Business

A new bill will be introduced to address bankrupt businesses -President

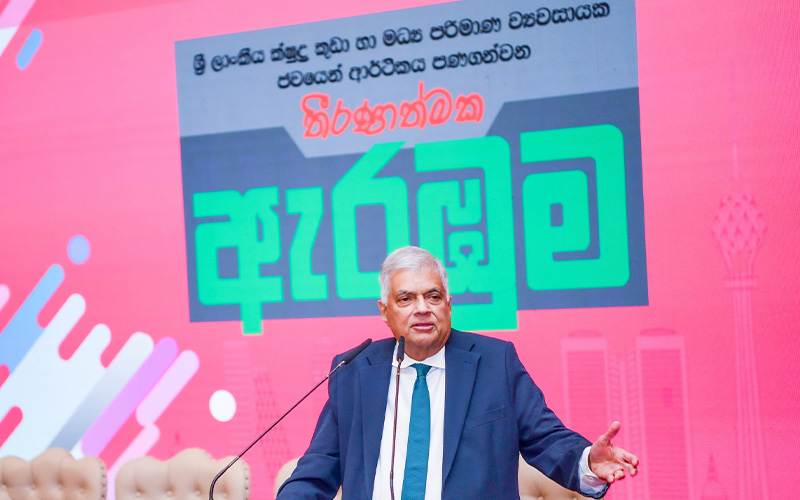

President Ranil Wickremesinghe stated that it is not feasible to indefinitely maintain the temporarily suspended Parate law and consequently, a new bill will be introduced to address bankrupt businesses.

The President also mentioned that the proposed bill includes provisions for restructuring loans taken by Micro, Small and Medium Enterprises (MSME).

Additionally, a new institution named “Enterprise Sri Lanka” will be established to provide necessary support and assistance to Micro, Small and Medium-Scale Entrepreneurs. The President emphasized that the government is committed to encouraging and empowering these entrepreneurs in Sri Lanka.

President Ranil Wickremesinghe made these remarks at the “Critical initiative to revitalize Sri Lanka’s micro, small and medium scale economy” event, organized by the Ceylon Federation of MSME, on Friday (19) at the Bandaranaike Memorial International Conference Hall (BMICH) in Colombo.

The President stated that a copy of the new bill, which has already been drafted, can be provided to the Ceylon Federation of Micro, Small, and Medium Enterprises. He requested that micro, small, and medium enterprises submit their views and suggestions on the bill.

Additionally, the President mentioned that an opportunity could be arranged to discuss the issues faced by micro, small, and medium enterprises with the International Monetary Fund delegation scheduled to visit Sri Lanka at the end of this month.

President of the Sri Lanka Micro, Small, and Medium Enterprises Federation Mrs. Sashika De Silva, presented a special commemorative gift to the President.

President Wickremesinghe further stated,

“There have been many questions from you, the Micro, Small and Medium-scale Entrepreneurs, about the recent challenges. Before addressing your specific concerns, I want to explain the background that led to these issues. We need to find solutions based on this context.

During the recent past, the country’s economy faced a severe collapse, impacting all businesses, particularly small enterprises and causing widespread losses among micro-enterprises. The banking system was also at risk. Our immediate priority upon taking office was to stabilize the situation, negotiate with the International Monetary Fund (IMF), and work towards economic recovery.

They indicated that reaching an agreement with the IMF would allow us to move forward. Private creditors also agreed to address the framework once we had an agreement with the official creditors. Without financial support, making progress was impossible.

During that period, we had to agree on several key issues. We decided not to print more money or borrow from banks, as banks themselves were struggling. These practices had become our main sources of income, but we were advised to abandon these flawed approaches and adopt a new strategy.

As part of this shift, we had to remove subsidies from some corporations. Previously, we were providing between LKR 700 and 800 million in subsidies annually, funded by the people of this country. To correct this, we stopped the subsidies, which led to an increase in prices for goods, including fuel.

