News

BOC records Rs. 106.9 billion Profit in 2024 while delivering inclusive returns for all stakeholders, contributing significantly to Sri Lankan economy at large

Bank of Ceylon (BOC), being the No. 01 Bank in Sri Lanka and the country’s highest rated banking brand, achieved robust financial results in 2024, demonstrating both resilience and persistence. The Bank recorded significant growth in key financial metrics, including total assets, deposits, and profitability. This exceptional performance underscores BOC’s agility and adaptability in the face of volatile market conditions and numerous challenges.

The General Manager / Chief Executive Officer, Russel Fonseka emphasized, “Our robust financial results demonstrate our strength and stability in this challenging economic climate. Looking ahead, we are committed to expanding our services, pioneering digital banking solutions, and solidifying our leadership position in Sri Lanka’s banking sector.”

Exceptional Financial Performance

Signifying its agility in adapting to market dynamics, the Bank successfully repriced its assets and liabilities, leading to a momentous 84% increase in net interest income to Rs. 167.6 billion compared to Rs. 91.2 billion in 2023.

Interest income of the Bank experienced a YoY decline of 12%, primarily due to relaxed monetary policy stance which led to diminished yields on loans and government securities compared to 2023. However, the reduction in interest expenses (32%) outpaced the drop in income, resulting a growth in net interest income. This growth underscores the Bank’s improved profitability, despite the challenging economic environment.

Net fee and commission income remained a strong contributor to the improved profitability, reaching Rs. 20.6 billion with 17% YoY increase. This growth was primarily driven by increased card-related transactions, retail banking services, and the intensifying adoption of digital banking channels by customers reflecting BOC’s seamless digital banking experience.

A net gain of Rs. 3.4 billion from trading has been recorded for the year, showcasing the Bank’s robust trading capabilities in capitalizing on market opportunities and generating capital gains whilst LKR appreciation resulted in exchange losses.

Proactive Risk Management and Credit Growth

The Bank proactively addressed heightened credit risks in specific industries by implementing targeted management overlays, reflecting a cautious approach to credit risk management amidst global and domestic economic uncertainties. This strategy enabled close monitoring, timely mitigation, and the allocation of sufficient provisions for potential credit losses.

An impairment charge amounted to Rs. 12.4 billion has been recognized for loans and advances reflecting challenges faced by sectors still recovering from economic downturns and global disruptions while a net reversal of Rs. 32.8 billion for other financial assets was recorded subsequent to the finalization of debt restructuring.

The debt restructuring resulted in a Day 1 loss of Rs. 19.6 billion, recorded under interest income, and a haircut loss of Rs. 4.9 billion, recorded as a de-recognition of financial assets. Consequently, the net impact on profit for the year on ISB restructuring was Rs. 14.1 billion.

Meantime, the impaired loans (Stage 3) ratio increased to 7.2%, indicating potential external economic pressures. Nonetheless, the impairment coverage ratio (Stage 3 impairment provision to Stage 3 Loans) remains strong at 53.6%, demonstrating the Bank’s prudent risk management.

The Bank actively supported business revival efforts by closely collaborating with customers to aid their recovery. These initiatives, coupled with strategic credit decisions, helped to mitigate credit losses and position the Bank as a key contributor to Sri Lankan economic recovery.

Operating Efficiency and Strong Profitability

The Bank reported total operating income of Rs. 182.0 billion, reflecting a significant growth of 81% compared to the previous year. This increase was driven by substantial improvements in net interest income, net fee and commission income and trading income.

Operating expenses amounted to Rs. 67.1 billion, marking a 28% YoY increase, which was mainly due to increased personnel costs (35%) and other overhead expenses (21%). Despite these higher expenses, the Bank effectively managed its operating costs, enhancing operational efficiencies during the year as depicted by the improved cost-to-income ratio of 40%, compared to the previous year.

The Bank’s operating profit before taxes on financial services reached Rs. 135.3 billion, a remarkable 155% enhancement over the preceding year. After accounting for Value Added Tax (VAT) and the Social Security Contribution Levy (SSCL), the PBT stood at Rs. 106.9 billion compared to Rs. 40.3 billion in 2023, reflecting a 165% notable growth. This robust performance in the facet of significant challenges, highlights the Bank’s resilience and steadfast commitment to fostering sustainable profitability.

Income tax expenses for the year amounted to Rs. 42.5 billion, resulting a profit after tax of Rs. 64.4 billion. Total taxes for the year amounted to Rs. 70.9 billion consequently resulting an effective tax rate of 52% that reflects the Bank’s substantial contribution to the national economy as a state-owned institution.

