Business

Lankan tea exports earned $ 1.3 Bn in 2021

Sri Lanka’s tea industry performed well in 2021 earning 1.3 billion U.S. dollars despite lower yields and higher costs of production.

Chairman of the Sri Lanka Tea Board Jayampathy Molligoda says that Sri Lanka earned approximately 1.3 billion U.S. dollars from the export of 288 million kilos of tea in 2021.

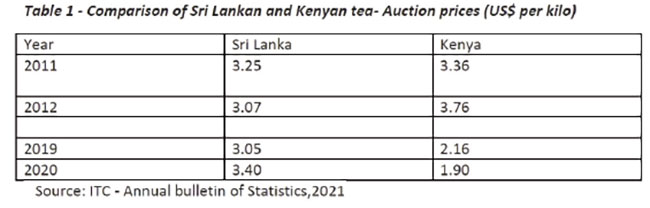

In a press release, Molligoda said the cost of production of Sri Lankan tea is among the highest in the global market and tea production peaked in 2013 and has declined since then. He said auction prices in Kenya and India are cheaper than in Colombo.

He said Sri Lanka needs to “focus more on the front end of the value chain” by marketing the clean, sustainable and wellness aspects of Ceylon Tea.

It said: The total export quantity is 288 million kilos. During the year 2020, the export revenue was Rs 230 billion (US $ 1,213 million) and the export quantity was 266 Mn kilos. It is significant to mention the average fob price at customs, which was Rs 867/= per kilo in 2020 has further increased to Rs 915.97 per kilo, whereas in 2019 it was only Rs 823/ per kilo of tea exported. The sales and tea production statistics for the month of December are yet to be finalised, however some 296 million kilos have been sold and closer to 300 million kilos tea production have been achieved for the full year. Last year tea production was only 279 million kilos.

It said: The total export quantity is 288 million kilos. During the year 2020, the export revenue was Rs 230 billion (US $ 1,213 million) and the export quantity was 266 Mn kilos. It is significant to mention the average fob price at customs, which was Rs 867/= per kilo in 2020 has further increased to Rs 915.97 per kilo, whereas in 2019 it was only Rs 823/ per kilo of tea exported. The sales and tea production statistics for the month of December are yet to be finalised, however some 296 million kilos have been sold and closer to 300 million kilos tea production have been achieved for the full year. Last year tea production was only 279 million kilos.

The negative side is that our tea estate productivity has been declining over a period of time; the year 2000 the tea production was 305 million kilos and has increased to 328 million in 2010. The peaked production of 338 million kilos in 2013- since then there has been a gradual decline of tea production, which is 2.6 % decline based on CAGR. The cost of production of tea producers has been increasing due to many factors which includes low productivity, both land and labour, high overheads and adverse impact of climate change and Covid-19.

It is relevant to mention here that the Kenyan tea production (main competitor for Sri Lankan teas) has been increasing rapidly and Sri Lankan tea production has been declining during the last 10-15 years. This is due to lack of tea replanting & infilling undertaken and the producers’ inability to address climate change effects and other factors, as there has been a gradual erosion of soil and land degradation, despite application of fertilizer.

Kenyan tea auction price in US $ is lower compared to Sri Lanka and, their growers are getting lower tea prices, whereas in Sri Lanka, small holders are getting a reasonable price and it is being regulated under Tea Control Act No 51 of 1957.

As can be seen, Ceylon Tea is the most expensive teas in the global market- gram to gram and as a result, there is a tipping point in the tea pricing structure for our tea exporters and marketers to be competitive in the global market place. In view of the above, an ‘integrated productivity and quality strategy’ is one of the key focus areas for the producers to reduce costs per kilo of made tea to enable the exporters and marketing teams to capitalize on Ceylon Tea ‘brand equity’. In the circumstances, it is important that the producers adopt an integrated balanced nutrient management system with more and more mineral and organic inputs to be applied in order to improve the soil quality to achieve Environmental and economic sustainability and focus on social well-being of the workers and small holders/growers rather than looking for short term gains.

