Business

WB inks credit agreement with SL to improve water resources-linked infrastructure

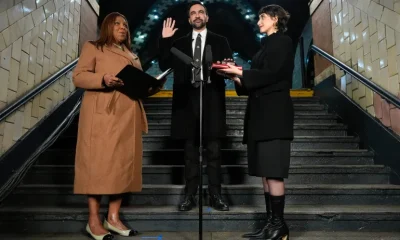

The agreement exchange: Secretary, Ministry of Finance Sajith Attygalle ® and WB Country Director for Sri Lanka Faris Hadad-Zervos

The government of Sri Lanka and the World Bank signed y a $69.53 million credit agreement to improve dams and irrigation schemes covering 165,000 hectares of agricultural land and improve the management of watersheds and water resources, benefitting 356,000 farming families.

Sajith Attygalle, Secretary to the Ministry of Finance signed on behalf of the government and Faris Hadad-Zervos, World Bank Country Director for Sri Lanka, signed on behalf of the World Bank.

“Effective management of water resources is critical to Sri Lanka’s long-term economic prosperity,” said Faris Hadad-Zervos, World Bank Country Director for Sri Lanka. “Sri Lanka is blessed with both natural and manmade water resources and protecting its watersheds will help the country adapt to climate change and reduce climate-induced risks on people and their livelihoods.”

The project aims to preserve, restore and better manage watersheds — with a focus on the Upper Mahaweli Watershed in the central hills — to help prevent impacts of extreme floods, drought and landside events, while at the same time contributing to improved water quality and farmer yields. The project will be implemented by the Ministry of Irrigation.

The project combines evidenced-based planning with investments in watershed management, dam safety inspection practices and dam risk assessments. The rehabilitation of irrigation systems will benefit from extensive stakeholder consultation and key project interventions will promote the participation of youth and women to ensure they are supported by the project.

“The government of Sri Lanka is committed to the conservation of our watersheds and plan to formulate a broad policy framework under the theme “Strategic Mechanisms for Developing a Common Watershed Management Approach in Sri Lanka” said . Chamal Rajapaksa, Minister of Irrigation. “The Ministry of Irrigation is happy to associate with the World Bank in developing our valuable water resources and watershed through this five-year project”

The World Bank support of $69.53 million credit is from its International Development Association, with project preparation activities supported by the Korea-World Bank Group Partnership Facility.

There are 19 projects in the World Bank portfolio in Sri Lanka amounting to $2.3 billion in a variety of sectors including transport, urban, water, education and health.

(WB)

Business

SEC Sri Lanka eases Minimum Public Holding Rules for listings via introductions to boost market flexibility

The Securities and Exchange Commission of Sri Lanka (SEC) has approved amendments to the Colombo Stock Exchange (CSE) Listing Rules to provide greater flexibility regarding the Minimum Public Holding (MPH) requirement for companies listing through the Introduction method.

These revisions were proposed and deliberated under Project 6 – New Listings (Public and Private), one of 12 key strategic initiatives launched by the SEC to strengthen Sri Lanka’s capital market framework. Project 6 aims to drive national capital formation, promote listings by highlighting benefits and opportunities for listed entities, and attract large-scale corporates to enhance market depth, liquidity, and investor confidence.

The amendments reflect a joint effort by the SEC and CSE, underscoring strong collaboration between the regulator and the Exchange to address evolving market needs while maintaining market integrity, transparency, and investor protection.

The salient features of the amendments to the CSE listing Rules are as follows;

Entities seeking listing by way of an Introduction on the Main Board or Diri Savi Board that are unable to meet the MPH requirement at the time of submitting the initial listing application, may now be granted a listing, subject to certain conditions on compliance.

Non-public shareholders who have held their shares for a minimum period of eighteen months prior to the date of the initial listing application may divest up to a maximum 2% of their shares each month during the six months commencing from the date of listing, and simultaneously, be subject to a lock-in requirement of 30% of their respective shareholdings as at the date of listing, until MPH compliance or 18 months from the date of listing, whichever occurs first.