Additionally, we had to increase VAT because the revenue from it was insufficient. Currently, the country’s economy is being managed with our own resources. This has placed a significant burden on us, but we had to bear it. The international community observed our efforts to manage our own challenges before seeking external support, and this is where we began our recovery process.

“Ultimately, we successfully managed all public corporations using our own resources. This has led to fuel prices fluctuating in line with global trends. There is potential to further reduce fuel prices by cutting certain costs, and the same applies to energy prices.

Next year, we aim to address all inefficiencies. Once the economy is stabilized, we will be able to make further progress. However, it is crucial to protect the banking system. We had to inject capital into government banks, such as the Bank of Ceylon and the People’s Bank, as well as private banks. This required using a portion of our funds. Safeguarding the banking system is essential for our continued advancement.

The International Monetary Fund and the World Bank have pointed out that our subsidies were insufficient and needed to be better targeted. As a result, we initiated the ‘Aswesuma’ program. Under this program, we are providing three times the amount previously given through the Samurdhi movement. While Samurdhi benefited 1.8 million people, our new Aswasuma program extends benefits to 2.4 million low-income earners. This program is a key initiative for supporting those in need.

In addition to safeguarding our banking system and supporting micro, small, and medium enterprises, we are also advancing large scale businesses.

We are focusing on granting land rights to 02 million people through the ‘Urumaya’ program by providing freehold land deeds. This process may take three to four years to complete, resulting in 02 million new landowners. We are also working on providing household ownership to approximately 200,000 people and establishing villages in the plantation sector with associated land and housing rights. In total, this initiative will benefit between 2 and 2.5 million people. Our goal is to continually work towards providing rights and support to the people.

Preliminary, we are focusing on providing rights at the grassroots level. This includes land used for agriculture, as poverty remains prevalent in villages. We are advancing agricultural modernization in rural areas to boost economic activity. This initiative will increase local money circulation, raise entitlement levels, and expand bank accounts, ultimately enhancing individual wealth. By supporting these efforts, we aim to help small and medium-scale businesses thrive alongside these communities.

Currently, we have suspended the Parate law, but it cannot remain suspended indefinitely. Therefore, we are working on a new Insolvency Bill, which we have now presented. A copy will be made available for discussion. Please review it, as it includes provisions for restructuring.

We should also focus on boosting exports. To support this, we are establishing a new organization called ‘Enterprise Sri Lanka,’ which will provide the necessary assistance. Additionally, we are setting up a National Bank for Development. While these changes cannot happen all at once, we are implementing them systematically as the economy develops.

In this context, your issues can be discussed. If you are interested, I can arrange consultations with representatives from the International Monetary Fund, who will visit Sri Lanka at the end of this month.

First, review and discuss these points among yourselves – What legal remedies are needed? – Are additional concessions required beyond those outlined in the draft? Discuss these matters and share your concerns. You can later discuss the law with the government. However, before doing so, let’s consult with the International Monetary Fund. I will also assign several officers from the Ministry to assist you. We are ready to help.

Former Finance Minister Ravi Karunanayake, President’s Senior Advisor Neranjan Dev Adhitya, Secretary of the Ministry of Industries Shantha Weerasinghe, Industrial Development Board Chairman Dr. Saranga Alahapperuma, President Counsel Ronald C. Perera, along with Chairmen and representatives of public and private banks, and officials from the Ceylon Micro, Small, and Medium Enterprises Federation, were present at the event.

Business

CMTA calls for urgent recall of vehicle valuation and import processes

The Ceylon Motor Traders Association (CMTA) has highlighted the fact that Sri Lanka’s vehicle import framework requires urgent recalibration to ensure fairness, transparency, and the protection of state revenue. The CMTA states that one of the most critical issues that must be addressed is the automatic 15 per cent reduction applied to the CIF value of used vehicle imports when calculating import duties. The CMTA maintains that duty calculations should be applied uniformly across all importers, whether the vehicle is brought in through an authorised agent as brand new or through a dealer as a used import.