Robust Financial Position and Capital Strength

As of 31 December 2024, BOC’s total assets reached to Rs. 4,985.1 billion and Group’s total assets reached to Rs. 5,048.7 billion, reflecting a notable growth of 13% compared to the end 2023. This growth, despite economic challenges, solidifies the Bank’s leading position in Sri Lanka’s competitive banking sector. The increase in total assets was primarily driven by significant rises in investment in debt and other instruments and investment in securities purchased under resale agreements. This underscores the Bank’s strategic focus on liquidity management and its ability to capitalize on favorable market conditions.

Gross loans and advances amounted to Rs. 2,436.2 billion as of 31 December 2024 despite a slight drop of 1% in the loan book stemming from LKR appreciation of 10% and sluggish credit demand.

The Bank’s deposit base stood strong at Rs. 4,208.6 billion as of 31 December 2024 with a remarkable growth of 8% despite the appreciation of the LKR, showcasing sustained customer confidence and the Bank’s strategic focus on deposit mobilization.

Additionally, BOC raised Rs. 15.0 billion in Basel III compliant Tier II capital via debenture issue during the year to strengthen the capital base of the Bank.

The Bank demonstrated strong financial performance across key metrics. The Return on Assets (ROA) before tax improved to 2.28% from 0.92% in 2023 and the Return on Equity (ROE) after tax significantly to 23.23% from 10.55% in 2023, reflecting enhanced profitability from the Bank’s asset base. The interest margin also increased to 3.57% from 2.08% in 2023, highlighting effective management of interest-earning assets and liabilities.

The Bank maintained robust capital adequacy, with a Common Equity Tier 1 ratio of 11.97% and a Total Capital Ratio of 16.55%, both above the Basel III requirements. This underscores, the Bank’s strong capital position and its ability to absorb potential risks. Additionally, liquidity coverage ratios for both rupee and all currencies remained well above regulatory requirements, at 329.00% and 269.63%, respectively, ensuring the Bank’s capacity to meet financial obligations.

Empowerment of SMEs, Women and Youth for Economic Prosperity

‘BOC Youth Loan scheme’ introduced in 2024 has created many success stories in diverse market spaces fostering the growth prospects for individuals and society at large by enhancing employment opportunities, offering innovative products and services to local and global markets and thus driving economic growth for Sri Lanka. Recently, the Bank launched the second phase of the loan scheme providing opportunities for more thriving youth to grip the benefits of this scheme.

‘BOC Ranliya Loan scheme’ initiated during the year specifically for women entrepreneurs offering loans of up to Rs. 100 million with concessionary rates of interest, grace periods and flexible repayment terms. Moreover, the Bank has introduced several loans schemes for MSME and rural development covering lifeline industries for a sustainable growth.

While nurturing financial inclusion among unreached communities of the nation, the Bank supported with the digital inclusion for ‘Aswasuma Welfare Beneficiary Program’ in this year also to assist the vulnerable social groups in their financial difficulties.

Further, BOC and Sri Lanka Post have entered into a groundbreaking partnership to reshape the accessibility of banking services across Sri Lanka by combining the banking expertise of BOC with Sri Lanka Post’s extensive network to bring essential financial services to the nation’s most underserved communities.

Global Recognition and Future Outlook

In 2024, BOC has been awarded the prestigious title of ‘ Bank of the Year Sri Lanka 2024’ by ‘The Banker magazine’, a renowned publication of Financial Times Group, UK the Bank has also achieved the remarkable distinction of being the only Sri Lankan bank listed in Top 1000 World Banks 2024 by them, signifying a respected benchmark of global banking excellence.

BOC is strategically positioned to navigate the evolving economic landscape with foresight and resilience. As the nation’s largest financial institution and a systemically important bank, it is committed to harnessing technological advancements and implementing initiatives that foster sustainable growth and financial stability. The Bank remains focused on enhancing customer experiences, supporting community development, and playing a pivotal role in ensuring the stability and growth of the country’s economy.

The Bank is committed in maintaining its high standards of excellence, driving economic progress, and reinforcing its leadership in fostering a robust and stable financial environment.

Bank of Ceylon Chairman, Kavinda de Zoysa stated that, “Together, we will uphold the Bank’s legacy, reinforcing its position as the largest financial institution in Sri Lanka, fulfilling our responsibility as Bankers to the Nation through Sustainable Growth, Prudent risk management and Strengthened Governance”.

With an extensive network of over 2,300 direct customer touchpoints, including fully-equipped and mobile branches, SME centers, ATMs, CDMs and CRMs island-wide, the Bank promotes financial inclusion across all provinces of the country. The Bank also operates internationally, with three branches in India, Maldives, and Seychelles, a limited services branch in Hulhumale and a fully-owned subsidiary in London, United Kingdom.

Fitch Ratings has recently upgraded the National Long-Term Rating at ‘AA-(lka)’ and the Long Term Foreign and Local Currency Issuer Default Ratings at ‘CCC+’.

