Business

“Enchanted Wonders” Christmas Tree Lighting

One Galle Face, the premier retail destination in Sri Lanka, officially unveiled Colombo’s most iconic Christmas experience with its annual Tree Lighting Ceremony held recently. This year, the mall celebrates the season under the enchanting theme “Enchanted Wonders,” creating a magical and visually captivating festive atmosphere for all visitors. The centrepiece of the celebration is Sri Lanka’s tallest indoor Christmas tree, standing at an impressive 76 feet, marking a standout moment in the country’s holiday calendar.

The ceremony transformed the mall into a festive setting filled with striking illumination, seasonal artistry, and immersive installations. The official lighting moment set the tone for the holiday season at One Galle Face, inviting families, shoppers, and visitors to experience a new era of experiential retail throughout the month. Guests can look forward to a line-up of interactive activities, family-friendly engagements, seasonal showcases, and exclusive festive privileges curated for One Galle Face Rewards Members.

The One Galle Face festive celebrations are powered by Sampath Bank as its Strategic Partner and YES FM as the Official Radio Partner. The memorable evening brought together a distinguished community of influential partners, leaders, and creative professionals from various domains, including senior leadership of One Galle Face, Shangri-La Hotel management, heads of leading international and local brands, Sampath Bank management and employees, MBC Network leadership, representatives from One Galle Face Tower and The Residences at One Galle Face, as well as popular personalities and local celebrities.

One Galle Face General Manager Sachin Dhanawade commented, “We are excited to officially launch the One Galle Face Christmas holidays with the lighting of the Christmas tree. The ‘Enchanted Wonders’ setting is guaranteed to elevate the One Galle Face festive experience as it is a next-generation Christmas theme designed to immerse shoppers in a magical, future-forward holiday atmosphere. As the premier retail destination in the country, we are constantly striving to deliver a world-class experience in terms of service and hospitality, ensuring an unforgettable experience for every time they walk in through our doors.”

With over 350 world-class brands, One Galle Face has established itself as Sri Lanka’s premier retail destination, offering a dynamic mix of global fashion labels, fine dining experiences, and family entertainment. Over the past 12 months, the mall welcomed over 40 new brands, including Carnage, Under Armour, Taco Bell, Levi’s, The Body Shop and Birkenstock, further enhancing its diverse portfolio and delivering an even wider selection of the most loved brands to its customer base. With even more exciting new openings planned in the coming months, the mall continues to evolve as a one-stop hub for shopping, leisure, and lifestyle.

Beyond retail, One Galle Face offers a holistic lifestyle ecosystem featuring something for everyone. Beauty and health-conscious individuals can enjoy its world-class wellness portfolio spanning personal care, aesthetics, grooming, and fitness.

Business

Cheaper credit expected to drive Sri Lanka’s business landscape in 2026

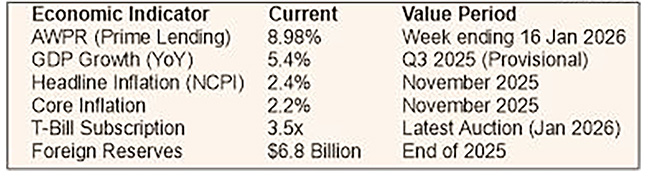

The opening weeks of 2026 are offering a glimmer of cautious hope for the business community weary from years of economic turbulence and steep financing costs. The Central Bank’s latest weekly economic indicators signal more than just macroeconomic stability. They point to early signs of a long-awaited trend; a measurable dip in borrowing costs.

“If sustained, this shift could transform steady growth into a robust, investment-led expansion,” a senior economist told The Island Financial Review.

The benchmark Average Weighted Prime Lending Rate (AWPR) declined by 21 basis points to 8.98% for the week ending 16 January, according to the Central Bank.

“For entrepreneurs and CEOs, this is not just another statistic. It could mean the difference between postponing an expansion and hiring new staff. Across boardrooms, the hope is that this marks the start of a sustained downward trend that holds through 2026,” he said.

When asked about the instances where Treasury Bills are not fully subscribed by the investors, he replied,” Treasury Bill yields remained broadly stable, with only minimal movement across 91-day, 182-day, and 364-day tenors. Strong demand was clear, with the latest T-Bill auction oversubscribed by about 3.5 times. This sovereign-level stability creates room for the gradual easing of commercial lending rates, allowing the Central Bank to nurture a more growth-supportive monetary policy.”

Replying to a question on how he views the inflation numbers in this context, he said, “The year-on-year increase in the National Consumer Price Index stood at a manageable 2.4% in November, with core inflation at 2.2%. Such an environment should allow interest rates to fall without sparking a price spiral. For businesses, it means the real cost of borrowing adjusted for inflation, and it is becoming more favourable for them. While consumers still face weekly price shifts in vegetables and fish, the broader disinflation trend gives policymakers leeway to keep credit affordable.”