For example, if an authorised agent imports a 2026 zero-mileage vehicle of a particular brand at a CIF value of USD 50,000, the full value is used for duty assessment. However, if a dealer imports the exact same 2026 model, also zero mileage and identical in specification, but registered and subsequently de-registered prior to shipment, the CIF value for duty purposes is reduced by 15% to USD 42,500. This concession is granted solely because the vehicle is technically classified as “used” due to prior registration, despite there being no practical difference in mileage, condition, or specification between the two vehicles.

The CMTA believes this practice creates a structural imbalance in the market and results in a significant erosion of import duty revenue to the State. When two identical zero-mileage vehicles are assessed at different CIF values purely on the basis of a procedural registration classification, it distorts competition, disadvantages compliant authorised agents, and undermines equitable tax collection. The Association therefore calls for a uniform valuation approach that reflects the true transacted value of the vehicle, regardless of its registration status prior to export.

Compounding this issue is the widespread application of a 15% depreciation adjustment, which further distorts declared values. When combined with under-declared transaction prices and manipulated valuations, duty is calculated on figures that are significantly lower than actual market value. These reduced values are then reflected across various online platforms and price-tracking websites, creating a distorted reference market that reinforces undervaluation and normalises non-compliant pricing behaviour.

One of the most pressing issues confronting the State is the growing misuse of VAT-free trade-ins which certain car sales are supposed to be practicing within the used vehicle business. These transactions, often structured as vehicle-for-vehicle or vehicle-for-asset exchanges in selling an unregistered vehicle and bypass standard VAT mechanisms and obscure the true transacted value of imports. Such practices often allow vehicles to enter the market with lower invoice values, directly impacting the calculation of import duties and other applicable taxes.

The absence of structured, enforceable processes to accurately define and verify transacted value has created an environment where valuation practices vary widely and lack accountability. Evaluations are frequently conducted at lower price points that do not reflect genuine purchase consideration, enabling systemic revenue leakage for the Government. While mechanisms exist in principle to address these discrepancies, their inconsistent application has rendered them ineffective.

Vehicle imports through CMTA members which operate within clearly defined and auditable frameworks, demonstrate that transparent valuation and predictable tax collection are both achievable and sustainable. These channels provide the State with accurate invoicing, traceable foreign currency outflows, and reliable duty and VAT collection, while limiting the scope for malpractices.

The CMTA believes that consumer safety cannot exist in isolation. The association believes that authorities have a responsibility to ensure that all businesses within the automotive industry operate ethically and within the law. When certain segments of the market are permitted to circumvent regulation, consumer safety is compromised and businesses committed to lawful operations and sustained customer support are placed at an unfair disadvantage.

Therefore, the association urges the relevant authorities to rigorously enforce existing laws and regulations to mitigate malpractices and ensure a level playing field for all participants in the industry and ensure proper collection of tax revenue for the nation. Fair enforcement will not restrict consumer choice; it will enhance it by promoting transparency, safety, and accountability across the market.(CMTA).

Business

Understanding Fixed Income

This article is part of a collaborative series by the CFA Society Sri Lanka, Securities and Exchange Commission of Sri Lanka (SEC) and the Colombo Stock Exchange (CSE) which aims to enhance financial literacy and empower individuals with the knowledge and tools to make informed financial decisions and build long-term financial security. This week, we present the third article from our series: Understanding Fixed Income, authored by Keshawa Perera, CFA.

Fixed income investments, commonly known as bonds, provide regular interest payments and return your original investment at the end of a fixed term. When you buy a bond, you’re lending money to a government or company, and in return, you receive fixed interest payments (the “coupon”) and your principal at maturity. Bonds are valued for their stability and predictable income, making them a foundation for conservative investors and retirees seeking steady yet lower-risk returns.