The overall performance is satisfactory, however, achieving any further increases of higher prices for Ceylon Tea has become a challenge, because Kenyan and Indian auction prices are much lower than Colombo auction prices. Nevertheless, we need to focus more on the front end of the value chain by implementing the already approved promotional activities under

‘Ceylon Tea global campaign coupled with aggressive marketing strategy formulated with the support of all the industry stakeholders’ participation. Therefore, the brand story that the cleanest tea in the world has to be reinforced through maintaining minimal level of chemical residues and demonstrating sustainable credentials including purity and wellness factor of Ceylon Tea. We, at Sri Lanka Tea Board wish to extend our gratitude to all the stakeholders for their dedication, commitment and the relative performance. It’s a great achievement under difficult and challenging environment.

Business

ADB approves support to strengthen power sector reforms in Sri Lanka

The Asian Development Bank (ADB) has approved a $100 million policy-based loan to further support Sri Lanka in strengthening its power sector. This financing builds on earlier initiatives to establish a more stable and financially sustainable power sector.

This second subprogram of ADB’s Power Sector Reforms and Financial Sustainability Program will accelerate the unbundling of the Ceylon Electricity Board (CEB) into independent successor companies for generation, transmission, system operation, and distribution, as mandated by the Electricity Act of 2024 and its 2025 amendment. The phased approach ensures a structured transition, ensuring progress in reform actions and prioritizing financial sustainability.

“Sri Lanka has made important progress in stabilizing its economy and strengthening its fiscal position. A well-functioning power sector is vital for the country’s continued recovery and sustainable growth,” said ADB Country Director for Sri Lanka Takafumi Kadono. “ADB is committed to supporting Sri Lanka’s long-term development and advancing key reforms in the power sector. This initiative will enhance power sector governance, foster private sector participation, and accelerate renewable energy development to drive sustainable recovery, resilience, and inclusive growth.”

To improve financial sustainability, the program will help implement cost-reflective tariffs and a comprehensive debt restructuring plan for the CEB. It will support the new independent successor companies in transparent allocation of existing debts. This will continue to strengthen their financial viability, enhance creditworthiness, and enable these companies to operate on a more sustainable footing.

The program also aims to strengthen renewable energy development and private sector participation by enhancing transparency and supporting power sector entities that are financially sustainable. It will enable competitive procurement for large-scale renewable energy projects and identified priority generation schemes, while upholding strong environmental standards.

Promoting gender equality and social inclusion is integral to the program. Energy sector agencies have implemented annual women’s leadership programs, adopted inclusive policies, and launched feedback mechanisms to ensure equitable participation of female consumers and entrepreneurs. The program includes targeted support for vulnerable groups, such as maintaining lifeline tariffs and implementing measures to soften the impact of tariff adjustments and sector reforms.

ADB will provide an additional $2.5 million technical assistance grant from its Technical Assistance Special Fund to support program implementation, build the capacity of successor companies, and help develop their business plans and power system development plans.

Business

Union Assurance becomes first insurer to earn the YouTube Silver Play Button

Union Assurance, Sri Lanka’s longest-standing private Life Insurer, has achieved a milestone in its digitalisation journey by being awarded the YouTube Silver Play Button, recognising the Company for surpassing 100,000 subscribers on its official channel. This achievement marks a first in Sri Lanka’s Insurance industry, across both Life and General Insurance, and underscores Union Assurance’s pioneering role in digital engagement.

This accomplishment reflects the Company’s unwavering commitment to making Life Insurance accessible, simplified, and engaging for all Sri Lankans. Through innovative content strategies, Union Assurance has successfully transformed complex Insurance concepts into relatable, informative, and inspiring narratives that empower individuals to protect what matters most; health, wealth, family, and future.

Receiving the Silver Play Button is more than a symbolic accolade; it is a testament to the strength and credibility of Union Assurance’s digital presence. In an era where trust and transparency define brand loyalty, this recognition validates the company’s ability to create content that resonates deeply with a growing audience. It enhances the brand’s authority, reinforces its visibility across digital platforms, and further solidifies Union Assurance as a leader in customer engagement.

Celebrating this achievement, Mahen Gunarathna, the Chief Marketing Officer at Union Assurance stated: “This milestone is a testament to the trust and engagement of our audience and reflects our dedication to innovation, transparency, and customer-centric communication.

