News

Will ‘changing pillows’ help Litro Gas to tide over billions of rupees in losses?

With soaring global LPG prices

By Suresh Perera

The appointment of a new Chairman to Litro Gas Lanka Limited has raised questions over whether “changing pillows” could help the government-owned enterprise that dominates Sri Lanka’s Liquid Petroleum Gas (LPG) industry to recoup Rs. 3 billion (Rs. 3,000 million) in accumulated losses over the past few months

“We are grappling with around Rs. 40 million in losses per day”, a senior Litro Gas official complained.

It has boiled down to a situation, where the company has to sell LPG below the procurement price by throwing in an involuntary ‘subsidy’ Rs. 700 for every 12.5kg cylinder of cooking gas sold in the market, he said.

With earnings and savings fast running out, it’s difficult to imagine how Litro Gas will be able to continue operations without a price revision, he remarked.

Amidst the crisis faced by Sri Lanka’s biggest importer and supplier of LPG, the government named Theshara Jayasinghe, former Chairman of National Youth Services Council as the new head of Litro Gas Lanka Limited.

He replaced Anil Koswatte, a sales and marketing professional and a leading entrepreneur, who founded ‘Lakarcade’, Asia’s biggest novelty gift and souvenir chain.

It was an unceremonious exit for Koswatte, who officials acknowledged, “did his utmost under difficult circumstances as the spike in international LPG prices was beyond him”.

Koswatte came under flak at one time for purportedly drawing a monthly remuneration of Rs. 3 million – Rs. 2 million from Litro Gas Lanka and Rs. 1 million from Litro Terminals Lanka Limited.

Declining to either confirm or deny that he he was paid a seven-figure salary, he told The Sunday Island at the time that his remuneration was a matter for the shareholders of the company to determine.

If Koswatte drew Rs. 3 million as his monthly salary, then his successor will also be entitled to the same privilege unless decided otherwise, officials pointed out.

Litro Gas Lanka is wholly owned by the Sri Lanka Insurance Corporation.

The Consumer Affairs Authority (CAA) has so far declined to give the nod to an appeal by Litro Gas for a Rs. 700 price increase per 12.5kg domestic LPG cylinder, they said.

At a time global LPG prices have soared, appointing a new Chairman to Litro Gas cannot be expected to make a revolutionary change, industry players pointed out.

“Whatever name there is to a face delegated to run the business, the reality is that the surge in international gas prices, coupled with the appreciation of the US dollar, has made procurement increasingly costly”, they said.

The bitter truth is that local LPG prices will have to be adjusted accordingly to sustain imports and keep the company (importer) afloat, they continued.

Asked about procurement prices, Janaka Pathirathna, Director, Sales, Marketing and Corporate Affairs of Litro Gas Lanka, said that global pricing has shot up to US$ 600 per metric tonne.

He said that the price is expected to remain high till December this year as the demand for LPG has picked up again with the world’s industrial sector resuming operations following the improvement in the Covid-19 pandemic situation.

He said that Sri Lanka procures LPG from a government-owned company in Oman at prevailing global market prices.

Meanwhile, the CAA’s Executive Director, Thushan Gunawardena said there is still no decision on revising the price of gas. Both Litro and Laugfs Gas have sought a Rs. 700 increase per 12.5kg domestic cylinder.

On the launch of the controversial 18-litre cylinders, he said the CAA Council is now examining the matter for follow-up action after a report is submitted.

He said the regulatory body has also come across issues relating to the use of gelatine in certain yoghurts, creamers instead of fresh milk in milk powder and a high alkaline level in bath soaps.

News

Auditor General issue acid test for newly constituted CC, says former COPE Chief

SJB Working Committee member and ex-SLPP lawmaker Charitha Herath says that all eyes are on the newly constituted Constitutional Council (CC) as to how it will handle the dispute between President Anura Kumara Dissanayake, and the previous CC, over the appointment of Auditor General (AG).

The former parliamentarian said so in response to The Island query yesterday (25). In terms of the Constitution, Prime Minister Dr. Harini Amarasuriya and Opposition Leader Sajith Premadasa last week agreed on the appointment of former civil servant Austin Fernando, Professor Wasantha Seneviratne and Ranjith Ariyaratne as non-MP members of the CC.

