Business

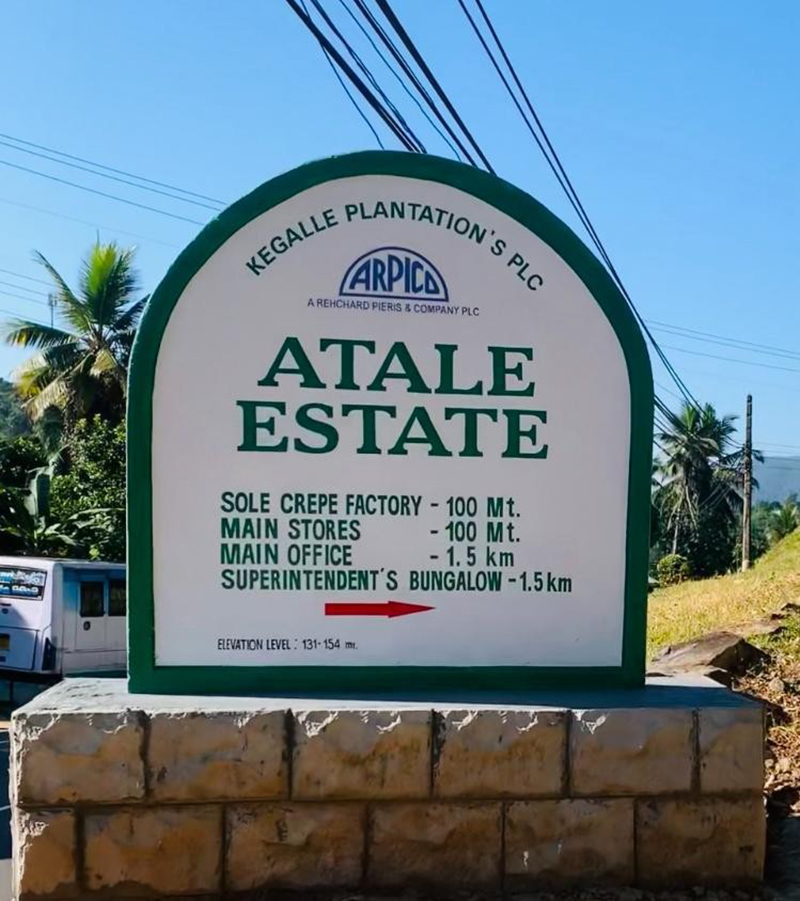

Atale Estate: A century of stewardship, sustainability at Sri Lanka’s largest rubber estate

Established in 1904, Atale Estate stands today as one of Sri Lanka’s most historically significant and geographically advantaged rubber estates. It was originally part of the extensive holdings of Messrs. Grand Central (Ceylon) Rubber Estates Ltd., which managed more than 43,000 acres through Carson Cumberbatch & Company.

Over time, the estate evolved, gradually incorporating neighboring properties such as Maboda, Boyagoda, Dickhena, New and Old Arandara and later the Dorpet and Myland estates. During the colonial era, several of these functioned as independent estates, with Pindenioya Estate even operating its own rubber factory and engaging in tea cultivation.

The estate’s long journey mirrors the broader transformation of Sri Lanka’s plantation industry, from early commercial expansion to post-independence nationalization and eventual corporate restructuring. Following the Land Reform Act of 1976, Atale Estate came under the management of the Janatha Estates Development Board (JEDB) until privatization in 1992 vested the estate with Kegalle Plantations PLC.

Administrative integrations over the decades expanded the estate to its present extent of 1,142 hectares, making it the largest rubber estate in the country. Today, it spans seven Grama Niladhari divisions in the Kegalle District and continues to benefit from the stewardship of seasoned planters whose expertise has shaped its long-term success.

Despite significant challenges, their leadership has ensured that the estate and its factory maintained high standards of productivity, environmental responsibility and operational excellence right through to the present day.

Atale Estate’s strength lies in its advantageous location within Sri Lanka’s low-country Wet Zone and its commitment to sustainability-focused plantation management. The estate benefits from abundant rainfall ranging between 2,000 and 3,000 millimetres annually, coupled with a warm average temperature of approximately 27.8°C.

