Business

Condominium developers see silver lining

Despite Covid-19

By R P A Perera

Covid-19 has had a drastic impact on Sri Lanka’s economy. That countries around the world are also reeling with the effects of the pandemic is of little consolation. It is interesting though that condominium developers with completed projects or those nearing completion with full inventory are likely to reap large benefits.

The industry which took a major hit with the Easter Sunday bomb attacks in Colombo, in April 2019, began recovering last year. RIU – a multi-sectoral research company with a global presence with offices internationally – in its Annual Real Estate Market Report 2019-2020 states that the market which remained sluggish in 2019 due to a variety of reasons, began to recover in 2020.

Providing a look into the future, CEO and Founding Director of RIU Roshan Madawala said, “We can note that the industry had performed with tenacity and resilience during the past 1 ½ years, despite the extraordinary economic challenges. Within the next 5 years, Sri Lanka could face an under-supply of apartments and other real estate assets due to a combination of variables which would essentially navigate it towards establishing a sellers’ market. This situation would have been somewhat unthinkable even 24-months back.”

“The research and data that we are analysing now suggests that the present time is exceptionally propitious for residential real estate investments,” Madawala continued. “In 2020 and 2021, low-interest rates stimulated the market to enhance the absorption rates of the prevailing stock of apartments in Colombo. Simultaneously combined with the diaspora’s interest levels gathering to an all-time high and with airports slowly reopening, the influx of buyers will be significant. The market is more appealing than ever before to persons earning greenbacks, British pounds and most other currencies, due to the weakening rupee. The amalgam of these variables and the novel reality faced by developers, whose costs have spiked due to the new import restrictions and subsequently the overall currency depreciation effect, indicates that developers will find it impossible to supply the next generation apartment projects at prices that tally with the present market. Therefore, the likelihood of an undersupply is real.”

Dr M A K Sriyalatha, Senior Lecturer, Department of Business Economics, Faculty of Management Studies & Commerce, University of Sri Jayawardenepura commenting on the effect of the import restrictions and currency devaluation on the real estate market said, “Restrictions and devaluation affect the prices of imported raw materials and it automatically affects property development such as real estate residential house prices in the short-term. But LKR priced units have become much cheaper making them more attractive to foreign investors. Real estate players with unsold or built-but-unsold inventory will benefit through the sale at higher prices.”

“What’s more, the interest rates are at a historic low, with the real interest rate being negative recently. This makes real estate investments more attractive in 2 ways, i.e. borrowing to invest is more feasible, and the returns generated are more attractive,” she added.

“Share prices and profitability of pureplay residential real estate companies providing high quality products are likely to improve over the price and profitability of commercial real estate developers, given the working-from-home concept being widely used. The larger the projects and the inventory, the higher the profit. A house of one’s own could not only be an asset but could also provide safety,” Dr. Sriyalatha said.

“We live in a VUCA (volatility, uncertainty, chaos and ambiguity) world driven by rapid technological advances that impact all aspects of human activity and markets,” RIU CEO Madawala continued. “However, real estate has traditionally proven itself as a safe haven during such times and in 2020/21, Sri Lanka’s real estate market has proven its resilience. Commercial and retail real estate will however need to navigate a more fluid and challenging environment in the short-medium term.”

Quality and trust are of paramount importance in the residential real estate sector. Naturally, established players with a good track record are at an advantage. The developers’ brand, stability and financial strength are all critical since real estate developments generally are long-term developments, (i.e., they take a few years to complete from the launch), investors therefore need to be comfortable with the stability of the developer and the ability to complete the project. Even in the current circumstances, the larger players are more likely to be able to withstand the adverse conditions due to their greater financial stability.

Industry players who have large projects which are nearing completion or where the major portion of the construction and the import of materials is already sourced or procured, are likely to enjoy significant profits and these may be reflected in their share prices.

Mr. Brahmanage Premalal, Group Chairman Prime Lands (Pvt) Ltd, commenting on the demand for condominiums said, “The demand for real estate in Sri Lanka, especially residential condominiums continued to surge throughout the year, as investors were seen rushing to take advantage of the reduction in policy interest rates announced by the CBSL as part of its monetary policy easing measures in the wake of the pandemic induced economic slowdown. Similarly, the ban on vehicle imports and the ongoing devaluation of the Rupee also appeared to be fueling the interest in real estate, which I believe, were a few of the other contributory factors that worked in favour of driving up the demand for condominiums. Further as it is with the import controls & increase of prices in raw materials the actual benefit is for the buyers as they get much higher returns. We see this phenomenon all over the world as the real investment against the inflation & high money supply is investment in real estate”.

Some industry players are also hopeful that the project developments within the Port City which are expected to commence soon will bring in a higher demand specially for the developments in Colombo and the suburbs, since the expatriates will require accommodation to overlook construction and development.

A handout prepared by the government directed at potential investors outlines various development initiatives supporting the theme, Sri Lanka is the Rising Star of Asia. Among them is the development of beachfront luxury villas at the Port City Colombo. A significant feature is that foreign investors are permitted 100% ownership of the real estate investment. Access to sites and temporary utility facilities (water and electricity) are already available while permanent utility connections are to be provided by June 2022. END.

The author is an independent writer and could be contacted on rukshicap@gmail.com for more information.

Business

SIA warns of 1,000 SME collapses, urges fair policies to protect Sri Lanka’s rooftop solar sector

By Sanath Nanayakkare

The Solar Industries Association (SIA), representing over 1,000 companies and employing 40,000 workers in Sri Lanka’s rooftop solar sector, issued a stern warning recently regarding threats to the industry’s survival and the nation’s renewable energy ambitions. The association condemned recent regulatory instability and called for urgent policy reforms to avert economic and social crises.

