Business

Daraz enables LANKAQR payments for Lanka Premier League 2022 tickets

A testimony to its commitment to further increasing its digital payment footprint in Sri Lanka, Daraz, the leading online marketplace in Sri Lanka, recently became the country’s first e-Commerce platform to enable LANKAQR-based transactions in Sri Lanka.

LANKAQR is an initiative by the Central Bank of Sri Lanka that enables consumers to make payments to merchants and service providers directly from their bank account by scanning a QR code with their mobile device.

Accordingly, Sri Lankan cricket fans can now purchase Lanka Premier League (LPL) 2022 tickets via Daraz using LANKAQR-based payments. Daraz is the ‘League Partner’ and ‘Exclusive Ticketing Partner’ of the third edition of LPL Twenty20 franchise cricket tournament in Sri Lanka. The first LPL ticket purchase via LANKAQR was made by D. Kumaratunge, Assistant Governor of Central Bank of Sri Lanka.

In an effort to further promote the usage of LANKAQR for LPL ticket purchases, an exclusive limited-time offer of 5% discount is made available with a maximum discount value of Rs. 750 for customers paying via LANKAQR through any certified mobile payment app. ComBank Q+ customers get an additional 5% cashback with a maximum discount value of Rs. 1,000 when purchasing LPL tickets.

In addition to online ticket sales on Daraz, offline tickets are made available at the following locations where users can pay through LANKAQR:

Kandy – Abeetha Ground, Pallekale on all match days, Kandy City Center on selected days

Colombo – Sri Lanka Cricket & P.D Sirisena Grounds, Maligawatte on all Colombo match days.

Daraz partnered with Commercial Bank of Ceylon, the acquiring bank of LANKAQR for Daraz, to process payment transactions through its state-of-the-art Q+ QR-based application.

Allowing users the convenience of paying through any preferred network, Daraz accepts LANKAQR payments via LankaPay, Visa, Mastercard and UnionPay networks through a total of over 24 mobile applications by over 21 financial institutions.

To encourage the shift towards a less-cash society while increasing financial inclusion in Sri Lanka, Daraz will enable LANKAQR payments at the point of delivery for cash on delivery orders as the next phase of the collaboration.

Business

World seen to be at crucial juncture as competition mounts for strategic resources

By Ifham Nizam

The intersection of climate change, energy security and global politics has never been more crucial, with geopolitical conflicts increasingly driven by competition over fossil fuels and critical minerals. Mayank Aggarwal, an energy and climate expert from The Reporters’ Collective, highlights this in his work, ‘Geopolitical Energy Chessboard’.

“Climate change and energy security are two of the most pressing global challenges, Aggarwal explains. “Urgent climate action is needed to mitigate its impact, but reducing fossil fuel use and transitioning to cleaner energy is a politically charged issue, he told The Island Financial Review.

His research highlights the complex web of energy politics, particularly in South Asia, where one in four people on earth reside. “South Asia is a major importer of fossil fuels and its energy security is critical. But the region also lacks a comprehensive dialogue framework to address climate and energy challenges collectively, he notes.

Aggarwal emphasizes that energy conflicts are not just national concerns but extend to the global stage. “From Libya and Iraq to Ukraine and Venezuela, conflicts over oil, gas, coal and critical minerals are shaping international relations. These disputes threaten economic stability and development goals worldwide.”

Despite the urgent need for a clean energy transition, political and economic interests delay global cooperation. “Countries are pulling out of climate agreements, favoring bilateral deals that often sideline developing nations. While global clean energy transition is essential, the geopolitical hurdles remain significant, Aggarwal warns.

He calls for a “Just Energy Transition” that ensures energy security and independence while engaging communities in decision-making. “We need regional cooperation, transparent negotiations for resource-rich areas and strong political will to drive climate and energy discussions at all levels, he concludes.

As the world grapples with escalating climate disasters and energy crises, Aggarwal’s insights highlight the urgent need for a balanced, just, and cooperative approach to energy politics.

Business

SEC Sri Lanka engages in interactive knowledge-sharing forum with University of Ruhuna

The Securities and Exchange Commission (SEC) of Sri Lanka recently participated in the Capital Market Forum 2025, organized by the Department of Accountancy and the Department of Finance of the Faculty of Management and Finance at the University of Ruhuna, in collaboration with the Colombo Stock Exchange (CSE). This interactive knowledge-sharing forum aims to enhance financial literacy and promote capital market participation among undergraduates and academics.