A phased MPH compliance framework has been introduced requiring a minimum 50% compliance with MPH requirement within 12 months and full compliance within 18 months from the date of listing.

Entities should include clear disclosures in the Introductory Document confirming their obligation to meet MPH requirements within the prescribed timelines.

In the event of non-compliance with the MPH requirement, certain enforcement actions have also been introduced.

The revised framework is expected to encourage more companies to consider listing via Introduction, thereby broadening market participation, improving liquidity, and contributing to the overall development of Sri Lanka’s capital market. Issuers, investors, and market intermediaries will benefit from a more enabling yet well-regulated listing environment.

Business

Manufacturing counters propel share market to positive territory

Stock market activities were positive yesterday, mainly driven by manufacturing sector counters, especially Sierra Cables, Royal Ceramics and ACL Cables. Further, there was some investor confidence in construction sector counters as well.

Amid those developments both indices moved upwards. The All Share Price Index went up by 150.54 points, while the S and P SL20 rose by 41.5 points. Turnover stood at Rs 4.65 billion with six crossings.

Those crossings were reported in Royal Ceramics which crossed 3.8 million shares to the tune of Rs 174.3 million; its share s traded at Rs 45.20, VallibelOne 1.4 million shares crossed to the tune of Rs 138.6 million; its shares traded at Rs 99, Melstacorp 500,000 shares crossed for Rs 87.24 million; its shares traded at Rs 174.50, Sierra Cables two million shares crossed for Rs 68.2 million, its shares sold at Rs 34.30, Kingsbury 1.5 million shares crossed for Rs 31.8 million; its shares traded at Rs 21.20.

In the retail market companies that mainly contributed to the turnover were; Sierra Cables Rs 418 million (20 million shares traded), Royal Ceramics Rs 363 million (eight million shares traded), Colombo Dockyards Rs 323 million (1.7 million shares traded), ACL Rs 311 million (3.5 million shares traded), Renuka Agri Rs 149 million (12.3 million shares traded), Sampath Bank Rs 94.7 million (648,000 shares traded) and Bogala Graphite Rs 86.4 million (529,000 shares traded). During the day 122.8 million shares volumes changed hands in 34453 transactions.

Yesterday the rupee opened at Rs 310.00/25 to the US dollar in the spot market, weaker from Rs 310.00/310.20 the previous day, dealers said, while bond yields were broadly steady.

By Hiran H Senewiratne

Business

Atlas ‘Paata Lowak Dinana Hetak’ celebrates emerging artists nationwide

Atlas, Sri Lanka’s leading learning brand, reaffirmed its purpose of making learning fun and enjoyable through the Atlas All-Island Art Competition 2025, which concluded with a gifting ceremony held recently at Arcade Independence Square under the theme ‘Atlas paata lowak dinana hetak’. Students from Preschool to Grade 11 showcased their talents across five categories, with all island winners receiving cash prizes, certificates, and gift packs. Additionally, merit winners in each category were also recognized. The event brought together students, parents, and educators, highlighting Sri Lanka’s cultural diversity, nurturing young talent, and reinforcing Atlas’s long-standing commitment to education, creativity, and building confidence among schoolchildren. The event concluded with the ‘Atlas Art Carnival’, which brought children and parents together through games and creative art activities in a fun and lively atmosphere.

-

News7 days ago

News7 days agoStreet vendors banned from Kandy City

-

Sports4 days ago

Sports4 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne

-

News2 days ago

News2 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

News7 days ago

News7 days agoLankan aircrew fly daring UN Medevac in hostile conditions in Africa

-

Sports5 days ago

Sports5 days agoTime to close the Dickwella chapter

-

Features3 days ago

Features3 days agoIt’s all over for Maxi Rozairo

-

Features7 days ago

Features7 days agoRethinking post-disaster urban planning: Lessons from Peradeniya

-

Opinion7 days ago

Opinion7 days agoAre we reading the sky wrong?