They replaced former Ministry Secretary Dr. Prathap Ramanujam, former Chairperson of the Sri Lanka Medical Association Dr. Dilkushi Anula Wijesundere and Dr. Dinesha Samararatne of the University of Colombo. Pointing out that they rejected the President’s nominees for the AG’s post on several occasions, Herath emphasised the pivotal importance of the appointment of a person with impeccable credentials.

The other CC members are the Prime Minister, Speaker Dr. Jagath Wickremaratne (Chairman), the Opposition Leader, the President’s nominee Bimal Rathnayake and five persons appointed by the President, upon being nominated as follows: one MP nominated by agreement of the majority of the MPs representing the Government (Aboobucker Athambawa, MP), one MP nominated by agreement of the majority of the Members of Parliament of the political party, or independent group, to which the Leader of the Opposition belongs (Ajith P. Perera, MP), and one MP nominated by agreement of the Members of Parliament other than those representing the Government and those belonging to the political party or independent group to which the Leader of the Opposition belongs, and appointed by the President ( Sivagnanam Shritharan, MP.)

The present CC was established on October 31, 2022 in terms of the 21st Amendment to the Constitution. The Attorney General heads the National Audit Office (NAO). One-time COPE Chief said that it would be the responsibility of the government to ensure the integrity of the NAO.

Chulantha Wickramaratne, who served as AG for a period of six years, retired in April 2025. Following his retirement, President Dissanayake nominated H.T.P. Chandana, an audit officer at the Ceylon Petroleum Corporation as the AG. The CC rejected that nomination. Subsequently, President Dissanayake appointed the next senior-most official at the NAO Dharmapala Gammanpila as Acting Auditor General for a period of six months. Then, the President nominated Senior Deputy Auditor General L.S.I. Jayarathne to serve in an acting capacity, but her nomination, too, was also rejected. Many an eyebrow was raised when the President nominated O.R. Rajasinghe, the Internal Audit Director of the Sri Lanka Army for the top post. That nomination too was rejected. As a result, the vital position remains vacant since 07 December, 2025.

Herath said that the government was in a bind over the Auditor General’s appointment and the disgraceful campaign launched against Attorney General Parinda Ranasinghe, Jr, PC.

The ex-lawmaker said that JVP/NPP loyalists masquerading as journalists and civil activists had launched the protest against the Attorney General. Herath said that the decision to send Deputy Secretary General of Parliament Chaminda Kularatne, on compulsory leave, too, was a matter of serious concern.

Herath said: “This is the same government that campaigned strongly on non-interference, institutional independence, and respect for the rule of law—principles they used to criticise every previous administration. Now, they appear to be doing exactly what they once opposed, only more openly. If this pattern continues, these undemocratic actions will eventually lead to their own downfall.”

BASL in late December, 2025 urged President Dissanayake and others, including the Opposition Leader, to consult civil society and professional bodies, including them, before the appointment of civil society representatives.

Herath said that the newly constituted CC would face its first acid test when it addressed the Auditor General issue.

by Shamindra Ferdinando

News

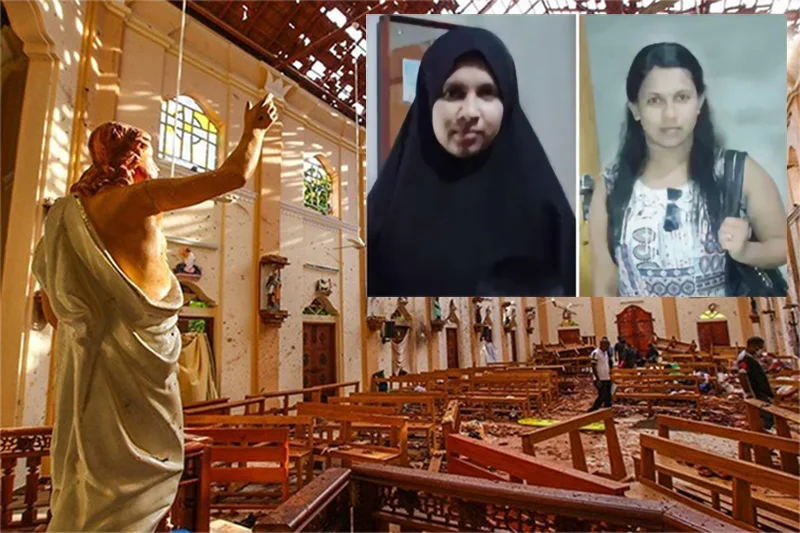

Easter Sunday carnage: Campaigners for justice ask govt. to have suicide bomber’s wife extradited

A Catholic Church–backed organisation, Just for Justice, has called on the government to immediately fast-track the extradition of Pulasthini Mahendran, also known as Sarah Jasmine, who has been linked to the 2019 Easter Sunday terror attacks.

