News

T-Bill dealers make a killing while bank depositors earn a pittance

by Sanath Nanyakkare

Primary dealers, including banks and other financial institutions that lend to the government through lending instruments, such as short-term Treasury Bills, stand to make a surplus profit of about 5.70% which is one of the highest in the history of Sri Lanka, The Island learns.

Surplus profit is made when these primary dealers profit from the prevailing interest pricing errors in the bank deposit rates and in the government securities market.

They invest in more liquid Treasury Bills which bring them an interest rate of 12.92% in just three months whereas an ordinary bank depositor earns an interest between 10-12% per annum.

This indicates a distortion in the money saving market especially against an inflation rate of 18%, analysts say.

Moreover, for the first time after more than five years, CBSL rejected all bids received at T-bond auction held on 29th March 2022 because higher interest rates were expected by market participants to compensate for galloping inflation and higher financing requirement of the government which normal depositors can never do.

Thus undersubscribed bill and bond auctions have increased Central Bank holdings of government securities to Rs. 1.7 trillion, data from the Public Debt Department reveals.

Sri Lanka recorded one of its highest inflation of 18.7% in March 2022 relative to 15.1% in February 2022 causing an alarm among the consumers in the country. Going forward, inflation is expected to remain high due to higher commodity prices and energy costs.

“Although lending rates have adjusted upwards, the adjustment in bank deposit interest rates remains sluggish, which has been inadequate to attract deposits into the banking system,” they said.

“The new Finance Minister will have to further hike interest rates at the next Monetary Policy Meeting to encourage banks and financial institutions to make the required adjustments to deposit rates in order to promote savings and to be fair by ordinary depositors,” they said.

News

Navy and Coast Guard seize 04 Indian fishing vessels poaching in Sri Lankan waters

During operations conducted in the dark hours of 18 Feb 26, the Sri Lanka Navy and Coast Guard seized 04 Indian fishing boats and apprehended 22 Indian fishermen, while they were poaching in Sri Lankan waters north of Mannar and off the Delft Island, Jaffna.

Recognizing the detrimental effects of poaching on marine resources and the livelihoods of local fishing communities, the Sri Lanka Navy and Coast Guard continue to conduct regular operations as proactive measures to deter such activities. These efforts underscore the collective robust approach and steadfast commitment to safeguarding the nation’s marine ecosystems while ensuring the economic security and wellbeing of its citizens.

The 02 fishing boats along with the 10 fishermen held in Mannar were handed over to the Fisheries Inspector of Mannar and the remaining 02 fishing boats intercepted off the Delft Island, together with 12 Indian fishermen were handed over to the Fisheries Inspector of Myliddy for onward legal proceedings.

News

Ambassador of Switzerland to Sri Lanka pays courtesy call on PM

The Ambassador of Switzerland to Sri Lanka Dr. Siri Walt paid a courtesy call on Prime Minister Dr. Harini Amarasuriya on the 17th of February at the Temple Trees.

Welcoming the Ambassador of Switzerland to Sri Lanka the Prime Minister briefed the Ambassador on her recent visit to Davos to participate in the World Economic Forum Annual Meeting noting that the series of high-level bilateral meetings held on the sidelines of the Forum, along with two important industry visits provided valuable insights for Sri Lanka’s economic engagement.

The discussion focused on Switzerland’s vocational education and training (VET) system, with particular interest in exploring possible cooperation and knowledge-sharing opportunities.

The Prime Minister also conveyed her appreciation for the assistance extended by the Government of Switzerland following Cyclone Ditwah. She emphasized Sri Lanka’s need for enhanced technical assistance during the ongoing rebuilding phase, especially in relation to the reconstruction of bridges and railway infrastructure.

Both sides reaffirmed their shared commitment to further strengthening bilateral relations between Sri Lanka and Switzerland, and to expanding cooperation in areas of mutual interest.

First Secretary (Political) of the Embassy of Switzerland in Colombo Ms. Justine Boillat, First Secretary (Migration) of the Embassy of Switzerland in Colombo Ms. Andrea Kienast and the Secretary to the Prime Minister, Pradeep Saputhanthri, Additional Secretary to the Prime Minister, Ms. Sagarika Bogahawatt and officials from the Ministry of Foreign Affairs , Foreign Employment, Tourism.attended the meeting.

[Prime Minister’s Media Division]

Latest News

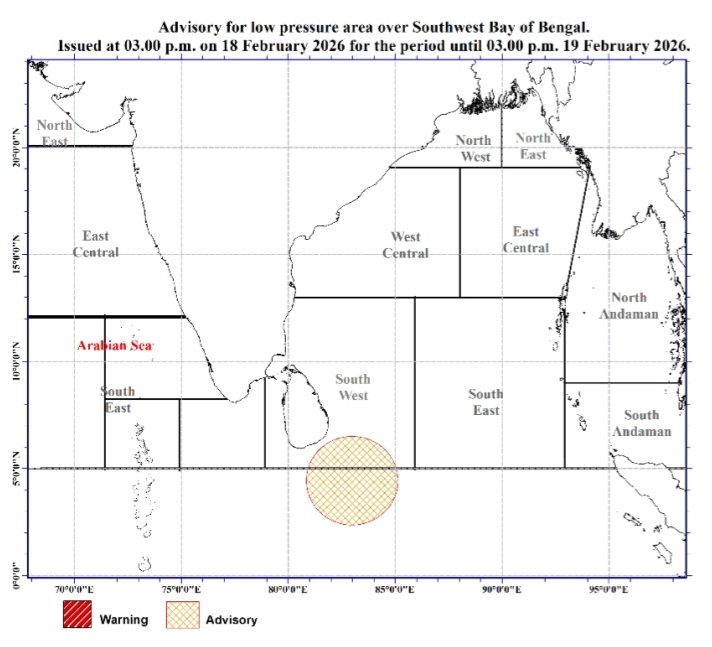

Advisory for low pressure area in the Southwest Bay of Bengal to the south-east of Sri Lanka

Advisory for low pressure area in the Southwest Bay of Bengal to the south-east of Sri Lanka.

Issued by the Natural Hazards Early Warning Centre of the Department of Meteorology at 03.00 pm on 18 February 2026

Multiday boats fishermen and naval community are warned that the low-pressure area still persists over the Southwest Bay of Bengal to the south-east of Sri Lanka. Under the influence of this system, heavy showers or thundershowers, Strong winds about (50-60) kmph, and rough or very rough seas can be expected in these sea areas.

The Meteorological Department is constantly monitoring the behavior of the system.

The naval and fishing communities are requested to be attentive to the future forecasts and bulletins issued by the Department of Meteorology in this regard.

-

Life style4 days ago

Life style4 days agoMarriot new GM Suranga

-

Business3 days ago

Business3 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features4 days ago

Features4 days agoMonks’ march, in America and Sri Lanka

-

Features4 days ago

Features4 days agoThe Rise of Takaichi

-

Features4 days ago

Features4 days agoWetlands of Sri Lanka:

-

News4 days ago

News4 days agoThailand to recruit 10,000 Lankans under new labour pact

-

News4 days ago

News4 days agoMassive Sangha confab to address alleged injustices against monks

-

News2 days ago

News2 days agoIMF MD here