Business

New exchange control regulations on top of import controls

A new order has been issued by the government under Foreign Exchange Act to preserve the Foreign Exchange Position of Sri Lanka in addition to ongoing import controls.

The Minister of Finance with the recommendation of the Monetary Board of the Central Bank of Sri Lanka and the approval of the Cabinet of Ministers has issued an Order dated 2 July, 2021 with a view to assisting and maintaining the financial system stability by minimising the pressure on the exchange rate and preserving the foreign currency reserve position of the country,

Accordingly following suspensions/restrictions on outward remittances will be effective for six (06) months commencing from 2 July 2021.

i. Suspend the repatriation of funds under the migration allowance out of funds received as monetary gifts by an emigrant from an immediate family member (i.e. parents, grandparents, siblings and spouse of the Emigrant).

ii. Limit the repatriation of funds under the migration allowance through Capital Transactions Rupee Accounts by the emigrants who have already claimed migration allowance under the general permission, up to a maximum of USD 10,000 or equivalent in any other designated foreign currency.

iii. Limit the eligible migration allowance for the emigrants who are claiming the migration allowance for the first time under the general permission, up to a maximum of USD 30,000 or equivalent in any other designated foreign currency.

iv. Limit the repatriation of any current income or accumulated current income (including Employees Provident Fund (EPF), Employees Trust Fund (ETF), gratuity and pensions or any other retirement benefits) by the emigrants through the Capital Transaction Rupee Accounts or Emigrant’s Remittable Income Accounts, under the general permission, up to a maximum of USD 30,000 or equivalent in any other designated foreign currency.

v. Limit the outward remittances or issuance of foreign exchange for any Sri Lankan individual who resides in or outside Sri Lanka and has obtained Temporary Residence Visa of another country which falls into a category of visa that entitles the individual to obtain permanent residency status or citizenship in that country at a future date, up to a maximum of USD 20,000 or equivalent in any other designated foreign currency.

vi. Limit the issuance of foreign exchange for any person resident in Sri Lanka who intends to leave Sri Lanka under the Temporary Residence Visa of another country up to a maximum of USD 10,000 or equivalent in any other designated foreign currency.

Vii. Suspend making payments through Outward Investment Accounts for the purpose of making investments in overseas by persons resident in Sri Lanka under general permission granted in the Schedule of the Regulations No. 1 of 2021 published in the Extraordinary Gazette Notifications No. 2213/34 dated 03 February 2021, excluding (a) investments to be financed out of a foreign currency loan obtained by the investor from a person resident outside Sri Lanka under the provisions of the Foreign Exchange Act, or (b) an additional investment to be made to fulfill the regulatory requirements in the investee’s country applicable on the investment already made in compliance with the provisions of the Act or repealed Exchange Control Act, in a company or a branch office in that country, or (c) an additional investment/infusion of funds (as applicable) to be made by eligible resident companies in already established subsidiaries or branch offices in overseas incorporated/established subject to the provisions of the Act or repealed Exchange Control Act, up to a maximum of USD 15,000 or equivalent in any other designated foreign currency, for the purpose of working capital requirements of the investee, or (d) the remittances for the purpose of maintenance of liaison, marketing, agency, project, representative or any other similar offices already established in overseas subject to the provisions of the Act or repealed Exchange Control Act, by eligible resident companies, up to a maximum of USD 30,000 or equivalent in any other designated foreign currency; provided that, the Head of Department of Foreign Exchange is satisfied with the fulfillment of such requirement.