High humidity levels help maintain soil moisture and reduce evapotranspiration, ensuring optimal conditions for rubber cultivation. The diverse topography, consisting of gently undulating and moderately sloped terrain, supports effective drainage and plantation accessibility, while fertile Red-Yellow Podzolic and Reddish Brown Latosolic soils promote strong root development. The naturally acidic nature of this soil, shaped by the region’s weather patterns, is ideally aligned with rubber’s agronomic requirements.

To preserve long-term soil health and environmental stability, the estate practices soil conservation through the introduction of cover crops and careful land-use planning. Crop diversification has been incorporated into the estate’s strategy, with oil palm, coconut and agarwood cultivated alongside rubber.

Additionally, more than 100 hectares have been replanted with recommended rubber clones, aligning with guidance from the Rubber Research Institute of Sri Lanka and other national agricultural authorities. The estate’s alignment with scientific institutions strengthens its commitment to adopting modern technologies, research-driven methods and environmentally sound production processes.

Atale’s sustainability credentials are bolstered by its Forest Stewardship Council (FSC) certification. First obtained in 2019, the certification ensures compliance with international standards on environmental protection, social responsibility and stakeholder engagement.

Business

Diplomatic thaw in Middle East sparks hope for Sri Lankan tea exports

Amid softening diplomatic rhetoric between the United States and Iran, a senior economist told The Island Financial Review yesterday that the stability of Sri Lanka’s tea exports to the Middle East, particularly Iran, would be maintained.

The economist, who closely follows regional developments, pointed to recent statements by Iranian Foreign Minister Abbas Araghchi and U.S. President Donald Trump as signs of de-escalation. Araghchi denied plans to execute anti-government protesters, while Trump indicated he had received assurances that killings had stopped and that the U.S. was “watching the process.”

“When geopolitical tensions ease, trade channels stabilise,” the economist said. “Iran and the Middle East are important markets for Sri Lankan tea. Any reduction in political risk is likely to support demand and reduce vulnerability in our export earnings,” he added.

The comments come against the backdrop of this week’s Colombo tea auction, where offerings totalled 6.0 million kilograms. The auction report noted “less activity from Iran and the Middle Eastern markets following recent restrictions in trading conditions,” reflecting the sensitivity of tea exports to regional instability.

Western Slopes and Nuwara Eliya teas showed mixed trends, with some grades firm and others declining. High and Medium Grown CTC teas sold around previous levels, while Low Grown varieties were easier by up to Rs. 20 per kg. Ex-Estate offerings remained steady at 0.74 million kilograms, with no significant change in quality, according to Forbes and Walker Research.

Low Growns, which accounted for approximately 2.4 million kilograms, saw varied demand: the Leafy category was quieter, while Semi-Leafy met with fair interest. Tippy teas faced pressure, especially in the Premium catalogue, where a lack of suitable bids left many unsold.

Selective demand was noted from shippers to the UK, Europe, and South Africa, while markets in Japan, China, the Middle East, and the CIS were reasonably active mostly at lower levels, Forbes and Walker said.

The economist added that while global tea markets remain volatile, any sustained calm in the Middle East could help restore buyer confidence from Iran – a key destination for Sri Lankan Orthodox teas.

“We are not out of the woods yet, but the signs are encouraging,” he said. “If the diplomatic tone continues to improve, we could see firmer demand from the region in the coming weeks,” he said.

By Sanath Nanayakkare

Business

Call for stepped-up economic engagement between SL and Maldives

Sri Lanka is looking to significantly expand its commercial engagement with the Maldives, with business leaders calling for a more focused strategy to capitalise on growing opportunities in trade, services and tourism-linked investments.

Immediate Past President of the Sri Lanka-Maldives Business Council Sudesh Mendis said that the Maldives remains a high-potential market for Sri Lankan exporters and service providers, particularly in construction materials, food and beverage supplies, logistics and professional services aligned with the island nation’s expanding tourism and infrastructure sectors.