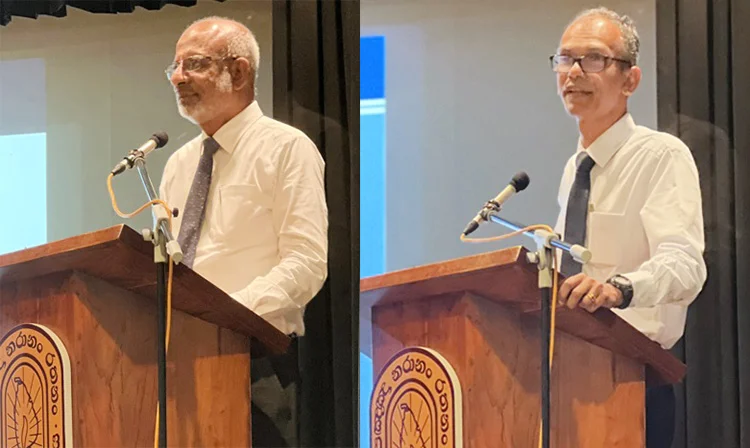

A key highlight of the forum was the workshop on “Nurturing Future Investors: The Role of Capital Markets in Personal and Economic Growth,” which featured distinguished speakers, including Senior Professor Hareendra Dissabandara, Chairman of the SEC, and Tushara Jayaratne, Deputy Director General of the SEC.

Senior Professor Hareendra Dissabandara delivered a compelling lecture on the crucial role of capital markets in fostering economic development. He emphasized how capital markets facilitate efficient capital allocation and contribute to long-term economic stability. A key focus of his discussion was the significance of capital formation as a sustainable alternative to debt financing for government projects. He illustrated this by comparing the market capitalization of a leading Sri Lankan company with the costs of several major government initiatives.

Professor Dissabandara highlighted the historical reliance on borrowing for infrastructure development in Sri Lanka, leading to fiscal imbalances, high-interest burdens, and economic vulnerabilities. He underscored the importance of equity financing in business sustainability, emphasizing that an efficient financial market channels surplus funds from households, institutions, and foreign investors into businesses and government projects. He explained that for over 70 years, successive governments have relied on borrowing to fund infrastructure and development, causing fiscal imbalances, rising interest burdens, high taxation, and economic vulnerabilities. He also noted that corporate professionals often overlook the importance of equity financing for sustainable growth.

Business

SLTDA successfully hosts intra-governmental dialogue on joint facilitation for tourism investments

The Sri Lanka Tourism Development Authority (SLTDA) successfully organized an event focused on facilitating investments in the tourism industry. The event which was attended by the Minister of Tourism Vijitha Herath as well as the Deputy Minister of Tourism Prof. Ruwan Ranasinghe, also brought together Heads of key government ministries and agencies to discuss the importance of collaboration in streamlining the approval process for investors.

The primary objective of the event was to highlight the government’s role in directing and facilitating private sector investments in Sri Lanka’s tourism sector. Government officials from various authorities actively participated, addressing key areas essential for economic and employment growth. The discussions emphasized the crucial need to focus on enhancing the ease of doing business in Sri Lanka to increase the country’s attractiveness to global tourism investors, thereby improving investor experiences and boosting tourism sector growth through foreign direct investments (FDIs).

Minister of Tourism Minister in his speech stated “Collaboration is key to unlocking Sri Lanka’s tourism potential. By streamlining investment processes, we can drive growth, create jobs, and strengthen our position as a world-class destination”, while the Deputy Minister of Tourism said “A thriving tourism sector requires strong partnerships. Together, we can create an investor-friendly environment that benefits our economy and showcases Sri Lanka’s unique charm to the world”. The SLTDA Chairman explained the objectives of the event, while during the open forum discussion, speakers from other key agencies underscored the importance of reducing costs and delays in the approval processes, which would ultimately encourage investors to focus on project development and job creation.

By fostering greater cooperation among government agencies, the event was aimed to position Sri Lanka as an investor friendly, more attractive and an efficient destination for tourism investors. To support this cause, the SLTDA had already developed a Land Bank Management Information System (LBMIS) as a pioneering initiative for identifying, cataloging, and managing land resources to promote tourism investments for economic development.

-

News5 days ago

News5 days agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

Features6 days ago

Features6 days agoShyam Selvadurai and his exploration of Yasodhara’s story

-

Editorial4 days ago

Editorial4 days agoRanil roasted in London

-

Latest News5 days ago

Latest News5 days agoS. Thomas’ beat Royal by five wickets in the 146th Battle of the Blues

-

News5 days ago

News5 days agoTeachers’ union calls for action against late-night WhatsApp homework

-

Editorial6 days ago

Editorial6 days agoHeroes and villains

-

Features4 days ago

Features4 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Editorial5 days ago

Editorial5 days agoPolice looking for their own head