Addressing a press conference at the Centre for Society and Religion in Maradana last week, Fr. Rohan Silva said Mahendran should be brought back to Sri Lanka without delay to enable investigators to uncover the identities of those who masterminded the attacks, which claimed the lives of more than 275 people and injured more than 500.

Mahendran, who now reportedly goes by the name Sarah Jasmine, is the wife of Atchchi Muhammadu Muhammadu Hastun, one of the suicide bombers who attacked St. Sebastian’s Church, in Katuwapitiya, in April 2019.

Fr. Silva referred to a recent statement made by Minister of Public Security Ananda Wijepala, in Parliament, that information uncovered during investigations indicated that Mahendran was not dead. The Minister also told Parliament that there was no indication she was currently in India, but added that the government could secure her extradition if the need arose.

“We tell the Minister and the government that there is an urgent need,” Fr. Silva said. “She must be brought back so that investigators can obtain details about the masterminds of the attacks.”

According to Fr. Silva, repeated efforts had been made to obstruct investigations by promoting the claim that Mahendran died in a suicide blast at a safe house in Sainthamaruthu on April 26, 2019, days after the Easter attacks, despite what he described as evidence suggesting otherwise.

Initial reports stated that 16 people were killed in the Sainthamaruthu explosion. However, the figure was later revised to 17 when police reported the incident to court on April 30, 2019, and informed the media that Mahendran was among the dead.

“It is our belief that those who masterminded and orchestrated the terror attacks wanted to remove Jasmine to prevent evidence being extracted from her,” Fr. Silva said. He added that there had long been suspicions that she was alive and had been taken to India or another country.

Fr. Silva questioned the government’s commitment to uncovering the truth, noting that despite the Minister’s statement in Parliament, no steps had been taken to bring Mahendran back.

“We have doubts whether this delay is due to conflicts of interest among investigators or those who direct them,” he said. “This government came to power promising impartial and expedited investigations into the Easter attacks and justice for the victims. Now, 81 weeks have passed, and we demand that the government deliver on those promises.”

by Norman Palihawadane

News

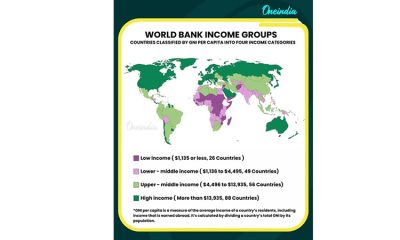

IFC invests $166 Mn in 3 Lankan banks to support businesses

Reinforcing its longstanding commitment to Sri Lanka’s private sector, the International Finance Corporation (IFC), a member of the World Bank Group, yesterday announced a high-impact investment programme of $166 million to support Sri Lankan businesses and accelerate the country’s transition from economic stabilisation to sustainable growth.

This comprehensive country-level financing package aims to expand financial access for small and medium-sized enterprises (SMEs), with a focus on empowering women-owned businesses and the agri-business sector. By targeting these key areas of Sri Lanka’s economy, the financing seeks to drive inclusive growth and unlock job opportunities for underserved groups.

This investment has been made strategically in three of Sri Lanka’s leading commercial private banks – Nations Trust Bank (NTB), Commercial Bank of Ceylon (CBC), and National Development Bank (NDB) – comprising a $50 million loan, $80 million in Risk-Sharing Facilities (RSFs), and $36 million in trade finance support.

While SMEs account for over 75 percent of all Sri Lankan businesses and 45 percent of jobs, access to credit remains a significant barrier to their expansion. Aligned with both the World Bank Group and key national priorities, this partnership aims to deliver targeted solutions for SMEs, helping businesses overcome challenges and supporting the country’s long-term economic resilience.