“The Maldives offers a demand-driven market where Sri Lankan products and services already enjoy strong acceptance, Mendis said, noting that geographical proximity and long-standing business ties give Sri Lanka a natural competitive advantage.

He said continued resort development, urban housing projects and public infrastructure investments in the Maldives have sustained demand for Sri Lankan goods, while services such as engineering, consultancy and skilled manpower also present room for growth.

However, Mendis stressed that logistical inefficiencies and administrative bottlenecks continue to limit expansion. “Improving shipping connectivity, reducing customs delays and ensuring smoother payment mechanisms are essential if Sri Lankan businesses are to scale up operations, he said.

Tourism collaboration was identified as another underdeveloped area, with Sri Lanka and the Maldives increasingly viewed as complementary destinations rather than rivals. Joint marketing initiatives and multi-destination travel packages could help increase visitor arrivals to both countries, Mendis added.

He also called for stronger private-sector leadership through regular trade missions, sector-focused business forums and targeted policy support to sustain momentum.

“With a coordinated and commercially driven approach, Sri Lanka can substantially deepen its economic presence in the Maldivian market, Mendis said.

Sri Lanka and the Maldives have maintained close economic relations, with bilateral trade expected to gain further traction as regional connectivity improves.

By Ifham Nizam

Business

News of IMF delegation’s visit to SL brings cheer to bourse

The CSE commenced trading yesterday on a negative note due to profit-takings but later turned positive, when sections of the media reported that an IMF delegation is to visit Sri Lanka next week to facilitate the fifth review of the extended fund facility to Sri Lanka.

Amid those developments both indices moved upwards. The All Share Price Index went up by 41.42 points, while the S and P SL20 rose by 25.28 points.

Turnover stood at Rs 4.73 billion with ten crossings. Top seven crossings were reported in DFCC, which crossed 4.4 million shares to the tune of Rs 701 million and its shares traded at Rs 159, HNB 250,000 shares crossed for Rs 105 million; its shares traded at Rs 420, Sierra Cables 2 million shares crossed for Rs 75 million; its shares traded at Rs 37.57, Seylan Bank 666,000 shares crossed for Rs 73.4 million; its shares traded at Rs 110.50.

Commercial Bank 300,000 shares crossed for Rs 57.2 million; its shares traded at Rs 225, Sampath Bank 300,000 shares crossed to the tune of Rs 46.6 million; its shares traded at Rs 155 and Ambeon Capital 1 million shares crossed for Rs 42 million; its shares traded at Rs 43.

In the retail market top seven companies that have mainly contributed to the turnover were; ACL Cables Rs 171 million (1.7 million shares traded), Commercial Bank Rs 153 million (686,000 shares traded), Sierra Cables Rs 130 million (3.5 million shares traded), Sampath Bank Rs 109 million (703,000 shares traded) , HNB Rs 109 million (250,000 shares traded), Lanka Credit and Business Finance Rs 76 million (8.2 million shares traded) and HNB (Non-Voting) Rs 76 million (213,000 shares traded). During the day 132 million share volumes changed hands in 37857 transactions.

It is said that the banking and finance sector led the market, especially HNB and Commercial Bank, while construction related companies, especially Sierra Cables, also performed well at the floor.

The manufacturing and travel and tourism sectors also performed well.

Yesterday the rupee was quoted at Rs 309.50/60 to the US dollar in the spot market weaker from Rs 309.35/50 Wednesday, having depreciated in recent weeks, dealers said, while bond yields were broadly steady.

The telegraphic transfer rates for the American dollar were 305.9000 buying, 312.9000 selling; the British pound was 408.2980 buying, and 419.6162 selling, and the euro was 352.7488 buying, 364.1370 selling.

By Hiran H Senewiratne

-

Business2 days ago

Business2 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Business6 days ago

Business6 days agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

News6 days ago

News6 days agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Editorial1 day ago

Editorial1 day agoThe Chakka Clash

-

Features6 days ago

Features6 days agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

Features6 days ago

Features6 days agoSubject:Whatever happened to (my) three million dollars?

-

Business2 days ago

Business2 days agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App

-

Features1 day ago

Features1 day agoOnline work compatibility of education tablets