Viii. Limit the outward remittances on capital transactions through Business Foreign Currency Accounts or/and Personal Foreign Currency Accounts held by a person resident in Sri Lanka, up to a maximum of USD 20,000 or equivalent in any other designated foreign currency, during the effective period of this Order;

ix.The Monetary Board shall have the authority to grant permission in terms of the Section 7(10) of the Foreign Exchange Act for the investments on case-by-case basis which exceeds the limits specified in the general permission granted in the Regulation No 1 of 2021 provided that, (a) the proposed investment is to be financed out of a foreign currency loan obtained by the investor from a person resident outside Sri Lanka under the provisions of the Foreign Exchange Act, or (b) the proposed investment is to be made to fulfill the regulatory requirement in the investee’s country applicable on the investment already made in a company or branch office in that country in compliance with the provisions of the Act or repealed Exchange Control Act.

Business

Sampath Bank’s strong results boost investor confidence

The latest earnings report for Sampath Bank PLC (SAMP), analysed by First Capital Research (FCR), firmly supports a positive outlook among investors. The research firm has stuck with its “MAINTAIN BUY” recommendation , setting optimistic targets: a Fair Value of LKR 165.00 for 2025 and LKR 175.00 for 2026. This signals strong belief that the bank is managing the economy’s recovery successfully.

The key reason for this optimism is the bank’s shift towards aggressive, yet smart, growth. Even as interest rates dropped across the market, which usually makes loan income (Net Interest Income) harder to earn, Sampath Bank saw its total loans jump by a huge 30.2% compared to last year. This means the bank lent out a lot more money, increasing its loan book to LKR 1.1 Trillion. This strong lending, which covers trade finance, leasing, and regular term loans, shows the bank is actively helping businesses and people spend and invest as the economy recovers.

In addition to loans, the bank has found a major new source of income from fees and commissions, which surged by 42.6% year-over-year. This money comes from services like card usage, trade activities, and digital banking transactions. This shift makes the bank less reliant on just interest rates, giving it a more stable and higher-profit way to earn money.

Importantly, this growth hasn’t weakened the bank’s foundations. Sampath Bank is managing its funding costs better, partly by improving its low-cost current and savings account (CASA) ratio to 34.5%. Moreover, the quality of its loans is getting better, with bad loans (Stage 3) dropping to 3.77% and the money set aside to cover potential losses rising to a careful 60.25%.

Even with the new, higher capital requirements for systemically important banks, the bank remains very strong, keeping its capital and cash buffers robust and well above the minimum standards.

In short, while the estimated profit for 2025 was adjusted slightly, the bank’s excellent performance and strong strategy overshadow this minor change. Sampath Bank is viewed as a sound stock with high growth potential , offering investors attractive total returns over the next two years.

By Sanath Nanayakkare

Business

ADB approves $200 million to improve water and food security in North Central Sri Lanka

The Asian Development Bank (ADB) has approved a $200 million loan to support the ongoing Mahaweli Development Program, Sri Lanka’s largest multiuse water resources development initiative.

The program aims to transfer excess water from the Mahaweli River to the drier northern and northwestern parts of Sri Lanka. The Mahaweli Water Security Investment Program Stage 2 Project will directly benefit more than 35,600 farming households in the North Central Province by strengthening agriculture sector resilience and enhancing food security.

ADB leads the joint cofinancing effort for the project, which is expected to mobilize $60 million from the OPEC Fund for International Development and $42 million from the International Fund for Agricultural Development, in addition to the ADB financing.