“SMEs are the undisputed backbone of Sri Lanka’s economy, and their growth is essential for creating jobs. During periods of crisis, IFC plays a critical counter-cyclical role by stepping in when private capital pulls back – and this investment in Sri Lanka’s financial sector reflects that commitment. By helping banks channel capital to women-led businesses, smallholder farmers, and the sectors driving recovery, we are enabling Sri Lanka not just to rebound, but also to grow forward with greater resilience and inclusivity,” said Allen Forlemu, IFC Regional Industry Director, Financial Institutions Group, Asia and the Pacific.

“As part of our One World Bank Group approach, IFC is dedicated to unlocking new inclusive financing streams and ensuring that prosperity reaches the front lines of Sri Lanka’s economy. Strengthening the country’s financial ecosystem means equipping banks with the capacity, tools, and confidence to extend finance where it is most needed – from expanding trade finance capabilities to modernising digital transaction systems. In partnership with three leading banks, NTB, CBC and NDB, our investments aim to build a foundation that empowers SMEs and communities to plan ahead, withstand future shocks, and participate fully in the opportunities that a competitive, inclusive economy can deliver,” said Imad Fakhoury, IFC Regional Division Director for South Asia.

IFC’s financing of $50 million to NTB, marks the first IFC-funded debt investment in Sri Lanka’s financial sector following the 2022 economic crisis. Of the total financing, $7.5 million or 15 percent is earmarked for on-lending to women-owned SMEs, enabling greater access to credit for women entrepreneurs.

Further, IFC has partnered with CBC and NDB to establish up to $80 million in RSFs. Under the facilities, which consist of $60 million for CBC and $20 million for NDB, IFC will share 50 percent of the principal losses incurred by the banks on a portfolio of eligible SME loans. This strategic intervention will help accelerate the banks’ strong commitment to expanding lending to SMEs, including to women-owned SMEs and agri-businesses. These facilities are supported by the IDA Private Sector Window Blended Finance Facility, through the Small Loan Guarantee Programme (SLGP), a programmatic approach to de-risking and scaling up financing for SMEs in eligible countries, including Sri Lanka.

IFC’s Global Trade Finance Programme (GTFP) will provide a $36 million trade finance facility guarantee to NTB and NDB, strengthening their trade finance capabilities. The trade finance lines consist of up to $20 million for NTB and $16 million for NDB and aim to enhance the banks’ ability to provide underserved sectors with access to global markets and supply chains.

Beyond financing, IFC will also deliver technical expertise to modernise NDB’s digital transaction banking and supply chain finance systems, directly expanding credit access for underserved SMEs. The upcoming advisory support also includes a comprehensive upgrade of NDB’s climate risk management framework, integrating climate considerations into the bank’s strategy and operations.

“As Sri Lanka rebuilds following multiple shocks – including the recent devastation caused by Cyclone Ditwah – IFC’s collaboration with leading financial institutions is instrumental in addressing urgent needs while laying the foundation for long-term competitiveness. These investments send a strong signal of confidence to the market,” said Gevorg Sargsyan, Country Manager for the World Bank Group in Sri Lanka and the Maldives. “The World Bank Group is committed to working across sectors and with partners to ensure our support has real impact when Sri Lanka needs it most. Our unwavering focus is on promoting sustainable and inclusive growth, so that every community has the opportunity to participate in and benefit from the country’s progress.”

These investments build on IFC’s 55-year history in Sri Lanka. IFC remains a long-term partner and shareholder in the country’s leading financial institutions, holding an equity interest in CBC and maintaining decades-long relationships with NDB and NTB.

Recently, IFC also helped strengthen Sri Lanka’s financial infrastructure by launching a Secured Transactions Registry (STR), enabling greater credit access for SMEs.

-

Business1 day ago

Business1 day agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion6 days ago

Opinion6 days agoAmerican rulers’ hatred for Venezuela and its leaders

-

Opinion4 days ago

Opinion4 days agoRemembering Cedric, who helped neutralise LTTE terrorism

-

Business4 days ago

Business4 days agoCORALL Conservation Trust Fund – a historic first for SL

-

Opinion3 days ago

Opinion3 days agoA puppet show?

-

Opinion6 days ago

Opinion6 days agoHistory of St. Sebastian’s National Shrine Kandana

-

Opinion1 day ago

Opinion1 day agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Features5 days ago

Features5 days agoThe middle-class money trap: Why looking rich keeps Sri Lankans poor