Business

LOLC Finance Factoring powers business growth

LOLC Finance PLC, the largest non-banking financial institution in Sri Lanka, brings to light the significant role of its Factoring Business Unit in providing indispensable financial solutions to businesses across the country. With a robust network of over 200 branches, LOLC Finance Factoring offers distinctive support to enterprises, ranging from small-scale entrepreneurs to corporate giants.

In light of the recent economic challenges, LOLC Finance Factoring emerged as a lifeline for most businesses, ensuring continuous liquidity to navigate through turbulent times. By facilitating seamless transactions through online platforms and expediting payments, the company played a pivotal role in sustaining essential services, including supermarkets and pharmaceuticals.

Deepamalie Abhaywardane, Head of Factoring at LOLC Finance PLC, emphasized the increasing relevance of factoring in today’s economy. “As economic conditions become more stringent, factoring emerges as the most sought-after financial product for businesses across various sectors. It offers a win-win solution by providing upfront cash up to 85% of the credit sale to suppliers while allowing end-users/buyers better settlement period.”

One of the standout features of LOLC Finance Factoring is its hassle-free application process. Unlike traditional bank loans that require collateral, LOLC Factoring extends credit facilities without such obligations. Furthermore, LOLC Finance Factoring relieves business entities of the burden of receivable management and debt collection. Through nominal service fees, businesses can outsource these tasks, allowing them to focus on core operations while ensuring efficient cash flow management.

For businesses seeking Shariah-compliant factoring solutions, LOLC Al-Falaah’s Wakalah Future-Cash Today offers an efficient and participatory financing model that meets both financial needs and ethical principles. Understanding the diverse challenges faced by businesses, LOLC Finance Factoring deliver tailored solutions that enhance cash flow, reduce credit risk, and support sustainable growth. Working together with LOLC Al-Falaah ensures access to a transparent, well-structured receivable management solution strengthened by the credibility and trust of Sri Lanka’s largest NBFI, LOLC Finance.

The clientele of LOLC Finance Factoring spans into various industries, including manufacturing, trading, transportation, healthcare, textiles, plantations, and other services, all contributing significantly to Sri Lanka’s economic growth. By empowering businesses with accessible and convenient working capital solutions, LOLC Finance’s Factoring arm plays a vital role in fostering economic development and prosperity of the country.

In the upcoming quarter, LOLC Finance Factoring remains committed to delivering innovative financial solutions tailored to meet the evolving needs of businesses. As Sri Lanka’s economic landscape continues to develop, LOLC Finance Factoring stands ready to support enterprises on their journey towards growth and success.

-

News7 days ago

News7 days agoWeather disasters: Sri Lanka flooded by policy blunders, weak enforcement and environmental crime – Climate Expert

-

Latest News7 days ago

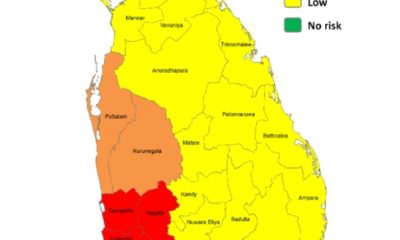

Latest News7 days agoLevel I landslide RED warnings issued to the districts of Badulla, Colombo, Gampaha, Kalutara, Kandy, Kegalle, Kurnegala, Natale, Monaragala, Nuwara Eliya and Ratnapura

-

News4 days ago

Lunuwila tragedy not caused by those videoing Bell 212: SLAF

-

News2 days ago

News2 days agoLevel III landslide early warning continue to be in force in the districts of Kandy, Kegalle, Kurunegala and Matale

-

Latest News5 days ago

Latest News5 days agoLevel III landslide early warnings issued to the districts of Badulla, Kandy, Kegalle, Kurunegala, Matale and Nuwara-Eliya

-

Features5 days ago

Features5 days agoDitwah: An unusual cyclone

-

Latest News5 days ago

Latest News5 days agoUpdated Payment Instructions for Disaster Relief Contributions

-

Latest News7 days ago

Latest News7 days agoWarning for Cyclonic storm “Ditwah” issued at 05.00 p.m. 29th November 2025