Referring to the growth trajectory, he mentioned, “With GDP growth provisionally at 5.4% in the third quarter of 2025 and Purchasing Managers’ Indices signalling expansion in both manufacturing and services, the economy is in a growth phase. However, to accelerate this momentum businesses need capital at lower cost to modernise machinery, boost export capacity, and spur innovation. Affordable credit is, therefore, not merely helpful, it is essential to shift growth into a higher gear.”

In conclusion , he said,” The coming months will be watched closely, because for Sri Lankan businesses, a sustained decline in borrowing costs isn’t just an indicator; it’s the foundation for growth. There’s hope that this easing in the cost of money will prevail through most of the year.”

By Sanath Nanayakkare ✍️

Business

Mercantile Investments expands to 90 branches, backed by strong growth

Mercantile Investments & Finance PLC has expanded its national footprint to 90 branches with a new opening in Tangalle, reinforcing its commitment to community accessibility. The trusted non-bank financial institution, with over 60 years of service, now supports diverse communities across Sri Lanka with leasing, deposits, gold loans, and tailored lending.

This physical expansion aligns with significant financial growth. The company recently surpassed an LKR 100 billion asset base, with its lending portfolio doubling to Rs. 75 billion and deposits growing to Rs. 51 billion, reflecting strong customer trust. It maintains a low NPL ratio of 4.65%.

Chief Operating Officer Laksanda Gunawardena stated the branch network is vital for building trust, complemented by ongoing digital investments. Managing Director Gerard Ondaatjie linked the growth to six decades of safeguarding depositor interests.

With strategic plans extending to 2027, Mercantile Investments aims to convert its scale into sustained competitive advantage, supporting both customers and Sri Lanka’s economic progress.

Business

AFASL says policy gap creates ‘uneven playing field,’ undercuts local Aluminium industry

A glaring omission in the Board of Investment’s (BOI) Negative List is allowing duty-free imports of fully fabricated aluminium products, severely undercutting Sri Lanka’s domestic manufacturers, according to a leading industry association.

The Aluminium Fabricators Association of Sri Lanka (AFASL) warns that this policy failure is threatening tens of thousands of jobs, draining foreign exchange, and stifling local industrial capacity.

“This has created an uneven playing field,” the AFASL said, adding that BOI-approved developers gain cost advantages over local fabricators, while government revenue and foreign exchange are lost through imports of products already made in Sri Lanka.

The core of the issue lies in a critical policy gap. While raw aluminium extrusions are protected on the BOI’s Negative List – which restricts duty-free imports – finished products like doors, windows, and façade systems are not. Furthermore, the list’s lack of specific Harmonised System (HS) codes allows these finished items to be imported under varying descriptions, slipping through duty-free.

This loophole, the AFASL argues, disadvantages a robust local industry that employs over 30,000 people directly and indirectly. Supported by five local extrusion manufacturers, a skilled NVQ-certified workforce, and a well-established glass-processing sector, the industry has been operational since the 1980s.

The association highlights that the damage extends beyond fabrication. The imported systems often include glass, hinges, locks, and accessories, all of which are produced locally, thereby cutting off demand across the entire domestic value chain. Small and medium-sized enterprises (SMEs), a segment government policy aims to support, are feeling the impact most acutely.

Since May 2025, the AFASL has been engaged in talks with the BOI, Finance Ministry, and Industries Ministry. Their key demand is to include specific HS codes on the Negative List and to list fabricated aluminium doors, windows, and curtain wall systems under HS Code 7610 to close the loophole.

While welcoming supportive recommendations from the Industries Ministry to add these products to an updated Negative List, the AFASL sounded a note of caution. It warned that proposed reductions in the CESS levy could further incentivise imports, undermining the sector’s recovery from the economic crisis.

The association also pointed to an inequity in the current framework. With most subsidies withdrawn, BOI-registered property developers continue to benefit from duty-free imports, while locally made products remain subject to heavy taxes for the general population.

The AFASL is urging policymakers to align investment incentives with national industrial policy, protect domestic manufacturing, and ensure fair competition across the construction supply chain to safeguard an industry vital to Sri Lanka’s economy.

By Sanath Nanayakkare ✍️

-

Editorial1 day ago

Editorial1 day agoIllusory rule of law

-

News2 days ago

News2 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business4 days ago

Business4 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial2 days ago

Editorial2 days agoCrime and cops

-

Features1 day ago

Features1 day agoDaydreams on a winter’s day

-

Editorial3 days ago

Editorial3 days agoThe Chakka Clash

-

Features1 day ago

Features1 day agoSurprise move of both the Minister and myself from Agriculture to Education

-

Business4 days ago

Business4 days agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App