How Bonds Work:

The Basics

A bond is a legal agreement between a borrower (issuer) and a lender (investor). The issuer promises to pay back the principal (face value) and make regular interest payments at a set rate (coupon rate) on specified dates (coupon dates) until the maturity date. Bonds are categorized by their maturity:

Short-term:

Up to 3 years

Medium-term:

3–10 years

Long-term:

Over 10 years

While bonds pay fixed interest, their value can fluctuate in the secondary market, where bonds are bought and sold after being issued. In the secondary bond market, bond prices and interest rates move in opposite directions. When interest rates fall, existing bonds with higher fixed interest rates become more attractive to investors, so their prices go up. Conversely, when market interest rates rise, older bonds offering lower interest rates become less valuable, causing their prices to drop. If you sell a bond before maturity, you may receive more or less than you paid, depending on market interest rates. Accrued interest (the interest earned since the last payment), is added to the bond’s sale price.

What determines the interest rates on bonds

Central bank policy rates and expectations: Short-term market rates are guided by Central Bank policy rtaes, which act as the benchmark for market interest rates. In addition, expectations about future policy decisions (such as rate hikes or cuts) can significantly influence how market interest rates move.

The Issuer: Bonds are issued by both the government ( such as Treasury bills and bonds) and private companies (known as debentures). The higher the risk that an issuer may not meet its interest payments, the higher the interest rate offered. Credit ratings are independent assessments issued by rating agencies such as Moody’s, S&P and Fitch Ratings, that measure how likely a government or company is to repay its debts. They help investors understand default risk, ranging from safer “investment grade” to riskier “speculative” grades. However, credit ratings are only opinions,not guarantees,so they should be considered together with your own analysis.

Term to Maturity: Longer maturities carry more uncertainty and so investors demand a higher interest rate (known as a term premium) to compensate for this risk

Liquidity: If a bond is not traded often, it can be harder to sell quickly. To make up for this, such bonds usually pay a higher interest rate, called a liquidity premium.

How Investors Earn Returns

from Bonds

1. Interest Income (Coupon Payments):

Most bonds pay regular interest, typically every six months.

Example:

If you invest LKR 100,000 in a Treasury Bond with a 12% coupon, you receive LKR 6,000 every six months until maturity.

2. Discounted Instruments (Treasury Bills):

Treasury Bills (short-term securities issued by governments) don’t pay periodic interest. Instead, you buy them at a discount and receive the full-face value at maturity.

Example:

Buy a 364-day T-Bill for LKR 92,000 (discounted price); at maturity, you receive LKR 100,000 (face-value), your return is LKR 8,000. The interest rate is 8.7%.

3. Capital Gains or Losses:

If you sell a bond before maturity, you may make a profit (capital gain) or loss, depending on market interest rates.

Example:

If you buy a corporate debenture at LKR 100,000 with a 10% coupon and sell it for LKR 105,000 after rates fall, you gain LKR 5,000 plus interest received.

Bonds vs. Stocks:

Understanding Risk and Stability

Shares and bonds serve different roles. Shares offer ownership in a company and the potential for high returns, but with greater volatility and risk. Bonds are loans to companies or governments, providing stable, predictable income and lower risk.

Predictable Income:

Bonds pay fixed interest, unlike shares, where dividends are not guaranteed.

Priority in Liquidation:

Bondholders are settled before shareholders if a company fails and is liquidated.

Defined Maturity:

Bonds have a set end date for repayment; shares do not.

Sri Lankan Experience:

From 1994–2024, the ASPI index averaged 14.57% annual nominal returns with 37.10% volatility. Treasury bills in comparison averaged 11.34% returns with no principal losses. Bonds provided stability while shares offered higher long-term returns but with greater risk.

Risks of Bond Investing

Bonds are generally less risky than shares, but not risk-free. Key risks include:

Interest Rate Risk:

When interest rates rise, bond prices fall. This is more pronounced for longer-term bonds.

Credit (Default) Risk:

The risk that the issuer fails to pay interest or principal. Typically this risk is higher with Corporate bonds or high-yield junk bonds with weak credit ratings. Government bonds usually are safer with lower credit risk, but Sri Lanka’s 2022 sovereign default shows that even these can be affected by economic crises. (Note: investors holding Sri Lankan government rupee bonds were not directly affected by the 2022 default, which mainly impacted external debt or foreign currency bonds. However local government bond holders experienced indirect impacts through high inflation and sharp interest-rate movements and policy uncertainty.)