The SIA categorically rejected the Ceylon Electricity Board’s (CEB) claim that rooftop solar installations caused the recent island-wide power outage, calling the accusation “baseless and misleading.”

“Public trust is eroded when accountability is misdirected,” the SIA stated. “We demand an independent, transparent investigation led by experts appointed by the Ministry or the Public Utilities Commission (PUCSL). The CEB’s unilateral statements disregard the sector’s contributions and jeopardize Sri Lanka’s renewable energy transition,” they said.

“While acknowledging the formation of a tariff determination committee, the SIA criticized its narrow focus on financial parameters, ignoring the sector’s socioeconomic value. Rooftop solar empowers businesses and households with energy independence, reduces grid strain, and supports climate goals. However, proposed volatile tariff structures risk destabilizing over 100,000 installations—primarily owned by middle-class families—and deter future investment,” they noted.

“A rigid, equation-based tariff system is unsustainable,” the association warned. “Sri Lanka needs a stable policy framework to attract long-term investments. For instance, retirees could invest EPF savings into solar projects, securing income while advancing national energy targets. Without urgent action, 1,000 SMEs and 40,000 jobs face collapse, with dire consequences for employment, energy security, and economic stability,” they pointed out.

SIA urged policymakers to establish an independent committee to investigate the power outage fairly, expand the tariff committee’s mandate to include socioeconomic and environmental benefits and implement predictable policies to safeguard SMEs, households, and investor confidence.

“Sri Lanka stands at a crossroads,” the SIA emphasized. “Protecting rooftop solar isn’t just about energy—it’s about livelihoods, economic resilience, and a sustainable future. We urge stakeholders to collaborate on solutions that prioritize both people and progress,: they emphasized.

Business

SLT-MOBITEL partners with the Rush Lanka Group to power its apartment portfolio

SLT-MOBITEL has entered into a strategic partnership with Rush Lanka Group to provide exclusive SLT-MOBITEL Fibre connectivity solutions to their portfolio of luxury apartment developments in Colombo and the suburbs, enhancing the digital experience of all residents.

The agreement was signed between Imantha Wijekoon, Chief Business Officer of Consumer Business at SLT, and Zaid Ariff, Director of Construction at the Rush Group headquarters. Representatives from both companies also attended the ceremony.

Under the partnership, SLT-MOBITEL will serve as the exclusive digital service provider for five prestigious Rush Lanka developments including Street Rush Residencies and Rush Court 4 in Mt. Lavinia, Rush Tower 2, Rush Metropolis in Dehiwala, and Rush Court 5 in Colombo 14. The collaboration ensures residents will enjoy superior fibre connectivity speeds, enabling seamless digital experiences in modern smart homes. The partnership with the Rush Lanka Group aligns with SLT-MOBITEL’s commitment to offer ultra-fast, reliable connectivity solutions to residential developments. Delivering exclusive fibre connectivity to luxury apartments, SLT-MOBITEL ensures residents have access to world-class digital services that complement the living experience promised by Rush Lanka Group.

Powered by advanced fibre technology, SLT-MOBITEL network will provide the residences with seamless performance across digital activities. The SLT-MOBITEL Fibre backbone ensures lag-free experiences whether tenants are gaming online, attending virtual classes, working remotely, or streaming high-definition entertainment. SLT-MOBITEL Fibre will transform the lifestyles of all apartment users bringing greater convenience and superior quality of life.

Rush Lanka Group, established in 1992, is a property developer specializing in luxury and semi-luxury apartments.

Business

Sri Lanka makes outstanding appearance at OTM and SATTE 2025 in India

Starting its promotional work for 2025, Sri Lanka Tourism Promotion Bureau (SLTPB) added another feather into its cap of endorsements, by being recognized as the most innovative Tourism Board promotion in Outbound Travel Mart (OTM) . In parallel to that, several other sub events were held. The OTM was held in Jio World Convention Centre, Mumbai—India, from 30th January to 01st February 2025.Before OTM, the Global Village – Global Exchange & Trade Exhibition was held at the Surat International Exhibition & Convention Centre , Sarsana, Surat (Gujarat – India , from 25th to 27th January 2025. This travel fair was organized by Southern Gujarat Chamber of Commerce and Industry (SGCCI).

Sri Lanka participated in both OTM and South Asia’s Travel & Tourism Exchange (SATTE), held from 19th – 21st Feb 2025, in New Delhi, India . This was an excellent opportunity for Sri Lanka to promote it’s potential as a unique travel destination, especially for the Indian counterparts, as SLTPB has identified India as the number one source market for Sri Lanka, tourism bringing the largest number of tourist arrivals to the destination.

-

Editorial7 days ago

Editorial7 days agoRanil roasted in London

-

Features7 days ago

Features7 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Opinion6 days ago

Opinion6 days agoInsulting SL armed forces

-

News4 days ago

News4 days agoAlfred Duraiappa’s relative killed in Canada shooting

-

Features7 days ago

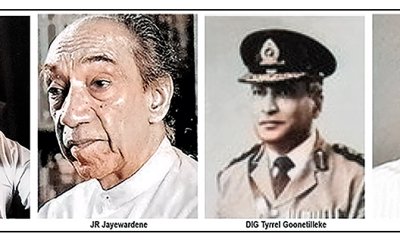

Features7 days agoMr. JR Jayewardene’s passport

-

Features7 days ago

Features7 days agoAs superpower America falls into chaos, being small is beautiful for Sri Lanka

-

Opinion7 days ago

Opinion7 days agoBeyond Victory: sportsmanship thrives at Moratuwa Big Match

-

Features7 days ago

Features7 days agoMemorable moments during my years in Parliament