute of Management (PIM). This focused talent intervention is aimed at upskilling high potential female employees to take up leadership roles in the future, aligned with the Group’s aim to increase the percentage of women in leadership positions to 30% by 2030.

Listed in the Colombo Stock Exchange since 1983, Aitken Spence is anchored to a heritage of excellence spanning over 150 years and driven by a team of more than 13,000 across 16 industries in 11 countries: Sri Lanka, Maldives, Fiji, India, Oman, Myanmar, Mozambique, Bangladesh and Cambodia, Singapore, and UAE.

Business

Diplomatic thaw in Middle East sparks hope for Sri Lankan tea exports

Amid softening diplomatic rhetoric between the United States and Iran, a senior economist told The Island Financial Review yesterday that the stability of Sri Lanka’s tea exports to the Middle East, particularly Iran, would be maintained.

The economist, who closely follows regional developments, pointed to recent statements by Iranian Foreign Minister Abbas Araghchi and U.S. President Donald Trump as signs of de-escalation. Araghchi denied plans to execute anti-government protesters, while Trump indicated he had received assurances that killings had stopped and that the U.S. was “watching the process.”

“When geopolitical tensions ease, trade channels stabilise,” the economist said. “Iran and the Middle East are important markets for Sri Lankan tea. Any reduction in political risk is likely to support demand and reduce vulnerability in our export earnings,” he added.

The comments come against the backdrop of this week’s Colombo tea auction, where offerings totalled 6.0 million kilograms. The auction report noted “less activity from Iran and the Middle Eastern markets following recent restrictions in trading conditions,” reflecting the sensitivity of tea exports to regional instability.

Western Slopes and Nuwara Eliya teas showed mixed trends, with some grades firm and others declining. High and Medium Grown CTC teas sold around previous levels, while Low Grown varieties were easier by up to Rs. 20 per kg. Ex-Estate offerings remained steady at 0.74 million kilograms, with no significant change in quality, according to Forbes and Walker Research.

Low Growns, which accounted for approximately 2.4 million kilograms, saw varied demand: the Leafy category was quieter, while Semi-Leafy met with fair interest. Tippy teas faced pressure, especially in the Premium catalogue, where a lack of suitable bids left many unsold.

Selective demand was noted from shippers to the UK, Europe, and South Africa, while markets in Japan, China, the Middle East, and the CIS were reasonably active mostly at lower levels, Forbes and Walker said.

The economist added that while global tea markets remain volatile, any sustained calm in the Middle East could help restore buyer confidence from Iran – a key destination for Sri Lankan Orthodox teas.

“We are not out of the woods yet, but the signs are encouraging,” he said. “If the diplomatic tone continues to improve, we could see firmer demand from the region in the coming weeks,” he said.

By Sanath Nanayakkare

Business

Call for stepped-up economic engagement between SL and Maldives

Sri Lanka is looking to significantly expand its commercial engagement with the Maldives, with business leaders calling for a more focused strategy to capitalise on growing opportunities in trade, services and tourism-linked investments.

Immediate Past President of the Sri Lanka-Maldives Business Council Sudesh Mendis said that the Maldives remains a high-potential market for Sri Lankan exporters and service providers, particularly in construction materials, food and beverage supplies, logistics and professional services aligned with the island nation’s expanding tourism and infrastructure sectors.

“The Maldives offers a demand-driven market where Sri Lankan products and services already enjoy strong acceptance, Mendis said, noting that geographical proximity and long-standing business ties give Sri Lanka a natural competitive advantage.

He said continued resort development, urban housing projects and public infrastructure investments in the Maldives have sustained demand for Sri Lankan goods, while services such as engineering, consultancy and skilled manpower also present room for growth.

However, Mendis stressed that logistical inefficiencies and administrative bottlenecks continue to limit expansion. “Improving shipping connectivity, reducing customs delays and ensuring smoother payment mechanisms are essential if Sri Lankan businesses are to scale up operations, he said.

Tourism collaboration was identified as another underdeveloped area, with Sri Lanka and the Maldives increasingly viewed as complementary destinations rather than rivals. Joint marketing initiatives and multi-destination travel packages could help increase visitor arrivals to both countries, Mendis added.

He also called for stronger private-sector leadership through regular trade missions, sector-focused business forums and targeted policy support to sustain momentum.

“With a coordinated and commercially driven approach, Sri Lanka can substantially deepen its economic presence in the Maldivian market, Mendis said.

Sri Lanka and the Maldives have maintained close economic relations, with bilateral trade expected to gain further traction as regional connectivity improves.

By Ifham Nizam

Business

News of IMF delegation’s visit to SL brings cheer to bourse

The CSE commenced trading yesterday on a negative note due to profit-takings but later turned positive, when sections of the media reported that an IMF delegation is to visit Sri Lanka next week to facilitate the fifth review of the extended fund facility to Sri Lanka.

Amid those developments both indices moved upwards. The All Share Price Index went up by 41.42 points, while the S and P SL20 rose by 25.28 points.

Turnover stood at Rs 4.73 billion with ten crossings. Top seven crossings were reported in DFCC, which crossed 4.4 million shares to the tune of Rs 701 million and its shares traded at Rs 159, HNB 250,000 shares crossed for Rs 105 million; its shares traded at Rs 420, Sierra Cables 2 million shares crossed for Rs 75 million; its shares traded at Rs 37.57, Seylan Bank 666,000 shares crossed for Rs 73.4 million; its shares traded at Rs 110.50.

Commercial Bank 300,000 shares crossed for Rs 57.2 million; its shares traded at Rs 225, Sampath Bank 300,000 shares crossed to the tune of Rs 46.6 million; its shares traded at Rs 155 and Ambeon Capital 1 million shares crossed for Rs 42 million; its shares traded at Rs 43.

In the retail market top seven companies that have mainly contributed to the turnover were; ACL Cables Rs 171 million (1.7 million shares traded), Commercial Bank Rs 153 million (686,000 shares traded), Sierra Cables Rs 130 million (3.5 million shares traded), Sampath Bank Rs 109 million (703,000 shares traded) , HNB Rs 109 million (250,000 shares traded), Lanka Credit and Business Finance Rs 76 million (8.2 million shares traded) and HNB (Non-Voting) Rs 76 million (213,000 shares traded). During the day 132 million share volumes changed hands in 37857 transactions.

It is said that the banking and finance sector led the market, especially HNB and Commercial Bank, while construction related companies, especially Sierra Cables, also performed well at the floor.

The manufacturing and travel and tourism sectors also performed well.

Yesterday the rupee was quoted at Rs 309.50/60 to the US dollar in the spot market weaker from Rs 309.35/50 Wednesday, having depreciated in recent weeks, dealers said, while bond yields were broadly steady.

The telegraphic transfer rates for the American dollar were 305.9000 buying, 312.9000 selling; the British pound was 408.2980 buying, and 419.6162 selling, and the euro was 352.7488 buying, 364.1370 selling.

By Hiran H Senewiratne

-

Business2 days ago

Business2 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Business6 days ago

Business6 days agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

Editorial1 day ago

Editorial1 day agoThe Chakka Clash

-

News6 days ago

News6 days agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Features6 days ago

Features6 days agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

Features6 days ago

Features6 days agoSubject:Whatever happened to (my) three million dollars?

-

Business2 days ago

Business2 days agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App

-

Features1 day ago

Features1 day agoOnline work compatibility of education tablets