Inflation Risk:

Rising inflation reduces the real value of fixed interest payments, thereby decreasing the ability to buy goods and services over time.

Liquidity Risk:

Some bonds, especially corporate debentures, may be hard to sell quickly in the secondary market, without a price discount.

Role of Credit Ratings

The Sri Lankan Bond Market:

An Overview

Government Securities:

Issued by the Central Bank of Sri Lanka (CBSL), these are considered highly reliable and are available in “scripless” (electronic) form.

Investors can buy new issues through licensed intermediaries called Primary Dealers or licensed commercial banks (minimum LKR 5 million in the primary market) or in smaller amounts in the secondary market. All transactions are electronic and managed by the LankaSecure System, providing security and liquidity.

Corporate Debentures:

Companies issue debentures to raise funds, usually listed on the Colombo Stock Exchange (CSE).

Maturity:

Typically, around five years

Interest: Fixed or floating rates (e.g., 12.5% per annum or linked to T-Bill rates)

Payment Frequency:

Annually, biannually, or quarterly

Security:

Often unsecured, with varying priority in liquidation

Purpose: To strengthen capital or business expansion

Sustainable Bonds (GSS+):

Recent regulatory changes allow Green (money is borrowed for environmentally friendly projects), Blue (focused on marine and freshwater conservation projects), Social, and Sustainability-Linked Bonds. These raise funds for environmental or social projects and attract investors focused on ESG (Environmental, Social, Governance) criteria.

Bonds in Your Portfolio:

Why They Matter

Bonds are a key part of a diversified investment strategy. They provide:

Stability:

Lower volatility than shares, especially during market downturns.

Predictable Income:

Regular interest payments, useful for budgeting and retirement.

Risk Reduction:

Help offset potential losses from riskier assets like shares.

Portfolio Balance:

The right mix of bonds and shares depends on your age, risk tolerance, and financial goals. Younger investors may hold fewer bonds, while those nearing retirement may increase bond allocations for stability and income.

Conclusion:

The Role of Bonds for Sri Lankan Investors

Bonds offer a reliable way to grow and protect your savings, providing stable income and reducing overall investment risk. While generally safer than shares, they are not entirely risk-free,interest rates, inflation, and credit events can affect returns. The Sri Lankan market offers a range of government and corporate bonds, including innovative sustainable options. By understanding how bonds work and the risks involved, investors can use fixed income securities to build a more resilient and balanced portfolio.

Business

American Premium Water redefines hydration with industry-first loyalty programme and mobile application

American Premium Water, an industry pioneer and market leader with over 30 years of experience in trusted and sustainable hydration, celebrated the launch of its Loyalty Programme and mobile application. The launch, held on 16th February 2026 at Cinnamon Lakeside, Colombo, marked a significant milestone as the first of its kind within Sri Lanka’s bottled water industry, reaffirming the company’s consistent commitment to product and service excellence.

Designed to promote healthier lifestyles, the American Premium Water Loyalty Programme rewards customers while encouraging regular hydration to support overall wellness. The programme features a quarterly reward scheme for Corporates, Small and Medium enterprises (SMEs), and Households, recognising and motivating commitment to healthier routines.

Launched alongside the Loyalty Programme, American Premium Water’s mobile application offers a convenient way for customers to track their daily hydration, monitor consumption patterns, receive real-time delivery updates, and manage payments efficiently. To further support healthy routines, customers who download and use the app for more than two months are eligible to have their monthly bill waived.

-

Life style7 days ago

Life style7 days agoMarriot new GM Suranga

-

Business6 days ago

Business6 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features7 days ago

Features7 days agoMonks’ march, in America and Sri Lanka

-

Features7 days ago

Features7 days agoThe Rise of Takaichi

-

Features7 days ago

Features7 days agoWetlands of Sri Lanka:

-

News7 days ago

News7 days agoThailand to recruit 10,000 Lankans under new labour pact

-

Latest News1 day ago

Latest News1 day agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction

-

News7 days ago

News7 days agoMassive Sangha confab to address alleged injustices against monks