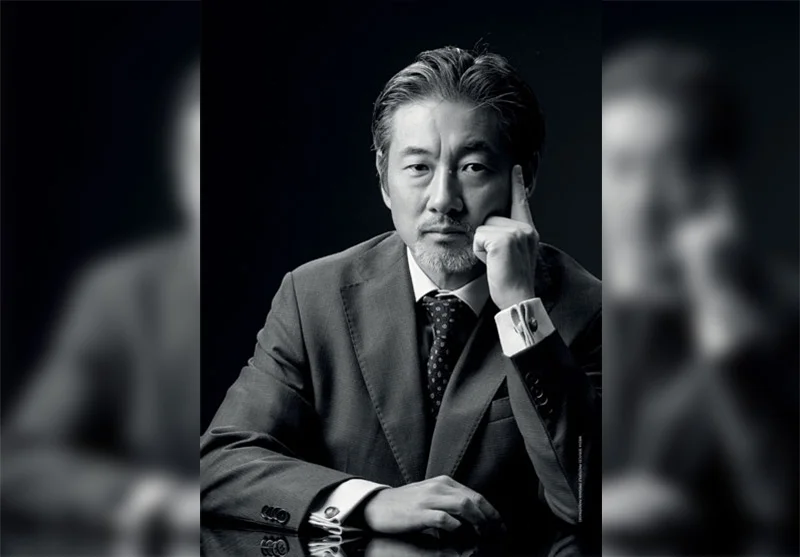

“While Sri Lanka has reduced food insecurity, it remains a development challenge for the country,” said ADB Country Director for Sri Lanka Takafumi Kadono. “Higher agricultural productivity and crop diversification are necessary to achieve food security, and adequate water resources and disaster-resilient irrigation systems are key.”

The project will complete the government’s North Central Province Canal (NCPC) irrigation infrastructure, which is expected to irrigate about 14,912 hectares (ha) of paddy fields and provide reliable irrigated water for commercial agriculture development (CAD). It will help complete the construction of tunnels and open and covered canals. The project will also establish a supervisory control and data acquisition system to improve NCPC operations. Once completed, the NCPC will connect the Moragahakanda Reservoir to the reservoirs of Huruluwewa, Manankattiya, Eruwewa, and Mahakanadarawa.

Sri Lanka was hit by Cyclone Ditwah in late November, resulting in the country’s worst flood in two decades and the deadliest natural hazard since the 2004 tsunami. The disaster damaged over 160,000 ha of paddy fields along with nearly 96,000 ha of other crops and 13,500 ha of vegetables.

Business

ComBank to further empower women-led enterprises with NCGIL

The Commercial Bank of Ceylon has reaffirmed its long-standing commitment to advancing women’s empowerment and financial inclusion, by partnering with the National Credit Guarantee Institution Limited (NCGIL) as a Participating Shareholder Institution (PSI) in the newly introduced ‘Liya Shakthi’ credit guarantee scheme, designed to support women-led enterprises across Sri Lanka.

The operational launch of the scheme was marked by the handover of the first loan registration at Commercial Bank’s Head Office recently, symbolising a key step in broadening access to finance for women entrepreneurs.

Representing Commercial Bank at the event were Mithila Shyamini, Assistant General Manager – Personal Banking, Malika De Silva, Senior Manager – Development Credit Department, and Chathura Dilshan, Executive Officer of the Department. The National Credit Guarantee Institution was represented by Jude Fernando, Chief Executive Officer, and Eranjana Chandradasa, Manager-Guarantee Administration.

‘Liya Shakthi’ is a credit guarantee product introduced by the NCGIL to facilitate greater access to financing for women-led Micro, Small, and Medium Enterprises (MSMEs) that possess viable business models and sound repayment capacity but lack adequate collateral to secure traditional bank loans.

-

Features5 days ago

Features5 days agoFinally, Mahinda Yapa sets the record straight

-

News6 days ago

News6 days agoCyclone Ditwah leaves Sri Lanka’s biodiversity in ruins: Top scientist warns of unseen ecological disaster

-

Features5 days ago

Features5 days agoHandunnetti and Colonial Shackles of English in Sri Lanka

-

Business4 days ago

Business4 days agoCabinet approves establishment of two 50 MW wind power stations in Mullikulum, Mannar region

-

News4 days ago

News4 days agoGota ordered to give court evidence of life threats

-

Features6 days ago

Features6 days agoAn awakening: Revisiting education policy after Cyclone Ditwah

-

Features4 days ago

Features4 days agoCliff and Hank recreate golden era of ‘The Young Ones’

-

Opinion5 days ago

Opinion5 days agoA national post-cyclone reflection period?