News

Easter attack victims receive Rs. 245 mn in compensation

By AJA Abeynayake

The Attorney General informed the Supreme Court on Thursday (27) that Rs. 245 million from the funds obtained from the respondents, as per the verdict delivered on 12 January 2023 by a seven-judge bench led by the Chief Justice, had been paid as compensation to the victims of the Easter Sunday attacks. The case stemmed from fundamental rights petitions filed against the respondents’ failure to prevent the coordinated attacks. To monitor the disbursement of these funds, 13 related fundamental rights petitions were taken up on Thursday before a three-judge bench comprising Chief Justice Murdu Fernando, Justices S. Thurairaja, and A.H.M.D. Nawaz. Representing the Attorney General, Additional Solicitor General Viveka Siriwardena informed the court that Rs. 311 million had been allocated for compensation, of which Rs. 245 million had already been distributed among 412 individuals, including the families of 215 deceased victims.

She further stated that Rs. 65 million from the allocated funds was expected to be used for victims’ medical treatment and for the care of affected elderly individuals.

President’s Counsel Shamil Perera and Sanjeeva Jayawardena, appearing on behalf of Cardinal Malcolm Ranjith, Archbishop of Colombo, and the Bar Association of Sri Lanka, respectively, told the court that they had not yet received detailed reports on the compensation payments.

Chief Justice Fernando asked the Additional Solicitor General why those reports had not been provided to the relevant parties. The Additional Solicitor General responded that the proceedings were focused on monitoring the disbursement of compensation to victims.

The Chief Justice, however, noted that withholding those reports from the petitioners did not align with the objectives of the case. She ordered that the reports be immediately provided to the Cardinal and the other petitioners.The court scheduled the next hearing of the petitions for 21 May.

News

SLPP-UNP govt. paid another Rs. 1.1 bn in compensation for houses destroyed in 2022

…. Gnanakka also received Rs. 28 mn

Chief Government Whip Minister Nalinda Jayathissa said on Thursday that the Ranil Wickremesinghe government had spent an additional Rs. 1,125 million as compensation for individuals whose houses were destroyed in 2022.

That was in addition to the Rs. 1,221 million paid to politicians as compensation, Minister Jayatissa said, revealing that an astrologer called Gnanakka from Anuradhapura had received Rs. 28 million in compensation for her Devalaya destroyed by mobs in 2022. (SI)

News

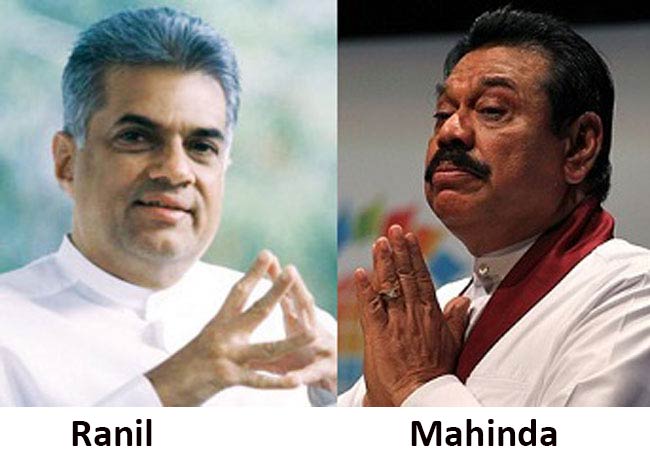

PM reveals foreign travel expenses of former Sri Lankan presidents

By Saman Indrajith

During yesterday’s parliamentary session, Prime Minister Dr. Harini Amarasuriya disclosed the expenditure incurred by the state on foreign trips undertaken by Sri Lanka’s Presidents.

Mahinda Rajapaksa’s foreign trips between 2010 and 2014 cost Rs 3,572 million. His successor, Maithripala Sirisena spent Rs 384 million on overseas travel from 2015 to 2019. Gotabaya Rajapaksa spent Rs. 126 million from 2019 to 2022, while President Ranil Wickremesinghe’s foreign travel between 2023 and 2024 cost the state Rs 533 million.

In contrast, the current president, Anura Kumara Dissanayake, had spent only Rs 1.8 million on foreign travel since assuming office in September 2024, the PM said.

The Prime Minister highlighted that the most expensive year for presidential foreign travel during that period was 2013, when Mahinda Rajapaksa’s trips alone amounted to an unprecedented Rs 1,144 million.

-

Business4 days ago

Business4 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports5 days ago

Sports5 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

News6 days ago

News6 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features5 days ago

Features5 days agoThe Murder of a Journalist

-

Sports5 days ago

Sports5 days agoMahinda earn long awaited Tier ‘A’ promotion

-

Features5 days ago

Features5 days agoExcellent Budget by AKD, NPP Inexperience is the Government’s Enemy

-

News6 days ago

News6 days agoMobile number portability to be introduced in June

-

Sports4 days ago

Sports4 days agoAir Force Rugby on the path to its glorious past